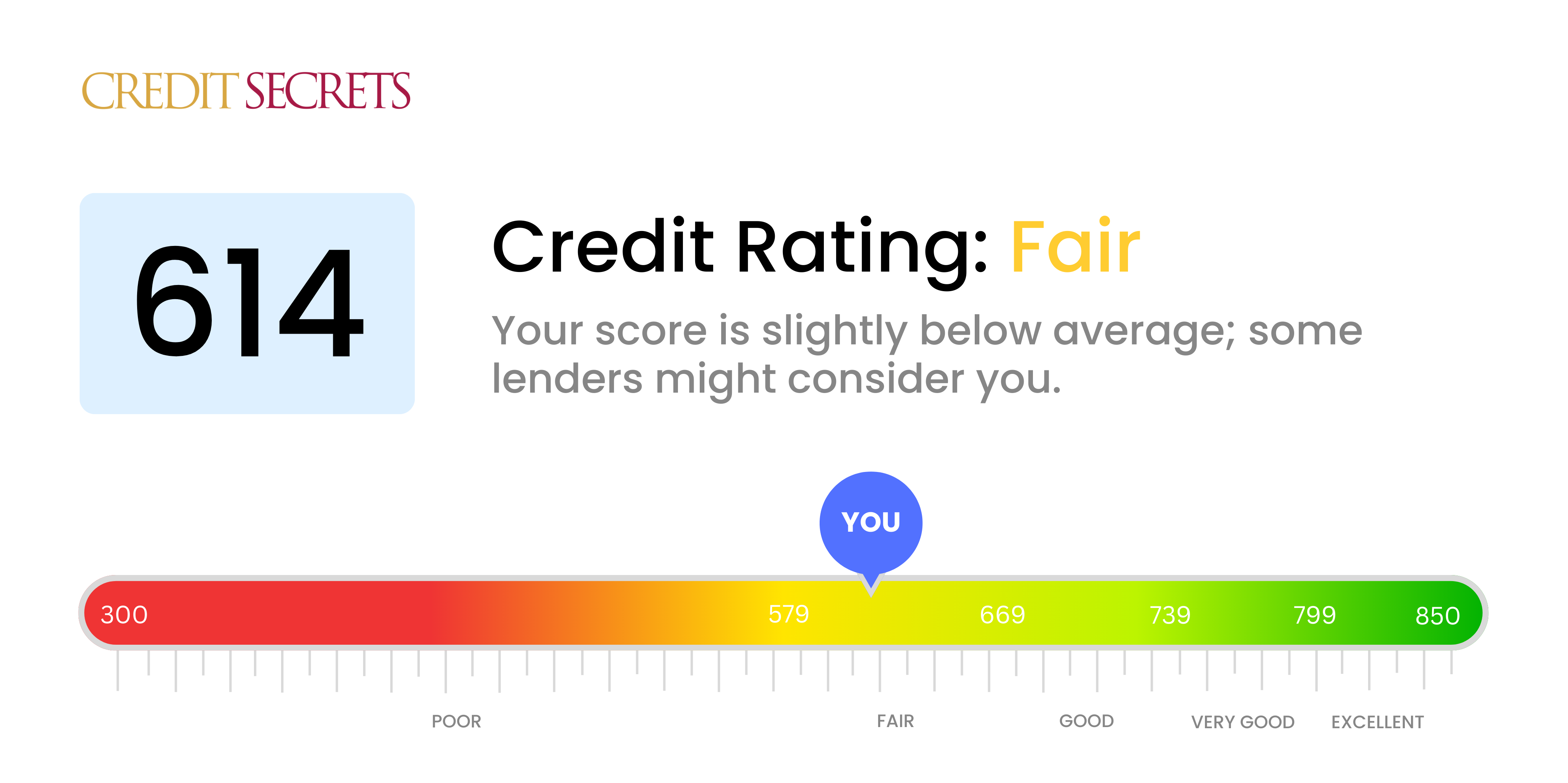

Is 614 a good credit score?

Your credit score of 614 lands in the 'Fair' category. This isn't the worst, but there is definitely room for improvement to enhance your financial opportunities. Individuals with scores in this range might find it more challenging to acquire credit at advantageous rates, and borrowing could come with additional conditions. But remember, this is a starting point – improvements are always possible.

Keep in mind, your financial future is not strictly determined by this number. Being in the 'Fair' range gives you the chance to step up your financial management and rebuilding process. With determination and the right strategies, you have the potential to shift your score into a better category, thereby opening more doors to financial opportunities.

Can I Get a Mortgage with a 614 Credit Score?

If you have a credit score of 614, attaining a mortgage may be somewhat challenging but not impossible. Despite this, it's crucial to comprehend that your interest rates may be a bit higher than the norm, as a middle-ranged score can make lenders consider you more of a risk. This could potentially result in higher costs over the life of your loan.

Do not feel disheartened; there are still possibilities to explore. Although conventional mortgages might prove difficult to get approved for, FHA (Federal Housing Administration) loans tend to be more lenient with credit scores and might be a suitable alternative. Just bear in mind that these types of loans often require mortgage insurance, but they can provide a path toward homeownership. You're facing a challenging circumstance, but there are options available and paths forward. Persistence can gradually lead you to your homeownership goal.

