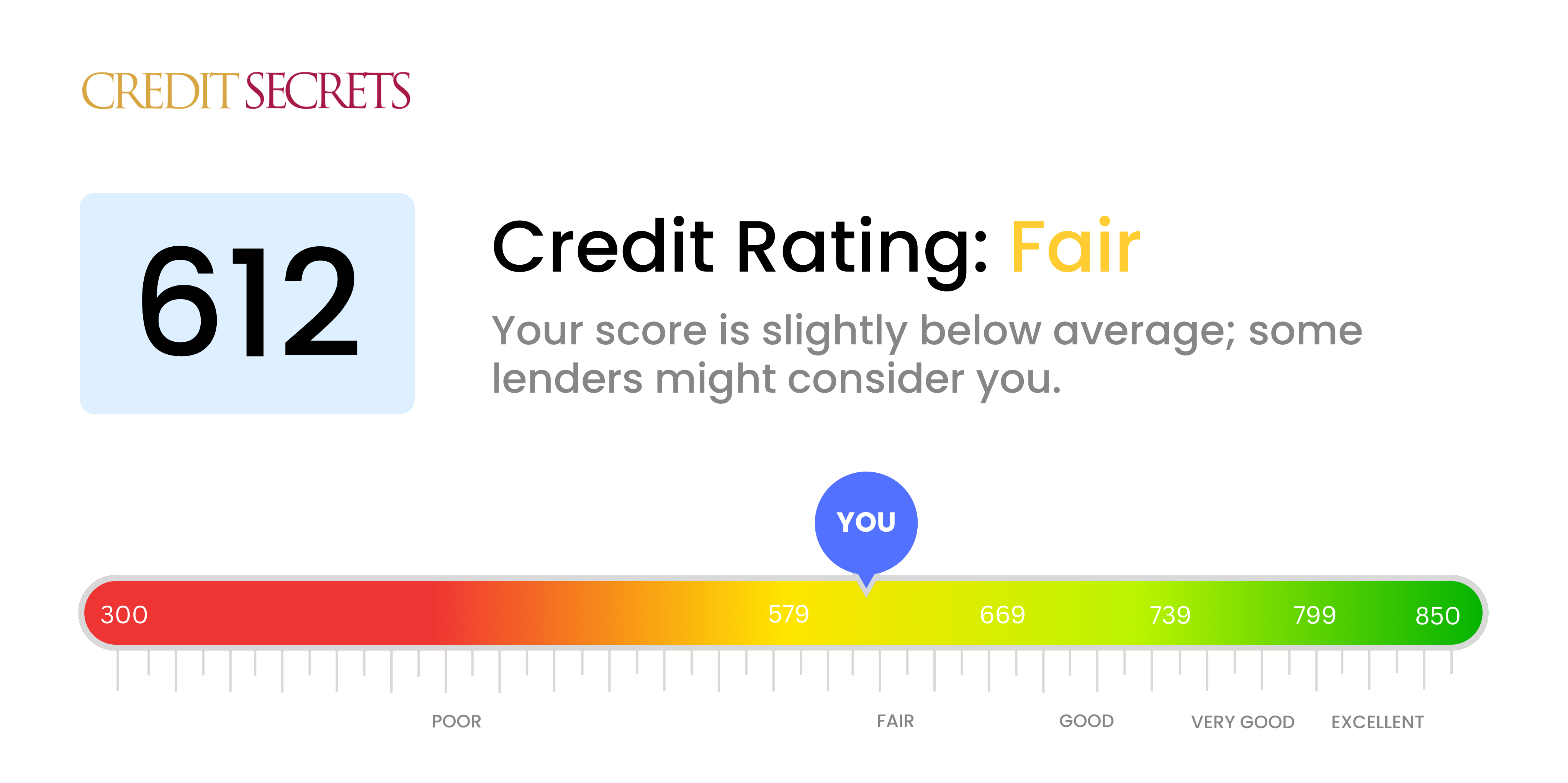

Is 612 a good credit score?

A credit score of 612 falls into the 'Fair' category. This may not be the ideal spot to be in, but it's certainly not the worst, and with some focused effort, you can definitely improve this number. You might have a bit of difficulty securing loans or credit cards with low-interest rates, but remember, this is not a life sentence - you have the power to change it.

Improving your credit score from 'Fair' to 'Good' or even 'Very Good' is absolutely achievable. You just need to understand how credit scores work, what factors are affecting yours, and then make a plan to address those issues. Regularly reviewing your credit reports, making payments on time, and keeping your credit balances low are a few ways to help you get there. Hang in there and remember, every step you take forward is progress.

Can I Get a Mortgage with a 612 Credit Score?

If your credit score is 612, securing a mortgage could prove difficult. A score in this range typically signifies a credit history with some notable issues, such as sporadic late payments or even collections accounts. Most mortgage lenders look for borrowers with a higher credit score, often above 660, for standard rate mortgages.

