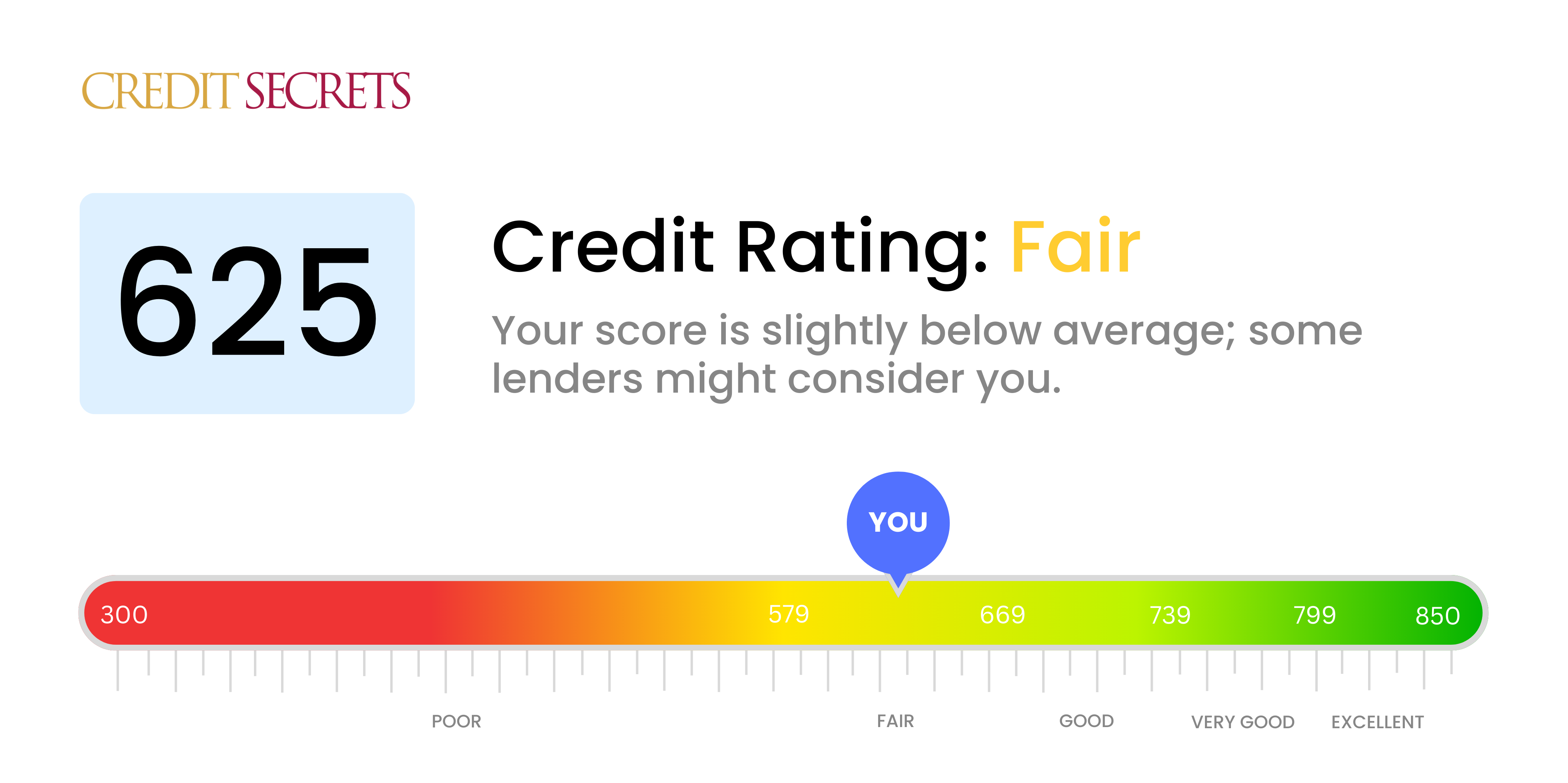

Is 625 a good credit score?

Your 625 credit score falls under the 'Fair' category. With a fair score, you might face somewhat limited options when it comes to credit cards and loans, and those you do qualify for may carry higher interest rates or require collateral. But there's no need to worry - this isn't the end of the road, you can certainly take steps to improve it. Continue to make your payments on time and reduce your debt to give your score a boost.

Remember, having a Fair credit score doesn't mean that you won't be able to receive credit at all. It just means you might have to work a little harder and be a bit more patient to get the best terms and rates. Keep making smart financial choices and gradually, you'll see your score climb up the ladder towards a 'Good' or even 'Excellent' score. Financial journey is a marathon, not a sprint, so keep going and stay hopeful.

Can I Get a Mortgage with a 625 Credit Score?

With a credit score of 625, your chances of mortgage approval can be slightly challenging, as this score is moderately below the optimal range that lenders typically look for. A score in this zone may signal a past of sporadic financial challenges such as inconsistent loan repayments or excessive credit use.

While it's understandably a tough spot to be in right now, it's possible to navigate through with strategic financial choices. One viable alternative could be seeking an FHA mortgage loan, which has more accommodating credit requirements. While the interest rates may be relatively higher, it presents an opportunity for homeownership, despite the lower credit score. Another avenue is to examine reasons for your lower score and take targeted actions, such as settling any pending delinquencies. While transforming a credit score doesn't happen overnight, with discipline and determination, you'll be in better shape for homeownership aspirations.

