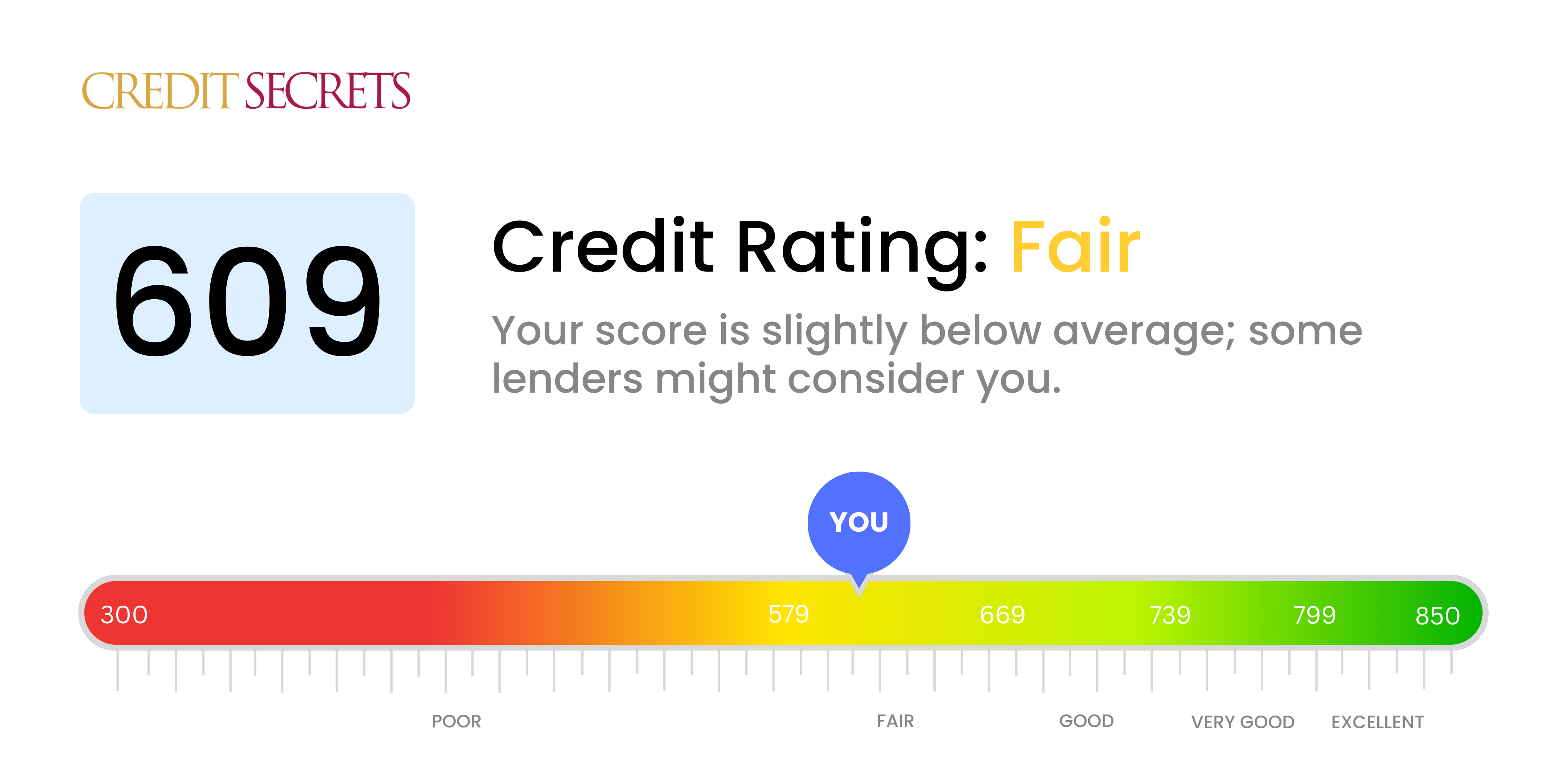

Is 609 a good credit score?

With a credit score of 609, you're positioned in the 'fair' category. This simply means, if you're looking for loans or credit, lenders may consider you as a somewhat risky borrower and you may face relatively high interest rates and less favorable terms. However, it's not the end of the road, and opportunities exist to improve your score.

Navigating towards a better credit score requires time, patience, and focus on positive financial behaviors. This includes regular bill payments, reducing debt, and maintaining a steady financial record. Although it may seem daunting, remember that your current score is not permanent; it's something you can certainly work on and improve.

Can I Get a Mortgage with a 609 Credit Score?

If your credit score is 609, you might find it challenging to secure a mortgage. This is because your credit score falls below the average range typically favored by most lenders. With a 609 credit score, it indicates that you may have had some financial instability, including late payments or other credit missteps.

However, don't lose heart. Some mortgage lenders consider applications from borrowers with lower credit scores. They might be more inclined if you have a stable income or a significant down payment. Understand, though, the approval process might come with higher interest rates and tighter restrictions due to perceived risk.

Focus on working to enhance your credit score while saving towards a larger deposit, to make your application more appealing to lenders. Remember, improving your credit health is not an overnight process, but a step-by-step journey towards financial stability. Stay optimistic, each effort you make is a step closer to your goal of homeownership.

