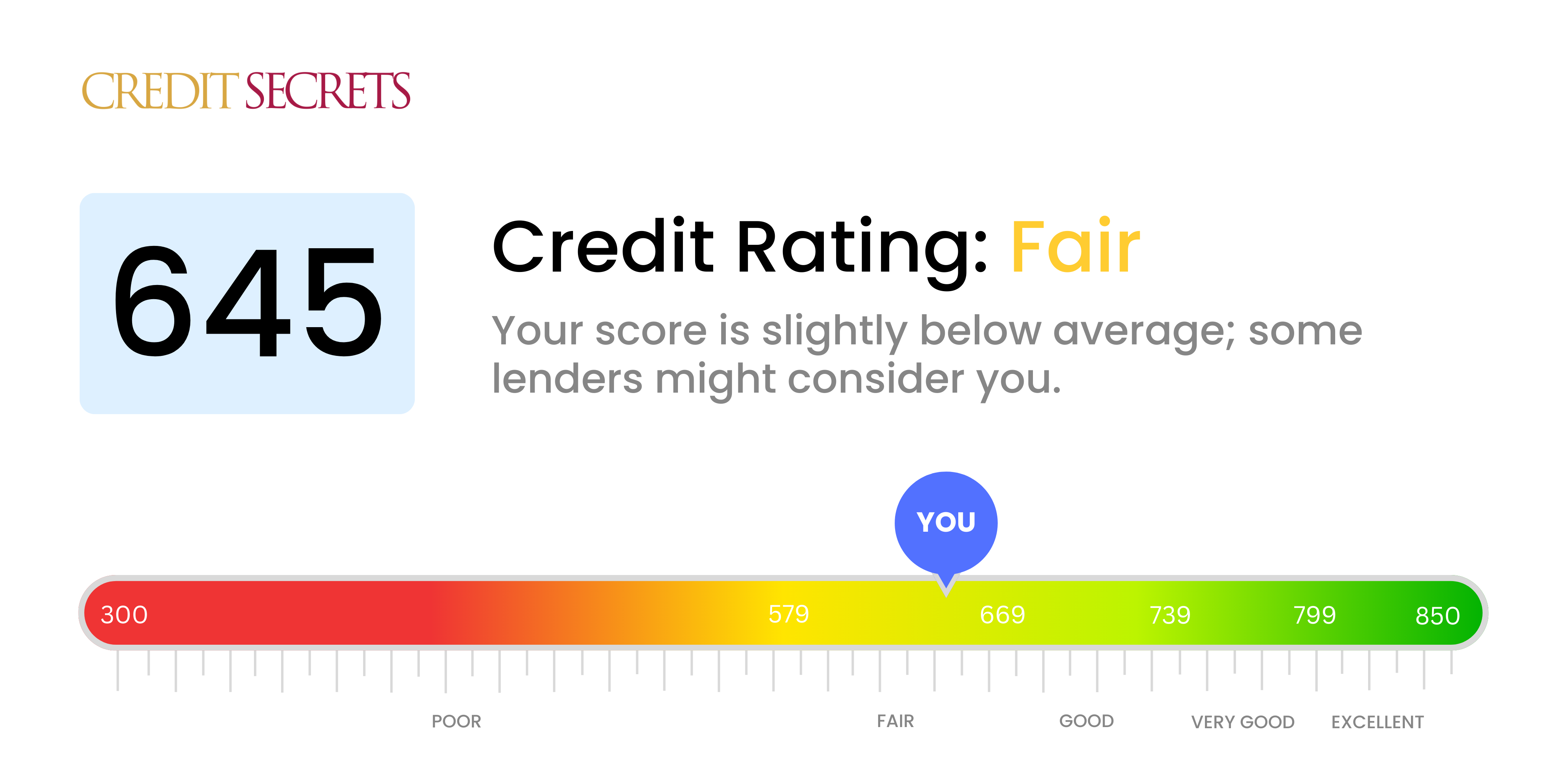

Is 645 a good credit score?

With a credit score of 645, you fall into the 'Fair' category according to the given credit score ranges. Although this doesn't represent an excellent or very good credit standing, it's not the end of the line, so keep your chin up.

Having a ‘Fair’ score means you might come across some difficulties obtaining credit and might face higher interest rates or stricter terms when you do. However, know that improved financial habits and responsible credit management can always elevate your score over time.

Can I Get a Mortgage with a 645 Credit Score?

When your credit score sits at 645, securing a mortgage might be a difficult feat. A majority of lenders often look for credit scores above this, hence, it may be a roadblock in your home-ownership journey. A score like this implies that you may have run into financial hiccups in the past. It's a tough spot to be in, but it's not the end of the road.

Though you may face challenges, there's still hope. Not all lenders have strict standards, and some may be willing to work with you. Another option could be looking into government-backed loans like FHA or VA loans which typically have more lenient credit requirements. Finally, focus on improving your credit score. Pay bills on time, keep credit balances low, and explore other avenues of credit-building. A higher credit score equates to better mortgage terms, including lower interest rates. It may take time, but consistent steps can deliver positive results. Always remember, the journey to better credit starts today.

