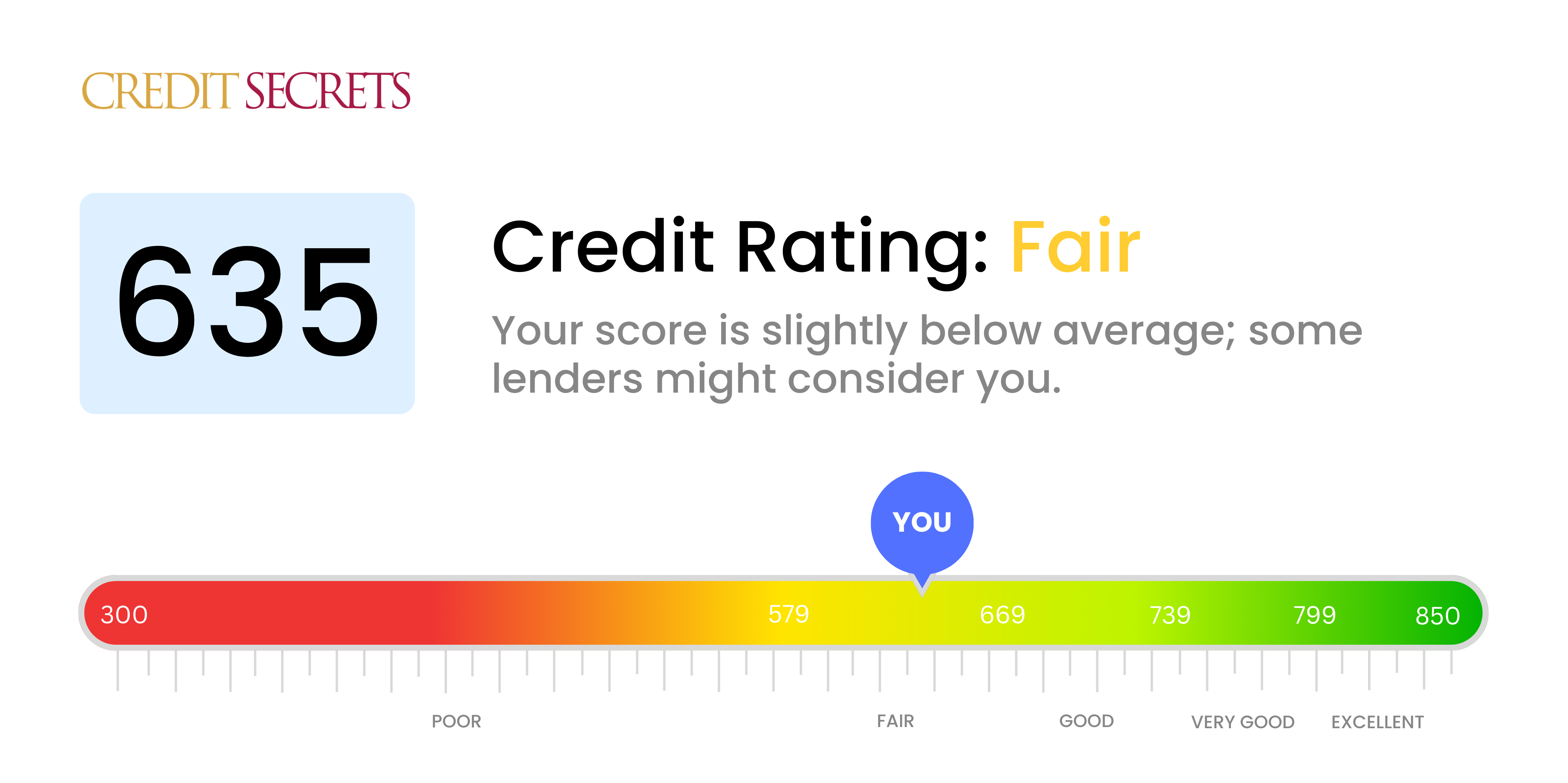

Is 635 a good credit score?

With a credit score of 635, you're right in the fair range. This means that your score is not considered high, but it's also not the lowest possible. While it's not an ideal situation, there is still plenty of room to improve.

With a fair score like 635, securing loans or credit can sometimes be a bit challenging, as lenders may see you as a somewhat high-risk borrower. Interest rates may be higher than they would be for someone with a higher score. However, it's important to understand that improving your score is a realistic goal. By consistently making on-time payments and reducing debt, you will see your score gradually improve over time.

Can I Get a Mortgage with a 635 Credit Score?

Carrying a credit score of 635 positions you in a bit of a gray area when it comes to mortgage approval. Lenders often prefer scores upwards of 660, and your score doesn't quite hit that mark. Unfortunately, this might imply you've had some difficulty managing debts or making on-time payments in the past.

Still, this doesn't necessarily close all doors. Certain programs or specialty lenders may be more lenient with credit requirements, although the trade-off often comes in the form of higher interest rates. These alternatives may enable you to procure your desired mortgage. Your journey towards homeownership may be challenging, but remember, it's not impossible. With perseverance and the right strategies, you can navigate this step of your financial journey successfully.

