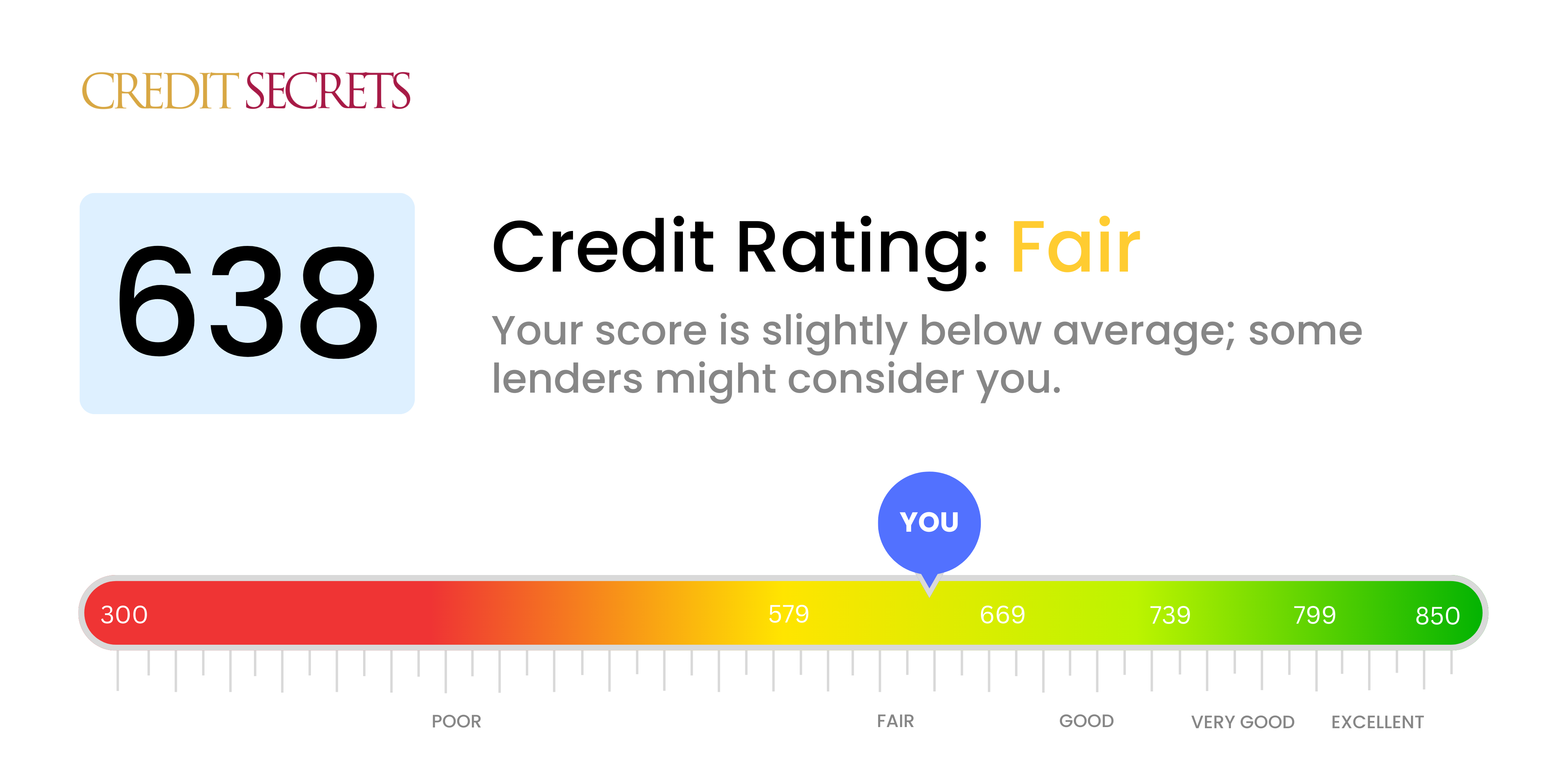

Is 638 a good credit score?

Your credit score of 638 falls within the fair range. Despite it's not being the best, it doesn't necessarily mean you're in a poor position.

This score can limit some of the credit opportunities open to you, possibly resulting in slightly higher interest rates or more rigid loan requirements. However, it's important to remember that improvements are always possible, and a few smart financial decisions can push your credit score towards a better range.

Can I Get a Mortgage with a 638 Credit Score?

Having a credit score of 638 may raise some challenges when it comes to applying for a mortgage. Most lenders typically look for a credit score of around 680 or higher, which suggests that your loan application might be scrutinized more closely or possibly even declined. That said, a lower score doesn't automatically count you out; factors like your income, debts, and other financial circumstances can't be ignored in a lender's decision-making process.

Please bear in mind, a lower credit score often means higher interest rates if you are approved for a mortgage. This is because lenders see borrowers with lower credit scores as somewhat risky. On the bright side, improving your credit score is absolutely possible even though it takes time and discipline. Focus on addressing any outstanding debts, consistently making payments on time, minimizing your utilization of available credit, and avoiding unnecessary hard inquiries. With dedication and patience, you can work towards improving your financial future.

