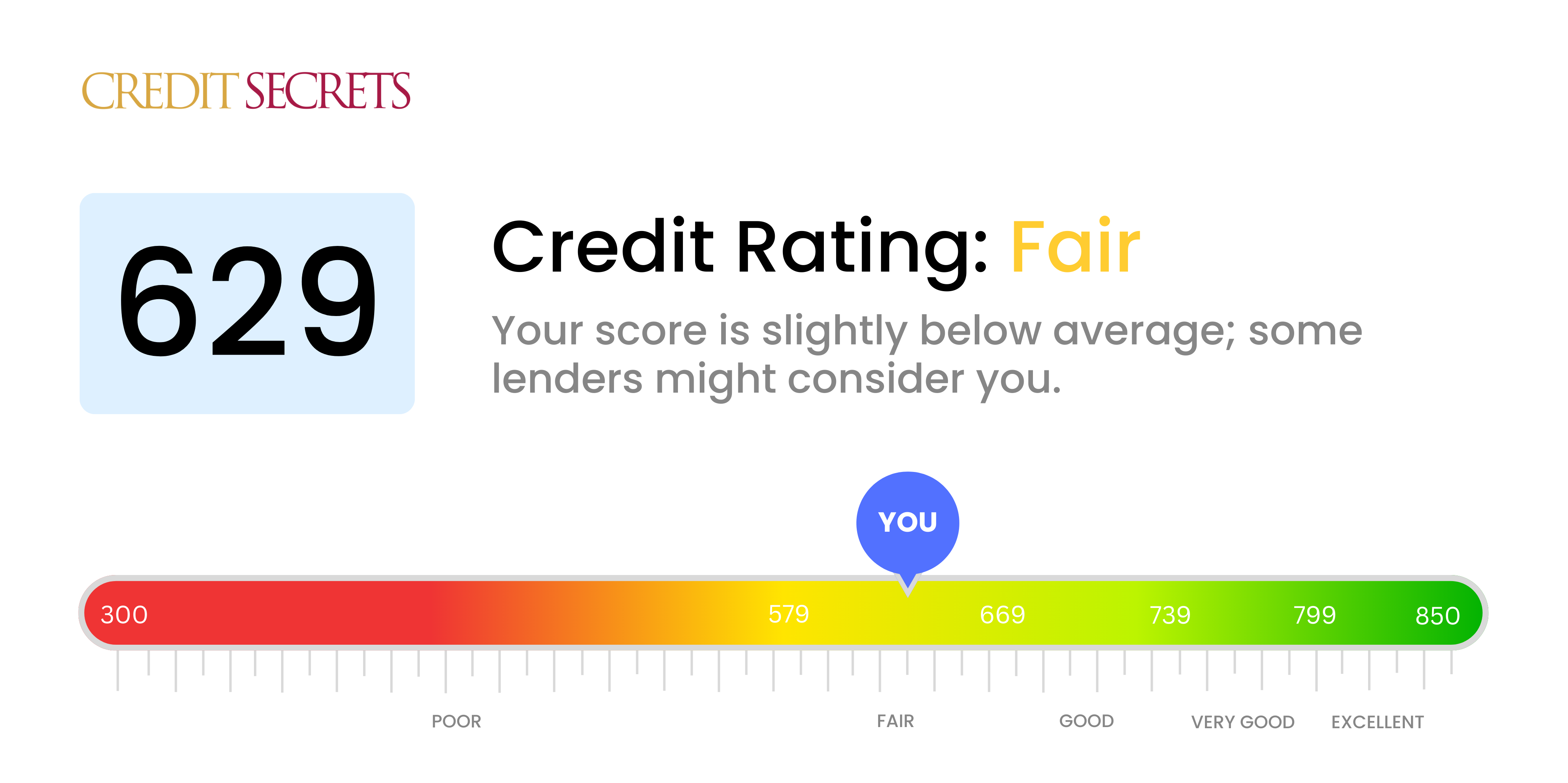

Is 629 a good credit score?

A credit score of 629 falls within the 'Fair' range. With this score, acquiring new credit might be somewhat challenging as some lenders may view it as a risk, meaning you may be charged higher interest rates than those with good or excellent scores, and your options for credit cards might be a bit limited.

It's important, however, to not be too disheartened. Many people have improved their credit scores from this point, and you have the power to do the same. By consistently making your payments on time, limiting the amount of debt you carry, and being disciplined about your spending, you can work towards reaching a 'Good' or even 'Excellent' credit score range over time.

Can I Get a Mortgage with a 629 Credit Score?

A credit score of 629 falls within the "fair" credit category. While it's possible to be approved for a mortgage with this score, it can be more difficult and you may encounter higher interest rates due to the risk lenders associate with lower credit scores. Understandably, this can be a tough situation, but it's important not to despair.

