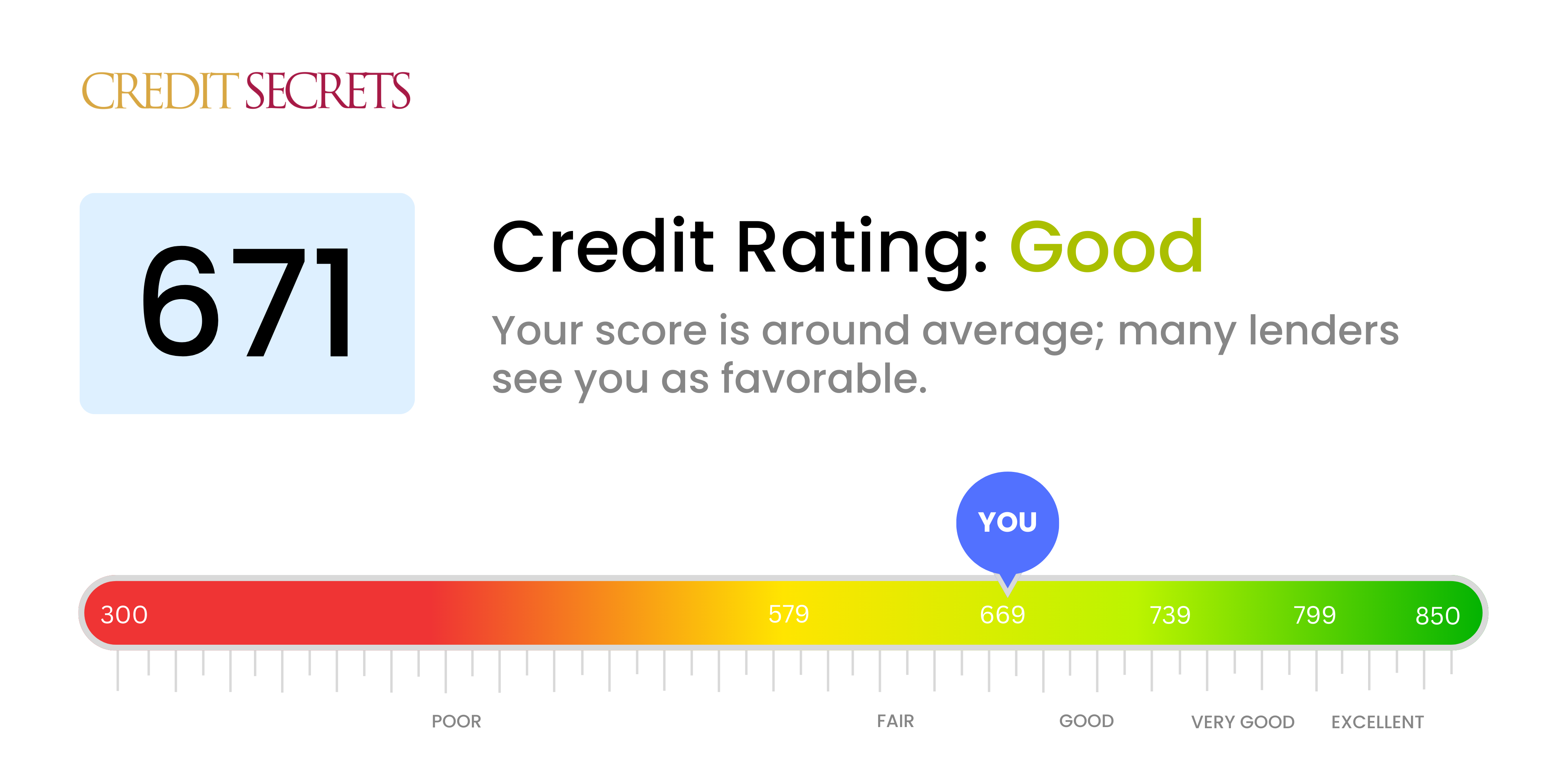

Is 671 a good credit score?

Having a credit score of 671 positions you comfortably within the 'Good' range. You can anticipate qualifying for a variety of credit products, but you might not get the most competitive interest rates.

While there's room for improvement, it's encouraging to remember that you're just a few disciplined financial decisions away from shifting into the 'Very Good' category. Commit to regular payments, reducing your outstanding debt, and mindful financial behavior to help elevate your credit score over time.

Can I Get a Mortgage with a 671 Credit Score?

For someone with a credit score of 671, your chances of being approved for a mortgage are fairly optimistic. This score reflects a relatively responsible credit history and is just within the range considered "fair" by most lending institutions.

