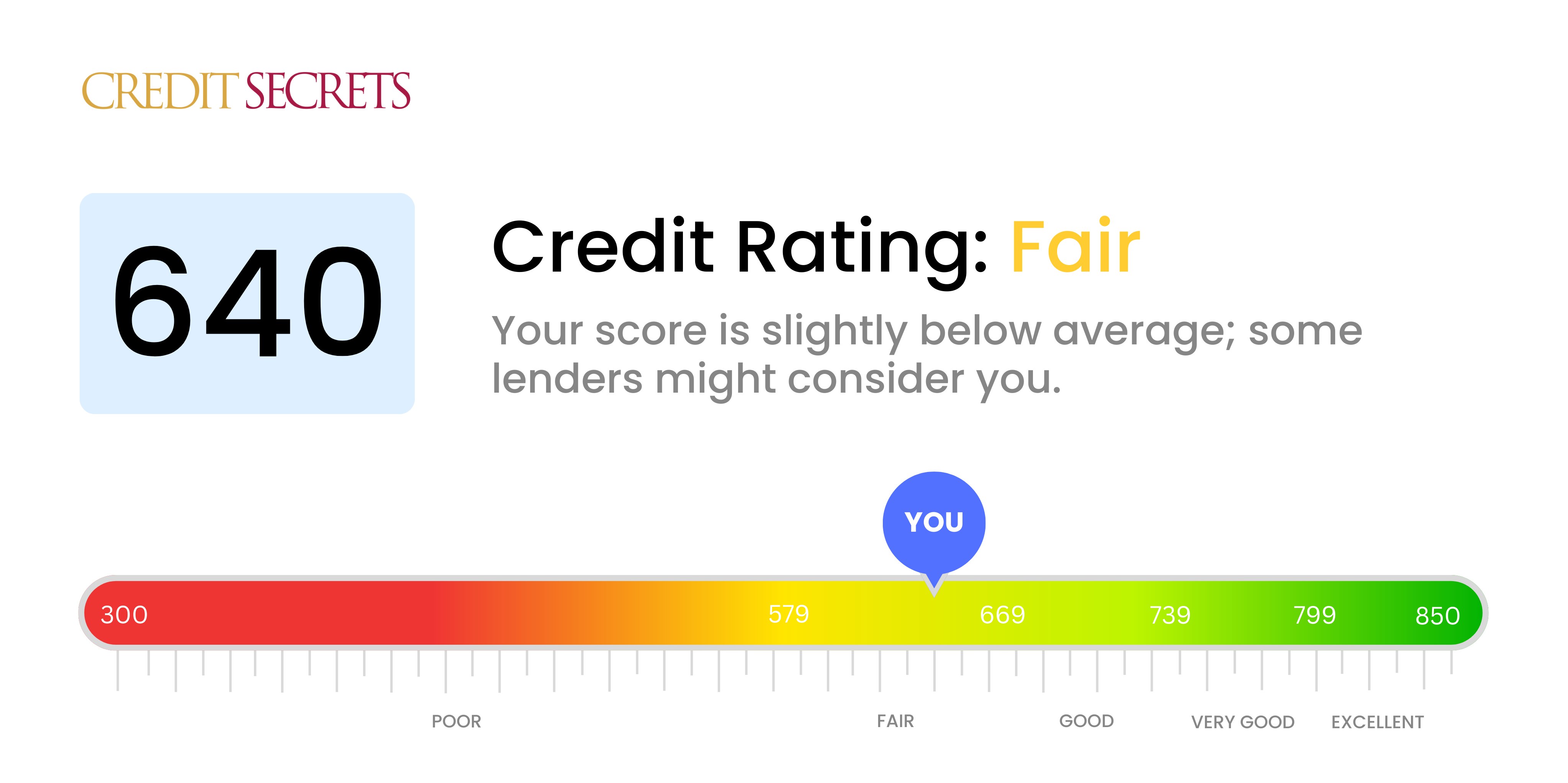

Is 640 a good credit score?

If you have a credit score of 640, you're in the 'Fair' category. It isn't the best, but don't lose hope, it's definitely not the worst and there are ways to improve.

With a Fair credit score, you might face slightly higher interest rates than those with good or excellent scores and approvals for loans or credit cards aren't guaranteed. However, it's within your power to boost your score. Consistent, responsible credit behavior is key to improve your 640 score over time.

Can I Get a Mortgage with a 640 Credit Score?

Having a credit score of 640 puts you in a borderline financial situation when it comes to applying for a mortgage. While your chances of being approved are not as high compared to someone with a better score, it's not entirely impossible either. However, you should be realistic and understand that the terms and conditions that come with your mortgage will likely not be as favourable. For instance, higher interest rates and a need for larger down payments could be expected.

Given your current score, you might want to consider alternatives such as a Federal Housing Administration (FHA) loan. The FHA approves mortgages for individuals with credit scores as low as 500, but scores between 500 and 579 require a larger down payment. Therefore, even with a score of 640, you meet the requirements for an FHA loan. This could give you a better chance to be approved for a mortgage. Nevertheless, striving to improve your credit score will always put you in a more advantageous position.

