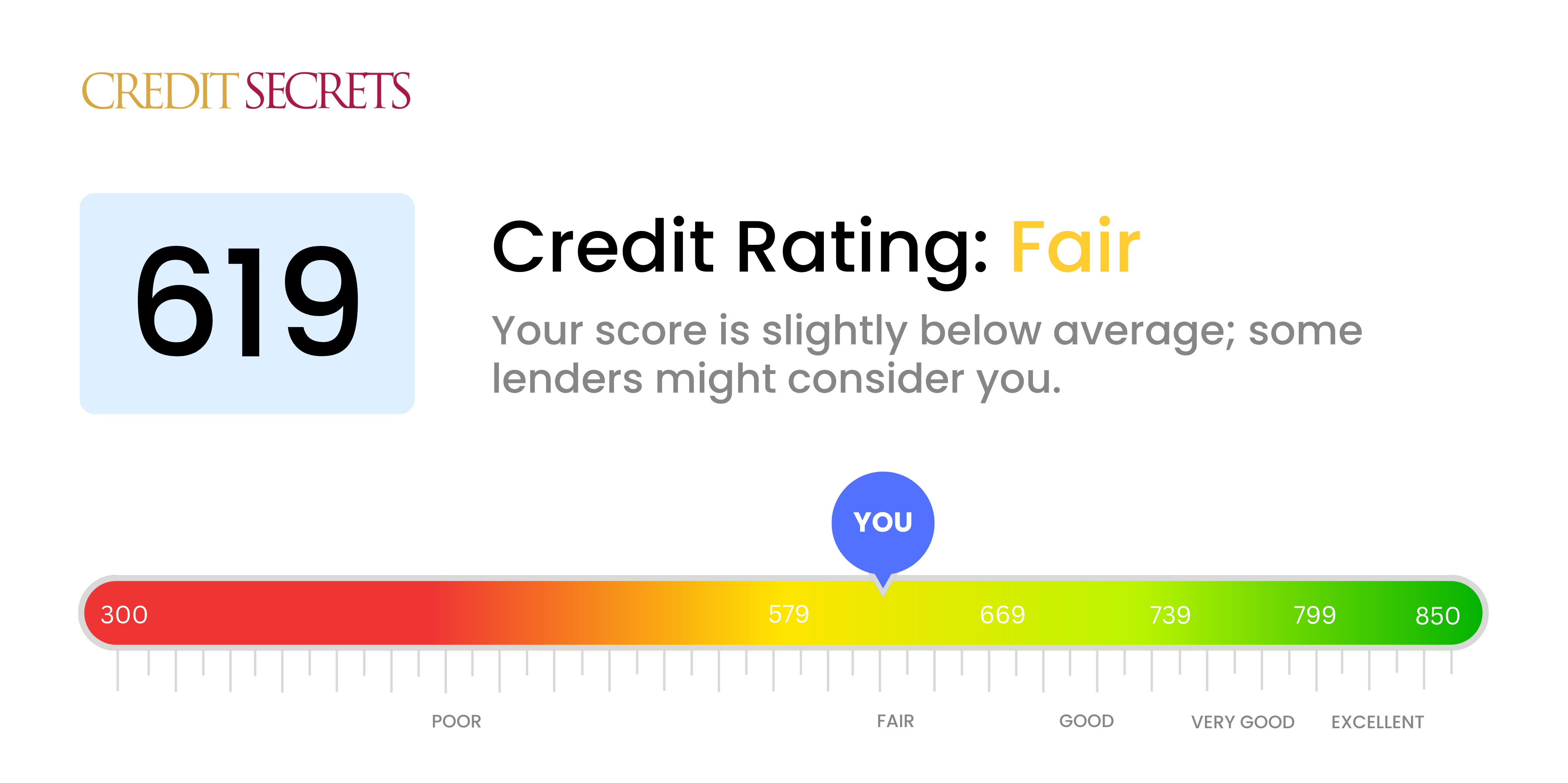

Is 619 a good credit score?

With a credit score of 619, you're currently within the 'Fair' credit range. While it's not the worst, there's certainly some room for improvement to unlock better financial opportunities.

Being in this credit bracket may make it a little challenging for you to get approved for loans and credit cards, but not impossible. Interest rates might be a tad higher due to the perceived risk you present to lenders and it may be a bit tougher to rent housing without a cosigner. However, don't be disheartened. This is just your current situation, not your final destination.

Remember that with the right tools, habits, and dedication, you can work towards improving your score. It's a journey, and Credit Secrets is here to guide you along the path to better financial health.

Can I Get a Mortgage with a 619 Credit Score?

With a credit score of 619, it might a be bit challenging to secure approval for a mortgage. Many lenders generally set their minimum credit score requirements at around 620-660, which means your score is slightly under that threshold. Having a credit score in the 600s could indicate some past credit challenges such as late payments or high credit utilization.

Despite this, it's not impossible to obtain a mortgage. There are certain loan programs like FHA loans that are designed for individuals with lower credit scores. Alternatively, you could consider strategies to boost your credit score before applying for a mortgage. This could involve reducing outstanding debt or ensuring all your bills are paid on time. Keep in mind that making the effort to improve your credit score doesn't just enhance your chances of mortgage approval, it also could give you the opportunity to secure a mortgage with a lower interest rate, resulting in less money paid over the life of the loan.

