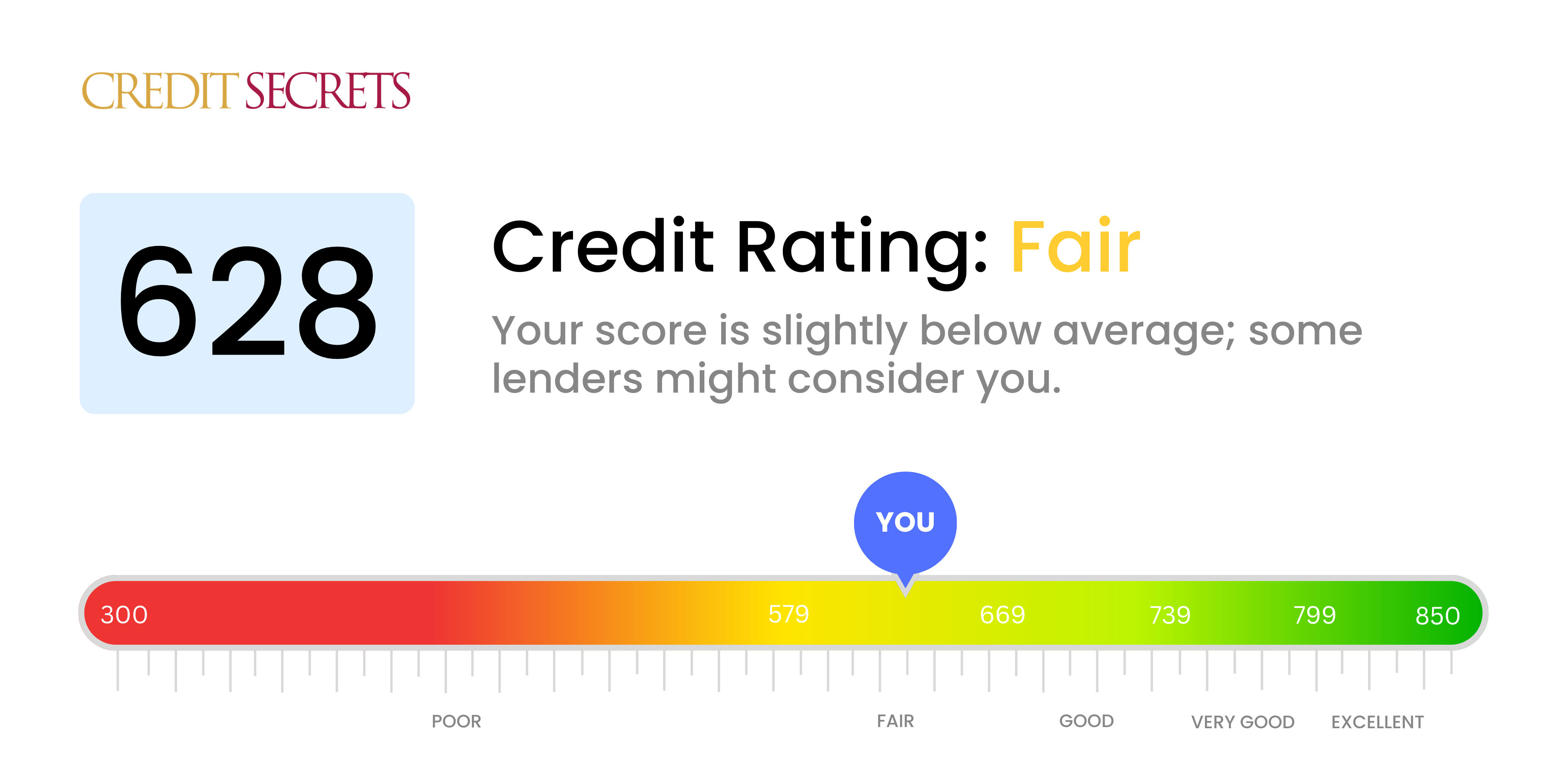

Is 628 a good credit score?

A credit score of 628 falls into the fair category. While it's not in the danger zone of a poor score, it's also not in an optimal range and could make it challenging when applying for loans, credit cards, or other financial products.

Expect to potentially face higher interest rates or tougher approval processes as lenders might consider you a moderate risk. But don't despair, with some consistent effort in maintaining good financial habits like paying bills on time, reducing outstanding debts and not applying for new credit impulsively, you have the opportunity to improve this score over time.

Can I Get a Mortgage with a 628 Credit Score?

With a credit score of 628, mortgage approval isn't guaranteed, but it isn't out of reach either. This score falls into the category of 'fair,' meaning that it's below the average credit score. However, there are mortgage lenders who consider applicants in this range, though you may not qualify for the best interest rates or terms.

Keep in mind that your interest rates could be higher compared to those with superior credit scores. Your credit score is a key determinant in both mortgage approval and the interest rate that lenders will offer. Higher scores represent less risk for the banks, so lower scores, like 628, often lead to higher interest rates. That being said, remember there are other factors at play, including your income and the size of your down payment. With a steady income and a substantial down payment, you might still secure a competitive mortgage deal even with a fair credit score.