Can I Get a Credit Card with a 640 Credit Score?

With a credit score of 640, you have a fair chance of being approved for a credit card. While this score is not considered 'excellent', it certainly doesn't place you in the 'poor' category. It's important to understand your credit status and be patient with your financial journey. A 640 credit score indicates responsibility and a history of handling credit, but it also suggests potential areas for improvement.

Considering your credit score, a good choice would be credit cards designed for fair credit. These include secured credit cards, which requires an initial deposit. This deposit essentially becomes your credit line, and the on-time payments can aid in improving your credit score over time. Some other credit cards specifically cater to those looking to build or improve their credit. Be aware though, the interest rates for these cards can be higher due to the moderate risk associated with fair credit scores. Still, with responsible use, these tools can serve to enhance your credit status incrementally.

Having a credit score of 640 might cause some difficulties in securing a personal loan from traditional lenders. This score falls a bit below the average range that most financial institutions typically deem as 'good', increasing the perceived risk and reducing your chances of approval. It's a tough situation, but understanding how this score impacts your borrowing power is key to finding a loan that suits your needs.

In situations where traditional personal loans might not be an option, you might consider looking into secured loans which require collateral, or co-signed loans where someone with a stronger credit score stands as your guarantor. There's also the avenue of peer-to-peer loans, as these arrangements tend to be more flexible with credit score requirements. Do bear in mind though, these options may carry with them higher interest rates and perhaps less-than-ideal terms and conditions, given they're associated with a higher risk lending environment.

Can I Get a Car Loan with a 640 Credit Score?

Having a credit score of 640 can make qualifying for a car loan a little tough, but not impossible. Lenders usually require a credit score of around 660 or higher to offer more favorable loan terms. Your credit score of 640 is slightly below this threshold, potentially resulting in higher interest rates or an outright loan denial. Lenders use your credit score as an indicator of lending risk, with lower scores suggesting a higher likelihood of difficulty repaying a loan.

However, don't lose hope! While it might be a harder road, obtaining a car loan with a credit score of 640 isn't out of reach. There are lenders who specifically cater to folks with subprime credit scores. But remember, to balance their risk, these loans often have significantly higher interest rates. Make sure to scrutinize the loan terms carefully. With patience and diligence, achieving your goal of car ownership can still become a reality.

What Factors Most Impact a 640 Credit Score?

With a credit score of 640, understanding the factors that have influenced your score is vital for its improvement. Your path towards a better financial health is personal to you, filled with many possibilities for learning and growth.

Payment History

Irregular payment habits can lower your credit score. Late or skipped payments are contributors to a score of 640.

How to Check: Analyze your credit report to find any missed or late payments. Remember any cases where you failed to pay on time, as these instances could have dragged down your score.

Credit Utilization factor

Maxing out your credit cards isn't healthy for your score. If your credit utilization is high, it could have adversely affected your score.

How to Check: Check your credit card statements thoroughly. If your spending is nearing your credit card limits, this could be a sign of high credit utilization.

Length of Credit History

A shorter credit history can be a damper on your score. This could be another reason why your score stands at 640.

How to Check: Study your credit report to understand the average age of your accounts and the age of your oldest credit account. Think about whether you've opened any new accounts lately.

Credit Mix and New Credit

Having a healthy blend of credit accounts and making sure new credit is responsibly managed is key to a good score.

How to Check: Check the variety of your credit accounts, including credit cards, retail accounts, and loans. Reflect on your recent applications for new credit.

Public Records

Any public records like bankruptcy or tax liens can be a drag on your score.

How to Check: Check your credit report for any such public records. Work on resolving any unresolved items that have been listed.

How Do I Improve my 640 Credit Score?

A credit score of 640 is less than optimal but it’s not insurmountable. Strategically addressing key areas can yield significant improvements. Here’s a roadmap tailored to your score level:

1. Make Timely Payments

Punctuality matters when it comes to credit score improvement. Ensure all your debts and bills are paid in a timely manner. This is the first step in repairing credit history and boosting your score. Make a schedule and stick to it to avoid missing or being late on a payment.

2. Manage Your Credit Card Usage

Ideally, limit your credit usage to 30% of your total limit across all credit cards. Avoid maxing out your cards, as high levels of debt influence credit score significantly. Aim to gradually pay off outstanding balances.

3. Apply for a Credit Builder Loan

If credit availability is a barrier, a credit builder loan may be a suitable route to take. This loan will show an ability to consistently make payments, thereby creating a positive credit history.

4. Dispute Any Inaccuracies

Get a copy of your credit report and review it for possible errors. If you find any, contact the credit reporting agency to dispute them. An accurate credit report is crucial for a fair score.

5. Maintain Older Accounts

Length of credit history is a factor in credit scoring. Keep old accounts open, even if they’re not in use, as long as they’re not costing you unnecessary fees. This adds to your total credit and lowers your overall credit utilization quotient.