Can I Get a Credit Card with a 609 Credit Score?

With a credit score of 609, obtaining a traditional credit card might be a bit challenging. This middle-score is often seen as risky by lenders, and it may paint a picture of previous financial difficulties. However, it isn't a verdict, rather it provides an opportunity to take stock of your current credit standing and adapt.

Even though approval might be tougher, you still have alternatives to explore. A secured credit card, for example, is an option. This type of card calls for a deposit that serves as your credit limit. Getting one of these is usually less difficult and can assist in boosting your credit over time. Another option might be a credit card specifically designed for those looking to build or rebuild their credit. Keep in mind that the interest rates on any credit options you'll likely be approved for may be higher due to the increased risk for the lender. However, by making timely and consistent payments, you could gradually increase your credit score and gain access to cards with better terms in the future.

If you have a credit score of 609, it's likely that you'll face challenges in securing a traditional personal loan. While this is an unfortunate reality, it is crucial to understand that this score reflects a higher financial risk from a lender's perspective. Traditional lenders utilize credit scores as a tool to gauge the likelihood of borrowing behavior. A score of 609 indicates the possibility of late payments or defaulting on the loan.

While securing a conventional loan may be challenging in this situation, it is not impossible. There are alternative lending options available, such as secured loans, which require collateral, or having a cosigner with a better credit rating vouch for you. Another avenue to explore could be peer-to-peer lending platforms that might be more forgiving with credit score requirements. Do remember, however, these alternatives often carry higher interest rates and more stringent conditions, as they signify a higher level of risk for the lender.

Can I Get a Car Loan with a 609 Credit Score?

Securing a car loan with a credit score of 609 might be a bit challenging. Most lenders like to see a credit score of at least 660 because it tells them you're likely a safe bet and a reliable borrower. With a score of 609, however, you fall into the subprime category. From a lender's perspective, this score suggests there might be a higher risk you'll have difficulty repaying the loan.

However, let's not lose hope. While it might not be a walk in the park, getting a car loan with a subprime score like 609 isn't impossible. Some lenders are willing to work with individuals who have lower credit scores. But remember, the conditions that come with these loans can often be steep. With a lower credit score, you might face higher interest rates as a measure to offset the perceived risk the lender is taking. Always review the terms before agreeing to a loan and explore all your options carefully.

What Factors Most Impact a 609 Credit Score?

Grasping the factors affecting a score of 609 is key to planning your path to a healthier financial future. By addressing these influential aspects, you can rebuild and enhance your credit.

Payment History

With a score of 609, your payment history could be negatively affecting your score. Late or missed payments are often responsible for lowering credit scores.

How to Check: Scrutinize your credit report for any missed or late payments. Reflect on whether payment scheduling has been a struggle.

Level of Debt

Your level of indebtedness could be another important factor. Higher debt levels, particularly on credit cards, can pull down your score.

How to Check: Look at your recent credit card statements. Are you consistently close to your credit limit? A key strategy is to strive to keep your balances well below your credit limits.

Credit History Length

A brief credit history or frequent changes in credit accounts might be impacting your score. Credit stability comes with time and careful management.

How to Check: Consider the age and stability of your credit accounts. Short-term accounts or frequent credit openings can affect your score.

Credit Mix

The variety of credit accounts you have, like credit cards, retail accounts, auto loans, and mortgages, can also influence your score. A balanced mix of credit displays responsible credit management.

How to Check: Study your credit report to determine the diversity of your accounts. Look for ways to responsibly diversify your credit mix if needed.

Derogatory Marks

Derogatory markings, such as collections or bankruptcy, can significantly impact your score.

How to Check: Revisit your credit report for any derogatory marks. Work on resolving any listed on your report.

How Do I Improve my 609 Credit Score?

A credit score of 609 falls under the category of subpar. However, take heart for this situation is not permanent. With particular actions structured towards your current situation, you can uplift your credit score. Here are five impactful steps relevant to your score level:

1. Rectify Outstanding Debt

Start off by resolving any accounts that are overdue. These have a major impact on your credit score. If required, liaise with your creditors to structure a viable payment plan.

2. Lower Credit Card Utilization

Consistently high credit card balances can harm your credit score. Aim to decrease your balances to less than 30% of your credit limit; ultimately keeping it below 10% is your goal. Prioritize cards with the highest utilization rates.

3. Consider a Secured Credit Card

Given your present score, a standard credit card may be hard to come by. In lieu, a secured credit card could help. This card requires a cash deposit which becomes the credit line for that card. Utilize it sensibly by making small purchases and ensuring full balance payment each month.

4. Seek to Be an Authorized User

Consider a friend or family member with a good credit standing. Request them to add you as an authorized user to their account. This will increase your credit score by mirroring their positive credit usage in your credit report.

5. Expand Your Credit Portfolio

Having a myriad of credit accounts aids in improving your credit score. Once you’ve established a positive payment trail with your secured card, contemplate over extending to other credit types like a retail credit card or a credit builder loan. Ensure you handle these responsibly.