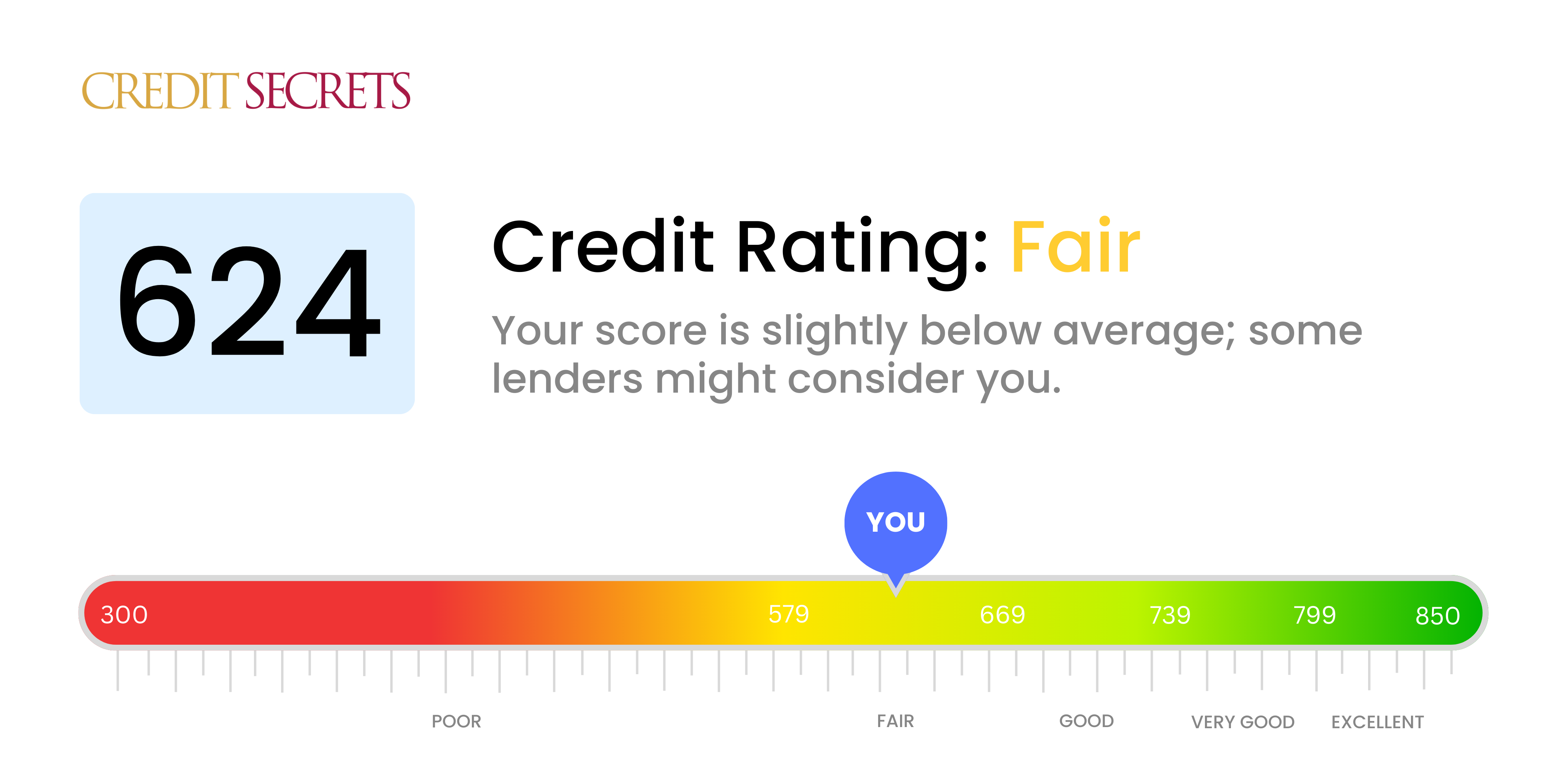

Is 624 a good credit score?

Your score of 624 is classified as a fair credit score. It's not as high as it could be, and may prevent you from accessing some financial opportunities, but it's also not the lowest score possible and there's definite room for improvement and progress.

With a score in this range, you might face slightly higher interest rates or rigorous lending conditions, as lenders might perceive you as somewhat of a risk. But, not to worry, this isn't a permanent situation — remember, your credit score is dynamic and constantly changing based on your financial habits. By dedicating yourself to responsible financial behavior like paying bills on time, reducing your debt, and being mindful of your spending, you can start paving a pathway to a higher credit score.

Can I Get a Mortgage with a 624 Credit Score?

With a credit score of 624, obtaining a mortgage can be challenging. This score falls below the typical minimum requirement set by many lenders, indicating a less-than-ideal credit history that may include missed payments, defaults, or other financial missteps. While it may seem disheartening, it doesn't necessarily mean homeownership is out of reach.

There are a few mortgage options geared towards helping individuals with lower credit scores, such as FHA and VA loans. These programs often have more lenient credit requirements and may still be an option for you. However, bear in mind that a lower credit score often correlates with higher interest rates, meaning you may end up paying more for your mortgage in the long term. Regardless, keep in mind that improving your credit is a process that takes time, diligence, and responsible financial habits.

