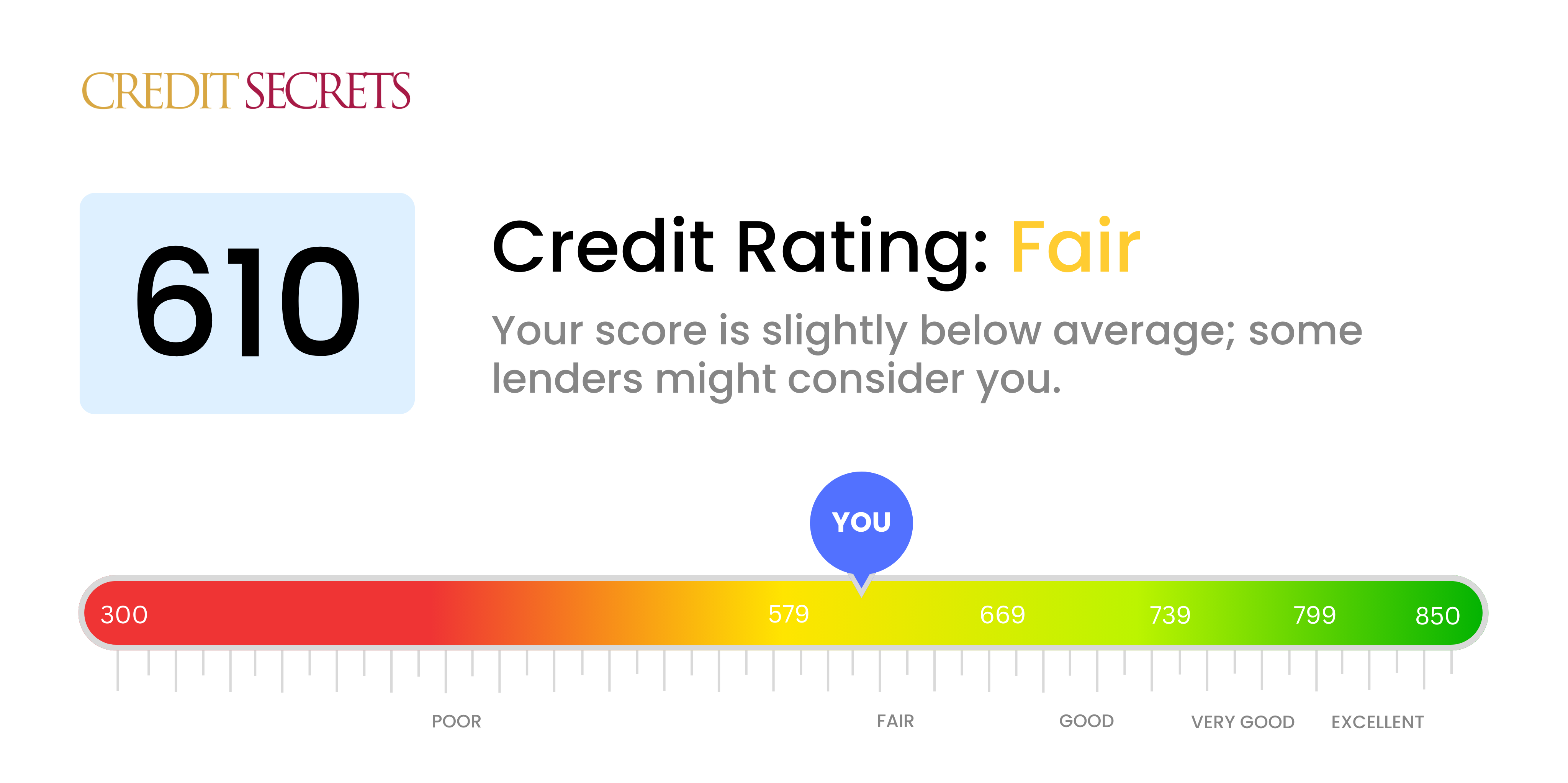

Is 610 a good credit score?

A credit score of 610 falls into the 'fair' range. This means that while it isn't considered a good credit score, it also isn't poor, and there's room for improvement. You may find securing loans or obtaining low-interest rates more challenging, but don't lose hope, there are proven strategies to enhance your credit score. By focusing on making timely payments and keeping your debt-to-credit ratio low, you can start working toward a better financial future.

Can I Get a Mortgage with a 610 Credit Score?

Unfortunately, with a credit score of 610, approval for a mortgage may be challenging. This score is generally viewed as fair and sits below the optimal range most lenders look for when offering a mortgage. Due to credit scores being a key indicator of financial health, a score of 610 could imply a history of missed payments or outstanding debt.

Although this might feel disheartening, it's not a dead end and there are other ways you can find to secure a home. You could look at saving for a larger down payment or explore government-backed loan programs like the FHA, which are designed to help individuals in your position. Alternatively, you could consider a co-signer if that's an option for you. It's important to remember that a credit score is not a static number and while improvement does take time, every positive financial decision can help increase your score.

