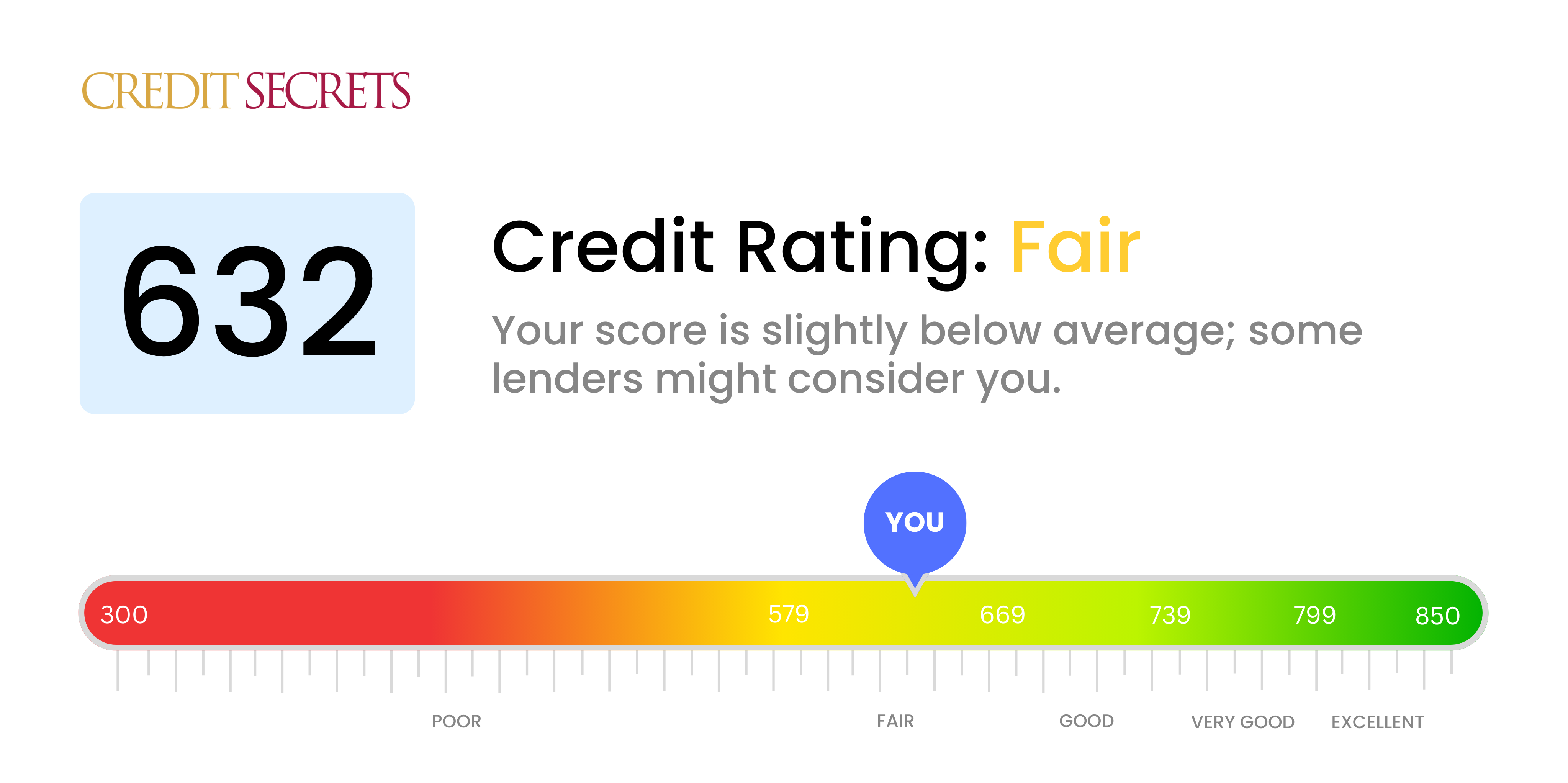

Is 632 a good credit score?

A credit score of 632 is generally considered to be fair. With this score, you might face a bit of a challenge securing prime rates on loans, as lenders could perceive you as a slightly risky borrower.

You might receive approval for credit or loans, but it's also likely you may encounter higher interest rates or stipulations compared to those with higher credit scores. However, it's important to remember that various lenders have different criteria, and it isn't impossible to find manageable credit options. Maintaining a positive outlook, you have every chance to improve your credit from here.

Can I Get a Mortgage with a 632 Credit Score?

Holding a credit score of 632, you could face some difficulties while applying for a mortgage. Often, lenders prefer applicants with credit scores that land in the 'good to excellent' range, which typically start at 670. A credit score of 632 falls into the 'fair' range, which may imply that you've had a few financial struggles in your past.

Though this might feel like a discouraging situation to be in, it doesn't mean that obtaining a mortgage is completely out of reach. Some lenders specialize in offering loans to people with less-than-ideal credit. However, it's important to bear in mind that these loans generally come with higher interest rates to offset the potential risk posed to the lender. This means that your mortgage payments could be higher than those of someone with a credit score in the 'good' range or above.

