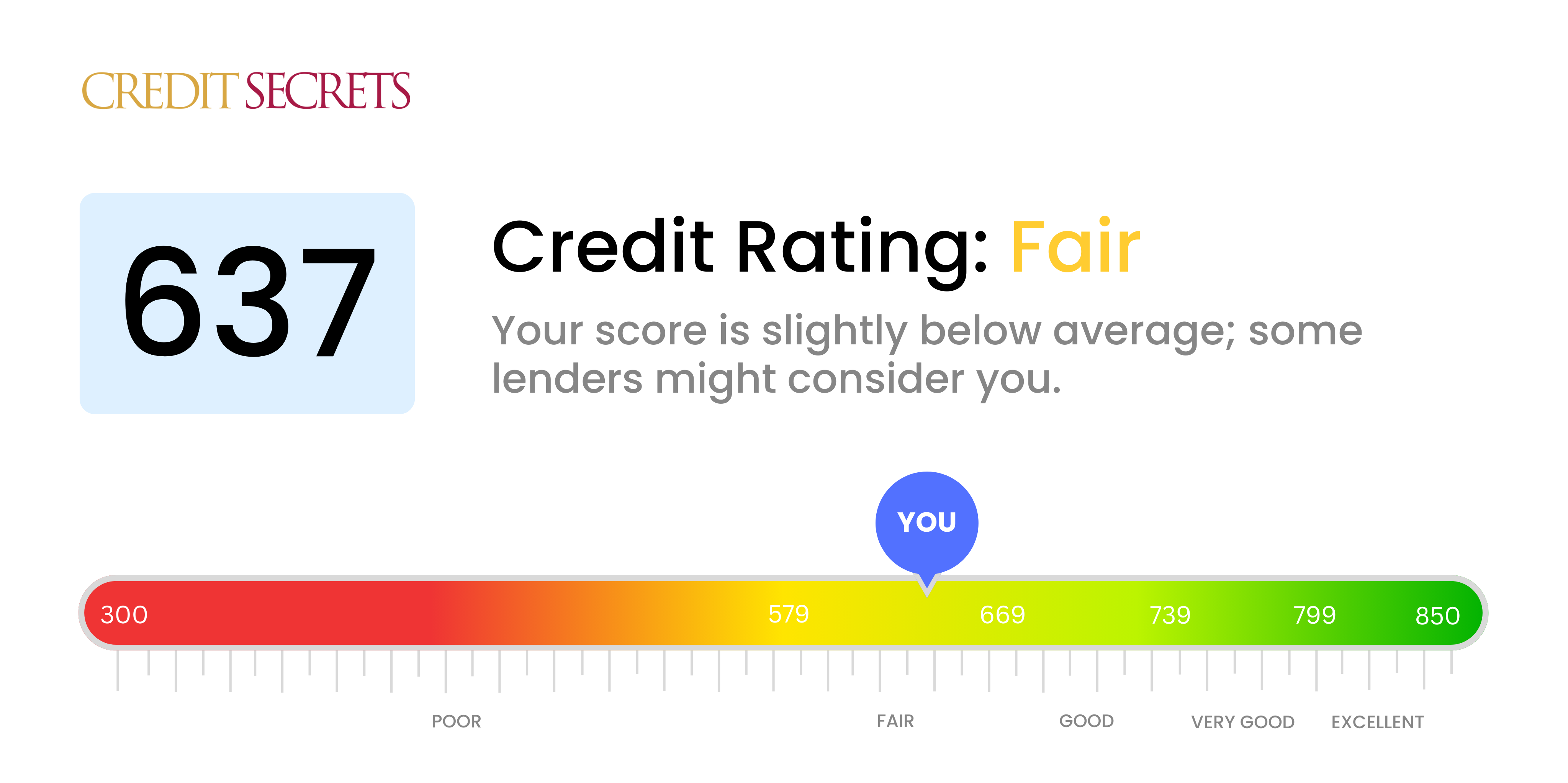

Is 637 a good credit score?

With a credit score of 637, it falls under the 'fair' category. This isn't the best credit score to have, but it does not mean you're out of options when it comes to securing credit.

Having a score in this range could mean you may face slightly higher interest rates or unfavorable terms when trying to obtain loans or credit cards. However, by taking the right steps, such as timely repayment of debts or lowering your credit utilization, you can steadily work on improving your credit score. Keep in mind that any improvement can have a positive impact on your financial future.

Can I Get a Mortgage with a 637 Credit Score?

When it comes to a credit score of 637, your chances of mortgage approval are moderate. Though not categorically denying, many lenders might be cautious as this score is below the ideal range. A score like this suggests a somewhat inconsistent credit management history, which may raise questions about your potential to consistently meet future mortgage payments.

Having said that, not all hope is lost. Every lender has different criteria, and some may still consider your application. However, they're likely to offset their risk by offering you loans with higher interest rates and less favourable terms. Mortgage approval isn't just about your credit score; other factors, like your down payment, income, and debt level, also play a role. It'd be prudent to strive to improve your credit score while also focusing on these other factors. With time, patience, and responsible financial behaviors, you can work towards an improving financial situation to boost your prospects of a more attractive mortgage deal.

