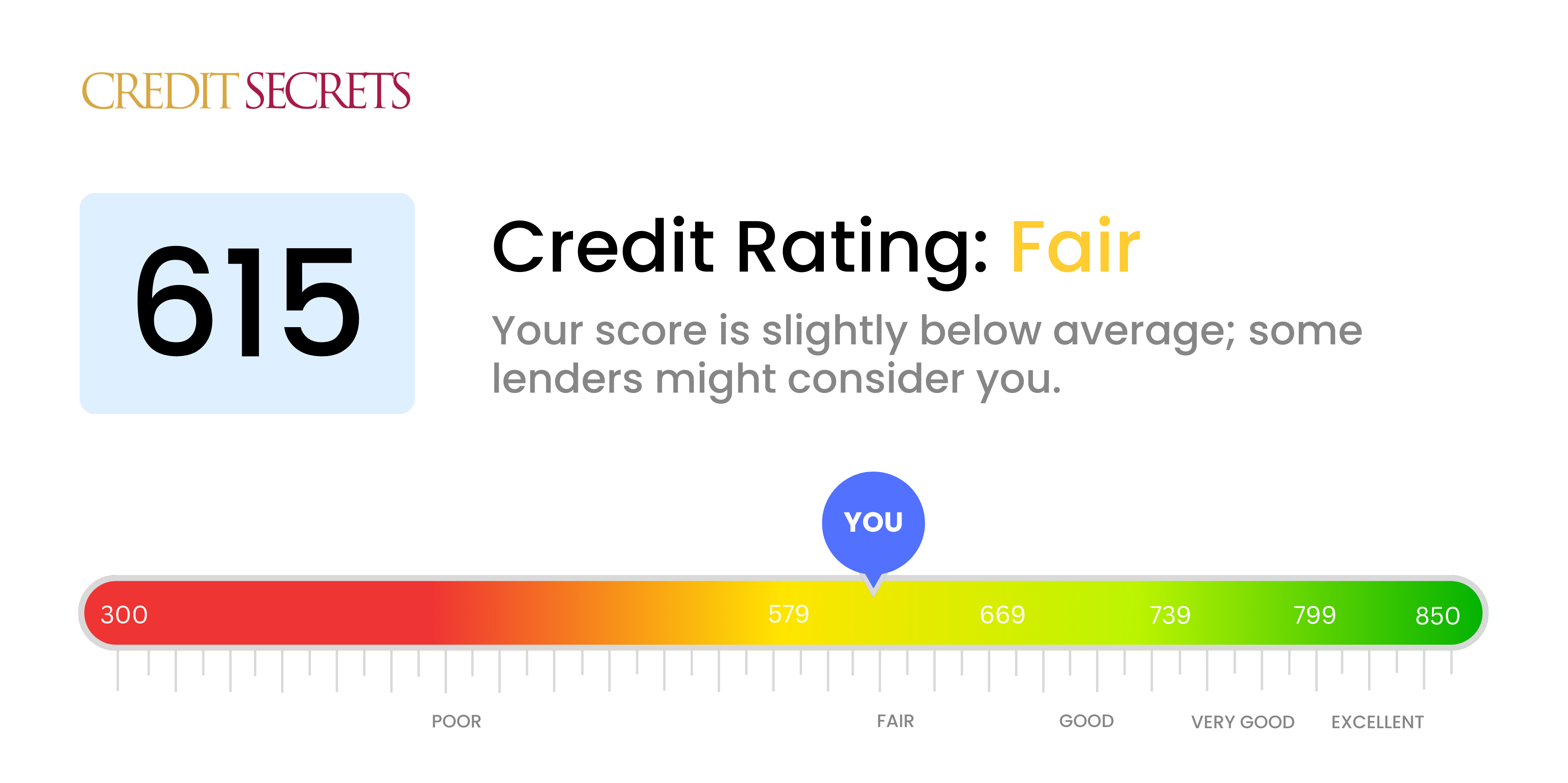

Is 615 a good credit score?

With a credit score of 615, you are in the category of 'Fair'. This isn't the best position for obtaining financial products or loans, but it isn't the worst either. You may find it challenging to qualify for competitive interest rates, and some lenders might be hesitant to extend credit to you. However, it's important to remember this isn't the end of the road.

Although you're on the lower end of the credit score spectrum, this doesn't mean you can't improve. A score of 615 is the start of your journey towards better credit. With commitment and the right approach, you can elevate your credit score to a position that opens up better financial opportunities. There's room for optimism, and remember, better finance management today means an improved credit score tomorrow.

Can I Get a Mortgage with a 615 Credit Score?

With a credit score of 615, you might run into some difficulties when attempting to be approved for a mortgage loan. This is below the threshold that most lenders consider as being a solid credit standing. A score in this region indicates past financial complications, possibly with frequent late payments or unpaid debt. These elements can be deterrents for many lenders.

