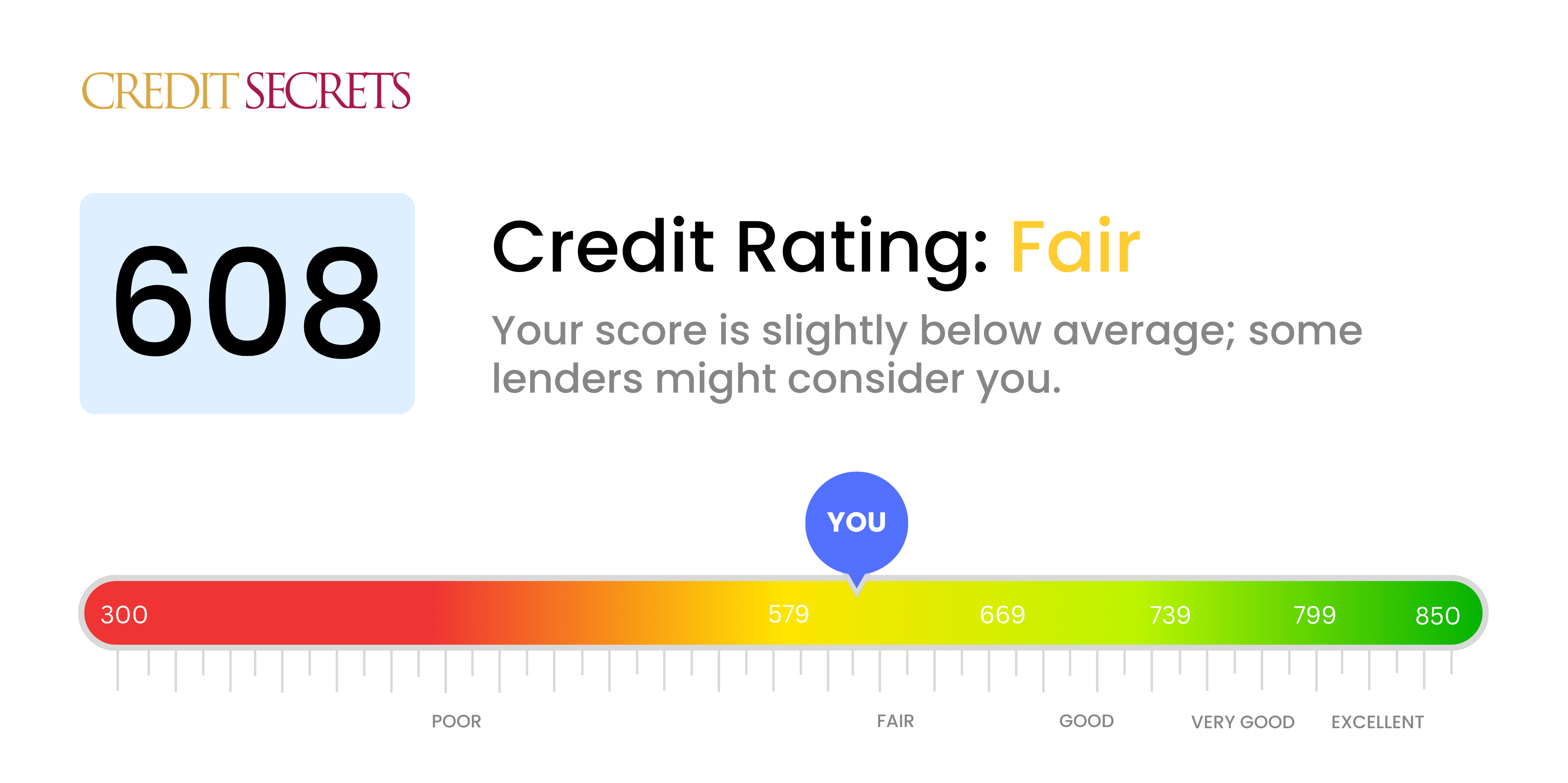

Is 608 a good credit score?

Your credit score of 608 falls into the 'Fair' category. This might not be the ideal score but, remember, it's not the worst either. You're in the process of building your credit health, and a bit of planning and discipline can help you escalate your score.

With a score of 608, lenders might see you as a slightly risky borrower, implying you may face higher interest rates and less favorable credit terms on loans or credit cards. However, it's not all bleak - many creditors are still willing to extend credit at this level. It's crucial to stay optimistic, timely bill payments and decreasing debts can gradually improve your credit score.

Can I Get a Mortgage with a 608 Credit Score?

Carrying a credit score of 608 might present challenges when seeking approval for a mortgage. This score is below the average, suggesting that you might have experienced some financial hiccups in the past. Mortgage lenders typically require a score that's significantly higher, as that demonstrates a history of responsible credit use and timely repayments.

However, don't be disheartened. There are options available to you. Some mortgage lenders specialize in assisting borrowers with lower credit scores. These 'sub-prime' lenders may offer you a mortgage but they often carry higher interest rates to offset the increased risk. Alternatively, consider government-insured loans like FHA or VA loans, which may be an option, despite a lower credit score. Take the time to fully investigate and compare these alternatives, as the interest rates and costs involved can greatly affect your future financial stability. Remember, improving your credit score is a journey that takes time and persistence.