Can I Get a Credit Card with a 619 Credit Score?

If you have a credit score of 619, it might be a bit difficult to get approved for a conventional credit card. Creditors and lenders might see this score as slightly risky, suggesting that there may be some past or present financial setbacks. Undoubtedly, this can be a hurdle, but it's important to confront these challenges with a realistic yet optimistic attitude. Recognizing your credit situation is a crucial step towards monetary improvement.

In dealing with this kind of score, it's worthwhile to consider different options like secured credit cards. These require you to make a deposit that becomes your credit limit and can be a route to gradually strengthening your credit score. You might also ponder getting a co-signer or using prepaid debit cards as alternatives, although these options don't magically solve the problem, they provide a pathway towards financial recovery. It's crucial to note that the interest rates offered in these alternatives will often be higher, as they're commensurate with the risk lenders perceive. Never lose sight of the fact that these are just temporary measures while you're on your journey to better credit health.

With a credit score of 619, securing a personal loan through traditional means may be somewhat more challenging. Lenders view a score in this range as indicative of higher credit risk, which could potentially lead to cautious lending terms or even denial of loan applications. Understandably, this may feel frustrating, but it's vital to recognize your credit score's standing and its implications.

Though traditional lending routes may be less accessible, alternative loan solutions could be available. You might look into secured loans—where collateral is provided—or co-signed loans, where someone with a stronger credit score can back your loan application. Peer-to-peer lending is another alternative, but it should be noted that these options often come with higher interest rates and terms less favorable to the borrower. This is a reflection of the increased risk seen by lenders based on your credit score. Remember, it's essential to weigh all your options carefully before making a decision.

Can I Get a Car Loan with a 619 Credit Score?

A credit score of 619 does indeed pose some difficulties when seeking approval for a car loan. This score falls into the "fair" credit category, which is viewed with some skepticism by lenders. They typically prefer scores above 660 for more favorable terms. A score of 619 indicates a higher lending risk as lenders interpret it as a sign of potential issues in repaying the loan.

However, this score doesn't mean a car loan is out of reach. Some lenders cater to individuals with less-than-ideal credit scores, but bear in mind the likelihood of higher interest rates reflecting the greater risk the lenders may be taking. Understanding lending terms thoroughly is crucial to avoid any financial pitfalls. Maneuvering the car loan landscape with this credit score will require some strategic planning and caution. The journey may be demanding, but owning a car on your own terms is still a realistic prospect.

What Factors Most Impact a 619 Credit Score?

Understanding your score of 619 is the first step toward improving your financial circumstances. Recognizing what factors most likely contributed to this score can help you forge a path toward a more secure financial future. Keep in mind, every financial journey is personal and filled with chances to learn and grow.

Timeliness of Payments

Timely payments significantly influence your credit score. Any missed or defaulted payments could have affected your score of 619.

What to Do: Review your credit history for any overdue payments or defaults. They are likely impacting your current score.

Debt-to-Credit Ratio

A high debt-to-credit ratio can pull down your score. If you're using too much of your available credit, this could be a major contributor to your score.

What to Do: Study your credit card statements. Are you regularly reaching or exceeding your spending limit? Strive to keep balances low in relation to your credit limit.

Credit History Age

A shorter credit history may be causing your score to be lower.

What to Do: Check your credit report to evaluate the average age of your accounts. Did you recently open several new accounts? This might have affected your credit score.

Type of Credit and New Accounts

Maintaining a variety of credit types responsibly contributes to a healthier score. Constantly opening new credit can impact your score negatively.

What to Do: Review your mix of credit. Have you been trying to open new credit frequently? This could be impacting your 619 score.

Credit Inquiries

Multiple credit inquiries in a short period can negatively impact your score.

What to Do: Scan your credit report for recent inquiries. Consider if you've been applying for too much credit at once, as this is likely affecting your score.

How Do I Improve my 619 Credit Score?

With a credit score of 619, it’s feasible to turn things around and build towards a secure financial future. The following steps can be very effective towards repairing your credit score at this level:

1. Prioritize Delinquent Accounts

Prioritizing your delinquent accounts is crucial. Accounts with late payments have a substantial negative effect on your credit score. Reach out to your creditors to set up a manageable payment plan if needed.

2. Concentrate on Your Credit Card Balances

High credit card debt can negatively impact your credit score. Put efforts into lowering your balances to a maximum of 30% of your credit limit. If you can, aim to keep your balances below 10% in the long run.

3. Consider a Secured Credit Card

It might be tough to acquire an unsecured credit card with your current score. A secured credit card, backed by a cash deposit, could be a realistic choice. Commit to using this card wisely – keep your balances low and pay off the total each month.

4. Try to Be an Authorized User

An effective technique could be becoming an authorized user on the credit card of a trusted person with a solid credit history. This method can help increase your credit score, as their positive credit behavior gets factored into your credit report. However, ensure the card issuer reports activities of authorized users to the credit bureaus.

5. Broaden Your Credit Range

Having a wide variety of credit types can greatly improve your credit score. After showing good behavior with a secured card, try utilizing different forms of credits like retail credit cards or credit builder loans to further diversify your credit portfolio.