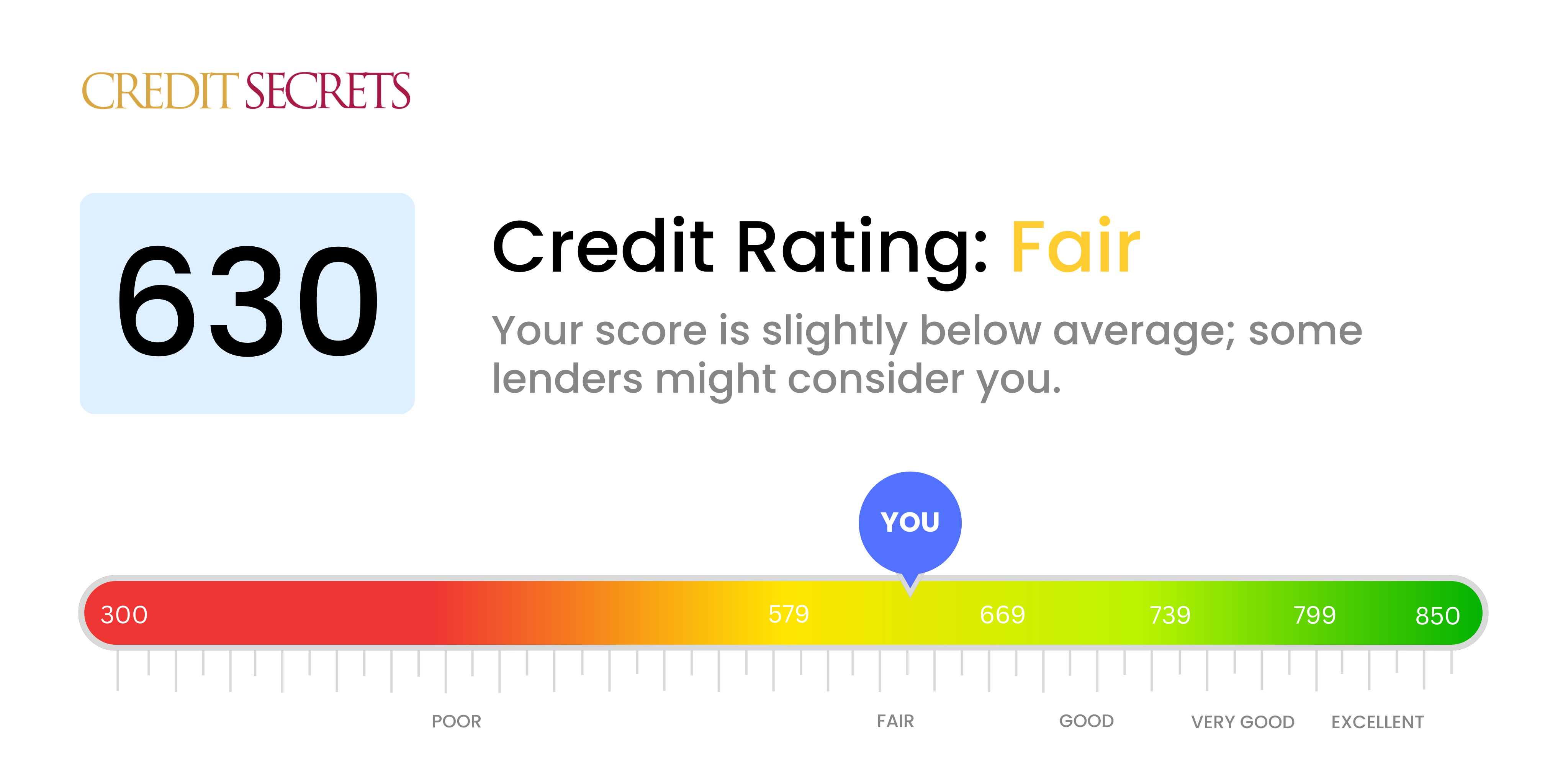

Is 630 a good credit score?

A credit score of 630 is considered as 'fair'. It is not an exceptionally good score, but it doesn't mean you're in financial crisis either.

With this score, obtaining credit may be more challenging and the interest rates offered to you may be a little higher compared to those with better scores. But don't worry, remember that it's entirely possible to improve this score by ensuring timely payments and maintaining low credit card balances. Stay optimistic and keep working towards your financial goals.

Can I Get a Mortgage with a 630 Credit Score?

If your credit score is 630, obtaining a mortgage might be challenging. This score is below the average range, making it less likely for lenders to consider your application favorably. This indicates that you may have had some difficulties in your financial history, such as infrequent late payments or high credit utilization.

Although you might face some difficulties, it's not impossible to secure a mortgage with this score. You may be subject to higher interest rates and might require a larger down payment. Subprime loans are also an option, but these often carry higher interest rates and fees. Alternatively, there are programs specially designed for people with lower credit scores, like FHA loans. Keep in mind, improving your credit score can increase your chances of loan approval and help you secure a better interest rate. Be resilient and positive as you tread on this financial journey. Persistence pays off, and you are more than your credit score.