However, this does not mean home ownership is off the table. It could mean that you may face higher interest rates and other less favorable loan terms. Your best course of action could potentially be to wait and work on improving your credit, then apply for a mortgage once your score has increased. This can lead to a less burdensome mortgage with more manageable monthly payments. While a 612 credit score does not completely disqualify you from getting a mortgage, patience and diligent credit management could lead to a more advantageous financial situation.

Can I Get a Credit Card with a 612 Credit Score?

With a credit score of 612, it's not impossible to get approved for a credit card, but it may be a bit difficult. This score indicates that there may have been a few financial missteps in the past. It's understandable and nothing to be ashamed of. Financial situations can often be complex.

While some traditional credit cards may be out of reach, there are still options available. Secured credit cards could be a potential route. These types of cards require a deposit which defines your credit limit. Although this might sound restrictive, this can be an effective method to gradually build back your credit score. With consistent payments and responsible card usage, your credit score can gradually improve. Bearing in mind, interest rates may be higher due to the credit score falling in the ‘fair’ category, indicating a slightly higher risk for lenders. Step by step, you can work towards boosting your financial stability.

A credit score of 612 is considered to be fair, which means securing a personal loan might be a bit challenging. Traditional lenders typically look for scores that fall into the good to excellent range. While your current score doesn't quite meet these standards, it's essential to know this isn't a final verdict. Your financial story is unique to you, and it's important to keep working toward improving your score.

Despite your current credit score, there could still be personal loan options available for you. Some lending institutions may may approve applicants with lower scores, although these loans typically come with higher interest rates. Additionally, online lenders or credit unions sometimes offer personal loans to individuals with lower credit scores, provided they can demonstrate the ability to repay the loan. While these options may extend credit, it's crucial to remember that they often come with more costly terms. Borrowing under these conditions can help in the short term, but it's always important to keep an eye toward improving your overall credit profile.

Can I Get a Car Loan with a 612 Credit Score?

Having a credit score of 612 can put some roadblocks in your path when applying for a car loan. Financial institutions often prefer scores above 660 to offer the best interest rates. Your credit score sits below that range, and this can be viewed as subprime by lenders, potentially leading to higher interest rates or even difficulty getting approved for a loan. This goes back to the fact that a score like yours might suggest to lenders that there could be difficulties with getting the borrowed money back.

However, your chances of getting a car loan are not completely dashed. There are lenders out there who can cater to folks with credit scores like yours. But tread carefully: loans from these lenders tend to come with higher interest rates because the risk to the lender is deemed greater. Despite a rockier road ahead, getting the car you want is not outside of your grasp. Investigate carefully, understand the terms thoroughly, and stay positive. You do have options.

What Factors Most Impact a 612 Credit Score?

With a credit score of 612, taking steps to improve your financial health begins with understanding where you currently stand. Analyzing the factors affecting your score will be significant in helping you make progress. Keep in mind that every financial journey is a unique one, filled with growth and challenges.

Payment History

The track record of your payments heavily influences your credit score. Late or missed payments could have played a role in reaching your current score.

What to Do: Take a close look at your credit report. Pinpoint any late or missed payments that might have caused your score to decrease.

Credit Utilization

If your outstanding balances are close to your credit limits, this could have a detrimental impact on your score.

What to Do: Go through your credit card statements. If your balances are near their limits, consider paying down your debts to decrease your credit utilization ratio.

History Length

Short credit history could potentially bring your score down.

What to Do: You can evaluate your credit report to determine the age of your oldest, newest, and the average age of all your accounts.

Type of Credit and Inquiries for New Credit

A lack of different credit types and/or frequent applications for new credit may have contributed to your score.

What to Do: Reflect on your mix of credit accounts and recent credit inquiries. Applying for new credit sparingly and maintaining a diversified credit mix can benefit your score.

Public Records

Public records such as bankruptcies or liens can significantly lower your credit score.

What to Do: Review your credit report for any public records. Address and seek resolution of any items listed that might have contributed to your score.

How Do I Improve my 612 Credit Score?

Your credit score of 612 is categorised as fair, but with some calculated efforts, it can be improved. Below are top strategies tailored to your current credit situation:

1. Ensure Timely Payments

The key to improving your credit score is making all of your credit payments on time. It weighs heavily on your credit score, making it crucial as a first step. Set up automatic payments or reminders to prevent any delays.

2. Settle Outstanding Debts

Clearing up any outstanding debts or collections will immediately prevent further damage to your credit score. You could get in touch with your lenders to settle your balances or arrange suitable payment plans.

3. Moderate Credit Card Utilisation

Keep your credit card balance as low as possible. Strive for below 30% of your credit limit, ultimately aiming for less than 10%. This shows that you’re capable of responsibly managing your available credit.

4. Responsible Use of Secured Credit Card

Securing a credit card might be tricky due to your current score. An excellent option is a secured credit card. This requires a cash deposit that becomes your credit limit. Use this card wisely and pay off the balance in full monthly.

5. Consistently Review Your Credit Report

Always maintain a habit of reviewing your credit report frequently. This will ensure any inaccuracies are spotted and disputed promptly, preventing any unexpected decrease in your credit score.

With these targeted actions, you’re well on your path to improving your credit score expediently.