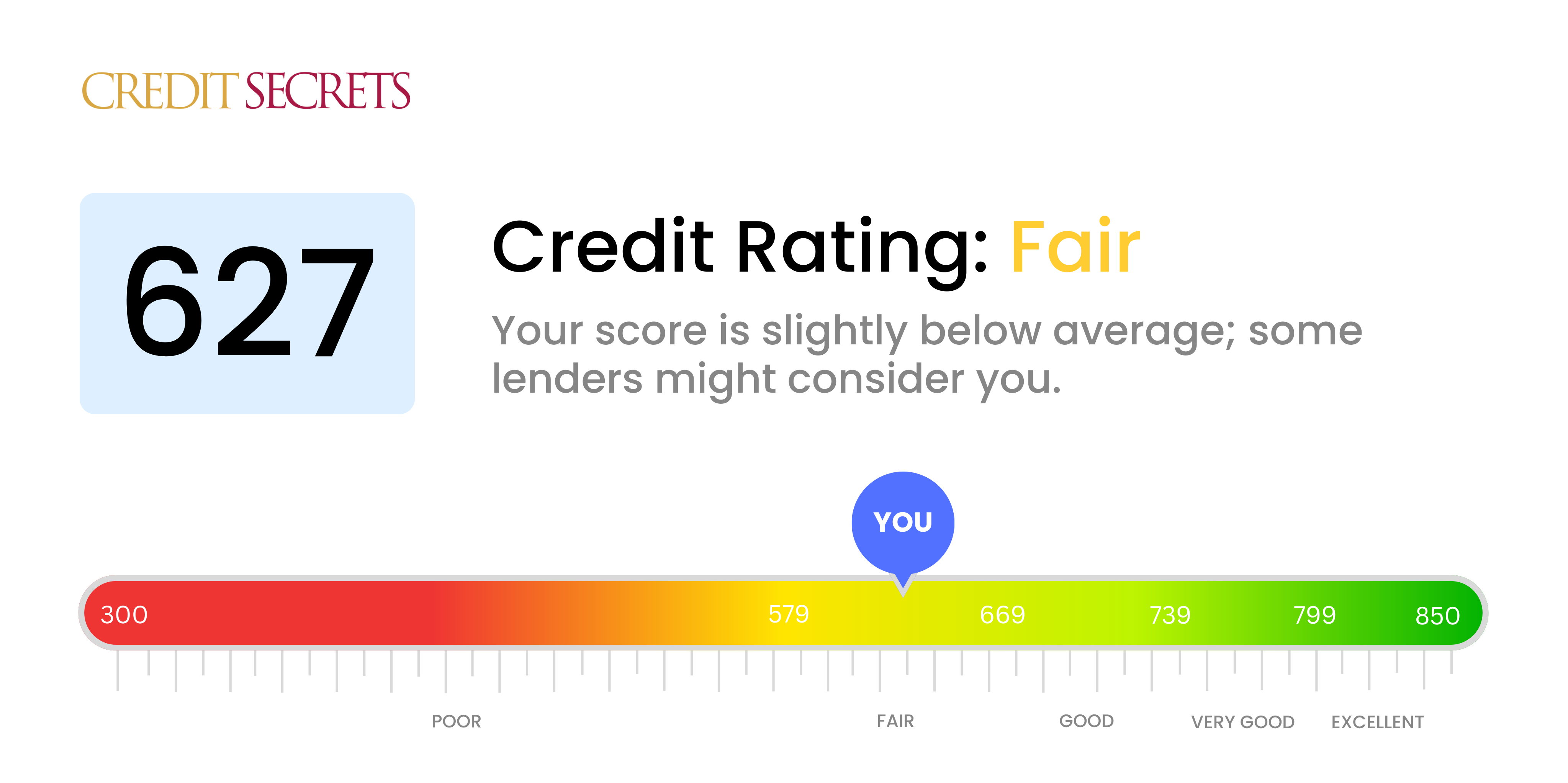

Is 627 a good credit score?

Your credit score of 627 is categorized as fair in the credit scoring system. This means that while you won't be turned down outright for credit, you may not receive the best interest rates, and there might be more restrictive terms in place when it comes to things such as credit limits or loan amounts.

However, don't be disheartened. This is not a permanent state and with time and effort in managing your credit, there's ample opportunity to improve. Being disciplined about making timely payments, keeping low balances on credit cards and not applying for unnecessary credit can help elevate your credit score to the next level. It's all within your reach!

Can I Get a Mortgage with a 627 Credit Score?

If you currently have a credit score of 627, you may face some difficulties in securing a mortgage. While not drastically low, this score is considered fair and might not suffice for lenders who are looking for solid evidence of creditworthiness. Lenders tend to seek higher scores as it assures them that the borrower can manage their financial responsibilities effectively.

A credit score of 627 may lead to your mortgage application being approved, but you should anticipate potentially higher interest rates. Lenders often factor in the level of risk in loaning money, and a fair credit score could lead to them charging higher interest to offset their risk. There might also be more stringent conditions on the mortgage, such as a larger down payment.