Can I Get a Credit Card with a 625 Credit Score?

Having a credit score of 625 can make the process of obtaining a traditional credit card somewhat difficult. Lenders often see this score as a moderate risk, indicating as it does a past that may include some financial missteps. It's not the news anyone wants to hear, but it's crucial to face this fact with both understanding and realism. Acknowledging the current state of your credit score is, after all, the first move on the path to financial recovery.

In confronting these challenges, options beyond traditional credit cards may be worth considering. One possibility is a secured credit card. These require a deposit which then becomes your credit limit, making them often more accessible, even with a less-than-perfect credit score. They can also be a helpful part of a strategy to rebuild credit over time. However, bear in mind that interest rates for such cards can be higher, reflecting the higher risk from a lender's perspective. Using these options wisely could be a meaningful step on your journey towards financial health.

A credit score of 625 might present a bit of a hurdle if you're seeking a traditional personal loan. Lenders typically prefer higher scores, as they indicate a lower risk. With a score like yours, it suggests to potential lenders that lending money to you might come with certain risks. However, this isn't the end of the road; it simply means you may face some challenges along the way.

The good news is, not all doors are closed to you. You might want to explore alternative financing options such as secured loans, which require collateral, or co-signed loans, where someone with a stronger credit score guarantees your loan. Peer-to-peer lending is another avenue you might consider. Be mindful though, as these alternatives could come with higher interest rates, reflecting the increased level of risk for the lender. In essence, securing a loan could be possible but it's crucial to understand the terms before you proceed.

Can I Get a Car Loan with a 625 Credit Score?

A credit score of 625 may be a challenge when seeking approval for a car loan. Lenders often gravitate towards scores of 660 and above for more favorable terms. Your score, falling below this range, might be considered subprime. This means it could lead to higher interest rates or even a potential loan denial. This is due to the interpreted higher risk you represent to lenders considering the possibility of repayment difficulties based on your credit history.

Even though your approval prospects may not seem promising, there's no need to give up on your car buying aspirations. Some lenders cater to those with lower credit scores. However, expect these loans to come tagged with noticeably higher interest rates, as this is how lenders manage their perceived risk. While it may be somewhat of a bumpy drive, it is still possible to secure a car loan with careful planning and due diligence of the terms. Stay positive; you still have options.

What Factors Most Impact a 625 Credit Score?

Gaining a grasp on a score of 625 is significant to mapping out your successful financial metamorphosis. Recognizing and resolving the factors linked to this score will facilitate a wholesome financial future. It's essential to appreciate that everyone's financial voyage is unique, equipped with challenges and learning possibilities.

Your Payment Patterns

Your payment history plays a major role in your credit score. If your payment history reflects late or missed payments, this might be a crucial contributor to your score.

Determining Factors: Check your credit report for any indication of late payments or missed installments. Think about any instances where you have missed or delayed payments, as these might have influenced your score negatively.

Use of Credit

A high percentage of utilized credit can negatively impact your score. If you're using the majority of your available credit, this might be a contributing factor.

Determining Factors: Analyze your credit card balances. Keep in mind, aiming to keep balances lower than the credit limit could help improve your score.

Credit Tenure

A shorter credit history may lower your score.

Determining Factors: Check your credit report to note the age of your oldest and newest credit accounts, and the average age of all your accounts. Also, consider if you have newly opened accounts.

Credit Diversity and Recent Credit

Having various types of credit and responsibly handling new credit is crucial for a good score.

Determining Factors: Check your credit report for the variety of credit you have, such as credit cards, installment loans, or mortgage loans. Also, consider whether you have recently applied for any new credit.

Legal Records

Legal determinations such as bankruptcies or tax liens can drastically hinder your score.

Determining Factors: Inspect your credit report for any legal records that are listed. Consider seeking legal assistance for any items that may need resolution.

How Do I Improve my 625 Credit Score?

While a credit score of 625 isn’t bad, it’s below the average score and falls into the “fair” credit category. Regardless, there are steps you can take to methodically increase your score. Here are the actions best suited to your present situation:

1. Update Late Payments

Start by tackling any late payments in your credit report. Past due accounts can bring down your score significantly. Reach out to your creditors to work out a payment plan to bring these accounts back into good standing.

2. Curb Credit Utilization

Your credit utilization ratio, the amount of credit you’re using compared to your credit limit, has a considerable effect on your score. Aim to keep your utilization under 30% of your total limit, and strive to bring it below 10% for long-term goals. Begin by paying down credit cards with the highest utilization.

3. Opt for Secured Credit Card

If qualifying for a regular credit card is a challenge, consider a secured credit card. This card needs a cash deposit that becomes your credit line for the account. By using it wisely and paying off the balance each month, you can gradually build your credit.

4. Consider Being an Authorized User

See if a friend or family member with positive credit would add you as an authorized user on their card. If the card issuer reports to the credit bureaus, this can reflect well on your credit report.

5. Mix and Diversify

Exploring different types of credit, like retail credit cards or credit builder loans, can help improve your score once you’ve established good payment history with your secured card. Manage these new types of credit with care to further enhance your score.