If your goal is to purchase a home, it may be worth exploring alternatives such as FHA (Federal Housing Administration) loans which are designed for borrowers with lower credit scores. Additionally, increasing your down payment could potentially improve your chances of approval as it reduces the lender's risk. However, it's essential not to exhaust your savings completely, and always ensure you can comfortably afford the mortgage payments as well as any unexpected costs. Improving your credit health certainly takes time and patience but maintaining a strong focus on your financial objectives can be very rewarding in the long term.

Can I Get a Credit Card with a 629 Credit Score?

With a credit score of 629, chances of getting a typical credit card approval might be a bit slim. This score, which might be viewed as fair by some lenders and poor by others, can somewhat limit options. It's not the end of the world, and it's commendable that you're taking initiative to understand where you stand. Awareness is a constructive step towards better credit management.

Don't dishearten, there are alternatives. A secured credit card or a starter card can be more within reach. A secured card, for instance, operates by having you make a deposit that serves as your credit limit. A starter card is designed especially for those with low scores or little credit history. Both of these options can be valuable tools in rebuilding your credit over time. However, be mindful that interest rates associated with these cards are likely to be higher, due to the perceived risk involved for the lender.

With a credit score of 453, obtaining a personal loan from traditional lenders might prove to be difficult. This is because such score is quite below the typically acceptable range for standard loans. Lenders may interpret this score as a high-risk indicator, making them reluctant to grant a loan on regular terms. It's disheartening, but it's also crucial to understand what this credit score might mean for your borrowing options.

Don't feel disheartened, though. There are alternative options available which may suit your needs. Consider things like secured loans, where collateral is put up, or co-signed loans, which involve another individual with a better credit score taking responsibility for the debt. Peer-to-peer lender platforms are another option, as these often have more flexible credit score requirements. Keep in mind, however, that these alternatives may come with higher interest rates and less favorable terms due to the potential risk seen by the lender.

Can I Get a Car Loan with a 629 Credit Score?

A credit score of 629 might pose some hurdles in your goal of getting approved for a car loan. Financial institutions often prefer applicants with credit scores of 660 or higher when offering favorable loan terms. Having a credit score below this benchmark lands you in what's referred to as a 'subprime' category. This isn't the best news because lenders might view you as a potential risk, given that your score suggests potential difficulties meeting repayments.

Yet, a lower credit score doesn't put an absolute stop to your car-ownership dreams. There are lenders who are willing to work with those who have lower credit scores. However, be mindful that these loans often come with higher interest rates. This is how lenders protect themselves from the perceived risk involved. Yet, navigating this route isn't impossible, with careful assessment and a thorough understanding of the loan terms, securing a car loan can still be an achievable goal.

What Factors Most Impact a 629 Credit Score?

A score of 629 suggests there are several areas where potential improvements can be made to reach a better financial standing. It's not about dismay, but about looking for ways to grow and achieve financial health.

Payment Performance

Timely payments reflect positively on your credit score. Late payments or missed bills could be impacting your current credit standing.

How to Check: Scan your credit report for any instances of missed or late payments. Any payment delays could be causing your score to dip.

Credit Usage

Utilizing a high percentage of your available credit can lower your score. It's best to keep balance utilization lower than 30% of your overall credit limit.

How to Check: Go through your credit card statements. Are your balances nearing their credit limits? Keeping this ratio low can benefit your score.

Established Credit History

A short credit history can negatively affect your credit score. The longer you responsibly manage your credit, the better for your overall score.

How to Check: Look over your credit report. Evaluate the age of your oldest and youngest accounts, and the average age across all accounts.

Variety of Credit

Diversifying the types of credit and managing responsibly can improve your score. This could be credit cards, retail accounts, instalment loans or mortgages.

How to Check: Assess your range of credit accounts. Also, gauge the frequency of your new credit applications - frequent hard inquiries could be affecting your score negatively.

Public Record

Having public records such as bankruptcies or tax liens can significantly lower your score.

How to Check: Review your credit report for public records. Rectifying any outstanding issue can bring a positive shift to your score.

How Do I Improve my 629 Credit Score?

Your score of 629 falls under the category of fair, but there’s much room for improvement. With strategic steps, attaining a good credit score is quite feasible. Here are the most effective steps tailored to your current situation:

1. Clear Any Outstanding Collections

Settle any debts that have been handed over to collection agencies urgently. Reach out to the agencies and negotiate a payment plan if possible. This can have a profound effect on raising your credit score.

2. Monitor Your Credit Report Regularly

Through consistent monitoring of your credit report, you can spot any errors, like inaccurate late payments, and dispute them timely. This can prevent unnecessary dips in your score.

3. Opt for Installment Loans

At your current score, an installment loan like a personal loan might be a viable option. Remember to keep timely payments on the loan which can significantly uplift your credit score.

4. Consider a Co-Signer

If you are struggling to get credit on your own, then consider having someone with a higher credit score co-sign a loan or credit card application for you. This offers an way to prove creditworthiness and improve your credit score.

5. Attend to Delinquencies

Addressing any delinquencies head-on and making necessary arrangements for payments can aid in ameliorating your score. Keep all accounts clean henceforth for best results.