Is 626 a good credit score?

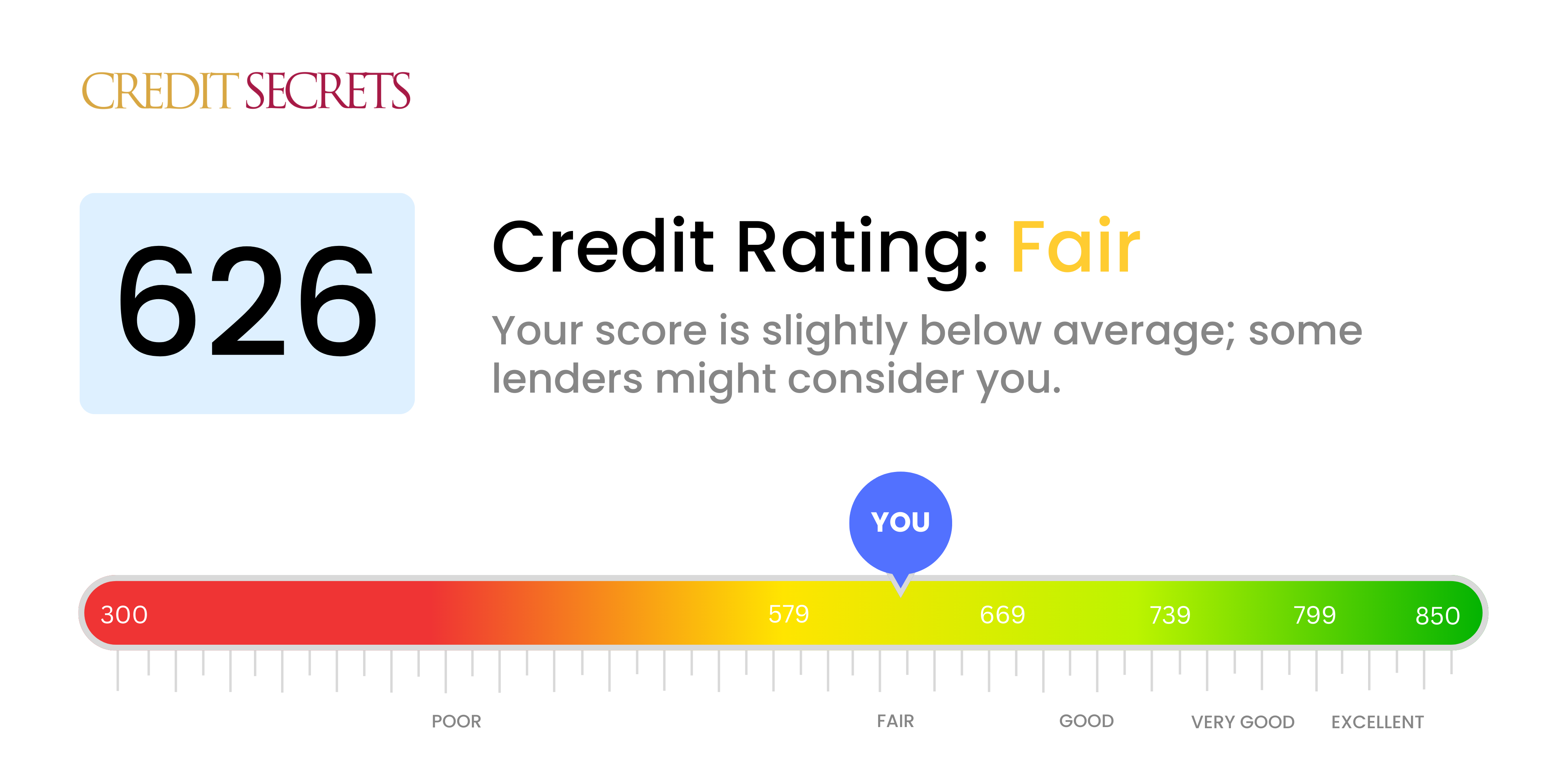

If you have a credit score of 626, your score is classified as "fair." This score isn't the worst, but it isn't the best either, it lies somewhere in the middle.

With a score such as this, you might find that getting credit approval can be a bit more challenging than it would be for someone with a higher score. Interest rates offered to you might also be less favorable. The good news is, there are proven ways you can work on improving your score. At Credit Secrets, we can guide you in understanding your credit score better, and offer tips to help you move your credit score up to the next level.

Can I Get a Mortgage with a 626 Credit Score?

With a credit score of 626, the potential for securing a mortgage may be a bit challenging. This score is categorized as fair, and some lenders may be hesitant to extend significant credit like a mortgage to borrowers in this score range. It reflects a less than perfect credit history, possibly with missed payments or occasional defaults.

However, having a fair credit score does not mean it is impossible to get a mortgage. Certain loan programs, like Federal Housing Administration (FHA) loans, accommodate borrowers with lower credit scores. The trade-off may be higher interest rates or requiring a larger down payment. This is because lenders use interest rates to offset the risk they take lending to borrowers with lower credit ratings. Dedication and consistency in responsible financial behavior can gradually improve your credit score over time, opening up more options for you in the future.

