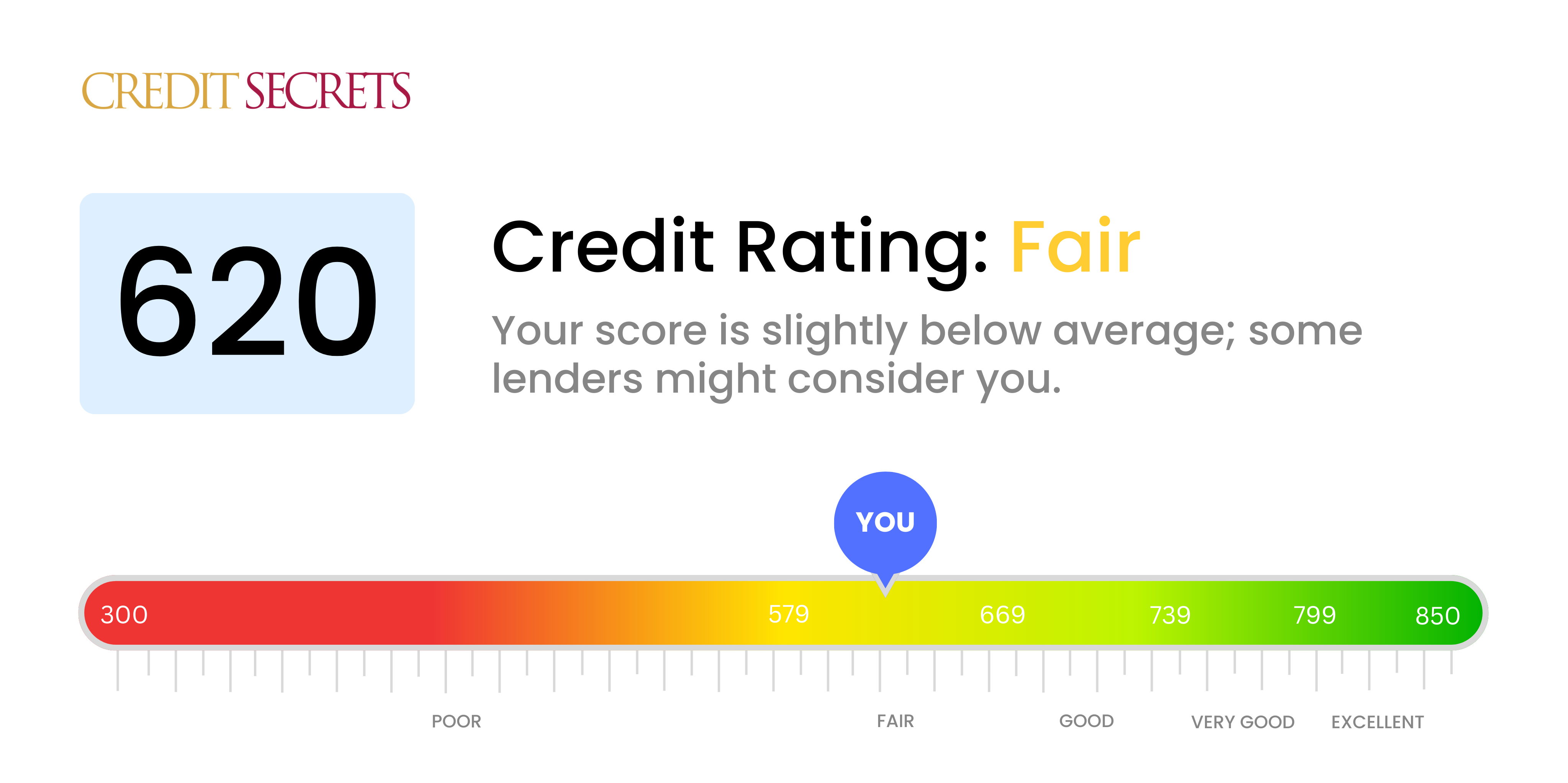

Is 620 a good credit score?

With a credit score of 620, you're in the zone that's considered fair. This isn't an ideal score, but don't worry, there's hope still for improvement.

Individuals with a score in this range may face challenges when it comes to securing optimal rates on loans, and they might not be approved for certain credit opportunities. However, improving your 620 score is certainly achievable. By mindful money management and making timely payments, your score can gradually increase.

Can I Get a Mortgage with a 620 Credit Score?

Having a credit score of 620 presents some challenges when applying for a mortgage. This score falls below the threshold that many lenders consider satisfactory, which could hinder your chances of approval. A score in this range may indicate some past financial missteps such as late payments or exceeding credit limits. Understanding that this is a difficult position to be in, finding alternate paths is beneficial.

One option could be applying for loans designed for individuals with lower credit, like FHA (Federal Housing Administration) loans. These types of loans often require a minimum credit score of 580, but may allow for exceptions if you can demonstrate steady income and are able to pay a higher down payment. However, it's important to note that obtaining a mortgage with a lower credit score may also mean higher interest rates. An alternative path is evenly stabilizing and improving your credit score over time, through consistent on-time payments and effective management of existing credit.

