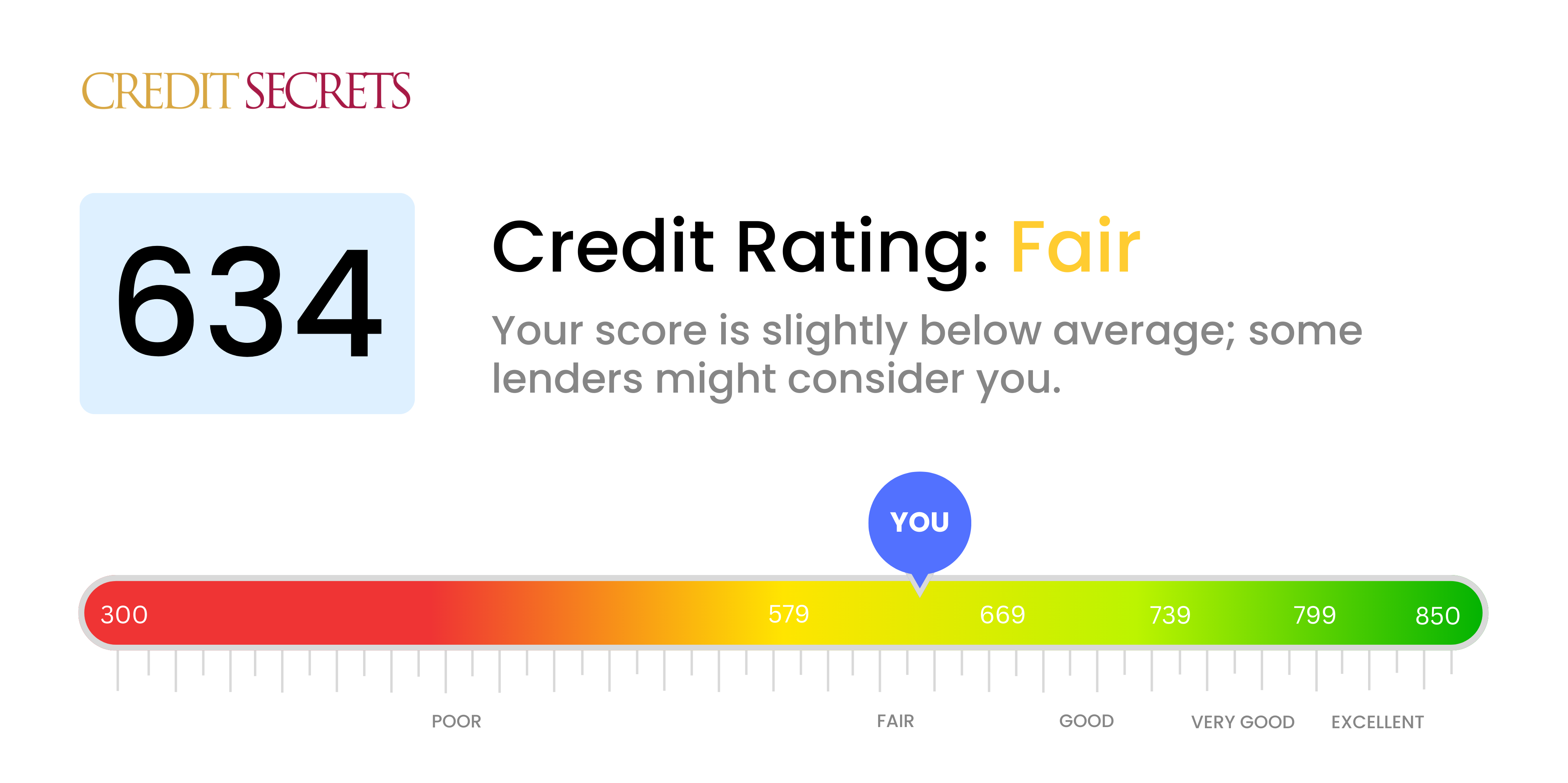

Is 634 a good credit score?

With a credit score of 634, your credit standing falls within the 'Fair' category. This isn't necessarily bad, but it does mean there's room for improvement to unlock better financial opportunities. You may face somewhat narrow options when applying for credit cards, loans, and mortgages, often accompanied by higher interest rates than those with stronger credit scores.

On a positive note, remember that your credit score is not set in stone. With consistent effort, responsible financial habits, and careful attention to your spending and payment habits, you can enhance your credit score over time. As your credit score increases, you'll gain access to better interest rates and more flexible finance options. The journey to improved credit can be challenging, but every step you take towards financial health and stability is an achievement.

Can I Get a Mortgage with a 634 Credit Score?

Reviewing a credit score of 634, it's apparent that achieving a mortgage approval might be difficult. Lenders often perceive this score as indicating inconsistent payment history or some financial struggles. However, this doesn't indicate a complete ineptitude, it simply implies there have been challenges.