Can I Get a Credit Card with a 635 Credit Score?

If you have a credit score of 635, you could face some challenges when applying for a traditional credit card. This score may be viewed by some lenders as risky, indicating a past history of not adequately managing credit. While this can be disappointing, it's crucial to remain realistic about the situation. Recognizing your credit health is an integral part of working towards better financial stability.

With a credit score in this range, you may want to consider options like secured credit cards. These cards require a security deposit, which typically acts as your credit limit and can be more accessible to obtain. This type of card can help to slowly rebuild your credit score. Prepaid cards, or having a trusted person co-sign on a card, could also be sensible alternatives. Although these solutions won't immediately solve your credit issues, they're a step in the right direction. Bear in mind that any credit you are able to obtain will likely come with higher interest rates due to the increased risk perceived by lenders.

Having a credit score of 635 might make it somewhat challenging to secure a personal loan from traditional lenders. They often view this score as a moderate risk, which could lead them to hesitate in approving your loan application. This score isn't great, but it's not the worst either. When dealing with financial matters, it's beneficial to acknowledge your current position, even if it's not where you hoped to be.

If a normal route for a personal loan seems unlikely, it may be beneficial to explore other options. You could consider a secured loan, where you offer up something valuable as collateral. Another servicable alternative could be a co-signed loan, where a person with a stronger credit score co-signs on the loan to lower the lender's risk. Peer-to-peer lending platforms could also be a valuable resource, as they can be less rigorous with credit requirements. However, be aware that these options may have higher interest rates and might not offer the most desirable terms due to the higher risk involved for the lender.

Can I Get a Car Loan with a 635 Credit Score?

Your credit score of 635, unfortunately, might give you a bit of trouble when applying for a car loan. Lenders typically prefer scores above 660, but don't give up just yet. Your score, while considered subprime, doesn't automatically disqualify you from getting a loan.

A lower credit score like yours signals a higher risk to lenders, often leading to higher interest rates on your loan or potential loan denial. Why? Because they think you might have trouble paying back the money based on your past credit history.

Despite the hurdles, getting a car loan isn't impossible. Some lenders cater to those with lower credit scores. Just remember to tread carefully because these loans often carry higher interest rates to offset the perceived risk to the lender. Be sure to understand all of the terms before you sign. Despite the challenges, buying a car is still a reachable goal.

What Factors Most Impact a 635 Credit Score?

Grasping the details of a 635 credit score can be a stepping stone to propelling your financial progression. By examining the factors that have most likely influenced this score, you can cultivate a strategy to enhance your financial standing.

Payment History

Your payment history can significantly impact your credit score. Having consistent late payments or defaults might be the reason for your score being at 635.

How to Check: Carefully review your credit report for any recorded late payments or defaults. If you have had instances where the payments were delayed, they probably have depreciated your score.

Credit Utilization

A high credit utilization ratio can reduce your score. If your credit consumption is usually close to the limit, this could be a factor.

How to Check: Look at your credit card balances. Are they frequently peaking the limit? Lowering the balances in relation to the limit can significantly uplift your score.

Length of Credit History

A relatively short credit history might negatively influence your score.

How to Check: Check your credit report to determine the average age of your accounts. If you've newly opened several accounts, they may have affected your score.

Credit Mix

Maintaining a healthy mix of credit types and managing them responsibly forms a key element of a well-rounded credit score.

How to Check: Scrutinize your variety of credit accounts like credit cards, retail accounts, or loan accounts. Having a diverse mix can help improve your score.

Derogatory Marks

Derogatory marks such as collections, tax liens, or bankruptcies can significantly pull down your score.

How to Check: Review your credit report for any derogatory marks. It's essential to address and resolve these items to improve your credit score.

How Do I Improve my 635 Credit Score?

Your credit score of 635 needs improvement, but don’t fret, as there are specific actions you can take to get onto the path to a brighter financial future. Start taking these steps appropriate to your current scenario:

1. Pay Off Your Outstanding Debt

Paying off unpaid debts is crucial, especially if there are any at risk of going into collections. This can pull down your score drastically. Try to tackle these promptly, and don’t hesitate to negotiate payment plans if needed.

2. Keep Your Credit Utilization Low

For a person with your credit score, it’s essential to keep credit balances below 30% of your credit limit and lower if possible. Strive to trim down the balances of cards with the highest usage rates first.

3. Obtain a Secured Credit Card

Obtaining a regular credit card may not be easy with your current score. A secured credit card may be feasible, requiring a cash collateral deposit which acts as your credit line. Make sure to make payments in full monthly, fostering a healthy payment history.

4. Take Advantage of Being an Authorized User

A dependable person with good credit can assist by adding you as an authorized user to their credit card. However, they should confirm that their card issuer reports authorized user activity to the credit bureaus to benefit you.

5. Broaden Your Credit Scale

Dealing with an array of credit types can assist in boosting your credit score. Once you have a secured card and have built a commendable payment history, explore other credits like retail credit cards or credit builder loans and handle them responsibly.