Can I Get a Credit Card with a 637 Credit Score?

With a credit score of 637, securing a traditional credit card might pose certain challenges. A score in this range could signal potential reservations for lenders, as it hints at past credit challenges. This might not be the news you hoped for, but understanding your current credit status, even with its complexities, is an important step towards achieving your financial objectives.

While your credit score may limit traditional options, it does not mean you're completely out of luck. Credit cards designed for those with 'fair' credit could still be within reach. Such cards include secured credit cards, which require a security deposit. This deposit typically determines your credit limit. Additionally, starter credit cards might also be an option; they are designed to help those with lower credit scores gradually improve their rating. Irrespective of the card type, remember approval often comes with a higher interest rate due to the perceived risk. The silver lining, though, is that with responsible usage over time, higher interest rates can decrease, and credit scores can improve. Keep in mind that this is only part of your larger financial journey.

With a credit score of 637, it's going to be a bit of a challenge to secure approval for a traditional personal loan. Potential lenders generally consider this score as a sign of higher financial risk. That doesn't mean you should lose hope, though. It's just essential to understand the implications of this score on your financing options.

Traditional loan routes may prove hard with a score of 637. As an alternative, consider options such as secured loans that require collateral or co-signed loans. A co-signer with a higher credit score can serve as your back-up. Peer-to-peer lending platforms could also be an option as they may have softer requirements for credit scores. But keep in mind, these loan options often carry higher interest rates and stricter terms due to the high-risk nature to the lender.

Can I Get a Car Loan with a 637 Credit Score?

With a credit score of 637, securing approval for a car loan could be somewhat difficult. Most lenders usually prefer scores above 660 to offer better terms. Your score falls below this range, thus placing you in a category termed as 'fair,' indicating that you pose a moderate risk to lenders. This situation can often result in higher interest rates or even potential loan denial. In essence, a lower credit score makes lenders question if you'll be able to pay back the money you borrow.

The positive news is your credit score won't entirely hamper your chances of getting a car loan. There are lenders who cater specifically to those with fair credit scores. However, they might propose loans with comparatively higher interest rates to protect their investment against the risk posed. Navigating through this might be a little intricate, but with thoughtful decisions and thorough exploration of the loan terms, purchasing your desired car can still become a reality. Keep your hopes up!

What Factors Most Impact a 637 Credit Score?

Grasping the factors affecting your score of 637 is a fundamental step in your journey to financial wellness. Remedying these issues can open the path to boosting your credit score. Always remember, every individual's financial path is distinctive, offering opportunities to learn and grow.

Payment Consistency

Your payment habits significantly shape your credit score. Numerous late payments or repeated defaults could very well be a major factor in your current score.

How to Check: Carefully scrutinize your credit report for any late or missed payments. Reflect on any episodes of deferred payments, as these might have lowered your score.

Use of Available Credit

Excessive use of your credit limit can have a negative impact on your score. If your credit cards are frequently maxed out, this could be influencing your current score.

How to Check: Study your credit card statements in detail. Are your balances often nearing the limit? Striving to keep balance usage low in relation to your limit can help.

Duration of Credit History

An insufficient credit history may be affecting your score.

How to Check: Analyze your credit report to determine the age of your oldest and newest credit accounts. Consider whether you've opened all your accounts more recently.

Assortment of Credit and New Credit

Handling a variety of credit types responsibly and opening new credit only when needed are critical for a good score.

How to Check: Consider your array of credit accounts, such as credit cards, retail accounts, and installment loans. Take into account the number of recent credit applications you have made.

Public Records

Public records like bankruptcy proceedings or tax liens can considerably alter your score.

How to Check: Review your credit report for public records. Attend to any items that need resolution.

How Do I Improve my 637 Credit Score?

With a credit score of 637, you’re on the right track, but there are immediate steps you can take to improve your standing. Below are the most impactful strategies tailored to your situation:

1. Review Your Credit Report

Each year, you are entitled to a free credit report from each of the three major credit bureaus. As a first step, obtain and review them diligently. Look for discrepancies and dispute any errors promptly as they can negatively impact your credit score.

2. Maintain On-Time Payments

Your payment history has the most considerable influence on your credit score. Make a plan to ensure all future bills and loan or card payments are on time. This will reinforce positive payment behavior in your credit history.

3. Limit New Credit Requests

When your score is 637, it’s beneficial to avoid making multiple new credit inquiries in a short span. Each request can slightly lower your score, and such activity might send a negative signal to potential lenders.

4. Cultivate Credit Age

Length of credit history contributes to your score. Rather than close old accounts, which shortens your credit history, keep them active and in good standing.

5. Manage Your Credit Utilization

As a rule of thumb, you should try to use only a small percentage of your available credit. A utilization rate below 30% can significantly boost your score, with a lower rate being even better.