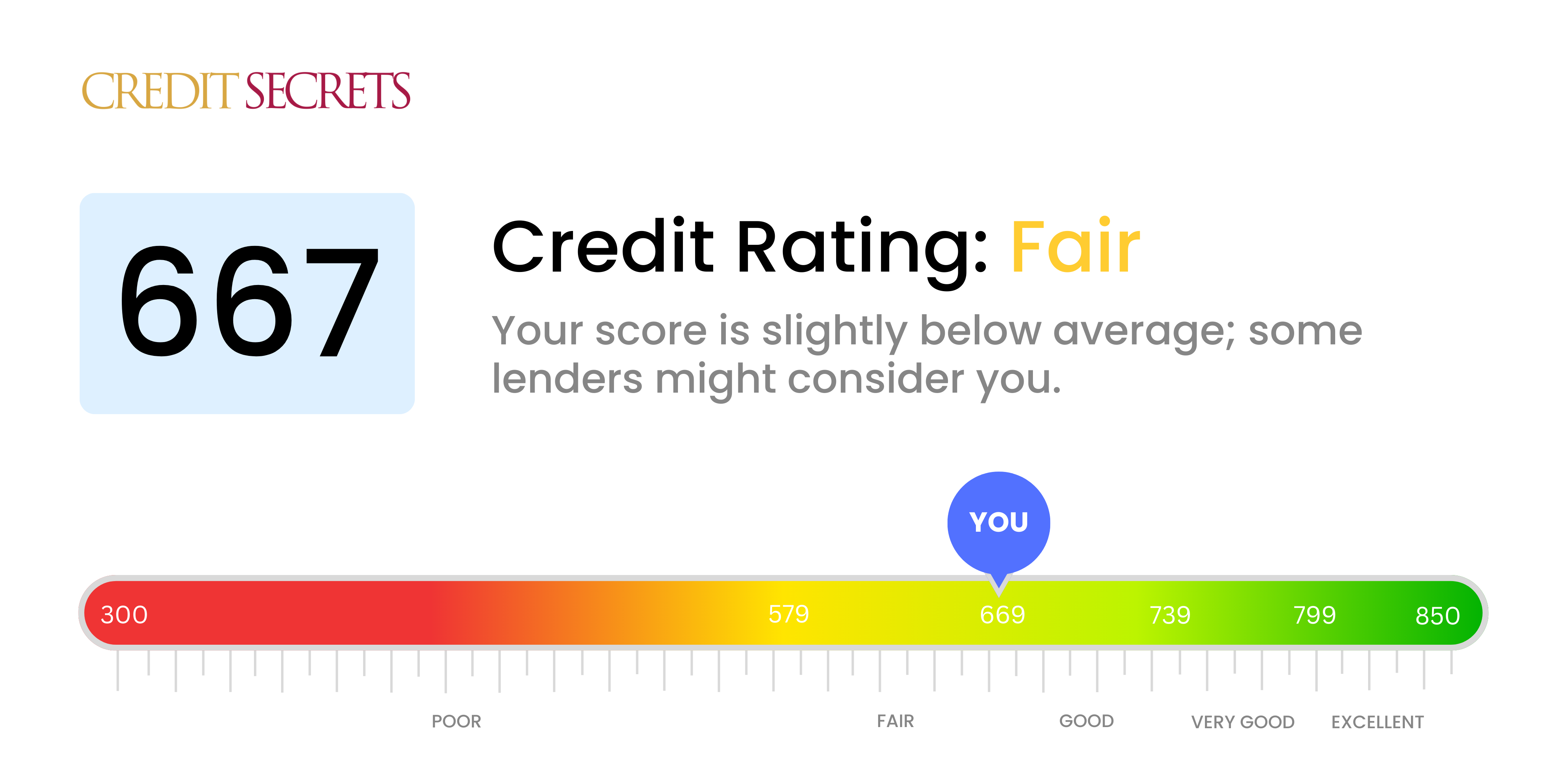

Is 667 a good credit score?

With a credit score of 667, you're just shy of being in the 'Good' range. Having a score in this range means you're right on the line of having access to better interest rates and financial opportunities, but you might face some strict terms from lenders or financial providers.

However, don't stress too much. It's definitely not the end of the road, and there's plenty you can do to improve your credit situation. By consistently paying off debts on time, reducing the amount of debt you owe, and being prudent about opening new credit accounts, you can strengthen your credit score over time. With concerted effort and a clear financial plan, a better credit score and more financial freedom are within your reach.

Can I Get a Mortgage with a 667 Credit Score?

With a credit score of 667, your probability of receiving approval for a mortgage is promising, though it's not guaranteed. Credit scores in this range are often considered "good," which instills confidence in lenders about your ability to repay loans. However, different lenders have specific standards, and while some may grant approval, others might require a higher score.

Assuming you receive approval for a mortgage, there are a few things to keep in mind about the process. To start, interest rates might not be the lowest available, as they are usually reserved for those with exceptionally high credit scores. That said, the rates you're offered are likely to be competitive and reasonable. Furthermore, the approval process might require additional documentation as proof of your financial stability. Nevertheless, a score of 667 places you in a promising position to be considered for approval by most mortgage lenders.

