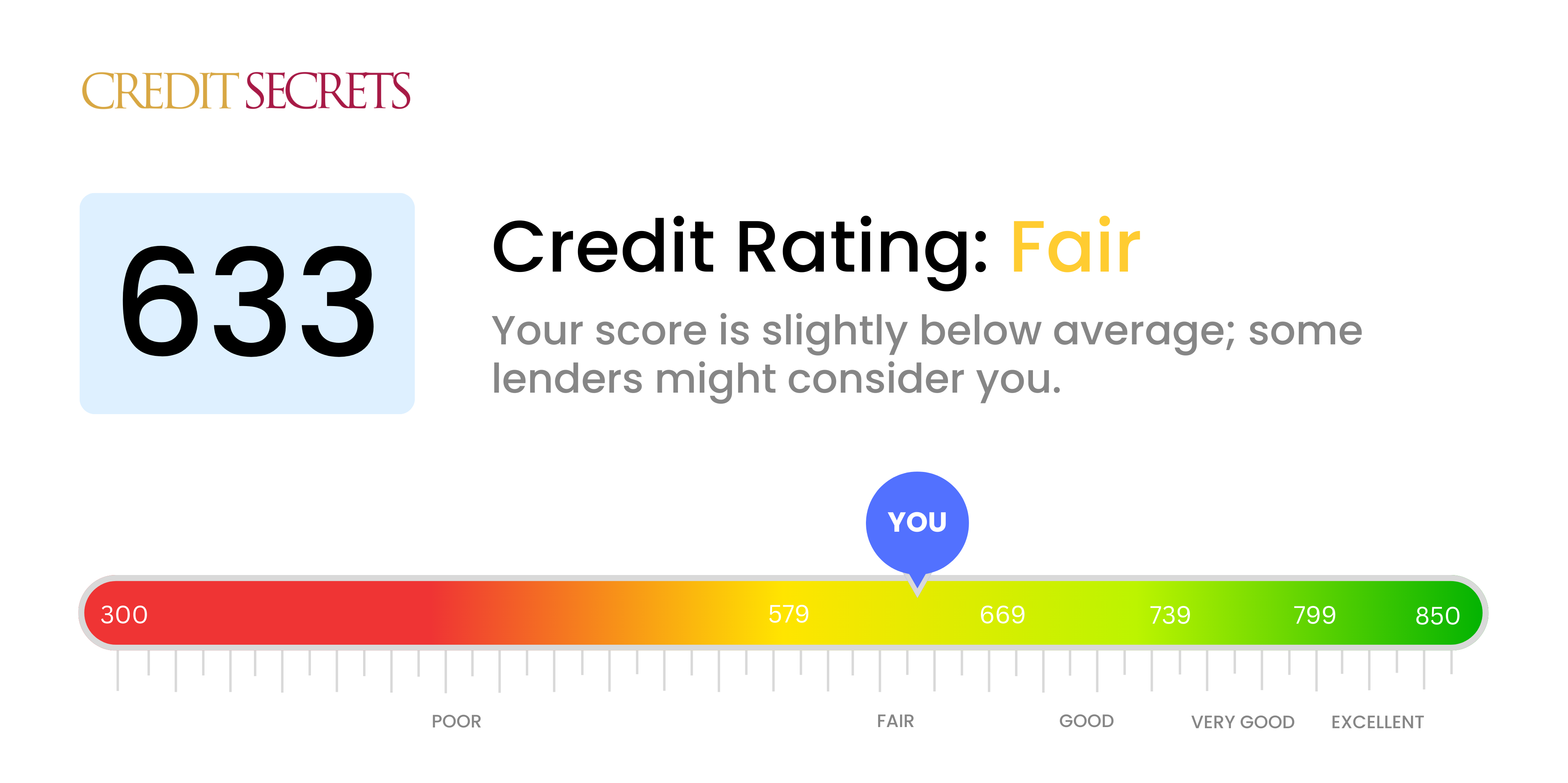

Is 633 a good credit score?

A credit score of 633 falls under the "Fair" category. Though it might not be considered as a good credit score, it's not the lowest either and there's ample room for improvement.

With this score, you might face higher interest rates and limited credit offers compared to those with higher credit ratings. Yet, don't lose hope - consistently paying your bills on time and decreasing your debt can gradually boost your score. You have the power to transform your financial health. Every step you take is a step towards better opportunities and financial freedom.

Can I Get a Mortgage with a 633 Credit Score?

If your current credit score is 633, securing a mortgage approval may turn out to be a challenging endeavor. Typically, financial institutions prefer lending to those with credit scores of 700 or above. With a score of 633, lenders might see you as a somewhat risky borrower due to past financial behavior including potential late payments or carrying high balances.

However, don't despair. There are a handful of mortgage options available specifically for those with lower credit scores, such as FHA loans. These are government-insured mortgages offering flexible qualification requirements. While these come with the possibility of approving lower credit scores, bear in mind that the lower the score, the higher the interest rate is likely to be. As always, it's best to continue working on improving your credit score as it broadens your mortgage opportunities and potentially lowers the financial burden.

