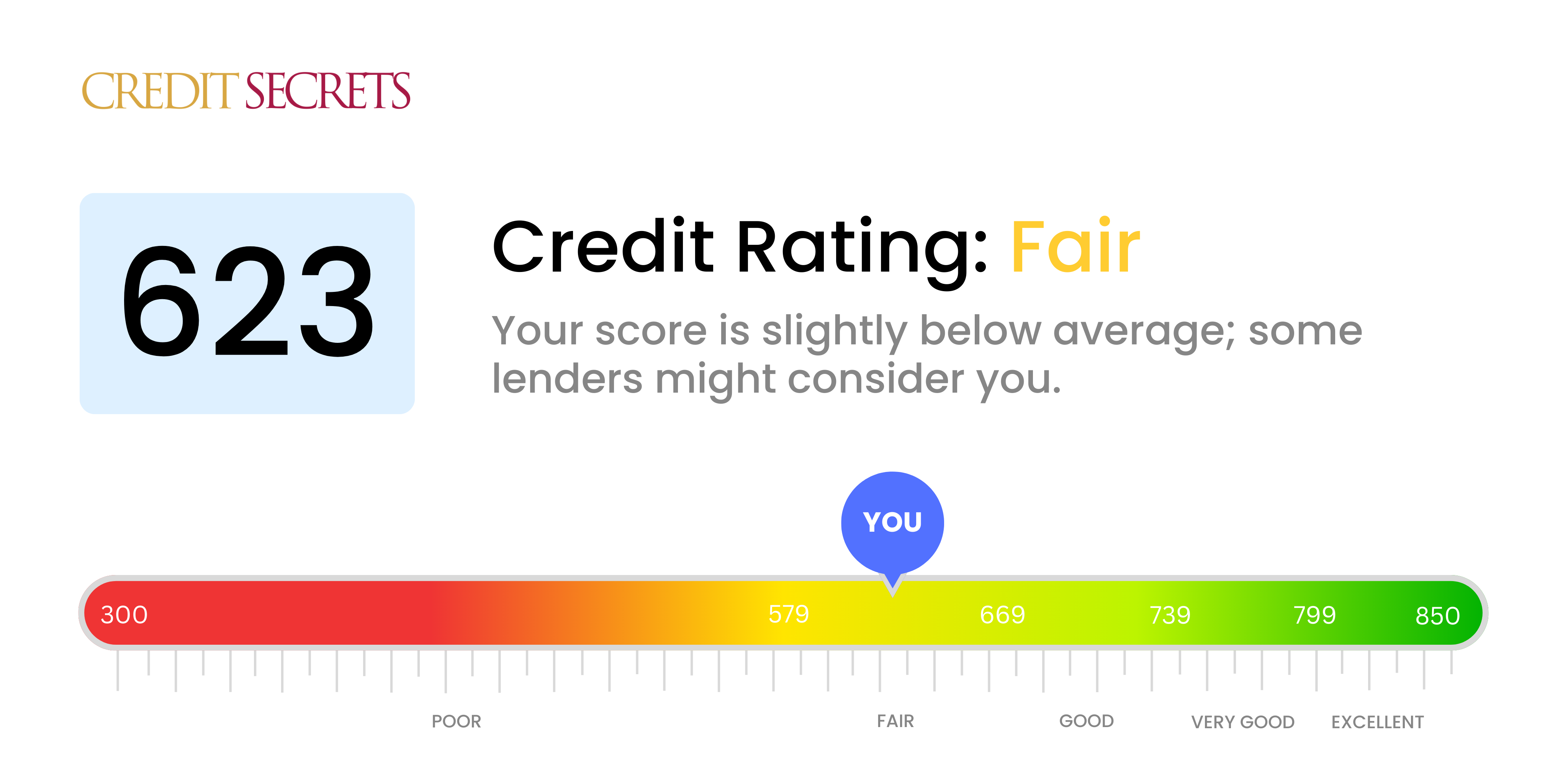

Is 623 a good credit score?

With a credit score of 623, your score lands in the 'Fair' category. Although not deemed poor, it is still not in the 'Good' range and there's definitely room for improvement. It's important to know that lenders and creditors might find this score a bit risky, which can affect interest rates and terms when applying for loans or credit.

However, it's not all doom and gloom. You have the power to boost your credit score. Timely payments, lower credit balance, and responsible credit usage can help enhance your score over time. Stick with it, and you'll see your efforts reflected in a stronger score.

Can I Get a Mortgage with a 623 Credit Score?

With a credit score of 623, acquiring a mortgage may be challenging. This score falls short of the preferred range for most mortgage lenders, which is typically around 660 or higher. This score implies that you may have had some past credit difficulties, such as late payments or being over your credit limit.

This doesn't mean you're without options, though. Some mortgage lenders may consider your application despite the less-than-ideal score, but bear in mind, the trade-off is often higher interest rates and fees. There are also alternative loan types, such as FHA loans, targeted specifically at those with lower credit scores. Begin addressing the underlying issues that may have led to this score - such as paying bills on time, reducing debt, and not applying for credit impulsively. With time and discipline, a higher score and better financial opportunities can be within your reach.