But remember, having a fair credit score does not guarantee approval. Lending decisions are based on a variety of factors, not just your credit score. Also, bear in mind that though you may very likely be approved with a score of 671, it may come with somewhat higher interest rates than those given to borrowers with 'good' or 'excellent' credit scores. Approval will mean showing your income, employment, and other financial factors are stable. Nonetheless, attaining a mortgage is an attainable goal for you.

Can I Get a Credit Card with a 671 Credit Score?

With a credit score of 671, your chances of being approved for a credit card are significantly higher than those with lower scores. It reflects a reasonably competent history of credit management. It's understood that maintaining a good credit score can be challenging, but you have worked hard and it's showing in your score.

Your score would likely allow you to consider a range of card options. Secured cards and starter credit cards should be well within reach, and they come with the added benefit of continuing to build your credit profile. Some premium travel cards may still be a little out of reach, as they typically require very high scores. As you continue your financial journey, always remember to keep an eye on the interest rates on offer. With your score, interest rates may be a little higher than for those with very strong credit, as lenders see a slightly increased risk. But keep moving forward and that will improve over time too.

If your current credit score is 671, it's sitting in the lower end of the 'fair' category. This does denote an elevated risk from a lender's perspective, but it's not altogether disastrous. You may still be eligible to apply for a personal loan, but it will likely be with higher interest rates compared to those with 'good' or 'exceptional' credit scores.

While you won't typically be disqualified from the loan eligibility solely based on this score, you should bear in mind that approval is not guaranteed, as lenders take into account other factors as well. The process may involve more stringent scrutiny of your income, job stability, and debt-to-income ratio, among other things. Despite the obstacles, this isn't a dead-end scenario - the journey towards a better financial future is still well within your reach.

Can I Get a Car Loan with a 671 Credit Score?

With a credit score of 671, you are in a position where getting a car loan approval may be feasible. Typically, lenders seek scores above 660 to offer favorable terms, so your score is just over this boundary. However, because it's not significantly higher, you may not get the absolute best rates available on the market. With a credit score in this range, lenders are more comfortable that you represent a fair risk

As you start the car buying process, you might find that interest rates offered to you are moderately competitive. Still, there's something to be cautious about. While potentially having access to multiple loan offers is good, it's essential you scrutinize and understand all the terms before settling on one. Ensure you factor in everything, from the loan term to the monthly payments, and not just the interest rate. This level of diligence will help you get the best possible deal with your current credit score of 671.

What Factors Most Impact a 671 Credit Score?

Your credit score of 671 is a reflection of your financial behavior and history. Understanding the factors affecting your score is the first step toward financial improvement. Let's dive into four key aspects that might be influencing your score.

Payment History

Timely debt repayment plays a substantial role in your credit score. If there are late payments or inconsistencies in your payment schedule, this could be dragging your score down.

How to Check: Go through your credit report to see if there are any late payments. Consider if unexpected circumstances might have led to late or missed payments.

Credit Utilization

The ratio of your current debt to available credit lines—or credit utilization—can have a big impact. High credit utilization can lower your score.

How to Check: Check your credit card balances—are they near the limit? Strive to keep your balances low, which sends a signal that you manage your credit well.

Length of Credit History

A shorter credit history can also affect your score. This can be especially true if you have recently opened new credit accounts.

How to Check: Look at your credit report and investigate the age of your oldest and newest accounts. Reflect on the past few months, did you open any new accounts?

Credit Inquiries

Frequent credit inquiries, like applying for new credit, can impact your score. It suggests financial instability to creditors and might lower your score.

How to Check: Evaluate your recent credit applications—if there are many, this might be negatively affecting your score.

By addressing these factors, you can start your journey to boosting your credit score.

How Do I Improve my 671 Credit Score?

With a credit score of 671, you’re on your way to better financial health, but targeted actions can enhance your standing in the eyes of lenders. Here are pertinent steps that can make a difference at your current credit level:

1. Demystify Your Credit Report

Request a free copy of your credit report from the credit bureaus and examine it for errors or discrepancies. If inaccuracies are found, dispute these as promptly as possible to improve your score.

2. Tackle High-Interest Debts

Leverage a strategy such as the avalanche method, paying off debts with the highest interest rates first. This will save you money in the long run and could positively impact your credit score.

3. Responsibly Use an Existing Credit Card

If you already have a credit card, ensure you’re using it wisely. Keep your utilization low, ideally less than 30% of your credit limit, and pay your balance in full each month to enhance your payment history.

4. Cultivate Payment Reminders

To avoid missed payments that can affect your score negatively, establish a system of reminders. This doesn’t have to be a complex setup; useful apps or calendar reminders can suffice.

5. Moderate New Credit Applications

Making several credit applications within a short period can lower your score. Try to limit new credit applications, especially if you do not urgently need the new line of credit.

By following these strategies in confluence with your current situation, you’re on the right path to improving your credit score and achieving your financial objectives.