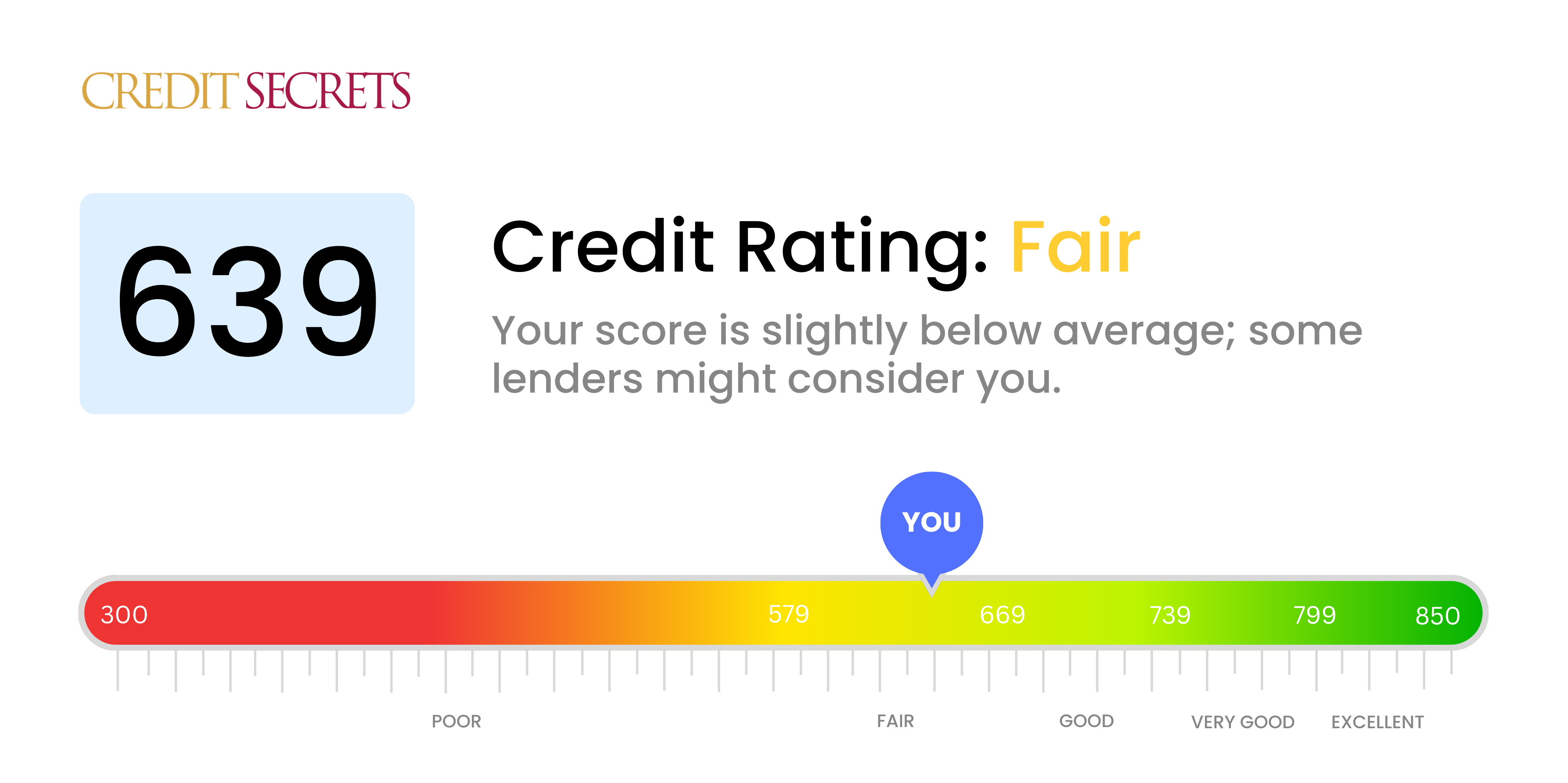

Is 639 a good credit score?

With a credit score of 639, your score falls into the 'Fair' category—it's not fantastic, but it's not the worst either. You may find it somewhat challenging to secure loans or credit with favorable terms, but not impossible, and remember, you have the potential to raise your score.

Although you might experience seemingly high interest rates from lenders or credit card companies, don’t let this hold you back from working towards achieving your financial goals. While it's an uphill climb, it's definitely realistic to improve your score. Progress might be slow, but with continued effort, you can gradually raise your credit score and open more financial opportunities.

Can I Get a Mortgage with a 639 Credit Score?

With a credit score of 639, you may face some challenges when attempting to get approval for a mortgage. Lenders typically look for scores in the 'good' range and above, which usually begins at 670. However, this does not mean that approval is impossible - it may simply mean that your approval might come with a higher interest rate or you may need a larger down payment to secure the mortgage loan.

Because your score falls a bit short, you may want to evaluate other options, such as Federal Housing Administration (FHA) loans, which are specifically designed for those with lower credit scores. FHA loans can be a viable alternative, as they typically have more lenient approval requirements. Don't lose hope - continue working on maintaining a healthy financial lifestyle and remember that your credit score isn't the only factor considered during the mortgage approval process.

