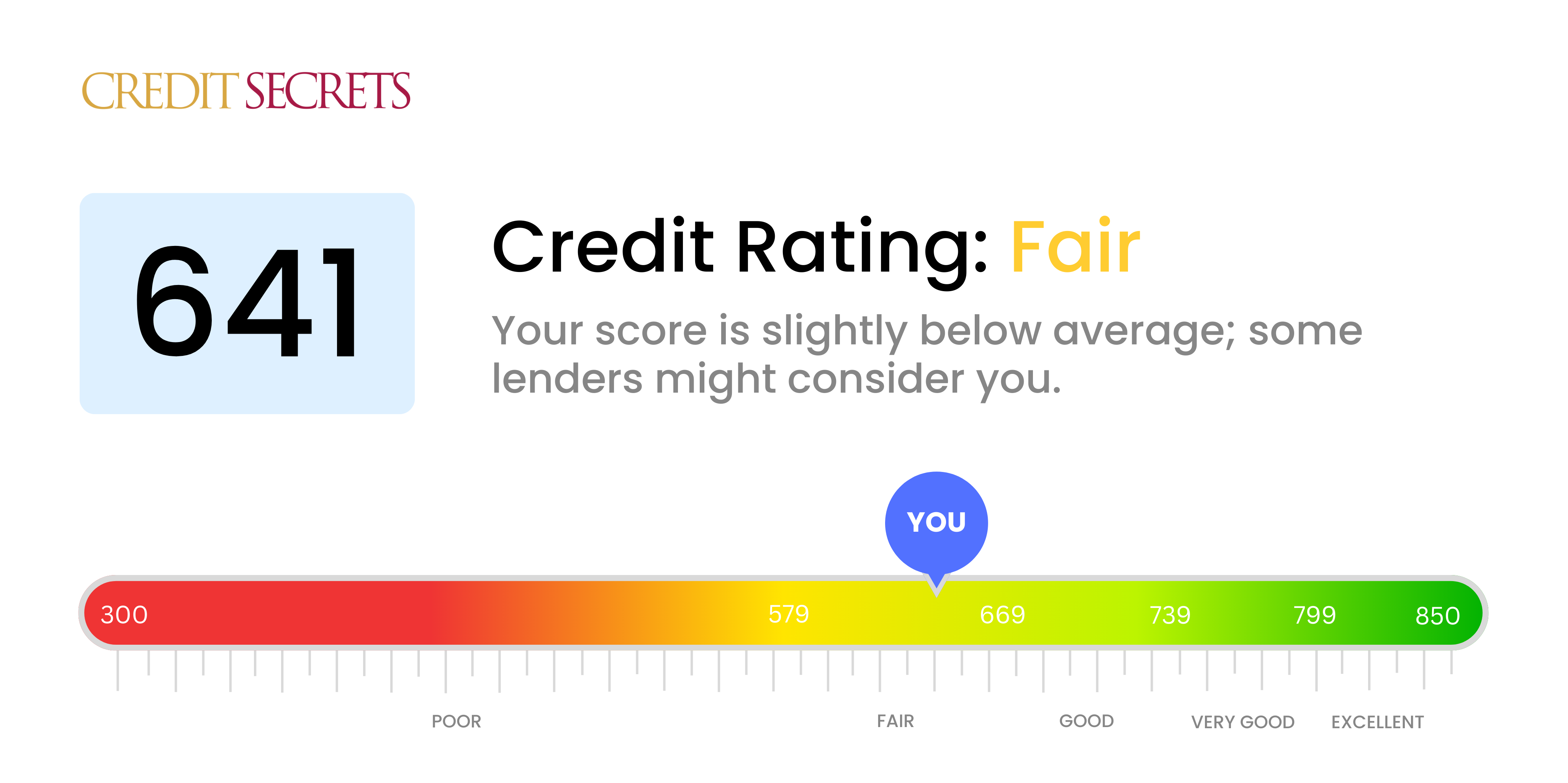

Is 641 a good credit score?

With a credit score of 641, you're currently sitting in the fair range. This might leave some room for improvement, but don't lose hope, there are numerous ways you can enhance your score in time. While you might not be awarded preferential rates on loans or credit cards with this score, you're not in the red zone and you've certainly moved beyond the poor range. Though more desirable credit opportunities may not be as accessible right now, a continued habit of responsible credit behavior could soon lead to improvement.

Your credit score is important, but remember it's just a snapshot of your credit health at one point in time, and can change with every passing month. Making consistent, on-time payments, minimizing your credit utilization, and maintaining a healthy mix of credit could help boost your score in the future. With continued discipline and dedication to improving your credit health, you might soon find yourself stepping into the good or even very good credit score range.

Can I Get a Mortgage with a 641 Credit Score?

With a credit score of 641, receiving approval for a mortgage might be problematic. This score falls within the "Fair" range, which may not meet the benchmarks set by some lenders. This score might indicate some past credit missteps, such as late payments or high balances. Don't be disheartened, though. Every lender has different requirements, and some may still consider your application.

