Is 670 a good credit score?

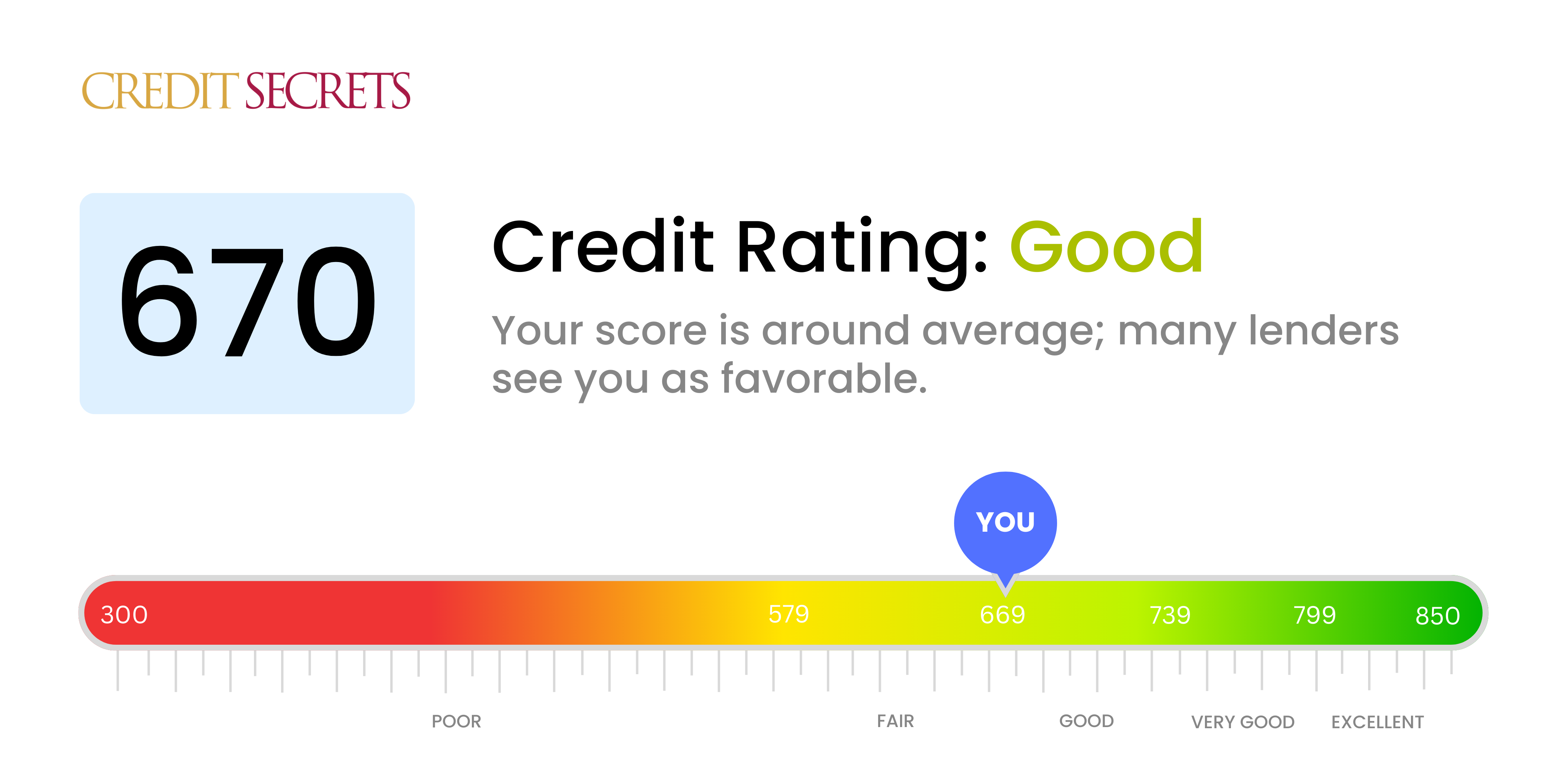

Your credit score of 670 falls within the 'Good' range on the traditional credit scale. This score is not bad, but it's also not in the top tiers, indicating that while you've managed your credit reasonably well, there may be room for improvement.

Even with a score of 670, many lenders will still consider you a desirable customer. You're likely to be granted credit, such as loans and credit cards, though the terms may not be as favorable as those given to individuals with very good or excellent scores. However, don't despair, as your current score presents a promising opportunity to strive towards an even healthier credit situation in the future.

Can I Get a Mortgage with a 670 Credit Score?

If you're seeking a mortgage with a credit score of 670, it's possible that you could be approved. Your score falls within the "fair" range on the credit spectrum, which means you've demonstrated an acceptable level of responsibility with handling your finances. However, it also implies that there may have been a few financial hiccups in your past.

During the mortgage application process, you may find that lenders scrutinize your financial history closely. They want to ensure that you're adequately capable of making your mortgage payments. While a score of 670 doesn't necessarily preclude you from receiving approval, it might mean you won't be offered the best interest rates available. Lenders reserve their best rates for applicants with very good or exceptional credit. Therefore, though you are likely to gain approval, be prepared for the possibility of higher rates. There's always room for improvement, so continue being diligent in timely payments and mindful of your financial decisions to reach a more advantageous position in the future.