Can I Get a Credit Card with a 608 Credit Score?

Having a credit score of 608 may pose some hurdles if you're attempting to secure a traditional credit card. As this falls into the 'fair' category, potential lenders might view your financial risk as a little higher than those with higher scores. It's not an ideal situation, but acknowledging where you stand is key to working towards better financial health.

Given the degree of risk associated with this credit score, it might be beneficial to explore options like secured credit cards. These cards require an upfront deposit which will serve as your credit limit. This could be a reliable stepping stone to gradually improving your credit score. Additionally, high-interest credit cards may be a reachable option as some cater specifically to those with lower credit scores. However, be aware, these often come with steeper interest rates. Progress may seem slow, but remember every step forward counts in the journey towards financial stability.

A credit score of 608 may prove tricky when trying to secure a personal loan from traditional lenders. To these institutions, a score such as yours might be indicative of potential risk, which can make them hesitant to approve your personal loan application. While it's a difficult thing to hear, it's crucial to understand exactly what your credit score signifies.

But don't be disheartened. You still have some options available. You could look into secured loans, where you offer an asset as collateral, or co-signed loans, where a person with a higher credit rating guarantees your loan. Peer-to-peer lending platforms might also be worth considering as they sometimes are more flexible with their credit requirements. But remember, these alternatives generally come with higher interest rates and less advantageous terms, as they bear higher risk for the lender.

Can I Get a Car Loan with a 608 Credit Score?

A credit score of 608 may create some roadblocks when attempting to secure a car loan. Lenders generally desire scores closer to 660 to offer favorable terms. Unfortunately, your score of 608 is seen as "fair" to "poor" on the credit score scale, which can result in higher interest rates or potentially, denial of the loan. This is because your score communicates to lenders how much of a risk they're taking by lending money and a lower score could suggest possible repayment hurdles.

That being said, don't lose hope just yet! There are lending options out there for those in your credit score range. Some lenders specialize in serving those with less than perfect credit, although these loans may carry noticeably higher interest rates due to the increased risk assumed by the lenders. It's paramount to review and understand these terms before accepting any loan. So yes, owning your dream car is still attainable, albeit with a bit more careful planning and effort on your part.

What Factors Most Impact a 608 Credit Score?

Understanding your credit score of 608 is the first step towards improving your overall financial health. It's important to know which variables influence your score the most and why.

Payment History

One of the primary influencers of your score is your payment history. Any delayed or missed payments can harm your credit score significantly.

How to Check: Take a look at your credit report for any discrepancies or late payments. Remember, even one missed payment can lower your score.

Credit Utilization Ratio

Using too much credit can negatively influence your score. If the balance on your credit cards is high compared to their limits, it's a likely contributor to your score.

How to Check: Examine your credit card statements. Do you often max out your cards? Keeping your balance less than 30% of your credit limit is advisable.

Length of Credit History

If you have a relatively short credit history, it can weaken your score.

How to Check: Look into the dates of opening of your credit accounts in your credit report. Have you recently opened several new accounts? Long-term accounts tend to boost scores.

New Credit and Credit Mix

Opening too many credit lines simultaneously can damage your score, and having a diverse portfolio of credit such as student loans, mortgages, and auto loans might improve it.

How to Check: Review your credit report, focusing on the variety of credit types and recently opened accounts. Responsible management of various kinds of debt reflects positively on your creditworthiness.

Public Records

Any public records, like lawsuits or bankruptcies, can significantly lower your credit score.

How to Check: Check your credit report for any public records. Addressing these promptly can slow the impact on your score.

How Do I Improve my 608 Credit Score?

With a credit score of 608, you’re on the threshold of fair credit, but there’s plenty to work on in order to boost your score. Below, we’ll guide you through some crucial and achievable steps you can take.

1. Evaluate Your Credit Report

Start by taking a good look at your credit report. Check for any incorrect data or discrepancies and if found, dispute them immediately. These can drag your score down without you realizing it.

2. Prioritize Existing Debt

Concentrate on managing any debt you currently have. By making payments on time and chipping away at the overall amount, you can greatly improve your credit score. Remember, punctual payment history is a cornerstone of good credit.

3. Maintain Low Credit Card Balance

High credit card utilization impacts your credit score negatively. Aim to maintain a balance of 30% or less of the card’s limit, with a long term goal of keeping it below 10%. Begin with the card that’s closest to its limit.

4. Consider a Secured Credit Card

Applying for a secured credit card can be a suitable option for this score range. By making regular small purchases and prompt payments, you can build a positive payment track record, which is beneficial for your credit score.

5. Seek to Diversify Credit

Once you’ve been consistently making payments on time, consider diversifying your credit portfolio. This could be via a credit-builder loan or a store credit card for example. This strategy showcases your ability to manage various types of credit responsibly and can help improve your credit score.