Nonetheless, getting approved with a 641 credit score might mean you're subject to higher interest rates, reflecting the risk lenders perceive in granting you a loan. Remember, the lower the credit score, the higher the perceived credit risk. If a mortgage is not immediately feasible, consider using alternative options, like renting while you work on enhancing your credit score. In time, a higher score can potentially unlock mortgage loans with better interest rates and terms, allowing you to reach your homeownership goals without stretching your finances too thin.

Your credit score is not static. By making payments on time, responsibly managing your debt, and regularly examining your credit report for errors, you can work to better your financial outlook. Remember, this process takes time. Patience and persistence are key.

Can I Get a Credit Card with a 641 Credit Score?

Having a credit score of 641 shows that financial management has had its ups and downs. It's an indicator for lenders that there may have been stumbles in the past, making them cautious. Yet, it's crucial to be realistic about this situation without losing hope. Recognizing the need for improvement is the first step towards a healthier financial status.

In a credit score range like this, approval for traditional credit cards can be challenging. Instead, a good fit may be "starter cards", designed for those working to enhance their credit scores. Secured credit cards, offering a credit limit in exchange for a deposit, might also be a feasible solution. Remember, these options won't provide an instant transformation, but they're stepping stones on the path towards financial security. Interest rates could be higher for these alternatives to reflect lenders' perception of risk. Yet, every step taken is a step towards improving credit score and future financial opportunities.

A credit score of 641 is lower than the score most conventional lenders desire for approving a personal loan. Such a score implies that you pose a heightened risk in the eyes of lenders, thus likely affecting your chances of getting loan approval in traditional ways. It's certainly not an easy situation, but understanding what this credit score means for your borrowing capacity is pivotal.

If standard loans seem difficult to acquire, there are other avenues you might want to explore. For instance, secured loans, where you provide an asset as collateral, or co-signed loans, where another person with a better credit score guarantees your loan. Peer-to-peer lending platforms are another possible route, as they sometimes have more flexible credit score requirements. Be aware, though, these alternatives often carry higher interest rates and less lenient terms due to the increased risk the lender takes on.

Can I Get a Car Loan with a 641 Credit Score?

With a credit score of 641, getting approved for a car loan might be a bit of a rough ride. Typically, lenders look for scores that are 660 and above for the best loan terms. Your score falls just under the preferred range which can present a few hurdles. This score may signal to lenders that there's a bit of risk involved in lending money, which may affect the terms they're able to offer you.

But don't lose hope just yet. This doesn't mean that a car loan is completely out of reach. There are lenders who are accustomed to working with lower credit scores. However, it's vital to approach these agreements with caution as they may have higher interest rates in order to offset the perceived risk. While it may be a bit more challenging, with proper understanding of the terms and a bit of discernment, landing a car loan with a score of 641 can certainly be a possibility.

What Factors Most Impact a 641 Credit Score?

A credit score of 641 indicates your journey towards a better financial future is on track, but there are areas to address for improvement. Let's explore the factors likely affecting your score.

Payment History

Prompt repayment of debts highly influences your credit score. Check your credit report for any overdue payments that may be affecting your score.

How to Check: Obtain your credit report and inspect it carefully for any late or missed payments. Acknowledge all past payment issues that could have impacted your score.

Credit Utilization

Your score reflects how you balance your credit. Excessive use of the credit available to you could be a key factor explaining your score.

How to Check: Go through your credit card records. Are your outstanding balances close to your credit limits? Lower ratio of credit utilization often results in a healthier score.

Length of Credit History

A younger credit history might have lowered your score. Lenders prefer to see a long history of responsible credit use.

How to Check: Review your credit report to see the length of your credit history. If you have recently acquired new accounts, this could affect your score.

Credit Diversity

A diverse mix of credit types can positively contribute to your score. A lack thereof might be a reason for your current score.

How to Check: Analyze the range of your credit accounts, including credit cards, retail accounts, and varied loans. Ensuring a well-managed credit mix can improve your score.

Public Records

Legal financial issues like bankruptcy or tax liens can significantly lower your score.

How to Check: Look into your credit report for any public records. Understand any listed items to plan your course of action.

How Do I Improve my 641 Credit Score?

With a credit score of 641, you’re on the verge of fair credit standing. Here are a series of impactful steps tailored to this specific credit score, that can help expedite your journey towards improved credit:

1. Rectify Late Payments:

Despite being deemed as a minor transgression, late payments can influence your credit score. Bringing them up-to-date and maintaining a timely payment schedule can prove beneficial.

2. Moderate Credit Utilization:

This essentially refers to the ratio of your total credit card balance to your credit limit. A lower credit utilization percentage is ideal. Aim to keep your credit usage below 30% to exhibit sound financial behavior and increase your score.

3. Seek Out Credit Building Options:

A credit builder loan or a secured credit card could be viable options to elevate your current credit score. These instruments are fairly simple to qualify for and can foster a positive payment history.

4. Leverage the Role of an Authorized User:

You may request a close associate or family member with a good credit track record to add you as an authorized user on their credit card. This can have a constructive effect on your score by reflecting their consistent payment history in your credit file.

5. Keep Credit Lines Open:

Rather than closing unused credit cards, keep them open. They add to your overall credit limit and consequently lower your credit utilization ratio.

To improve your score, focus on achieving these steps systematically, remembering that building credit is a gradual process.