Despite this, options for getting a mortgage aren't completely non-existent, though you may be met with less favorable terms or higher interest rates. Finding an alternative route may be worthwhile. FHA (Federal Housing Administration) loans or other government-backed loans tend to be more forgiving on lower credit scores, or you may consider saving for a larger down payment to lower the risk for the lender. Remember, a low credit score isn't a lifetime sentence, with diligent habits and consistent payments, you can improve your credit health for future lending opportunities.

Can I Get a Credit Card with a 634 Credit Score?

With a credit score of 634, it might be a bit challenging to obtain a conventional credit card. Lenders may see this score as moderately risky, suggesting past financial setbacks. This can understandably feel disappointing, but it's important to face such realities head-on and with a mature understanding. Knowing where your credit stands is the critical first step towards improving your financial health.

With this level of credit score, your options might be somewhat limited. A potential solution could be applying for secured credit cards. These cards require a deposit which usually equals your credit limit, but they’re typically easier to get approved for and can help improve your credit over time. Alternatively, you might want to look at starter credit cards, designed for folks attempting to build or rebuild credit. Just bear in mind, interest rates for these types of credit cards might be higher due to the associated risk perceived by lenders. Despite these hurdles, remember that these are just steps on your journey towards financial stability.

A credit score of 634 is considered below average and may make obtaining a personal loan more challenging. Lenders typically look for a score of at least 600 to allay their risks. Your current score might result in either loan denial or approval with less favorable conditions such as higher interest rates. It’s important to be upfront about the challenges that this could present.

Despite this setback, don’t lose hope. There are different routes you could explore to secure a personal loan. Secured loans, which require collateral, or peer-to-peer loans, which may offer more lenient credit requirements, could be a potential solution. Another option is a co-signed loan where someone with a higher credit score guarantees your loan. But bear in mind, these types of loans may come with higher interest rates and less favorable repayment terms due to the increased risk perceived by lenders.

Can I Get a Car Loan with a 634 Credit Score?

Having a credit score of 634 places you in a position that can make seeking a car loan a bit of a struggle. Most lenders would ideally seek applicants with a score above 660 to offer favorable loan terms. Your score, unfortunately, is seen as subprime, and this could influence higher interest rates or even a denial of the loan application. Simply put, your score suggests a higher level of risk to the lender, due to potential problems with repaying borrowed money in a timely matter.

Despite the challenge, don't lose hope. Understand that there are lenders who cater specifically to individuals with less-than-perfect credit scores. But be warned, the interest rates for these loans can often be substantial due to the increased perceived risk. Approach this path with caution and meticulously scrutinize all terms before committing to a loan. It may not be easy, but securing a car loan with a score of 634 is not entirely impossible. With a steady resolve and careful planning, you can make it happen.

What Factors Most Impact a 634 Credit Score?

Unraveling the mystery behind a credit score of 634 is an essential step towards financial betterment. Recognizing and tackling the factors that have played a role in shaping this score can alleviate your financial stress, and pave the path for financial wellbeing. Remember, every credit journey is unique, brimming with opportunities to learn and grow.

Payment Habits

Payment habits can significantly impact your credit score. Frequent late payments or payment defaults can massively bring down your score.

How to Check: To check this, review your credit report to identify any delayed or defaulted payments. Reflect on your past payment behaviors which might have influenced your score.

Credit Utilization Ratio

A high credit utilization ratio - the proportion of credit limit used - can negatively impact your score. If you're frequently maxing out your credit cards, this could be a crucial influencer.

How to Check: To verify this, you can analyze your credit card statements. If your balances are frequently near the limits, you may want to address this aspect.

Diversity of Credit

Lack of variety in your credit types or not managing new credit responsibly could be another reason for your current score.

How to Check: In order to check this, you can evaluate the diversity of your credit accounts. Consider whether you have a healthy mix of credit accounts like credit cards, retail accounts, installment loans, and mortgage loans.

Public Record Filings

Public record filings such as bankruptcies or tax liens significantly hamper your credit score.

How to Check: To confirm this, examine your credit report for any public records. Tackling any of the listed items that need resolution can positively impact your score.

How Do I Improve my 634 Credit Score?

With a credit score of 634, you’re at a ‘fair’ level, but pepping it up to ‘good’ or ‘excellent’ is definitely possible. Here are some tailored steps for your current situation:

1. Make Payments on Time

One of the largest factors impacting your credit score is the consistent repayment of debts. Make sure to always pay your bills on time, even if it’s just the minimum payment.

2. Keep Card Balances Low

A high credit utilization ratio can have a negative effect on credit scores. Make it a habit to pay down your balances, aiming to keep them below 30% of your total credit limit.

3. Apply for a Secured Credit Card

With a score in the 600s, getting a secured credit card might be easier. The deposit you pay to get the card becomes your line of credit. Use this card responsibly to gradually build up your credit history.

4. Seek Authorized User Status

If you know someone with positive credit history, ask them to add you as an authorized user on their account. This can help improve your credit score, however, ensure the credit card issuer reports user activity to the credit bureaus.

5. Try Different Forms of Credit

To improve your credit mix, once you’ve proven you can handle a secured card, consider getting a credit builder loan or a store credit card. Manage these accounts and their repayments responsibly.