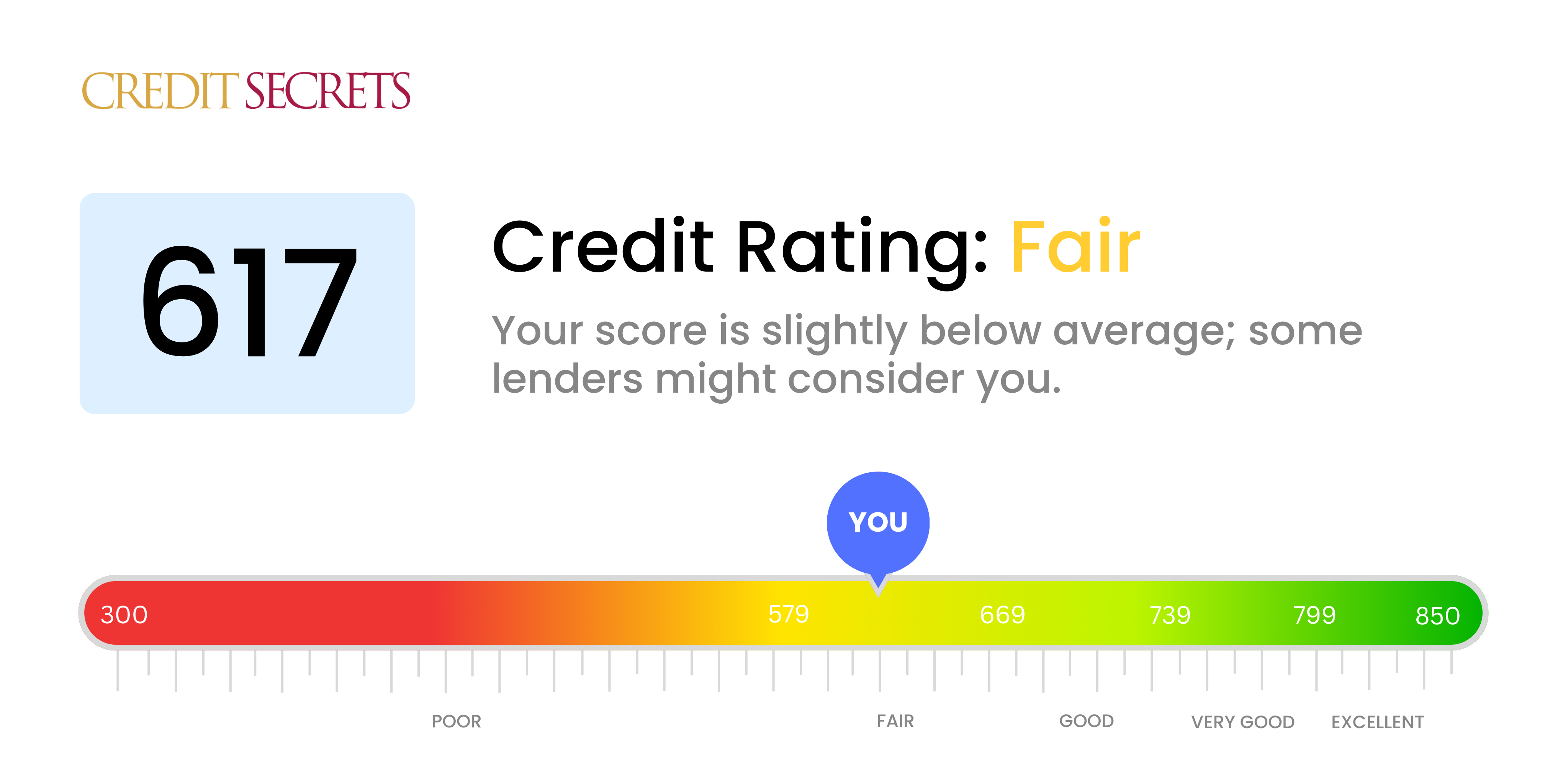

Is 617 a good credit score?

With a credit score of 617, you're currently in the 'Fair' category. Although this isn't ideal, you should know it's a starting point, and there's room for improvement on the road to reaching your financial goals.

There may be some impacts with this score, such as higher interest rates on loans and credit cards or difficulty being approved for them at all. However, it's not all bad news. There are strategies to lift your credit score, like ensuring you pay bills on time and keeping your credit card balances low. Keep in mind, it's a journey, and progress can be made with consistent effort.

Can I Get a Mortgage with a 617 Credit Score?

If you have a credit score of 617, securing approval for a mortgage may pose a bit of a challenge. Most lenders usually reserve their best interest rates for borrowers with credit scores that are in the high 600s or above. Your current score suggests that there may have been some past credit missteps, but don't lose hope, every situation can be improved.