While you have the choice to proceed with seeking a mortgage now, you can also consider pausing to work on improving your credit score. By making timely payments and keeping your credit utilization low, you may be able to raise your score over time. This could qualify you for more favorable mortgage terms in the future.

Can I Get a Credit Card with a 632 Credit Score?

With a credit score of 632, it's likely that approval for a traditional credit card may be difficult. Lenders may see a score in this range as risky, possibly signaling past financial problems or difficulty managing money. This news might be tough to hear, but it's important to face it head-on.

Potential alternatives for credit are available, even with a score of 632. Exploring secured credit cards could be a good start. Secured cards require a deposit that then serves as your credit limit. Secured cards can be easier to get and can help improve your credit over time. Also, prepaid debit cards might be worth considering if traditional credit cards are currently out of reach. Do remember, while these alternatives don't immediately rectify the situation, they play a part in your journey towards financial stability. One more point to consider - the interest rates for any form of accessible credit for someone with a 632 score might be on the higher side, reflecting the perceived risk by lenders.

A credit score of 632 is considered subprime and sits below the usual threshold for what lenders typically view as acceptable. This credit score may make it difficult for you to secure a traditional personal loan due to the perceived risk associated with it. This isn't the news you hoped for, and it's understandably challenging.

Despite this, there remain certain alternatives may become viable options. One route could be pursuing a secured loan, in which you provide an asset as collateral. Another option is a co-signed loan, where someone with a higher credit score guarantees your loan. Peer-to-peer lending may also be an avenue to explore, as they may have more relaxed credit score standards. Please remember though, these alternatives often come with higher interest rates and less favorable terms, as the lender is taking on more risk. Even in difficult circumstances, it's important to stay informed and proactive.

Can I Get a Car Loan with a 632 Credit Score?

With a credit score of 632, you might face some hurdles while applying for a car loan. It's not uncommon for lenders to look for credit scores over 660 to offer the best loan conditions. Unfortunately, your score doesn't quite meet this threshold. This doesn't necessarily mean a flat-out rejection, but it may mean less favorable loan terms. A credit score under this cutoff point represents a higher risk to lenders, indicating potential repayment issues. Therefore, there's a chance of facing higher interest rates.

Despite this, don't be disheartened. There's still hope for securing a car loan. Remember, some loan providers are adept at dealing with applicants who have lower credit scores. However, one word of caution: these loans might come with much higher interest rates to counterbalance the perceived lenders' risk. So, be sure to read and understand the terms thoroughly, considering all aspects before taking a decision. With a mindful approach, getting a car loan can still be an achievable goal.

What Factors Most Impact a 632 Credit Score?

Investigating a score of 632 is pivotal in outlining your path to financial growth. Recognizing and rectifying the crucial issues influencing your score can lead to superior financial stability. Always keep in mind that each financial path is unique, filled with potential growth and learnings.

Payment Efficiency

Being prompt with your payments greatly affects your credit score. If there's a pattern of late payments, this would contribute majorly to your current score.

Checking Method: Scrutinize your credit report for any delinquent payments. Think about any past payments that were non-punctual, these could have downgraded your score.

Credit-to-Debt Ratio

A high credit-to-debt ratio can lower your score. If your credit card balances are nearly or fully maxed out, this could be a possible reason for your score.

Checking Method: Inspect your credit card statements. Are the dues close to the maximum? Endeavor to keep dues low compared to their limit to enhance your score.

Duration of Credit History

Having a shorter credit history can lower your score.

Checking Method: Analyze your credit report to gauge the age of your oldest and newest credit accounts and the average age of all your accounts. Reflect if you have recently opened new accounts.

Credit Variety and Newly Acquired Credit

Holding a diverse portfolio of credit types and maintaining new credit diligently are key for a good score.

Checking Method: Assess the variety of your credit accounts, such as credit cards, retail accounts, installment loans, and mortgage loans. Reflect if you have been cautious about acquiring new credit.

Public Records

Public records especially bankruptcies or tax liens can dramatically lower your score.

Checking Method: Go through your credit report for any public records. Address any listed due for resolution.

How Do I Improve my 632 Credit Score?

With a credit score of 632, you’re not far from the edge of a fair rating, which starts at 650. However, various strategies can help you enhance your score further. Here’s where you should focus your efforts:

1. Keep Your Bills Current

To improve your credit score, make it a priority to pay all your bills on time. Late payments can harm your score, so set up automatic payments or reminders to ensure you never miss a due date.

2. Lower Revolving Credit Balances

If your credit card balances are high, work on lowering them. Aim to maintain your balances to less than one-third of your available credit limit for the best impact on your score.

3. Review Your Credit Report for Inaccuracies

Errors on your credit report can pull your score down. Obtain copies of your credit reports from all three bureaus and review them for any inaccuracies. If found, dispute these with the reporting bureau.

4. Limit New Credit Inquiries

New credit applications cause hard inquiries, which can lower your credit score. Limit new credit applications to avoid unnecessary dents in your score.

5. Consider a Credit Builder Loan

Consider taking out a credit builder loan, where a bank or credit union lends you a small amount but holds onto the money until you repay the loan. On-time payments help to build a positive payment history which can increase your credit score.