While this may sound discouraging, all isn't lost. As an alternative, you could be eligible for loans specifically designed for those with low credit ratings. These subprime mortgages may seem appealing because they make homeownership achievable sooner. Yet, they often come with higher interest rates and stricter terms to counterbalance the risk presented by a low credit score. Remember, this isn't the end of your homeownership dreams. Taking action to boost your credit score, while it may require time and patience, can put you in a significantly better place to secure a mortgage with reasonable conditions in the future.

Can I Get a Credit Card with a 615 Credit Score?

If you have a credit score of 615, you might find it challenging getting approved for a traditional credit card. Lenders often see this score as somewhat risky and indicative of past financial hiccups. It may be a tough pill to swallow, but understanding your credit standing is crucial to making informed financial decisions.

Looking at other options might be a smart move. Consider pursuing a secured credit card, which is typically more accessible and can help you slowly rebuild your credit. This kind of card requires a deposit, which then becomes your spending limit. Additionally, looking into prepaid debit cards could work for you too. These alternatives might not provide an immediate credit score boost, but they're important steps in your journey towards financial growth. It would be helpful to note that interest rates for available credit tend to be higher for people with a score similar to yours as it represents a heightened risk to lenders.

With a credit score of 615, your chances of obtaining a personal loan approval from traditional lenders could be limited. Your credit score, regretfully, falls below the minimum threshold often expected by lenders, increasing the risk perception. We understand this isn't the news you want to hear, but it's important to understand your options in this circumstance.

When traditional loans cease to be viable, alternative sources of credit can be considered. Secured loans require you to provide an asset as a collateral, which could be an option if you're comfortable leveraging your property. Alternatively, a co-signed loan, supported by an individual with a higher credit score could be another pathway. Additionally, platforms for peer-to-peer lending might offer certain flexibility towards credit score. However, keep in mind that these options usually entail higher interest rates and potentially stricter terms, due to the perceived increase in lending risk.

Can I Get a Car Loan with a 615 Credit Score?

With a credit score of 615, securing a car loan might be a tad challenging. Most lenders often seek scores of 660 and above for favourable terms, labeling anything below 600 as subprime. Your score, being in the 600s, is viewed as moderately risky to lenders as it signifies potential issues with repaying the borrowed funds.

Nevertheless, having a credit score of 615 doesn't imply that getting a car loan is off the table entirely. There are lenders who work with individuals with less than perfect credit. Being cautious and understanding the terms meticulously is helpful as these loans usually come with higher interest rates. That's because, the higher risk you represent to lenders, the higher the interest rates you may face. Despite the hurdles, obtaining a car loan isn't an impossibility.

What Factors Most Impact a 615 Credit Score?

Unlocking the secrets behind a credit score of 615 is key in plotting your course to financial wellness. Pinpointing the factors at play can be a game-changer in your future financial health. Remember, every journey toward better credit is unique, filled with opportunities to learn and grow.

Payment History

Your payment history has a significant impact on your score. If you have a history of late payments, this might be causing your current 615 score.

How to Check: Look over your credit report for instances of late payments. Think about any times you might have slipped up, because these can affect your score.

Credit Utilization

If you're maxing out your credit cards each month, this could be weighing down your score. Keeping a lower balance can improve your score.

How to Check: Look at your credit card balances. If they're near their limits, consider paying them down to a level well below their maximum.

New Credit

Opening new accounts can temporarily lower your score. If you've recently opened a variety of accounts, it could be impacting your credit status.

How to Check: Check your credit report. Recent new accounts could be affecting your score

Credit Mix

Managing different types of credit responsibly helps beef up your score. Not having a diverse mix of credit could be a factor in a lower score like 615.

How to Check: Examine your types of credit. Diversity in your credit types can boost your score.

Public Records

Public records like bankruptcies or unpaid taxes can greatly reduce your score.

How to Check: Search your credit report for any public records. Rectifying these can help improve your score.

How Do I Improve my 615 Credit Score?

With a credit score of 615, you’re not too far from fair territory. Implementing these targeted, manageable strategies can help you boost your score:

1. Prioritize Timely Payments

Payment history is essential in credit scoring. Prioritize making all of your payments on time, even if they’re only the minimum. This can improve your score over time and demonstrate positive financial behavior.

2. Monitor Your Credit Utilization

Ensure your credit card balances are less than 30% of your total available credit. This will improve your credit utilization ratio, which is significant to credit scoring models. It would be best if you work towards consistently maintaining your balances low.

3. Clean Up Your Credit Report

Obtain a copy of your credit report and review it for inaccuracies. Any incorrect negative mark can drag down your score. If you identify errors, dispute them with the credit bureaus or contact the originating creditor.

4. Limit Credit Inquiries

Avoid applying for too many forms of new credit in a short time frame. Every application can slightly lower your score, and several in a short period could hint at financial distress.

5. Consider a Credit-Builder Loan

Identify a trusted financial institution that provides credit-builder loans. These loans allow users with lower credit scores to demonstrate responsible debt management. Proceeds of the loan are typically held in an account while you make payments. This creates a positive payment history and helps increase your score.