While this might seem disheartening, remember there are alternative paths to homeownership. Some lenders specialize in working with individuals with lower credit scores, or you might explore government-backed loans which often have more flexible credit requirements. Succeeding with these options, however, may still necessitate vigilant financial planning and management.

Can I Get a Credit Card with a 627 Credit Score?

Holding a credit score of 627, it's plausible to get approved for a credit card, but your options may be a tad limited. Credit card issuers don't view this score as ideal, but conversely, they don't regard it as particularly high-risk either. It's a score that sits somewhere in the middle, corresponding to your past financial actions and decisions.

The types of credit cards that could be a good fit for your situation could include starter credit cards or secured credit cards. Starter cards are designed for those new to credit or those recovering from a past financial mishap and offer policing interest rates. On the other hand, secured cards require a deposit upfront that acts as your credit limit, minimizing the risk to issuers. Hence, acquiring these cards is likely easier. Remember that the interest rates on these types of cards may be higher due to the slightly higher risk associated with this credit score range. But managing them responsibly can steadily lead towards better financial health.

A credit score of 627 may pose some difficulties when seeking approval for a personal loan. Many traditional lenders prefer applicants with higher scores as these represent less risk. That said, every lender's requirements vary, so it's not entirely out of the question. Keep in mind, though, that your credit score reflects your financial history and lenders use this information to assess your ability to repay a loan. It's not a comfortable spot to be in, but understanding your situation is the first step towards making improvements.

If a traditional personal loan isn’t an option due to your credit score, explore other possibilities. Consider a secured loan, which involves offering collateral such as a car or home. There's also the option of a co-signed loan. This method involves finding a co-signer with a strong credit score who's willing to vouch for your reliability. Alternatively, peer-to-peer lending platforms can sometimes provide loans with more lenient credit requirements. Just be aware that these alternatives may carry higher interest rates due to the increased risk the lenders are taking on by approving you.

Can I Get a Car Loan with a 627 Credit Score?

Having a credit score of 627 can cause some bumps in the road when applying for a car loan. While it's not the worst score you could have, it's also not in the most desirable range for most lenders. Typically, lenders prefer credit scores at or above 660. Your 627 score drifts a bit from this and indicates to lenders a higher degree of risk when it comes to lending money.

While it may be a bit tougher, it's certainly not impossible to secure a car loan with a 627 credit score. Some lenders have experience working with individuals with lower credit scores. Keep in mind, however, the interest rates charged on these loans can be significantly higher because of the additional risk lenders are taking. Before making a decision, it's crucial to fully understand the terms, including the interest rates, to make sure it aligns with your financial capabilities and goals. Finding a suitable car loan is definitely achievable with some mindful understanding and patient searching.

What Factors Most Impact a 627 Credit Score?

Understanding your credit score of 627 is an important step on your path to financial prosperity. Let's explore the key factors that might have influenced this score.

Credit Utilization

Your credit utilization could be a potential determinant of your score. If your credit card balances are quite high compared to your credit card limits, it might be impacting your score.

How to Check: Review your credit card statements. If your balances are consistently pushing your limits, this could be a factor.

Payment History

Your payment history is also influential. Late payments or missed payments might be affecting your score.

How to Check: Look over your credit report for any instances of late or missed payments.

Length of Credit History

The length of your credit history might be another important aspect. A shorter credit history, or a history with numerous newly opened accounts, can be a negative factor.

How to Check: Check your credit report to understand the age of your accounts and if you've recently opened a lot of new ones.

Credit Mix

Your mix of credit forms - such as credit cards, retail accounts, installment loans and mortgage loans - counts. Operating a variety of credit types is considered positive.

How to Check: Assess your portfolio of credit accounts. A lack of diversity could be a culprit.

Public Records

Public records like bankruptcies, lawsuits, or tax liens on your credit report can take a toll on your score.

How to Check: Scrutinize your credit report for any public records and work towards resolving them.

How Do I Improve my 627 Credit Score?

With a credit score of 627, you’re on the cusp between poor and fair credit. Implementing the right strategies can significantly boost your score. Here are key steps tailored for your current situation:

1. Regularly Monitor Your Credit Report

Monitor your credit report for errors and discrepancies. Any inaccurate information, from wrong addresses to falsely reported late payments, can impact your score. Report errors promptly for correction.

2. Limit Hard Enquiries

Each time you apply for credit, a hard inquiry is made, which may slightly lower your score. Aim to space out your credit applications, and only apply when you’re relatively confident of approval.

3. Settle Outstanding Debt

Old, unpaid debts can drag your credit score down. Focus on settling these debts, starting with those in collections or charged-off. Settling these accounts may increase your score in a significant way.

4. On-Time Bill Payment

Prompt payment of bills, from utilities to rent, reflects positively on your score. Consider setting up automatic payments to help manage your monthly commitments.

5. Create a Personal Budget

Create a personal budget to crack down on overspending, and systematically repay debts while saving money. This step helps to effectively manage your finances and boost your credit score over time.

Remember, improving your credit score is a marathon, not a sprint. Be patient, maintain these good practices, and your score will begin to rise.