Can I Get a Credit Card with a 624 Credit Score?

Holding a credit score of 624 might pose some obstacles to obtaining a typical credit card. Lenders may perceive this score as somewhat risky, suggesting past financial missteps or challenges. Accepting this reality may be tough, but understanding your current credit standing is crucial for future financial growth.

Despite these challenges, options like a secured credit card - where a deposit is made to act as your credit limit - can prove to be beneficial. This sort of card tends to be more accessible to those with lower credit scores and can assist in building your credit with time. Additionally, alternatives like seeking a co-signer or utilizing pre-paid debit cards could also be explored. Keep in mind, these choices aren't instant solutions but are valuable tools in progressing towards improved fiscal stability. Interest rates associated with any credit made available to individuals with your score typically tend to be quite high, reflecting the increased risk perceived by lenders.

Having a credit score of 624 may make getting a personal loan feel like a mountainous task. That's because this score falls into the "fair" category and is seen as somewhat risky by many traditional lenders. However, it's important to remember that every lending institution has its own unique approval criteria. Just because one lender may turn you down doesn't necessarily mean they all will.

While obtaining a loan with a credit score of 624 might be challenging, it's not impossible. You may have to conduct more thorough research on loan providers that are more flexible with their credit requirements. Keep in mind, though, that such flexibility usually comes with a higher interest rate. This is because your credit score communicates to lenders how trustworthy you are in repaying money, and a lower score can be seen as a greater risk. Hence, the higher interest is their way of balancing this risk. Stay positive and open-minded as you navigate through this, and remember, you have options.

Can I Get a Car Loan with a 624 Credit Score?

With a credit score of 624, some challenges may arise when trying to secure a car loan. Most loan providers prefer to work with borrowers who have scores above 660, seeing them as less risky. Since your score is 624, falling below their preferred range, you might experience higher interest rates or even a denial when applying for a car loan.

Despite your score, don’t let it diminish your hope for obtaining a car loan. Specialized lenders exist who work with those whose credit scores are less than stellar. However, beware as these loans typically have higher interest rates. Such rates are a measure taken by the lenders to protect themselves due to the greater perceived riskiness. So, even though the journey may seem daunting, with a thoughtful approach and comprehensive understanding of the terms, securing a car loan remains a realistic goal. Keep that vision of purchasing your dream car alive!

What Factors Most Impact a 624 Credit Score?

With a credit score of 624, understanding key factors affecting your score is vital to improving your financial health. No two financial journeys are exactly alike, but by understanding common factors, you can start taking steps toward improvement.

Payment History

Your payment history plays a significant role in your credit score. Late or missed payments can cause your score to drop.

Checking Method: Inspect your credit report for any payment irregularities. Delinquent payments might have pulled your score down to its current 624 level.

Credit Utilization

Maxing out your credit cards or coming close to your credit limit can negatively impact your score.

Checking Method: Review your credit card statements. Are your credit balances near or at their limits? Keeping balances low can help improve your score.

Length of Credit History

A shorter credit history may have influenced your score negatively.

Checking Method: Look at your credit report to see the age of your oldest and newest accounts, and the average age of all your accounts. Recently opened accounts might also have lowered your score.

Types of Credit

Having a diverse mix of credit (credit cards, retail accounts, installment loans, mortgage loans) can add positive points to your score.

Checking Method: Analyze your credit report for the variety of credit sources. The absence of a healthy credit mix might have caused your score to be at its present state.

Public Records

Public records, like bankruptcies or tax liens, can drastically reduce your score.

Checking Method: Review your credit report for any listed public records. Dealing with these proactively can positively influence your score.

How Do I Improve my 624 Credit Score?

With a score of 624, you’re on the cusp of fair credit. There are key steps you can take to improve your credit score to a more favourable range:

1. Rectify Late Payments

A vital step towards improving your credit score is rectifying any late payments. It’s crucial to bring your accounts up to date as this can help to considerably enhance your score. Consider contacting your creditors to work out a feasible payment plan.

2. Decrease Credit Utilization

Lowering your credit card balances can do wonders for your credit score. Aim to limit your credit utilization ratio under 30%, ideally less than 10%, to increase your credit score. Start with the credit card with the highest utilization rate.

3. Consider a Secured Credit Card

With your current credit score, a secured credit card can be a good option. This type of card is backed by a cash deposit that defines your credit limit. Use it wisely, making minor purchases and ensuring you pay off the balance monthly.

4. Be an Authorized User

If possible, leverage a trustworthy person’s good credit. Having yourself added as an authorized user to their credit card helps to improve your credit score by gaining their positive payment history. Ensure the card issuer submits authorized user activity to the credit bureaus.

5. Broaden your Credit Portfolio

Working towards a diversified mix of credit accounts can boost your credit score. Once you’ve shown responsibility with your secured card, consider incorporating other types of credit like credit builder loans or retail store cards, and manage them carefully.