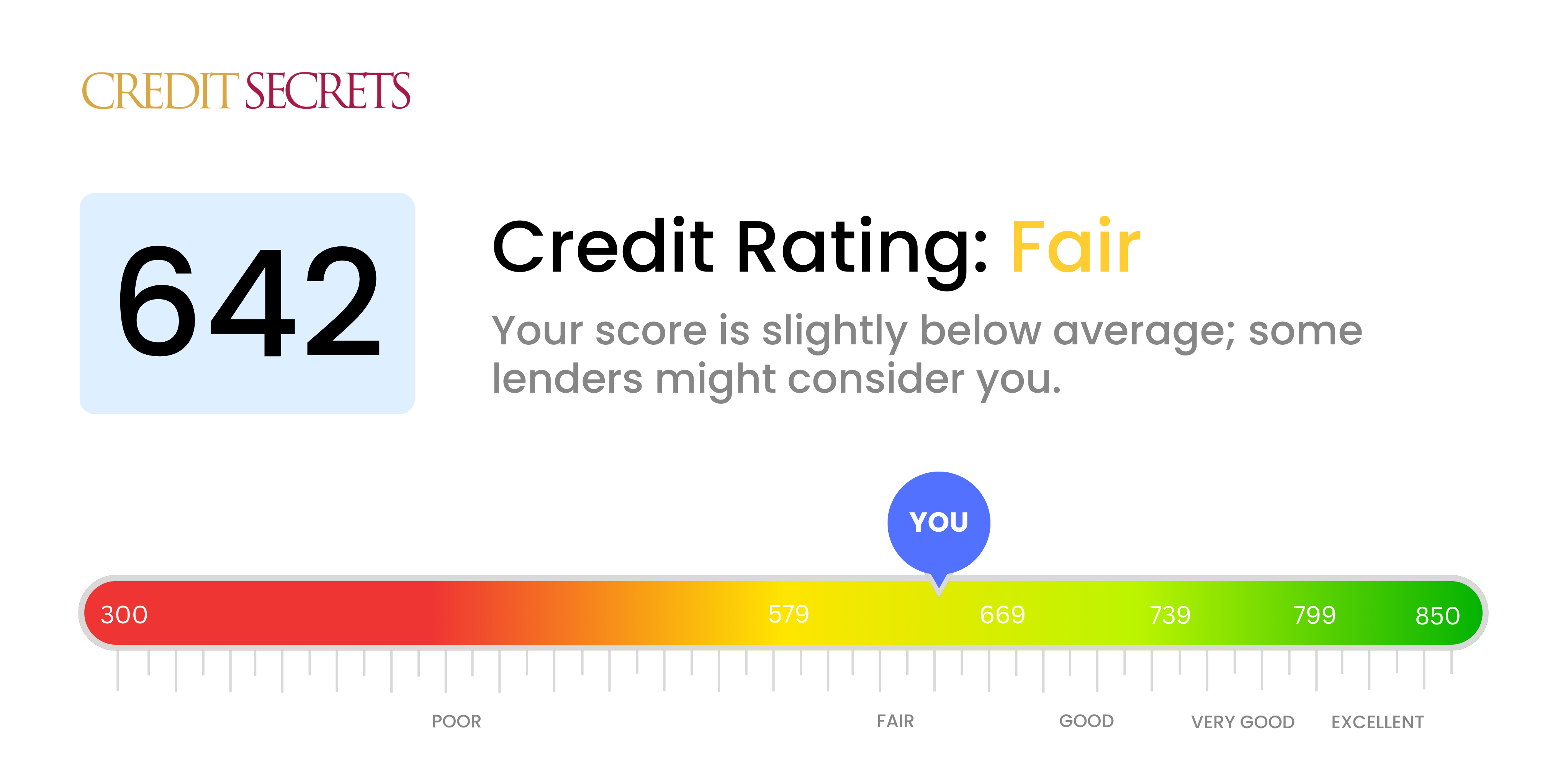

Is 642 a good credit score?

With a credit score of 642, your financial standing falls within the 'fair' range. This is not a bad score, but it's not in the good zone either– it's somewhere in between.

As a result, when it comes to loan applications, you might face slightly higher interest rates or less favorable terms compared to someone with a higher score. However, many lending and credit institutions will still consider this range acceptable for granting credit. Remember, you still have room for progress and improving your credit health is possible.

Can I Get a Mortgage with a 642 Credit Score?

With a credit score of 642, securing a mortgage approval may pose a challenge. While it's not necessarily a poor score, it's not in the 'good' credit range either. Note, most lenders search for borrowers with scores of 700 or higher. If your score is 642, lenders may perceive you as a slightly riskier borrower than someone with a higher score.