Can I Get a Credit Card with a 614 Credit Score?

Having a credit score of 614 certainly presents some hurdles in getting approved for a traditional credit card. It's not a disaster, but it's also not ideal. Lenders may see this as a slightly high-risk score, an indication of some past financial and credit hiccups. This can feel disheartening, but it's vital to be realistic and firmly aware of your credit situation. Remember, becoming familiar with your credit standing is crucial to developing a strategy towards financial stability.

With a score like 614, there is a bright side. You might just qualify for some types of credit cards designed for building credit, like secured cards or credit cards for fair credit. In both cases, these cards can help you build up your credit over time. Secured cards require a deposit that acts as your credit limit. Credit cards for fair credit, on the other hand, tend to come with higher interest rates than you'd see with a card for those with excellent credit, because the perceived risk to the lender is higher. Nevertheless, these cards can be stepping stones towards improved credit health, just be wary of the interest rates and make sure to pay your balances on time.

With a credit score of 614, obtaining a personal loan from traditional lenders might be a challenge. This score is considered to be in the 'fair' credit range, which could lead to lenders viewing you as a higher risk. While it is not impossible, you may find yourself faced with less favorable terms or higher interest rates as a way for the lenders to mitigate this risk.

There's no need to lose hope, however. The world of lending consists of more than just traditional banks. You might want to explore alternatives such as secured loans, where you provide an asset as collateral, or perhaps co-signed loans, where another individual with a better credit score shares the repayment responsibility. Another viable option could be peer-to-peer lending platforms, which often have more lenient credit requirements. Please remember, these alternatives might come with higher interest rates due to the perceived risk. Overall, it's important to weigh all your options carefully and choose the one that fits your financial situation best.

Can I Get a Car Loan with a 614 Credit Score?

Navigating the path to a car loan with a credit score of 614 might be rocky terrain, but it's not off the beaten track. Usually, lenders prefer scores above 660 for the best conditions. Your score of 614 might push you into a category that's considered a bit risky, which could mean higher interest rates or potentially a loan refusal. This risk stems from past repayment difficulties that low credit scores often indicate.

Don't lose hope though, because there are still possibilities available. Certain lenders focus on providing car loans to individuals with lower credit scores. Do tread carefully, these loans often carry significantly higher interest rates. This is the lender's way of offsetting the potential risk associated with lower credit scores. Despite the bumps in the road, with a good understanding of the loan terms, there's still a good chance of securing a car loan.

What Factors Most Impact a 614 Credit Score?

Comprehending the dynamics of a 614 credit score is crucial for your journey towards financial advancement. Addressing factors that contribute to your score can lead you towards a more stable financial future. Always remember, every financial journey is unique, offering myriad chances to grow and learn.

Credit Utilization

An impactful factor on your credit score is credit utilization. If your credit card balances are high in relation to their limits, this might be impacting your score.

How to Check: Examine your credit card statements. Are the balances high compared to their limits? Strive to keep a low balance-to-limit ratio for a positive impact on your score.

Defaults or Derogatory Reports

Defaults or derogatory reports appearing on your credit report can significantly decline your credit score.

How to Check: Review your credit report for any such listings. Remember any instances of non-payment or delayed payment as these could be the reasons behind what you see.

Recent Credit Queries

Frequent credit inquiries in a short span can negatively affect your credit score.

How to Check: Peruse your credit report to see the number of credit inquiries. Consider if you have been applying for too much credit lately.

Age of Credit History

A shorter credit history could be influencing your score in a negative manner.

How to Check: Analyze your credit report to assess the average age of all your accounts. Reflect on whether you've been opening too many new accounts recently.

Type of Credit

A balanced diversity of credit types need to be managed responsibly for a good score.

How to Check: Study your mix of credit accounts, including credit cards, mortgage loans and other types. Ponder on the variety of credit types in your report.

How Do I Improve my 614 Credit Score?

With a credit score of 614, you might face challenges in obtaining favorable credit terms, but it doesn’t mean you’re stuck there. Here are the most actionable next steps you can take at this level to lift your score:

1. Prioritize Unsettled Defaults

Work on addressing any defaults in your credit history. Pending payments and unresolved defaults can have a significant impact on your score. Contact your lenders, settle your debts and negotiate for the removal of these defaults from your credit report.

2. Lower Credit Card Usage

Keep your credit card usage low. One of the factors impacting your credit score is the percentage of available credit you use. Aim to use less than 30% of your credit limit. This demonstrates your responsible use of credit and positively impacts your score.

3. Explore Secured Loans

Secured loans, guaranteed by collateral, can be easier to obtain at this score and can show your ability to manage loans responsibly. Opt for a small secured loan and ensure you make regular payments. This will help build a better credit history.

4. Inquire About Credit-Builder Products

Speak to your bank about credit-builder products. Such loans or savings programs help establish a history of on-time payments, which is crucial for improving your credit score.

5. Consider A Co-Signer

If you have someone willing to co-sign on a small loan or a credit card, this can help you prove your reliability and build your credit score. Ensure you manage the co-signing responsibly so it benefits both parties.