Can I Get a Credit Card with a 639 Credit Score?

A credit score of 639 is generally considered fair, and while it's not necessarily bad, it is nearing the edge of what many credit card companies may consider risky. This score might make it slightly more challenging to get approved for some credit cards, but it does not mean chances are completely out of your favor. It's critical to remember that while it might be a hurdle, it's one that can be surmounted with the right tools and awareness.

There's a good range of credit cards that are often open to individuals with this credit score, including secured and unsecured cards targeted at those looking to strengthen their credit. Certain issuers might have credit cards designed for people in this credit range - such as cards that offer rewards or benefits but might come with high-interest rates or annual fees. Other options are credit-building or secured cards, which require a refundable deposit but can help build credit over time with consistent, responsible use. Always consider the terms and interest rates carefully before applying. In your scenario, it might be higher, signaling the lender's way of mitigating potential risk.

With a credit score of 639, you might find it somewhat difficult to secure a personal loan from traditional lenders. While this score isn't drastically low, it's still considered fair and could be seen as a risk by potential lenders. This means your chances of being approved for a loan at optimal interest rates may not be as high as you'd like.

While navigating this situation might feel overwhelming, it isn't without possible solutions. Alternatives like peer-to-peer loans or secured loans could be an option. Remember, these alternatives often have higher interest rates or less flexible repayment terms due to the higher perceived risk. Taking chosen steps should happen with awareness and understanding of their implications on your overall financial health. Remember, every financial decision you make can have ripple effects on your future credit opportunities.

Can I Get a Car Loan with a 639 Credit Score?

With a credit score of 639, securing approval for a car loan may prove a bit of a hurdle. To reel in the most favorable loan terms, lenders typically look for scores above 660. Anything below that could put you in what's considered a 'fair' or possibly 'subprime' category. With a score of 639, you fall into this group. This could mean potentially higher interest rates - a measure taken by lenders when they perceive a higher risk of not getting repaid.

But, don't be disheartened. Possessing a middling credit score doesn't prohibit you from obtaining a car loan. While the challenge might be greater, and the interest rates likely higher, it is still feasible. A number of lenders are equipped to work with individuals who have scores similar to your 639, but be sure to review the loan terms thoroughly before making a commitment. The road to a car loan isn't closed to you, but proceed with caution.

What Factors Most Impact a 639 Credit Score?

Appreciating what a score of 639 means is a vital step towards improving your financial position. The key to moving forward lies in acknowledging the elements influencing your score and setting in motion a plan to address them. It’s important to remember, every financial path is unique with room for growth.

Payment Timeliness

Your credit score is significantly impacted by the timeliness of your payments. If there have been any instances of later or missed payments, these could be a major factor in your current score.

How to Check: Look at your credit report for any late or missed payments and think about any times you have not paid bills on time as these might be impacting your score.

Credit Utilization Ratio

Having high balances on your credit cards can lower your credit score. If you are using much of your available credit, this could be a key aspect of your current score.

How to Check: Monitor your monthly credit card statements. Are you close to maxing out your credit limits? Keeping balances low is a beneficial strategy.

Duration of Credit History

A less lengthy credit history can affect your score negatively.

How to Check: Check your credit report to see how long your oldest and newest accounts have been open. Consider whether you've recently opened multiple accounts, as this may also impact your score.

Account Diversity and New Credit Applications

Maintaining a range of credit types and judiciously applying for new credit are crucial aspects for a healthy credit score.

How to Check: Examine your mix of credit accounts like credit cards, retail accounts, and loans. Pay attention to how frequently you've been submitting credit applications.

Public Records

Public records like bankruptcies or liens can have a substantial influence on your credit score.

How to Check: Review your credit report for any public records. Address and resolve any outstanding items as soon as possible.

How Do I Improve my 639 Credit Score?

With your credit score of 639, there’s room for improvement to move from the “fair” category to “good”. Success can be achieved by applying a focused strategy suitable for your particular situation. Consider the following targeted steps:

1. Handle Late Payments

Do you have any payments that became overdue recently? Attend to those first. Late payments can lower your credit score, so it’s crucial to resolve these promptly. Get in touch with your lenders and create a repayment plan if needed.

2. Keep Credit Utilization Low

Credit card balances need to be kept in check. Aim to maintain your credit utilization under 30% of your total limit. It helps boost your score when your cards aren’t maxed out. Prioritize the repayment of credit cards close to their limit.

3. Apply for a Starter Credit Card

If you don’t have a credit card yet, applying for a starter card is a good idea. Just make sure to pay off the balance each month on time to help build a solid payment record.

4. Seek Trustworthy Co-signer

Ask someone you trust with strong credit to co-sign a loan or credit card application. Their creditworthiness can help secure approval and begin contributing positive activity to your credit report. Ensure the lender reports co-signer transactions to the credit bureaus.

5. Explore Different Types of Credit

Varying the types of credit you use, such as including installment loans or retail credit cards can contribute positively to your credit score. Remember, always keep the debt manageable and prioritise regular, on-time payments.