Can I Get a Credit Card with a 667 Credit Score?

Having a credit score of 667 puts you in a fair range, making it quite likely that you'll be approved for a credit card. This score can be interpreted as a reflection of generally safe financial habits, though there might be room for improvements. Being in this range should be seen as an opportunity to further elevate your financial standing. It's a position of potential growth, so don't lose sight of your financial goals.

Given that you're eligible to get a credit card, you should consider which type best suits your needs and circumstances. Starter credit cards could be an excellent choice, being designed for those with fair credit scores and offering rewards to encourage responsible usage. Secured credit cards might also be a good idea because they require a deposit as a safety net, lowering risk for the lender, which could lead to lower interest rates. Lastly, it's always wise to compare different credit cards, looking beyond just the interest rates and carefully considering other associated fees, rewards, and penalties.

If you have a credit score of 667, you'll find yourself located in the "fair" range on most traditional lending scales. This indicates that while you're not considered a high-risk borrower, you're not in the ideal range either. Approval for a personal loan at this level isn't guaranteed, but it is possible. You may encounter slightly higher interest rates or stricter loan terms, as lenders may see you as a somewhat higher risk compared to borrowers with excellent credit ratings.

In terms of your personal loan application process, you should prepare yourself for a meticulous review of your credit history. Be ready to provide evidence of stable income, and possibly references. Lenders will thoroughly check your ability to repay the borrowed sum. You may also need to be patient, as approval times can vary. Yet, don't let this discourage you. Many have secured loans with this credit score. Remember, every lender has different criteria and the key lies in finding one that aligns with your financial profile.

Can I Get a Car Loan with a 667 Credit Score?

With a credit score of 667, the likelihood of being approved for a car loan is quite favorable. That's because most lenders consider credit scores above the 660 mark as prime and usually offer acceptable terms. Your score of 667 falls nicely within this range. It's a reflection of responsible credit behavior and implies to lenders that there is a lower risk of defaulting on payments.

As you proceed with the car purchasing process, there are a few things to keep in mind. The interest rates offered to you should be relatively moderate, thanks to your credit score. It's crucial, however, that you carefully review the terms and conditions of the loan agreement. Being knowledgeable about the details can help ensure a smooth car purchasing journey. Remember, the goal is not only to buy a car, but to also maintain and possibly even improve your credit score for the future.

What Factors Most Impact a 667 Credit Score?

Delving into a score of 667 is integral to understanding your financial status. Each person's financial journey is unique, and knowing the factors that have led to your score can navigate you towards financial improvement.

Prompt Payment

Payments arriving past the due date can significantly hamper your credit score. The importance of maintaining regular, prompt payments cannot be overstated when improving your credit score.

Way to Verify: Scrutinize your credit report for instances of past due payments. Reflect on how these may have impacted your current score.

Credit Balance

Your credit balance influences your score. If your credit usage is high compared to your available credit, this could be contributing to your current score.

Way to Verify: Look at your credit card statements. Is high utilization a pattern? If so, aim to reduce the utilized chunk of your available credit.

Age of Credit

The lifespan of your credit accounts could be affecting your score. A brief credit history may negatively impact your score.

Way to Verify: Peruse your credit report to see the age of your oldest and most recent accounts, as well as the average age of all accounts. Assess whether you have opened new accounts recently.

Credit Diversity and New Credit

Managing a mix of different types of credit and handling new credit responsibly are vital parts of a good credit score.

Way to Verify: Evaluate your assortment of credit accounts. This could range from credit cards to installment loans. Take note of how often you're applying for new credit.

Public Records

Public records like tax liens can be impactful on your score. Even though these are serious, remember that clearing them up can help improve your score over time.

Way to Verify: Review your credit report for any public records that could be affecting your score. Engage with resolving any listed issues.

How Do I Improve my 667 Credit Score?

With a credit score of 667, you are at the higher end of the “fair” category, but still away from achieving “good” status. However, you can follow these accessible and impactful steps based on your situation for vital credit improvement:

1. Monitor Your Credit Report:

You must frequently check your credit report for any errors and discrepancies. Even the smallest errors can have significant impact on your credit score. You are entitled to a free copy of your credit report from each of the major credit bureaus once a year. Dispute any errors immediately.

2. Aim for Low Utilization:

You should ideally keep your credit utilization below 30% for each credit card and across all cards. This not only helps in maintaining your credit score, but it also shows potential lenders that you manage your credit responsibly.

3. Establish Automatic Payments:

Late payments can negatively impact your credit score. To avoid such situations, consider setting up auto-pay for your bills. This ensures bills are paid on time and helps to build a positive payment history.

4. Increase Credit Limit Responsibly:

Try and increase your credit limit without increasing your spending habits in parallel. This can lower your credit utilization ratio and thus, can have a positive impact on your credit score. Remember to ask the lender if your credit limit raise will result in a hard inquiry.

5. Limit Your Credit Inquiries:

Maintaining a stable credit profile is essential to boost your score. Avoid taking on new debt or applying for new credit unless it’s necessary. This limits hard inquiries on your profile which can lower your score.