This doesn't mean obtaining a mortgage is impossible. However, you may have to face a more stringent approval process, and even if approved, might face higher interest rates. You could explore FHA (Federal Housing Administration) loans or unconventional lenders who may be more flexible. It's critical to ensure your financial stability before taking such routes. Remember, your credit score is just a snapshot of your financial health at a given time. With consistent on-time payments and responsible financial behavior, it's still possible to reach your goal of homeownership in the future.

Can I Get a Credit Card with a 642 Credit Score?

With a credit score of 642, acquiring a traditional credit card might be a bit challenging. This particular score indicates a moderate-risk to lenders, which shows that there might have been some past financial hiccups. Approaching this situation with a clear understanding and positivity becomes important here. Knowing where your credit stands, even if the reality is not as pleasing, is the first crucial step towards improving it.

A credit score of 642 opens up the possibility of opting for a secured credit card or a starter credit card. A secured credit card requires a deposit, and your credit limit would be equal to this initial deposit. On the other hand, a starter credit card, aimed at those with low credit or no credit history, could be an option. Always remember, these aren't immediate solutions, but steps towards growing your credit health. It's important to note that interest rates on the credit cards available might be higher because of the moderately high-risk your credit score represents to lenders.

With a credit score of 642, it may be challenging to secure approval for a personal loan from traditional lenders. This credit score is considered to be in the fair range and may present a higher degree of risk than someone with a higher credit score. Navigating the loan landscape with this score can be difficult, yet it's important to embrace the situation and explore all available options.

If the conventional route doesn't pan out, there are other avenues available. These include secured loans which require collateral, co-signed loans where someone with a stronger credit score co-signs for you, or peer-to-peer lending platforms. However, keep in mind these options often carry higher interest rates due to the increased risk for the lender. Despite these challenges, remember, alternative options do exist and a fair credit score is not a permanent barrier to your financial goals.

Can I Get a Car Loan with a 642 Credit Score?

Having a credit score of 642 is somewhere in the middle--a bit of a gray area. See, usually lenders like to see scores above the 660 mark to offer the most favorable terms. This means that your score of 642 falls just shy of what is typically seen as 'good'. This sort-of 'middle-of-the-road' score could lead to higher interest rates because it signals a degree of risk to potential lenders.

That said, don't lose hope. Your dream of owning a car isn't out of reach. Some lenders are open to working with people who have a similar credit score, but remember, you may be required to tolerate higher interest rates. While it isn't an ideal situation, it's necessary to protect the lender's investment against the heightened risk. It's important to be careful and consider all the terms and conditions thoroughly, but rest assured, securing a car loan is truly possible.

What Factors Most Impact a 642 Credit Score?

Deciphering a credit score of 642 is essential to shaping and implementing your financial advancement strategy. It's integral to identify and take action on factors positively or negatively affecting your score, fostering personal growth and financial well-being.

Credit History Duration

A shorter credit history could be impacting your score negatively, and causing a score around 642.

How to Check: Look over your credit report, assessing the age of your most seasoned and newest accounts, and the median account age. Acknowledge if you've recently opened new credit accounts.

Payment Consistency

Delayed or missed payments are likely influencing your score negatively.

How to Check: Scour through your credit report to identify any instances of late or missed payments. Contemplate on circumstances that may have led to these irregular payments.

Credit Usage Ratio

Running a high balance on your credit cards is another factor most likely affecting your score.

How to Check: Scrutinize your credit card statements. If your balances are nudging towards the limits, it's imperative to aim towards maintaining a low usage ratio.

New Debt

Frequently applying for new credit can be a red flag, possibly lowering your score.

How to Check: Reflect on your recent financial activities. If you've been seeking new credit often, consider limiting these applications.

Negatives on File

Public records such as bankruptcies or tax liens can severely impact your score.

How to Check: Inspect your credit report for any public records. It's important to address any current blemishes or rectify past infractions.

How Do I Improve my 642 Credit Score?

A credit score of 642, which is considered fair, is not far from the “good” category. You can enhance this score with a few focused steps that are within reach at this level:

1. Monitor Your Credit Report

Knowing what’s on your credit report is crucial. Ensure that all the information is accurate and up-to-date. If you discover errors on your report, take immediate steps to dispute them. This can have a noteworthy positive effect on your credit score.

2. Keep up with Payments

Payment history carries a heavy weight on your credit score. To improve your rating further, ensure all your bills are paid on time. Set up automatic payments as a reminder and to avoid late payments.

3. Maintain Low Credit Card Balances

Keeping your credit card balances low is another excellent way to increase your credit score. It is ideal if you can keep your balance below 30% of your credit limit.

4. Avoid New Debt

Until your score improves, refrain from taking on new loans or credit cards. Every time you apply for a new line of credit, your score takes a small hit.

5. Stick to a Budget

Make a budget and stick to it. Tracking your spending can prevent you from running up high balances, ensuring you don’t fall behind on payments, and helps you save more over time.