Can I Get a Credit Card with a 670 Credit Score?

If your credit score is 670, chances are you'll likely be approved for a credit card. This score positions you right at the boundary of 'fair' and 'good' credit according to most lenders. Honestly vast improvement is needed, but you have cause for some optimism. It shows that you have been somewhat consistent with your financial responsibilities.

However, while a credit score of 670 could potentially open some doors, the type of credit cards available might be more limited. Secured credit cards or starter cards would be a good option to consider. They have more lenient approval requirements and can help build your credit score over time. On the downside, they might come with higher interest rates because lenders would still consider you a slight risk. Premium travel cards, on the other hand, may be harder to qualify for with a 670 credit score. It's important to remember to use credit wisely as it can either boost or lower your credit score.

With a credit score of 670, you fall on the threshold of what is typically deemed as fair credit. This score tends to be seen as a moderate risk by lenders and they may have reservations about approving a personal loan. It's not an ideal situation, but it's the reality of having a credit score in this range. Honesty is crucial when it comes to dealing with your financial standpoint.

On the other hand, this doesn't mean getting a personal loan is completely out of reach. There are lenders who specialize in catering to those with lower credit scores. These loans may have slightly higher interest rates as a reflection of the perceived lending risk. Secured loans or peer-to-peer lending are also alternatives to consider. Remember, it's about finding a solution that both fits with your financial capacity and aligns with your financial goals. Always remember to read the terms and understand the potential long term implications as not to risk worsening your current credit score.

Can I Get a Car Loan with a 670 Credit Score?

Having a credit score of 670 puts you right on the edge of the fair and good categories. For auto loans, this score is generally seen as average. So, getting approved for a car loan is a realistic expectation, but lenders may not offer the most favorable terms. They might propose slightly higher interest rates because a score of 670 may present some risk. However, it doesn't mean you're a high risk. It just represents a bit more uncertainty for lenders than a higher score would.

When venturing into the car purchasing process, know that your credit score plays a vital part in the terms you'll be offered. The higher the score, the better the terms. Hanging in the balance with a score of 670 doesn't mean you can't secure a reasonable deal. Remember, your credit score isn't the only thing lenders consider. Keep in mind, the terms offered can be negotiated and always review the terms carefully before agreeing. Everything from the loan duration to the interest rate can significantly impact your financial future.

What Factors Most Impact a 670 Credit Score?

Recognizing what a 670 credit score signifies is your first step towards a stronger financial position. You can better your credit score by focusing on key aspects that likely affect your current score.

Payment History

Regular and timely payments strongly influence your credit score. Missed or late payments could be causing your score to be lower than desired.

How to Check: Examine your credit reports for missed or late payments. The frequency and recency of these late payments can both impact your score.

Credit Utilization Ratio

Your credit utilization ratio, that is, the amount of credit you're using in relation to your credit limit, could be impacting your score negatively. Aim to use 30% or less of your available credit.

How to Check: Review your credit card statements. If your credit balance is consistently high, it might be time to consider a payment strategy.

Credit History Length

An insufficient credit history might be affecting your score. The longer your credit history, the better your score tends to be.

How to Check: Look at your credit report to determine the age of your oldest account. If your history is quite short, patience is required as building a long credit history takes time.

Credit Mix

Managing a variety of credit types like credit cards, car loans, and mortgages efficiently can improve your score.

How to Check: Review your credit report to understand the diversity of your credit types. If your mix is narrow, you might consider diversifying but ensure you can responsibly manage any new credit.

Derogatory Marks

Derogatory marks like bankruptcies, foreclosures, or tax liens can noticeably hurt your score.

How to Check: Scrutinize your credit report for any derogatory marks. If any are found, work towards resolving them to possibly boost your credit score.

How Do I Improve my 670 Credit Score?

A credit score of 670 puts you in the ‘Fair’ credit category. While you’re not far from reaching the ‘Good’ credit score levels, there are specific steps you can take to enhance your financial standing.

1. Regular On-Time Payments

The importance of making your payments on time can’t be overstated. Your payment history is a key factor in determining your credit score. Automate your payments where possible to ensure consistency and timeliness. It’s the most straightforward step you can take in boosting your credit score.

2. Monitor Your Credit Utilization Ratio

Keep a close eye on your credit utilization ratio – the amount of credit you’re using compared to your credit limit. The lower this ratio, the better for your credit score. Aim to use less than 30% of your total credit limit, and even less if possible.

3. Consider a Credit Builder Loan

A credit builder loan could be a good option for someone with a score like yours. These loans are designed to help you boost your credit score by demonstrating successful repayment of the loan over time.

4. Limit Hard Inquiries

Too many hard inquiries in a short period can lower your score. Only apply for new credit when needed. Furthermore, if you can, try to spread out your credit applications.

5. Check for Inaccuracies

Lastly, regularly review your credit report for errors or inaccuracies, which could be unfairly dragging your score down. Inaccurate information can be disputed and removed, thereby reflecting the true state of your financial habits.