Can I Get a Credit Card with a 645 Credit Score?

Having a credit score of 645 may present slight challenges when applying for a traditional credit card. Lenders could perceive this score as slightly risky, indicating a past of inconsistent financial habits. It's crucial to face this reality with empathy and understanding. Acknowledging your credit status is an essential step towards financial recovery, even if the truths uncovered can be a bit hard to swallow.

Given your credit score, you might have better luck applying for a secured credit card. This type of card requires a deposit, which then determines your credit limit. Secured cards can be a helpful pathway towards rebuilding credit over time. Additionally, exploring the option of asking a trusted individual to co-sign for a loan or card, or considering prepaid debit cards, could offer feasible alternatives. Interest rates for any credit option available at this credit score will likely be higher due to the perceived risk from lenders. Perseverance and good financial habits can gradually improve your credit health.

Having a credit score of 645 may place you in a somewhat tricky spot when it comes to securing a personal loan. Unfortunately, many traditional lenders may find this score slightly risky and may deny loan approval. We understand it may feel disappointing, but this is the harsh reality of having a credit score within this particular range.

Nevertheless, this does not mean all hope is lost. It's crucial to consider other borrowing routes which may be open to you. Secured loans, which require you to provide an asset as collateral, or co-signed loans, where another individual with a higher credit score guarantees your loan, are potential options. Another to consider is peer-to-peer lending networks, which tend to have relatively relaxed criteria when it comes to credit scores. However, be cautionary that these alternatives might carry higher interest rates and less lenient terms due to the increased risk perceived by the lender.

Can I Get a Car Loan with a 645 Credit Score?

With a credit score of 645, you might be questioning the likelihood of you getting approved for a car loan. It's true that obtaining a car loan can be slightly more challenging as this score is generally perceived as 'fair'. Most lenders tend to favor scores over 660 when deciding on favorable loan terms.

This credit score does not automatically disqualify you for a car loan, but it could possibly influence the terms of the loan. Lenders may view this score as a riskier proposition, which could mean facing higher interest rates or more stringent repayment terms. But don't despair, it is still entirely possible to secure a car loan with your present score. Some auto lending companies do offer loans to individuals with fair or below average credit scores, despite the raised interest terms. It's important to carefully evaluate the terms and ensure they work with your financial circumstances before committing.

What Factors Most Impact a 645 Credit Score?

Grasping the parameters of a 645 credit score is the first step towards a solid financial future. By addressing and understanding the factors that affect your score, you set a path forward to financial success. Remember, everyone's journey is distinct and filled with learning.

Payment History

Your payment history has a great impact on your credit score. Late payments or defaults could play a pivotal role in where your score currently stands.

How to Check: Examine your credit report for any missed or late payments. Consider your payment habits and how they might have influenced your score.

Credit Utilization

If your balance is nearing your credit limit, your credit score could be suffering. High credit utilization is a common reason for a lower score.

How to Check: Look closely at your credit card statements. Are you frequently close to your limit? Try to keep your balance low in relation to your limit.

Credit History Span

Having a shorter credit history can lower your score. If you're relatively new to credit, this could be a key factor.

How to Check: Check your credit report for the age of your oldest and newest accounts. Reflect on your recent credit-related activity.

Credit Diversity and Recent Credit

Maintaining a mix of credit types and managing new credit can positively reflect on your score.

How to Check: Assess the mix of your credit accounts. Have you recently applied for new credit? Responsible handling of new credit is crucial.

Public Records

Records such as bankruptcies or defaults can considerably lower your score.

How to Check: Review your credit report for any public records. Resolve any listed items.

How Do I Improve my 645 Credit Score?

With a credit score of 645, it falls within the fair range. However, there’s room for improvement. Here are some practical, attainable steps specific to your current credit situation:

1. Settling Collection Accounts

Make sure you address any accounts in collections. Neglecting these can heavily weigh your credit score down. Strive to settle these accounts, even if it means setting up manageable payment plans. Be certain to request a ‘paid in full’ letter from each collector once settled.

2. Mind Your Credit Utilization Ratio

Your credit utilization, the amount of credit you’re using compared to your credit limit, contributes significantly to your score. Aim to keep this ratio below 30%, ideally around 10%. Start by paying down cards with the highest utilization first.

3. Apply For a Secured Credit Card

Your current score might limit your eligibility for regular cards. A secured card, backed by a refundable deposit, could be a viable option. Be sure to use it responsibly, making small, regular purchases and paying off the balance monthly.

4. Seek to Become an Authorized User

Consider asking a trustworthy person with good credit to add you as an authorized user on their card. This can aid in elevating your score through their positive payment history, but ensure that the cardholder’s activity is reported to the credit bureaus.

5. Add variety to Your Credit Types

A mix of different credit accounts can have a positive influence on your credit score. Once you’ve managed a secured card wisely, look at managing other credit types, like a credit builder loan or a department store card.