Can I Get a Credit Card with a 610 Credit Score?

Having a credit score of 610 may present some challenges when trying to get a traditional credit card. This score is often seen as risky by lenders, based on past financial behaviors. But remember, it's important to face your credit situation with honesty and patience. Recognizing your current credit state is the initial stride toward better financial health.

There's no need to be discouraged if you're facing such challenges, as there are still other viable options. Secured credit cards, for instance, might be a suitable choice. These cards require a deposit, which typically becomes your credit limit, making them more accessible and making it possible to start rebuilding your credit gradually. Further, consider utilizing co-signer arrangements or prepaid debit cards. Although these alternatives don't offer an immediate remedy, they can become crucial steps in your journey toward financial stability. However, do remember that such options often come with significantly higher interest rates due to the increased perceived risk for lenders.

Having a credit score of 610 indeed signals to lenders that you might face certain challenges when applying for personal loans. Traditional lenders typically look for scores in the higher ranges, viewing a 610 score as a potential risk. This doesn't mean getting a loan is impossible, but it's essential to understand the implications of your credit score to your loan approval chances.

If traditional personal loans are not immediately accessible, several options might be suitable. Secured loans, where you offer up something of value as collateral, could be a possibility. Another option might be a co-signed loan, where someone with a higher credit score co-signs the loan with you. Also, some peer-to-peer lending platforms may have more flexible credit requirements. Remember, though, these alternatives often equate to higher interest rates and less friendly terms due to the increased lender risk. Remain vigilant and make sure any option chosen is the right fit for your financial situation.

Can I Get a Car Loan with a 610 Credit Score?

Having a credit score of 610 does present some challenges when trying to secure a car loan. Most lenders prefer scores above 660 and anything lower might be seen as subprime. Your score of 610 fits into this subprime bracket and, unfortunately, this could mean higher interest rates or even loan denial. This is due credit scores portraying your financial behavior, and a lower score could indicate a higher risk for lenders.

Nonetheless, don't lose hope just yet. It's still feasible to obtain a car loan with your credit score of 610. Some lenders are prepared to work with those who have lower credit scores. However, be mindful that the interest rates might be significantly higher as this compensates for the risk the lenders are taking. Proceed with caution, fully understand the terms, and with careful planning, obtaining a car loan is still a viable option.

What Factors Most Impact a 610 Credit Score?

Understanding a credit score of 610 is essential for crafting a strategy to bolster your financial health. It's vital to identify and address the likely factors causing your current score, preparing you for a path to strong financial standing.

Payment History

Your payment history is likely to significantly impact your credit score. Any missed or late payments could be a root cause of your current score.

How to Check: Investigate your credit report for any missed or late payments. Reflect on whether there were any payment delays which might have affected your score.

Credit Utilization

High utilization of your available credit can negatively influence your score. If your credit card balances are high compared to your available credit, this could be a significant factor.

How to Check: Go through your credit card statements minutely. Are your card balances creeping close to their credit limits? Striving to keep your balances lower than your limits can help your credit score.

Length of Credit History

A brief credit history could be negatively impacting your score.

How to Check: Look into your credit report for a full history of your account ages. Check the age of your newest and oldest credit accounts, and the average age of all your accounts.

New Credit and Credit Mix

Applying for new credit sparingly and having a diverse mix of credit accounts can positively impact your score.

How to Check: Look at the variety of credit accounts you own and how often you apply for new credit.

Public Records

Public records like bankruptcies and tax liens can exert a significant toll on your credit score.

How to Check: Browse your credit report for any public records and address any listed items that might require resolution.

How Do I Improve my 610 Credit Score?

With a credit score of 610, you’re on the boundary of poor and fair credit, but fear not! Here are tailored steps that you can take to elevate your credit:

1. Review your Credit Reports

Errors on your credit reports can drag your score down. Obtain your credit report from each of the three major credit bureaus and meticulously comb through each for inaccuracies. If you do find errors, file a dispute to have them removed.

2. Pay down Outstanding Debt

Payment history is a significant part of your credit score, so prioritize paying down your existing debts, focusing on those with higher interest rates to save money over time.

3. Increase your Credit Limit

Contact your credit card issuer to request a credit limit increase. If approved, this can lower your credit utilization ratio (the percentage of your total credit limit in use), given that you don’t additionally increase your spending.

4. Build Credit with a Secured Loan or Secured Credit Card

Demonstrating that you can handle credit responsibly can boost your score. A secured loan or credit card, though it requires a security deposit, may be easier to qualify for with a lower score and help you build credit when used wisely.

5. Limit New Credit Applications

New credit inquiries can temporarily lower your score. Limit your applications to only when necessary, and seek out lenders that employ soft inquiries for prequalification, which will not impact your score.