Can I Get a Credit Card with a 623 Credit Score?

With a credit score of 623, achieving approval for a traditional credit card might feel like an uphill task. This score might lead lenders to view you as potentially risky, but it's crucial to approach this situation with understanding and pragmatism. Recognizing your credit status is the vital first step to better financial health.

Due to the possible hurdles associated with this score, it might be beneficial to consider other credit options. You might want to consider secured credit cards, which require a refundable security deposit. These cards might be easier to qualify for and can help in gradually improving your credit with responsible use. You can also think about having a co-signer or exploring options with prepaid debit cards. Please remember, these suggestions do not offer an immediate fix; instead, they act as stepping stones on the journey to better financial health. Furthermore, it's important to note that you might face higher interest rates on any line of credit you obtain due to the perceived risk associated with your credit score.

Handling a credit score of 623 can feel overwhelming. When trying to attain a personal loan, this score can cause some challenges. Generally, traditional banks may hesitate to approve loans to individuals with this credit score. The risk involved in lending to someone with this score is often seen as too high, and thus, it's less likely for you to be approved for a conventional personal loan. It's important to understand this reality to know where you stand.

Fortunately, there are still some alternatives that may be worth exploring. These include secured loans, which use your assets as collateral, or co-signed loans, where a trustworthy individual with a higher credit score co-signs the loan with you. Peer-to-peer lending platforms could also be a potential avenue as they often have more flexible credit score requirements. Always be aware, however, these options may come with higher interest rates and may not offer the most favourable terms, given the higher perceived risk of lending to someone with a lower credit score.

Can I Get a Car Loan with a 623 Credit Score?

Having a credit score of 623 might make the process of getting a car loan slightly trickier for you. The favor of a lender generally tilts towards those with scores above 660. Your score of 623, however, falls below the preferred range, and is considered 'fair'. This implies that you represent a moderate risk to lenders, based on your past credit history.

The good news is that your dreams of owning a car are not dashed. There exists a group of lenders who work specifically with individuals like you, who may have lower credit scores. Just keep in mind--these loans will, in all likelihood, come with a higher interest rate. This is the lender's way of offsetting the risk associated with lending to those with lower credit scores. While the journey obtaining a car loan may be a little turbulent, you can still potentially secure one with diligent effort and careful examination of loan terms.

What Factors Most Impact a 623 Credit Score?

Understanding a credit score of 623 is integral to your financial growth journey. Acknowledging the contributing factors to this score can help you set foot on a path towards a healthier credit report. Remember that each finance journey is uniquely tailored to the individual, offering ample occasions for personal and financial development.

Late Payments

One major factor that often impacts a credit score such as 623 is the history of payments. If there have been instances of delay or missed payments, these might have negatively affected your score.

How to Check: Go through your credit report for any disclosed late or missed payments. Take some time to recall if there have been instances where your payments were not on time.

High Credit Card Balances

Having high balances on your credit cards compared to their limits can negatively affect your credit score. If you are habitually reaching or exceeding your credit limits, this might be a primary reason for your current score.

How to Check: Study your monthly credit card statements. If you find balances consistently touching or crossing the limits, try to maintain a lower credit utilization ratio.

Short Credit History

Having a short credit history or having recently opened many accounts can decrease your score.

How to Check: Review your credit report to ascertain the tenure of your oldest and newest accounts, and the overall average age of your credit accounts. Assess if you have opened multiple credit accounts in a short span.

Diversity of Credit

Maintaining a diverse mix of credit such as installment loans, credit cards, or mortgages is useful for a strong credit score.

How to Check: Look at your current mix of credit to evaluate how varied it is. If you primarily have one type of credit, consider diversifying.

Public Records

Presence of negative public records like bankruptcies, tax liens, or court judgments can harm your score.

How to Check: Inspect your credit report for any public records. If any is found, ensure you address these swiftly.

How Do I Improve my 623 Credit Score?

With a credit score of 623, you’re in the “fair” category, which means there is room for improvement. Taking the right steps can help you elevate your score. The following are plausible actions for someone in your situation.

1. Credit Utilization

Your credit utilization rate plays a significant role in your credit score. Try to keep your balances below 30% of your credit limit on each card. Paying off high balances should be one of your priorities.

2. Monitor Your Credit Reports

Set up a routine to regularly check your credit reports for errors. Correcting any inaccuracies can lead to an immediate score boost.

3. Set Up Automatic Payments

Automatic payments can help ensure that you pay your bills on time, something key to improving your score. Even one late payment can significantly impact a credit score in the 600’s range.

4. Installment Loan

Taking out a small installment loan and paying it off on schedule can add to your credit mix and show lenders that you can handle various types of credit responsibly.

5. Limit Unnecessary Credit Inquiries

Applying for a new line of credit should be done sparingly since each hard inquiry can chip away at your score. Instead, focus on improving the conditions of current credit accounts.

By implementing these smart strategies, upgrading your score from fair to good can be easily conceivable.