While a mortgage approval might be difficult, some lenders still might consider your application. Be prepared, however, for potential higher interest rates and perhaps more stringent lending terms due to the perceived credit risk. It's a difficult position to be in, but there is certainly a path to enhance your credit situation and achieve home ownership. The journey to improve your credit might be long and challenging, but it's certainly not impossible. Good luck on your path to better financial stability and achieving your home ownership dreams.

Can I Get a Credit Card with a 617 Credit Score?

Having a credit score of 617 signals some past struggles with debt and could make it more difficult to be approved for a conventional credit card. While this situation might seem disappointing, remember that grasping your credit status is a crucial step towards better fiscal health. The truth might not always be pleasant, but transparency is key when dealing with financial matters.

Given the slightly lower score, you might want to consider a secured credit card. This type of card requires a deposit which acts as your credit limit, making it easier to obtain. Alternatively, a co-signer or a prepaid debit card are also worth considering. While these alternatives don't provide an instant fix, they're valuable tools in the journey towards financial stability. Keep in mind that any credit offered to someone with a 617 credit score may come with higher interest rates, as the risk to lenders is perceived to be higher.

If you have a credit score of 617, it's important to understand where you stand in the lending landscape. A score like this is certainly below the threshold that most of the traditional lenders would consider as a 'good score'. This might set up some challenges for you in getting approved for a personal loan as such a score would indicate a riskier borrower in the lender's eyes.

Does this mean you can't get a personal loan at all? Not necessarily. Look at secured loans in which you provide the lender with collateral. Another option might be to find a willing and trustworthy co-signer who has a stronger credit score. You may also explore peer-to-peer lending platforms that sometimes have less rigid criteria. But remember, these alternatives usually come with higher interest rates and terms that are less flexible. This denotes a higher level of risk for the lender, which is mirrored in the lending terms.

Can I Get a Car Loan with a 617 Credit Score?

Having a credit score of 617 may present some obstacles when you're trying to secure a car loan. Most lenders view a score of 660 and above as more desirable, therefore, a score of 617 could be seen as a bit risky. With a score in this range, lenders might conclude you've had some difficulty repaying borrowed money in the past.

That being said, it's important to remember that not every door is closed. You may still find some lenders who are willing to approve a car loan for you. However, be prepared that these loans may come with higher interest rates because of the increased risk perceived by the lenders. Despite the potential hurdles, it is not impossible to obtain a car loan with your present credit score. Carefully review the terms and conditions before pursuing these types of loans to ensure they are the right fit for your current financial situation.

What Factors Most Impact a 617 Credit Score?

Decoding a score of 617 is crucial for crafting your financial remedy plan. Here, we focus on collective factors contributing to this score, so as to guide you towards prosperous financial health.

Neglected Payments

Your credit score could be heavily affected by overlooked payments or defaults. These could be one of the major factors repressing your score of 617.

Action: Check your credit report for any overlooked payments or defaults. Taking note of them reveals how your past could be affecting your present financial health.

Credit Saturation

A high credit saturation could be lowering your score. If you're maxing out your credit cards, this might be one of the factors causing your score to be 617.

Action: Scrutinize your credit card statements closely for high balances. Keeping balances lower than your limit can help improve your score.

Short Credit History

Limited credit history might also be impacting your score negatively, as lenders want evidence that you can handle credit responsibly over the long term.

Action: Go through your credit report to understand the age and dispersion of your credit accounts. Reflect on whether you've recently opened new accounts.

Multiple Loan Types

Having a diverse mix of loans (credit cards, retail accounts, installment loans, mortgage loans) and managing them responsibly can enhance a credit score.

Action: Check your existing loan types. Having a healthy mix of credit types sends a strong signal of your financial responsibility.

Public Records

Public records containing information about bankruptcies or tax liens could significantly damage your score.

Action: Inspect your credit report for these public records and consider resolving any extant issues that could improve your score.

How Do I Improve my 617 Credit Score?

With a credit score of 617, you’re on the fringes of fair credit, but there’s room to grow. Embrace these strategies specifically designed for your score range:

1. Scrutinize Your Credit Report

There might be errors on your credit report that are holding your score back. You’re allowed one free report per year from each of the credit bureaus, so make sure you obtain and thoroughly inspect them. Correct any errors you find with the respective credit bureau.

2. Timely Payments

At this score level, even one late payment can lead to a significant drop. Aim to pay your bills on or before the due date. Setting up automatic payments can help avoid missing any due dates.

3. Prioritize Paying Down Debt

Your debt-to-income ratio is a key factor in your credit score. Focus on reducing your overall debt to positively impact this ratio and your credit score.

4. Secure a Credit-Builder Loan

A Credit-Builder Loan can enhance your credit if you don’t qualify for a traditional loan. Your payments (with interest) are put into a savings account, which you receive at the end of your term. These loans are typically reported to credit bureaus, thereby helping build a good credit history.

5. Handle New Credit with Care

To maintain your ascending credit score, any new credit should be pursued sparingly. Each application can temporarily lower your score, especially if you don’t have a solid credit history. Therefore, apply for new credit only when necessary.