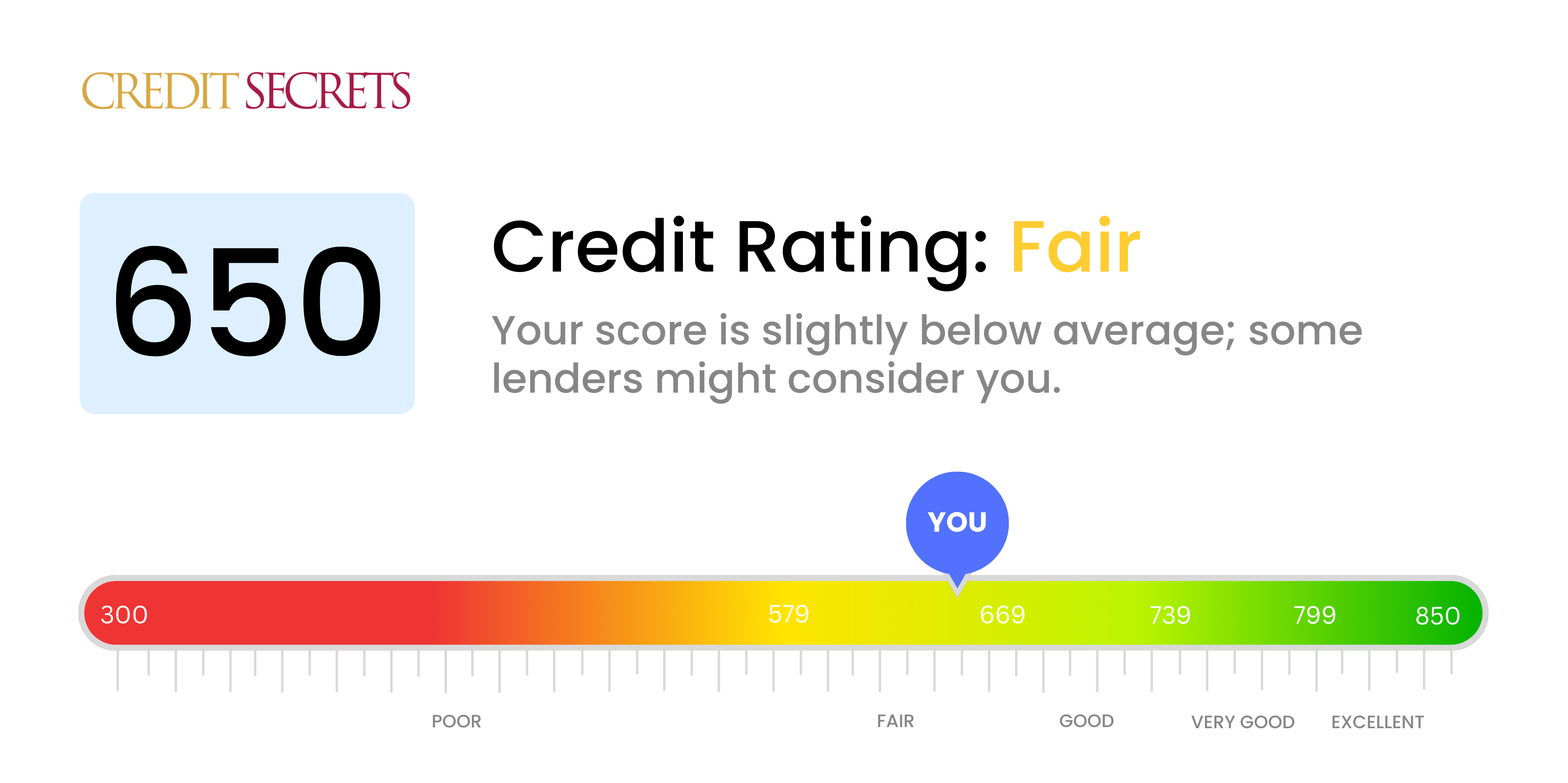

Is 650 a good credit score?

With a credit score of 650, you fall into the 'Fair' category. While it's not classified as poor, there's still room for improvement to reach a 'Good' or 'Excellent' credit rating.

This score might limit your access to certain loans and credit cards, and you could face higher interest rates. However, don't be disheartened - there are strategies you can use to better your credit score. With some careful financial planning and responsible credit use, it's entirely possible to boost your score and unlock improved financial opportunities.

Can I Get a Mortgage with a 650 Credit Score?

If you have a credit score of 650, securing a mortgage approval may be possible, but not guaranteed. This is because many lenders typically seek borrowers with higher scores for their best interest rates. A score of 650 indicates that you have a fairly good, but not excellent, credit history, and lenders may perceive your credit profile as mildly risky.

If you do receive approval for a mortgage, you should be aware that you might face higher interest rates. This is because the interest rate you're offered is directly affected by your credit score - the higher your score, the lower your interest rate. Even though a 650 score does not exactly place you in the high-risk category, lenders may try to offset their risk by offering higher rates. Regardless, don't be discouraged. With regular on-time payments and responsible credit use, your credit score can improve over time, potentially making you eligible for better mortgage terms in the future.