Can I Get a Credit Card with a 628 Credit Score?

Having a credit score of 628 might make your journey towards acquiring a credit card slightly thorny. This score is often seen as subprime by lenders, which indicates you've had a few financial bumps in the past. This situation might seem discouraging, but confronting it with courage and understanding is crucial for your financial progress. Recognizing and acknowledging your present credit standing plays a vital role in your financial rehabilitation.

Unfortunately, this credit score could make it tough to be approved for most traditional credit cards. However, you still have options like secured credit cards, these cards require a deposit which will be your credit limit. They are generally more accessible to obtain, and they can assist in gradually rebuilding your credit. Higher than average interest rates can be anticipated, given the risk lenders perceive. Yet, always remember: these are just temporary steps on your journey to financial stability. Keep your sights on your long-term goals.

If you have a credit score of 628, you may find it somewhat challenging to receive approval for a personal loan from traditional lenders. This score sits below the preferred range for most lenders, suggesting a higher level of risk. Though this hurdle may seem daunting, it is vital to address the financial implications that this credit score may impose on your borrowing options.

If conventional personal loans aren’t an accessible choice, some alternatives may exist. Secured loans, where you offer collateral, or co-signed loans, in which another individual with superior credit acts on your behalf, could present possible options. You might also investigate peer-to-peer lending platforms, which may offer more flexible credit requisites. Notwithstanding, it is essential to realize these alternatives typically carry higher interest rates and a less desirable set of terms, reflecting the amplified risk for the lender.

Can I Get a Car Loan with a 628 Credit Score?

A credit score of 628 might place some challenges in your path when seeking approval for a car loan. Usually, lenders prefer scores above 660 to offer the most favorable terms, and scores below 600 are often tagged as subprime. Your score of 628, while not in the subprime category, still indicates a heightened risk to loaners.

This higher perceived risk might lead to more expensive interest rates or even rejection of the loan application. It reflects a potential struggle for borrowers to fulfill repayment obligations based on historical data. The disheartening reality is that it can be a rough journey, but don't lose hope. There are lenders who specialize in dealing with such situations, extending loans to individuals with not-so-high credit scores.

Remember to tread carefully though, as the increased interest rates these loans come with are the loaners' way of protecting their investment. The path may seem somewhat rocky, but with careful planning and thoroughly understanding the terms, getting a car loan is far from impossibility. Stay focused, be strong and carry hope in your heart, your dream car might just be around the corner.

What Factors Most Impact a 628 Credit Score?

Navigating through a credit score of 628 requires careful understanding of the factors influencing this rating. Addressing these elements optimistically paves the path towards enhancing your financial standing.

Punctuality in Payments

Unsettled dues or delays in payment can have significant bearings on your credit score. If you've had instances of non-payment, this could contribute towards your current score.

How to Check: Peruse through your credit history to check for any late payments or unpaid debts. Recall any instances where payments were postponed as these can be detrimental to your score.

Credit Utilization

Maintaining high credit limits can negatively impact your credit score. If most of your credit cards are close to their maximum limit, this may be a reason for your score.

How to Check: Scrutinize your credit card statements. Is the used credit close to the maximum limit? Striving to keep the credit usage low in comparison to the limit is beneficial.

Time Span of Credit History

A brief credit history might have a negative repercussion on your score.

How to Check: Examine your credit history to see the age of your earliest and latest accounts and the mean age of all your accounts. Question if any accounts have been recently instated.

Diversity in Credit and New Credit

Possessing an array of credit types and diligently managing new credit is crucial for a desirable credit score.

How to Check: Look into your range of credit accounts, such as retail accounts, installment loans, and mortgage loans. Consider your frequency of new credit applications.

Public Records

Public records such as bankruptcy cases or tax liens can considerably affect your credit score.

How to Check: Review your credit report for any public records. Resolve any items identified that require attention.

How Do I Improve my 628 Credit Score?

Your credit score of 628 falls under the ‘Fair’ category. But don’t worry, with purposeful and intentional strategies, this score can be boosted. Let’s consider the most accessible and impactful actions tailored for your score range:

1. Regular On-time Payments

Your payment history greatly influences your credit score. If you’ve had issues with late payments in the past, it’s time to change. Start by setting up payment alerts or automatic payments to ensure you pay every bill on time, as this practice will gradually increase your credit score.

2. Handle Outstanding Debts

Look into your credit report for any outstanding debts, collections or judgements. Develop a strategic plan to settle these debts, starting with the smallest, a method often referred to as the ‘snowball approach’ which can be highly effective.

3. Maintain Low Credit Card Balances

Keeping high balances on your credit cards can hamper your credit score. Try to keep the balance of each card under 30% of your credit limit, and if possible, aim for under 10%. Paying down the cards with the highest utilization rates should be your priority.

4. Review Your Credit Report

Get into the habit of periodically examining your credit report to ensure its accuracy. Mistakes, if any, should be promptly reported and rectified. This practice aids in maintaining a healthy credit score.

5. Steer Clear of Frequent Credit Inquiries

Each time you apply for a new line of credit, a hard inquiry is carried out, which may impact your credit score. Limiting new credit inquiries can help maintain or improve your score.