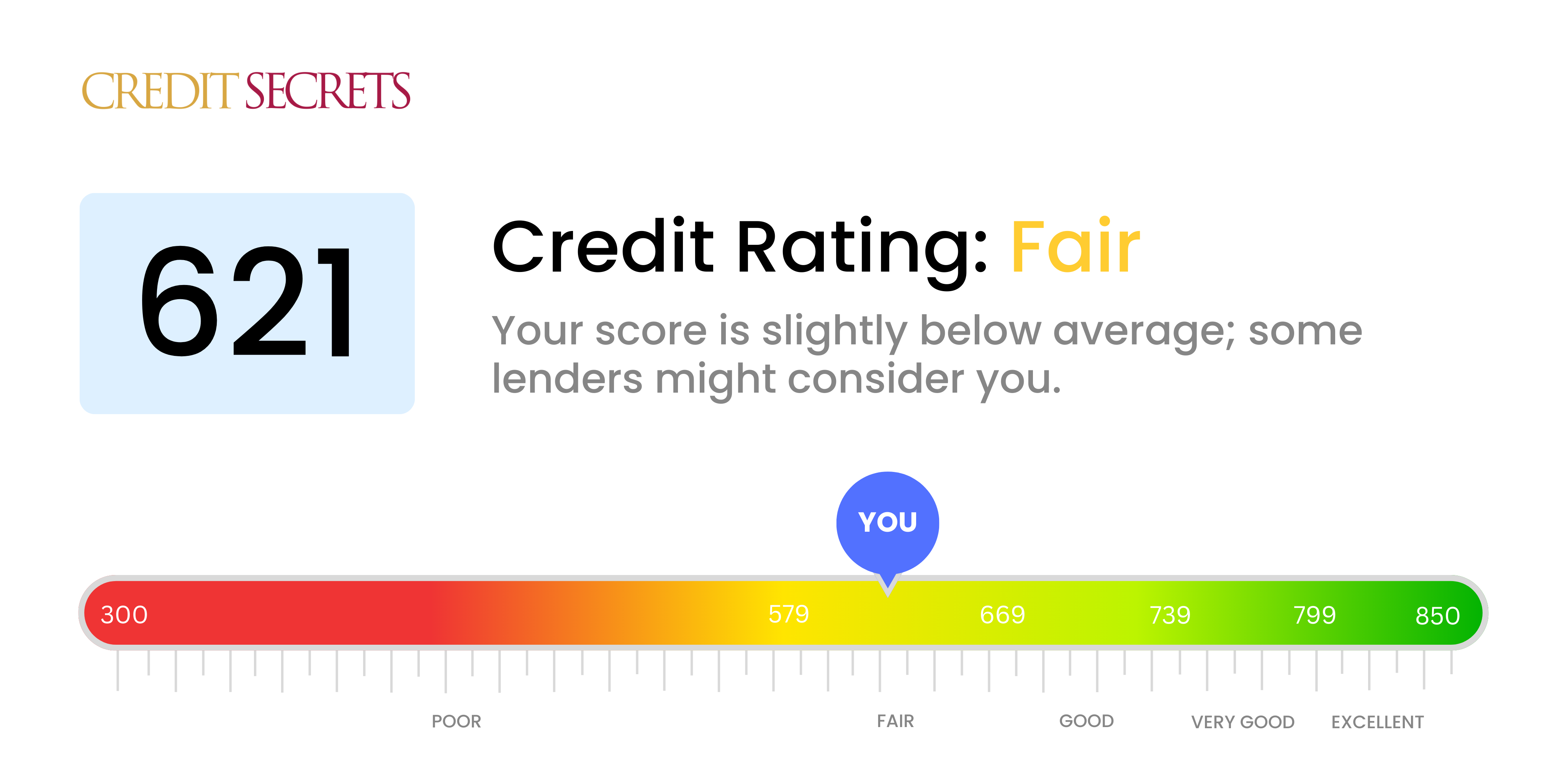

Is 621 a good credit score?

With a credit score of 621, you've landed in the 'Fair' category. This isn't the most optimal place to be, but it's also not the worst. While your opportunities for credit and loans may be somewhat limited, it's not a dead-end situation.

Being in the 'Fair' credit score range can bring some challenges with it. You may face higher interest rates and might not be approved for certain types of credit, such as premium credit cards or high-value loans. However, it doesn’t mean you're out of options completely. By taking positive steps now, you have a great chance to start improving your score and opening doors to much better financial possibilities.

Don't lose heart, your current credit score is a starting point, not your final destination. By understanding your credit score and making wise decisions, you can start on the journey to improving your financial health. Remember, better credit opens more doors, and it's never too late to start improving.

Can I Get a Mortgage with a 621 Credit Score?

With a credit score of 621, it might be challenging to get approved for a mortgage as many lenders generally seek a higher score. This score indicates some inconsistencies in your repayment history or outstanding debts that could cast doubt in the lender's eyes. It's important to remember that while this is a hurdle, it's not insurmountable.