Can I Get a Credit Card with a 620 Credit Score?

With a credit score of 620, obtaining a traditional credit card may prove to be a steep climb. This score is often viewed as risky by lenders. It may be disheartening to hear this, but grasping the reality of your credit status is crucial in navigating financial challenges. A candid understanding of your situation facilitates informed decisions towards enhancing your financial health.

Considering this kind of credit score, you should contemplate other options, such as obtaining a secured credit card. This type of card necessitates a deposit that matches your credit limit. They can be relatively easy to acquire and can serve as a stepping stone to fortify your credit over time. Pre-paid debit cards or having a co-signer are equally valid alternatives. While these options won't entirely rectify the situation immediately, they are stepping stones towards financial stability. Furthermore, remember that any credit available to someone with this credit score is likely to come with steeper interest rates, as lenders perceive a higher lending risk.

With a credit score of 620, the conventional lending landscape could seem a tad challenging. This score, though not disastrously low, is frequently regarded as a 'subprime' by many lenders. This could make it more difficult to be approved for a personal loan in the traditional sense. However, don't fret. It's important to understand what this score means from a lender's point of view.

In terms of alternatives, options such as secured loans where you pledge an asset, or having an individual with a higher credit score co-sign your loan, could be considered. The rise of peer-to-peer lending platforms also offers a potential avenue as these often maintain more flexible credit requirements. However, keep in mind, these options could potentially come with higher interest rates, reflecting the heightened risk for the lender. It's certainly not an easy path, but remain hopeful. There are ways around the hurdles presented by a 620 credit score.

Can I Get a Car Loan with a 620 Credit Score?

With a credit score of 620, you're on the cusp of what's typically considered for a car loan. The credit world often sees scores over 660 as more appealing, but a score under this doesn't spell the end of your car purchasing journey. Your 620 score signals to lenders a moderate risk, which can make the lending process slightly more challenging, but it's not impossible.

Being in this credit range, you may face slightly higher interest rates or stricter loan terms than someone with a higher credit score. This is a common practice by lenders to manage their risk, as a lower score can indicate potential repayment issues. However, this shouldn't pressure you into giving up on your car-ownership dreams. There are lenders willing to work with a 620 credit score, just remember to read and understand the terms before agreeing to a loan. Your car loan goal is achievable, but it's always healthy to approach it with inquiries and a careful look at the fine print.

What Factors Most Impact a 620 Credit Score?

Analyzing a score of 620 is a powerful step in your financial progression. The key reason for this score can provide the right analysis needed in your journey to financial success. Be aware that your financial journey is unique, marked by enlightenment and opportunities to learn.

Credit Utilization Ratio

High credit utilization may be a significant factor affecting your credit score. If your credit card balances are close to their maximum, this could be a reason for your score.

How to Check: Evaluate your credit card statements. If your balances are near to their limits, consider working towards lower usage.

Length of Credit History

A shorter credit history may be impacting your score adversely.

How to Check: Look over your credit report to gauge the age of your oldest and newest accounts. Reflect on whether you have opened new accounts recently which might shorten your average credit age.

Credit Mix

Not having a variety of credit types on your credit profile might be lowering your score.

How to Check: Assess your variety of credit accounts, including credit cards, retail accounts, installment loans. Considered improving mix if it's not diverse.

Payment History

If you have late payments or defaults, this could impact your score significantly.

How to Check: Scan your credit report for any instances of late payments or defaults. These could be past mistakes that are hurting your score.

Public Records

If there are bankruptcies, tax liens, or other judgements on public records, these can negatively affect your score.

How to Check: Scrutinize your credit report for public records. Any listed items may need resolution to improve your score.

How Do I Improve my 620 Credit Score?

A credit score of 620, while not ideal, is certainly not the end of the road. There are ways to steadily improve it. Below are achievable strategies exclusively for this current score:

1. Review Credit Reports

Errors on your credit reports can drag your score down. Find the inaccuracies and dispute them immediately. This can fairly and accurately reflect your credit history, thus helping your credit score.

2. Consider a Debt Consolidation Loan

Taking out a debt consolidation loan might help. It can simplify your loan payments by combining all your debts into a single debt and it can potentially lower your interest rate. Ensure to repay on time to increase your credit score.

3. Opt for a Secured Loan or Secured Credit Card

A secured loan or secured credit card may be easier to qualify for at your score level. They require a security deposit that then becomes your credit limit. Make small charges each month and repay in full to build a consistent payment history.

4. Apply for a Credit-Builder Loan

A credit-builder loan allows you to “borrow” against a deposited amount in a designated account. Your on-time payments are reported to the credit bureaus, thus, improving your credit history and score.

5. Limit Your Credit Card Utilization

Relatively high credit card balances can negatively impact your credit. Keep your credit utilization below 30% of your total credit limit to help your credit score. Pay-off the cards with the highest balances first to quickly decrease your overall utilization.