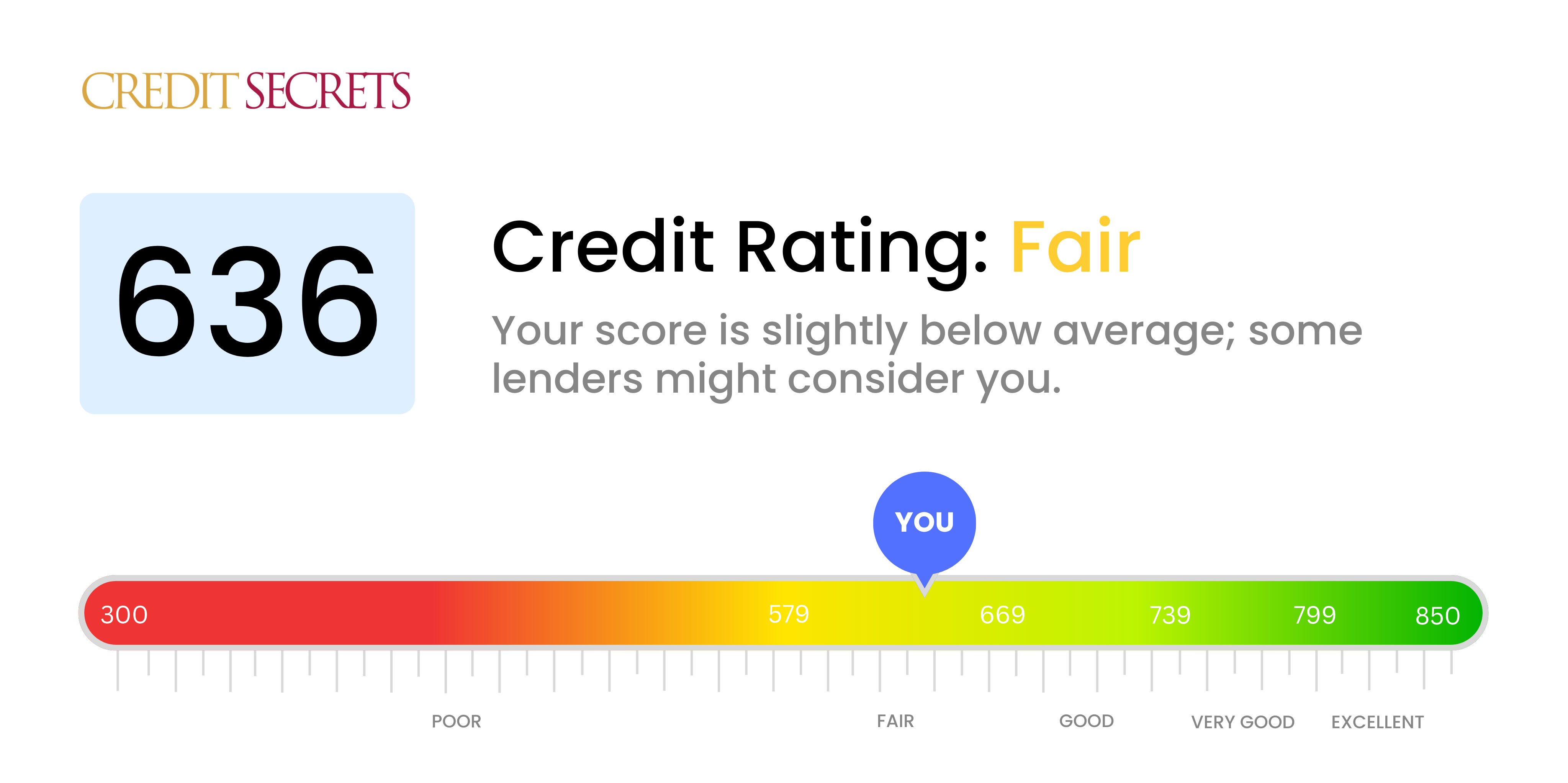

Is 636 a good credit score?

A credit score of 636 falls into the 'Fair' category. It's not the worst, but there's certainly room for improvement. With this score, you may find it a bit challenging to qualify for premium credit offerings, get approved for loans or obtain low-interest rates. The good news, however, is that improving your score is achievable. By paying bills on time, reducing debt, and keeping your credit utilization low, you should see your score rise over time. Always remember that building a good credit score is a journey, not necessarily an overnight process.

Can I Get a Mortgage with a 636 Credit Score?

With a credit score of 636, obtaining a mortgage may be slightly more challenging, as this figure aligns closely with the lower end of the 'fair' credit range in most scoring models. Lenders typically consider this score as borderline, suggesting that you may have had some credit missteps in the past.

However, don't lose hope. Some mortgage lenders might still consider applicants with this credit score, but be ready for a potentially higher interest rate reflecting the perceived risk. For now, consider options such as FHA loans, which are specifically designed for individuals with lower credit scores. Continually monitor your credit score and take steps to improve it, such as making sure your bills are paid on time, maintaining a low credit card balance, and not applying for new credit unnecessarily. This score isn't a brick wall, just another step on your journey to financial success.