Can I Get a Credit Card with a 633 Credit Score?

Having a credit score of 633 places you in the "fair" credit category. This may not provide a wide handful of options for credit cards, but it does not mean you won't be approved. Approval for credit cards depends mostly on the lender, though having this score might make the process a bit more challenging. It's crucial to take your financial situation objectively, handling it with a realistic and can-do attitude.

Your middle-of-the-road score may make you eligible for certain starter credit cards. These types of cards, such as secured cards, often come with lower credit limits and higher interest rates, but they are designed for people in your situation, looking to build a stronger credit profile. The key is to practice good financial habits, like making payments on time and not exceeding your credit limit. Slow and steady wins the race: it's about maintaining healthy financial habits to gradually open up more credit opportunities in the future.

With a credit score of 633, obtaining a traditional personal loan may be a bit challenging, but not impossible. This score is below the ideal range for many lenders, signaling a fairly high risk. Despite the hurdle, it is crucial to acknowledge what this credit score may mean for your borrowing prospects.

While it may be more difficult to secure a loan with this credit score, there are other options. Consider alternatives like secured loans, which demand collateral, or a co-signed loan if there's someone with a higher credit score ready to stand in for you. Peer-to-peer lending, despite potentially higher interest rates and stricter terms, could also be a viable solution. It's important to remember, however, that these options reflect the lender's increased risk and can often be more expensive in the long run.

Can I Get a Car Loan with a 633 Credit Score?

If your credit score is sitting at 633, it might feel quite challenging to be approved for a car loan. Generally, lenders prefer to see scores above 660 to offer favorable loan terms, and anything under 600 is often categorized as subprime. Your score of 633, though not in the subprime range, is still not ideal and may raise certain obstacles during the loan approval process.

With a score of 633, it's possible that lenders could perceive you as a somewhat risky borrower. This could translate to higher interest rates or perhaps even a denial of the loan. This doesn't mean the situation is hopeless though. Some lenders are more than willing to work with borrowers with less-than-perfect credit, but this usually means accepting higher interest rates. Despite these potential setbacks, owning a car is still within your grasp, bearing in mind the necessity of careful planning and prudent scrutiny of the loan conditions.

What Factors Most Impact a 633 Credit Score?

Assessing Your Credit Score of 633

Understanding the factors influencing your score of 633 empowers you to take the steps necessary for credit improvement. Take note of the following elements that might be impacting your score negatively.

On-Time Payment Record

Payment punctuality is crucial to your credit score. Any late payments could be a major reason behind your 633 score.

How to Check: Go through your credit report for any late payments or missed installments. Remember, every timely payment boosts your score.

Credit Utilization Ratio

Maxing out your credit cards repeatedly may negatively affect your score. It's essential to maintain low balances compared to your available credit.

How to Check: Check your credit card balances. Regularly paying down balances and keeping usage below 30% of your credit limit is a good practice.

Length of Credit History

Short credit history can negatively impact your score.

How to Check: Look at your credit report to evaluate the age of your accounts. If you've opened several new accounts recently, it could be affecting your score.

Credit Diversity and Recent Inquiries

Having different types of credit (credit cards, auto loans, mortgages etc.) and responsibly managing them improves your credit score. Furthermore, multiple inquiries for new credit can lower your score.

How to Check: Review your current mix of credit types. Monitor if you've made several credit applications in a short span of time.

Derogatory Marks

Derogatory marks such as collections, tax liens, or bankruptcies can significantly lower your score.

How to Check: Examine your credit report for any derogatory marks. Taking prompt action to resolve them can help boost your credit score.

How Do I Improve my 633 Credit Score?

Carrying a credit score of 633 means you’re on the edge of fair credit territory. Here are key steps tailored for your current credit score to help you ascend towards a healthier credit profile:

1. Scrutinize Your Credit Reports

Start by familiarizing yourself with your credit reports from all three credit bureaus. Check for any discrepancies or errors which could potentially lower your score. If you discover inaccuracies, swiftly dispute them.

2. Prioritize Timely Payments

Keeping current on all your accounts significantly improves your credit score. Show lenders your reliability by paying all your bills on time. If this is difficult, consider setting up automatic payments.

3. Manage Your Credit Utilization

Keep a keen eye on your credit card balances. Ensure they’re well below 30% of your credit limit, ideally under 10%. Efficient payment prioritizing cards with the greatest utilization can significantly better your score.

4. Apply for a Secured Credit Card

Obtaining a conventional credit card with a 633 score could prove challenging. A secured credit card, however, is within reach. They require cash collateral, with responsible use assisting in boosting your score.

5. Become an Authorized User

If you have a trustworthy, credit-savvy person in your life, ask them to add you as an authorized user on their credit card. Your score can benefit from their consistent, responsible credit behavior. Just check that the card issuer reports authorized user activity to credit bureaus.

6. Maintain a Varied Credit Portfolio

A diverse portfolio can enhance your credit score. After good history with a secured card, probe into other credit forms, such as retail credit cards or credit builder loans. Always manage them diligently.