Can I Get a Credit Card with a 638 Credit Score?

Having a credit score of 638 can be a bit of a hurdle if you're hoping to secure a traditional credit card. This score reflects a history of minor financial complications and lenders may see it as a moderate risk. It's not a judgment, it's just an assessment. Acknowledging your credit score is a positive step towards financial improvement, even if the truth might seem less than ideal.

Due to this mid-range credit rating, it might be worthwhile to consider alternatives like a secured credit card. These cards require a deposit which sets your credit limit. They're typically easier to acquire, and over time, they can help you enhance your credit score. Options like having a co-signer or choosing pre-paid debit cards could also be suitable contingents. Although these aren't quick fixes, they provide constructive support in your journey towards better financial stability. Remember, a 638 score often sees higher interest rates on credit, mirroring the increased risk to lenders. Yet, don't be discouraged. Every step towards improving your credit is a worthy effort towards your financial freedom.

Having a credit score of 638 may present some obstacles when trying to secure a personal loan. Most traditional lenders typically prefer credit scores that are in the higher range. The risk associated with lending to those with lower scores makes it less likely that they would approve your loan application. This reality might be hard to confront, but understanding this is key to exploring your options and progressing forward.

While conventional loans may be challenging to achieve with a 638 credit score, other alternatives exist. Secured loans, where you provide an asset as collateral, or co-signed loans, where another person with higher credit co-signs on the loan, are potential options. Peer-to-peer lending platforms might provide a more lenient credit requirement. It's essential to note that these alternatives typically have higher interest rates and tougher conditions due to the elevated lending risk. However, they offer an opportunity to access the financing you require while working to improve your credit score.

Can I Get a Car Loan with a 638 Credit Score?

With a credit score of 638, there will likely be some hurdles for you while applying for a car loan. Most lenders look favorably upon scores that are above 660 for providing satisfactory terms and loan approval. A score below 600 generally places you in the subprime category, meaning lenders see you as a greater risk. Your score of 638 is placed just above this bracket, so while it isn't ideal, it's not the worst-case scenario either.

This higher-risk label may lead to less favourable loan conditions such as higher interest rates, but it does not necessarily mean a total loan rejection. There are lending institutions that cater to those with a less-than-perfect credit score, but do be prepared for a potentially higher cost of borrowing. High-interest rates are a common way lenders manage their risk, protecting themselves against potential difficulties with loan repayment. Ultimately, while the journey may be a bit more challenging, a car loan is still a very real possibility.

What Factors Most Impact a 638 Credit Score?

Achieving a score of 638 calls for an understanding of the vital factors that have influenced your score to this degree. Recognizing and addressing these elements can assist you in paving a path toward financial wellness. Just remember, your financial journey is unique, lined with opportunities for growth and knowledge.

Payment Consistency

Persistence in making timely payments is dramatically impactful on your credit score. If there are any instances of delayed or missed payments, it could heavily weigh down your score.

How to Check: Analyze your credit report for any missed or overdue payments. Reflect on whether there have been disruptions in your payment habits.

Credit Utilization Rate

Your credit utilization plays a crucial role in your score. If you frequently reach or exceed your credit limit, it's likely lowering your score.

How to Check: Scrutinize the balance-to-limit ratio on your credit card statements. Aim to maintain a lower balance as a proportion of your limit to aid in improving your score.

Credit History Duration

A relatively shorter credit history can lower your score.

How to Check: Look through your credit report to gauge the longevity of your oldest and newest accounts and the average age of all your accounts. Think about whether you've opened several new accounts recently.

New Credit and Variety of Credit

Managing new credit responsibly and maintaining a diverse range of credit types can positively impact your score.

How to Check: Observe the variety of your credit accounts which can range from credit cards, retail accounts, installment loans, to mortgage loans. Ensure you're taking on new credit carefully and moderately.

Public Records

Public records such as bankruptcy or tax liens can significantly impact your score.

How to Check: Go through your credit report for any public records. Address any areas listed that may need resolution.

How Do I Improve my 638 Credit Score?

Having a credit score of 638 means there is room for improvement, but don’t worry, boosting your score is entirely within reach. Please consider these key strategies for your specific scenario:

1. Make Payments On Time

Consistently making payments on time is crucial. A single late payment can significantly decrease your score. Consider setting up automated payments to ensure that none of your bills slip through the cracks.

2. Lower Your Credit Utilization

Credit utilization, the ratio of your actual credit card balances to your overall credit limits, is a vital credit score factor. Aim to keep this ratio below 30%, which may mean making consistent payments to lower your balances.

3. Evaluate Your Credit Report for Errors

It’s essential to regularly review your credit report for any inaccuracies. Disputing and resolving erroneous information can help bolster your credit score.

4. Maintain Older Credit Accounts

A longer credit history can benefit your credit score. Try to keep your older credit accounts open and in good standing to demonstrate a lengthy and positive credit history.

5. Consider a Credit Builder Loan

A credit builder loan, a type of installment loan, can diversify your mix of credit and demonstrate your ability to manage different types of credit responsibly, which can in turn improve your score.

With a systematic approach and disciplined financial habits, you can increase your credit score and move closer to your financial goals.