This doesn't mean options aren't available. One possibility is exploring mortgages designed for lower credit scores, such as FHA loans. Also, consider steps to elevate your credit score, including catching up on all late payments and reducing your total debt. This may increase your chances when you reapply for a mortgage. Just remember, change won't happen overnight. It requires dedication and patience. Rest assured, it's absolutely possible to get on the path towards homeownership with thorough planning and conscious effort.

Can I Get a Credit Card with a 621 Credit Score?

Having a credit score of 621 might make getting a traditional credit card a bit of a challenge. In the world of credit, this score lies in the fair category. It indicates that there may be some financial missteps in your past. It's critical to confront this situation with both honesty and hope.

Due to the potential challenges with a 621 credit score, looking into other options such as secured cards might be worthwhile. With secured cards, a deposit is provided up front, which often equals the credit limit. These cards can be easier to get and are valuable in rebuilding credit over time. Alternatively, starter credit cards might be more accessible and beneficial for your situation. Remember, even though these options might not provide an immediate solution, they are effective stepping stones toward re-establishing a healthy credit score. The interest rates on these types of cards may be slightly higher, reflecting the increased risk to lenders.

A credit score of 621 might make it challenging, but not impossible, to secure a personal loan. This score is considered "fair," which unfortunately may not meet the credit requirements of some traditional lenders. Applicants with a credit score of 621 are viewed as somewhat risky for lenders, which could potentially limit your options.

Nevertheless, don't lose hope. There are lenders who consider applicants with fair credit scores. You might look into credit unions or online lenders, who often have more flexible lending criteria compared to traditional banks. However, keep in mind that if you do get approved, your interest rate might be higher due to your lower score. Remember, the lower the credit score, the higher the perceived risk to the lender, and thus, the higher the interest rate you may be given. It's important to likely plan for these potential higher costs when considering a personal loan.

Can I Get a Car Loan with a 621 Credit Score?

If your credit score is sitting at 621, it may put a bit of a damper on your car loan approval prospects. Typically, lenders are more comfortable extending loans to individuals whose scores exceed the 660 mark. Unfortunately, your score of 621 falls a little short of this benchmark. This lower score signifies greater risk to lenders, who might then offer higher interest rates or deny your application, based on an anticipation of potentially problematic repayments.

Nevertheless, this isn't a conclusive no to your dream of owning a car. You'll find that some lenders specifically cater to those with lower credit scores. However, bear in mind that such loans usually come with a higher price tag in the form of raised interest rates. This is a lender's strategy to safeguard their investment against perceived risk. So, while the road may have a few more bumps than expected, with a bit of caution and a thorough understanding of the terms, getting a car loan is not an unattainable goal.

What Factors Most Impact a 621 Credit Score?

Deciphering a score of 621 can empower you to chart your course towards financial upgrading. Let's demystify and address the factors contributing to your score, setting you on the road to financial betterment. Understand that each financial journey is custom-tailored, filled with room for growth and revelation.

Credit Card Balances

A major factor impacting your credit score could be high credit card balances. If your credit balances are nearing their limits, this could be bringing down your score.

How to Check: Analyze your credit card statements. If the balances are skirting the limits, take steps to reduce them.

Timeliness of Payments

Your payment track record holds significant impact on your credit score. A few late or missed payments may be a major reason for your current score.

How to Check: Scrutinize your credit report for any tardy payments. Make a note of any delays as these could be impacting your score.

Credit Diversity

A well-diversified credit portfolio can aid in enhancing your score. The absence of diverse credit types could be affecting your current score.

How to Check: Scan your credit report for the variety of credit accounts, like credit cards, retail accounts, and loans. Evaluate your account portfolio to ensure diversity.

Public Records

Public records such as tax liabilities could be substantially affecting your score.

How to Check: Examine your credit report for any indicated public records. Make resolutions to rectify any listed items.

Credit File Age

A shorter credit history might influence your score negatively.

How to Check: Review your credit report to assess the duration of your credit history. Factor in if any new accounts were recently opened..

How Do I Improve my 621 Credit Score?

A 621 credit score falls under the ‘poor’ category, however, it’s not the end of the line. There are numerous effective measures which, when applied strategically, can help boost your score.

1. Regularize Payment History:

Your credit payment history carries significant weight. Therefore, it’s paramount to pay your current bills on time. Late payments are detrimental to your credit score. Setting up automatic payments can help ensure bills are paid promptly and assist in building a strong payment history.

2. Pay Down Outstanding Balances:

High credit card balances can unfavorably impact your credit score. Strive to lower your balances to less than 30% of your credit limit, ideally lower than 10%. Prioritize the repayment of bank cards with the highest usage rates.

3. Apply for a Secured Credit Card:

Applying for a secured credit card can be beneficial. This card requires a security deposit which then doubles as your credit line for the account. Ensure to use it minimally, and pay off the balance consistently each month to boost your credit score.

4. Authorized User Status:

Consider becoming an authorized user on a credit card belonging to a relative or friend with a robust credit status. This strategy can boost your overall score by incorporating their positive payment history into your profile.

5. Explore Credit Account Diversity:

Having a diverse credit portfolio can fortify your credit score. Diversify your credit file with a mix of installment and revolving credit. This can prove your responsibility in handling various types of credit.