Can I Get a Credit Card with a 630 Credit Score?

With a credit score of 630, while it might be more challenging to secure approval for most credit cards, remember that it's not impossible. It's considered to be in the "fair" range, which may indicate to potential lenders that you pose a somewhat higher risk than those with higher scores. It's vital to grasp the reality of your financial situation and remember that credit scores can always improve.

Given the reality of this credit score, your options might be slightly limited but not entirely restricted. You might want to consider secured credit cards. These cards require a deposit that becomes your credit limit and are often easier to acquire in these situations. Alternatively, you might also deem starter credit cards as viable options. These are designed specifically for individuals who are either new to credit or trying to rebuild. It's important to understand though, this score may result in higher interest rates, which are a reflection of the heightened perceived risk by lenders. Yet, they can act as stepping stones on your path to a better financial standing.

With a credit score of 630, getting approval for a typical personal loan may be challenging. Credit scores in this range often indicate a significantly less favorable lending risk to most standard lending institutions. It can be a tough situation to navigate, but it's crucial to understand the impact of your current credit score on your likelihood to secure a personal loan.

There are alternate options out there for you to consider. Exploring secured loans, where collateral is provided, or co-signed loans, involving someone with a stronger credit standing, could provide possible solutions. Peer-to-peer lending platforms are also a viable path, as their credit score requirements can be comparatively lenient. Still, bear in mind that these alternatives typically lead to higher interest rates and stringent terms, given the additional risk perceived by the lender.

Can I Get a Car Loan with a 630 Credit Score?

Having a credit score of 630 could pose some hurdles when seeking approval for a car loan. Most lenders seek a higher credit score, ideally around 660, to offer competitive interest rates and favorable terms. With a credit score of 630, you might find yourself in a 'high risk' classification because the score represents a potential difficulty in repaying the loan on time.

Even though a lower credit score presents a challenge, it doesn't mean your car loan ambitions are impossible. Certain lenders specialize in assisting those with modest credit scores. It's crucial to remember, however, that dealing with these lenders can often mean dealing with higher interest rates. These rates are inflated to balance the risk the lender perceives they're taking with your credit score. Don't get discouraged - with careful planning and a full understanding of the loan terms, you can still get approved for a car loan.

What Factors Most Impact a 630 Credit Score?

Deciphering a credit score of 630 is a key step forward on your path to financial success. By pinpointing and addressing the elements shaping your score, you can carve out a healthier financial future for yourself. Just like fingerprints, every financial journey is distinct and packed with learning and growth prospects.

Credit Utilization Rate

With a score of 630, high credit utilization could be a significant factor pulling your score down. If your balances are often close to their limit, this has likely taken a toll on your score over time.

How to Check: Take a close look at your credit card statements. If your balances are perpetually more than 30% of your limit, it's time to make some changes.

Missed or Late Payments

Your payment history can weigh heavily on your credit score. If you have a record of defaults or delayed payments, these could have significantly impacted your score.

How to Check: Go through your credit report carefully and identify any missed or late payments, as this factor can compromise your creditworthiness.

Insufficient Credit History

Insufficient credit history could also be holding your score down. If you've recently opened new accounts, your credit score may have been adversely affected.

How to Check: Check your credit report and evaluate both the age of your oldest account and the average age of all your accounts.

Credit Diversity

Having a mix of different types of credit can bolster your score. If you only have one type of credit, this may have kept your score from going higher.

How to Check: Examine your accounts. Having a mix of credit cards, retail accounts, installment loans, and mortgage loans can cast a positive light on your credit profile.

Outstanding Judgments or Liens

Judgments or liens documented on your credit report can have a considerable negative impact on your score.

How to Check: Scrutinize your credit report for any liens or judgments and take action where necessary.

How Do I Improve my 630 Credit Score?

With a credit score of 630, you’re on the brink of having fair credit. There are certainly targeted steps available to help you increase this score. Here are your most feasible actions:

1. Review Your Credit Report

Errors on your credit report could be dragging down your score. Obtain a free copy of your credit report from each of the three major bureaus and thoroughly review it for inaccuracies. If found, contact the respective credit bureau and creditors to rectify these errors.

2. Tackle High-Interest Debt

Paying down debt with high interest should be your prime focus as it could be burdening your score. With these paid off, you will have less debt overall, reducing your credit utilization ratio and increasing your score.

3. Utilize a Credit-Builder Loan

At a 630 credit score, a credit-builder loan could be a viable option for you. These are small loans held by the lender in a secured account while you make payments. The timely repayments are reported to credit bureaus, aiding in increasing your score.

4. Maintain Older Credit Accounts

Longer credit history can contribute to a better credit score. Hence, keep your oldest credit accounts open, even if not in use, as long as they are not costing you unnecessary fees.

5. Pay Bills On Time

Becoming regular with on-time payments is a strong method to influence your credit score positively. Payment history is a significant part of your credit score, and timely payments can rapidly improve your score over a period.