Can I Get a Credit Card with a 636 Credit Score?

With a credit score of 636, the chances of being approved for a classic credit card are fair, but not guaranteed. A medium-range credit score like this indicates that financial responsibility has been shown but there's room for improvement. Facing this reality might be tough, but it's a necessary step towards reaching financial goals.

While the likelihood of gaining approval for premium travel cards may be low, starter credit cards and certain types of secured cards could be considered. Starter cards are typically designed for those with lower credit scores, helping them responsibly grow their credit over time. Some secured credit cards might also be a viable option, these require a deposit as a safety net, and gradually allow for credit building. But keep in mind that credit cards offered to people with this score typically come with higher interest rates due to lenders' perceived risk. It's vital to understand these realities while working towards financial security and independence.

With a credit score of 636, it can be difficult to be approved for a traditional personal loan. Many lenders view this score as an indicator of potential risk, making it challenging to find a lender who is willing to provide the funding you need. This might feel like a big hurdle, but it's not an insurmountable one. It's critical to understand how your credit score impacts your financial options.

If being approved for a conventional loan seems unlikely, there are alternatives you might explore. Secured loans, which require collateral, or loans co-signed by someone with stronger credit, may be more accessible. Another avenue might be peer-to-peer lending platforms, which are often more flexible with credit score requirements. However, these alternatives typically entail higher interest rates and tougher terms due to the increased risk for the lender. Despite these challenges, it's important to remember that there are options available for you.

Can I Get a Car Loan with a 636 Credit Score?

With a credit score of 636, you might find that getting a car loan isn't a walk in the park. Most loan providers usually prefer credit scores of 660 or more to approve a loan with favorable conditions. Your score of 636, although not far from this standard, is slightly below it. As a result, lenders may see you as a somewhat higher-risk borrower based on your past credit performance.

Now, this doesn't mean securing a car loan is off the table entirely. Some lenders are open to working with individuals who have credit scores similar to yours. However, keep in mind that these loans might carry higher interest rates to offset the additional risk the lenders are taking on. It might not be the smoothest ride, but by being mindful and taking the time to thoroughly understand the terms of your loan, the path to obtaining a car loan remains open.

What Factors Most Impact a 636 Credit Score?

Deciphering a score of 636 is crucial on your path to financial prosperity. Addressing the elements that may have led to this score is the ultimate key to elevating your credit health. Remember, everybody's financial journey is individual and sprinkled with opportunities for growth and education.

History of Bill Payments

Your bill payment history plays a significant role in determining your credit score. Late or missed payments could be a primary reason for your score.

Method to Check: Scrutinize your credit report for any late or missed payments. Reflect on circumstances that may have led to these delayed payments which have had an effect on your score.

Credit Usage

Over-utilization of your credit limit can negatively impact your score. In case you're close to maxing out your credit cards, this could be a major issue.

Method to Check: Inspect your credit card statements. Are your remaining balances near their upper limits? Maintaining a low balance compared to your limit is recommended.

Lifetime of Credit History

A limited credit history might act as a detriment to your score.

Method to Check: Go through your credit report to ascertain the duration of your oldest and newest accounts and the average lifespan of all your accounts. Think about whether any recent activity, like opening new accounts, may have affected your score.

Types of Credit Used and New Credit

Maintaining a mix of credit types and handling new credit responsibly drives a positive credit score.

Method to Check: Review your spectrum of credit accounts, such as credit cards, mortgages, retail accounts and installment loans. Contemplate whether your recent credit applications have been judicious.

Public Records

Public records like tax liens or bankruptcies can severely hamper your score.

Method to Check: Analyze your credit report for any public records. Attend to any item that might need resolutions.

How Do I Improve my 636 Credit Score?

With a credit score of 636, you might be feeling concerned about improving your financial standing. Fear not, because with focused steps, you can see improvement in your score. Check out these practical steps tailored to your current situation:

1. Prioritize Delinquent Accounts

Your first action should be to deal with any accounts that have late payments recorded. Paying these accounts to up-to-date status will significantly lessen their negative impact on your credit score. Reach out to your creditors to discuss potential options such as payment plans if needed.

2. Control Credit Card Spending

Excessive card balances compared to your credit limit can negatively impact your score. Aim to keep your credit card balance below 30% of your credit limit and ideally, strive to maintain it under 10%. Begin by paying down the cards with the highest utilization rates.

3. Consider a Secured Credit Card

A secured credit card might be a suitable option for you, considering your current score. It necessitates a cash-deposit that serves as your credit limit. Make sure to use it wisely, paying off your full balance monthly to establish a favorable payment history.

4. Authorized User Strategy

You might want to consider asking a close relative or friend with good credit to add you as an authorized user to their credit card account. This could give your credit score a help, by adding their positive payment history to your own credit report. Always verify that the card vendor reports authorized user activities to the credit bureaus.

5. Expand Your Credit Variety

Having different types of credit can enhance your credit score. Once you’ve demonstrated responsible payment behavior with a secured card, look into diversifying your credit portfolio with options such as credit builder loans or retail credit cards.