Can I Get a Credit Card with a 626 Credit Score?

With a credit score of 626, it may be somewhat difficult for you to get approved for most premium credit cards. Creditors often take this score as an indication of some financial inconsistencies in your past. While it's not the best case scenario, it's crucial to face it with courage and perseverance. Recognizing and accepting your current credit situation is the first positive step towards a healthier financial future.

Having a score like this, there are several alternative possibilities you may want to look into. Secured credit cards, for example, might be a good fit. These cards require a deposit that will serve as your credit limit, making them relatively easier to acquire and helpful in gradually restoring your credit standing. Another option could be store cards that have less stringent requirements. Just keep in mind that, because of your score, interest rates might be higher, reflecting the increased risk for the lenders. But don't lose heart, as these options may help you climb up the ladder to a more robust financial status.

With a credit score of 626, your chances of being approved for a traditional personal loan may be slim. This score strikes most lenders as being risky, leading to a higher likelihood of loan denial. It's a tough spot to be in, but it's crucial to have a clear understanding of what this credit score indicates about your loan prospects.

Even though standard loans may not be viable, other options like secured or co-signed loans could be available to you. Secured loans require collateral, while co-signed loans need someone with a higher credit score to vouch for you. Peer-to-peer lending platforms may also be a practical choice, as they can sometimes have more flexible credit score requirements. Be wary, however, that these alternatives usually include higher interest rates and non-optimal terms due to the perceived credit risk by the lender.

Can I Get a Car Loan with a 626 Credit Score?

With a credit score of 626, seeking approval for a car loan may be more difficult than you'd like. The preferred score for lenders tends to be over 660 as it shows a history of reliable repayment. Having a score below 660, and especially in the 600-630 bracket, can sometimes be seen as subprime and could lead to higher interest rates, or perhaps not getting the loan approved.

However, don't feel disheartened. Some lenders stand ready to assist those having credit scores on the lower end. It's vital to understand though, such loans typically come with higher interest rates due to the perceived risk lenders deem to take. Make sure to read all the terms carefully. Despite the hurdles, securing a car loan with a credit score like yours is not impossible. It just requires a bit more effort and dedication, so keep your hopes up!

What Factors Most Impact a 626 Credit Score?

Analyzing your credit score of 626 can empower you to take control of your finances. Paying attention to certain key factors could help elevate your score and bring you closer to your financial goals.

Payment Performance

The record of how promptly you've made payments in the past can have a deep impact on your credit score. Any delinquencies or defaults are likely to lower your score.

How to Check: Scan your credit report for any signs of late payments or non-payments. Reflect on your payment habits and identify areas of improvement.

Credit Card Utilization

Your credit card utilization ratio plays a role in shaping your credit score. If you're frequently nearing or exceeding your credit limits, this could be pulling your score down.

How to Check: Check your recent credit card statements to see the relationship between your existing balances and your credit limits. Lower ratios are generally better for your credit health.

Credit History Duration

The length of your credit history can also influence your score. A shorter history might leave you with a lower score.

How to Check: Your credit report should include specifics on the age of your earliest and most recent credit accounts. Evaluate if you have opened new credits recently, which can lower your score.

Credit Diversity & Fresh Credit

Having a mix of different types of credit and managing new credit responsibly adds to a robust credit profile.

How to Check: Go through your credit accounts, looking for diversity. Are there credit cards, retail accounts, installment loans, and mortgage loans? Have you been applying for new credit judiciously?

Public Records

Public records like tax liens or bankruptcies can cast a long shadow on your credit score.

How to Check: Check your credit report for any public records that could be hurting your score. Resolve any listed items that may require attention.

How Do I Improve my 626 Credit Score?

A credit score of 626 puts you in the fair category, and while it’s not the lowest, there’s room for significant improvements. Let’s strategize the most effective ways for a score at this level:

1. Prioritize Highest Impact Debts

The negative influence of some debts, like collections and charge-offs, can be more significant on your credit score. Your initial focus should be on settling these debts. It may seem overwhelming, but remember to take it one step at a time.

2. Aim for Lower Utilization Rates

Your credit utilization ratio forms an essential part of your credit score. It’s best to maintain your balances under 30% of your total credit limit, and even better if you can get it under 10%. Attacking the cards with the highest utilization rates first can be beneficial.

3. Build a Strong Payment History

Payment history has a substantial impact on your credit score. Therefore, consistently paying your bills on time cannot be overstated. If remembering due dates is a challenge, consider setting up automatic payments.

4. Review Your Credit Reports for Errors

Errors on your credit report can unfairly drag down your score. You have the right to request a free annual copy of your credit report from each of the three major credit bureaus. Examine each report carefully and dispute any inaccuracies you may find.

5. Leverage Different Types of Credit

Once your secured card payment history is solid, introducing varied types of credit, like personal loans or automotive financing, can further elevate your credit score. While diversifying, remember—manage any new credit responsibly.