Can I Get a Credit Card with a 650 Credit Score?

If you have a credit score of 650, you're in a position that's not ideal, but certainly not hopeless when it comes to getting a credit card. This score is in the 'fair' category, meaning lenders may consider it more of a risk. But don't let this deter you - it's entirely possible that you could still get approved for certain types of credit cards.

Secured credit cards may be a fitting choice for your situation. These require a deposit that sets your credit limit and can be less difficult to obtain. Another option might be starter credit cards, designed specifically for those looking to build or improve their credit. These types of cards can pave the way for better options in the future. However, keep in mind that cards available to individuals with a 650 credit score may come with higher interest rates given the risk perceived by lenders. Always remember, your current credit score is not permanent, and you have the power to change it through responsible financial behaviors.

A credit score of 650 might make obtaining a traditional personal loan more difficult. The lower the score, the higher the risk you represent to lenders. But don't be discouraged, as there are many financial strides you can make to adjust this reality.

While securing a personal loan through traditional means may be challenging, alternative options exist you can consider. This could be opting for a secured loan, which requires an asset as collateral, or potentially using a co-signed loan where another individual with stronger credit backs up your loan. You could also think about exploring peer-to-peer lending platforms, which sometimes provide loans to individuals with lower credit scores than traditional lenders. However, bear in mind that such options normally carry higher interest rates or may come with less favorable terms due to the lending risk. This situation may be frustrating, but staying informed about your options is an important step toward achieving your financial goals.

Can I Get a Car Loan with a 650 Credit Score?

Securing a car loan with a credit score of 650 might be somewhat tricky. A score of 650 is typically seen as fair, which falls a little short of what lenders often prefer, which is a score above 660. It's because your credit score acts as a guide to lenders about your likelihood of repaying borrowed money. The higher the score, the more confidence they have. So your score of 650 may mean you're seen as a slight risk, which may lead to higher interest rates or even not getting approved for the loan.

But, all hope is not lost. There are lenders who are ready to work with individuals who have credit scores like yours. Just be vigilant and understand that the terms of your loan may be different. The interest rates may be a bit higher as the lender is taking a risk on your loan. But remember, purchasing a car is still an achievable goal. You just need to diligently understand the terms and conditions of your car loan before agreeing to it.

What Factors Most Impact a 650 Credit Score?

Achieving a full understanding of a 650 credit score can significantly assist in your financial growth. The factors causing this score need to be evaluated to prepare a roadmap for achieving a higher credit score, providing you with the necessary financial stability.

Credit Utilization

Your credit utilization directly affects your credit score. Carrying high balances or maxing credit cards can negatively impact your score.

How to Check: Scrutinize your credit card balances. Are they close to their limits? Always aim to maintain a low balance relative to your credit limit.

Payment History

Consistent late payments or missed payments can be one of the main triggers for a 650 credit score.

How to Check: Assess your credit report for any delayed payments or defaults. Consider any instances where you were not able to pay on time, as it's likely they had influenced your score.

Account Inquiries

Frequently applying for new credit can lead to multiple hard inquiries, which can lower your score.

How to Check: Examine your credit report to find out the frequency of your credit applications and make sure you apply for new credit sparingly.

Diversity of Credit

Lack of diversification in your credit types might result in a lower score.

How to Check: Evaluate the types of credit you have. Do you only have credit cards? Adding an installment loan or a mortgage loan can contribute positively to your score.

Negative Information

Items such as collections, tax liens or bankruptcies can significantly mar your credit score.

How to Check: Look over your credit report thoroughly. Deal promptly with any negative items listed to improve your credit score.

How Do I Improve my 650 Credit Score?

With a credit score of 650, you’re on the cusp between fair and poor credit. However, rest assured, this is not irreversible. You can make significant improvements by engaging in the following steps tailored to your current situation:

1. Paying Bills On Time

Payment history greatly affects your credit score. Ensure you are paying all your bills promptly, as late payments can negatively impact your credit score. Setting up automatic payments can help ensure bills are paid on time.

2. Work on Credit Utilization

Your credit utilization should be under 30% but strive for lower. This refers to the percentage of your available credit in use. Work on keeping your card balances low to achieve this.

3. Limit Credit Inquiries

Too many hard inquiries on your credit report can lower your score. These occur when lenders check your credit for a loan or credit card application. Try and limit these as much as possible.

4. Correct Errors on Your Credit Report

Incorrect information on your credit report can also lower your score. Regularly check your credit report, and if you find errors, dispute them immediately with the credit bureau.

5. Keep Old Accounts Open

Even if you’re not utilizing an old credit card, keep the account open to increase the length of your credit history, which can help improve your score.

Following these steps can help boost your credit score above 650 and move you closer to your financial goals.