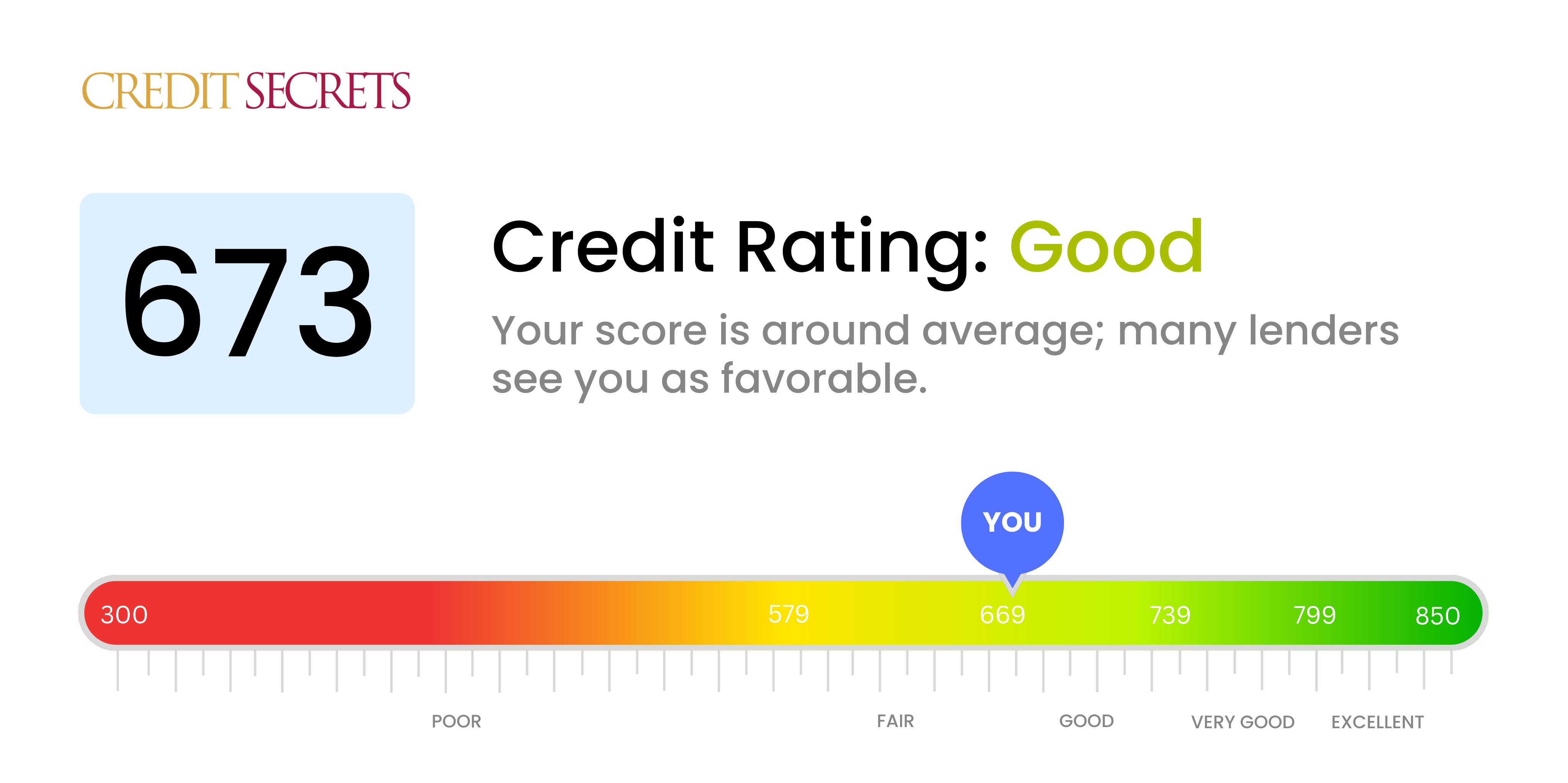

Is 673 a good credit score?

Your credit score of 673 sits nicely in the 'Good' range. This simply means you have demonstrated responsible money management behavior and lenders might see you as a lower risk borrower.

People with a similar score to yours can generally expect to receive better interest rates and financial opportunities than those with lower scores. Though it doesn't make you immune to loan or credit card application rejections, it does raise your chances of approval. As you continue improving your score, you can unlock even more benefits and opportunities. Remember to keep your financial health a top priority to reach your goals.

Can I Get a Mortgage with a 673 Credit Score?

Having a credit score of 673 puts you in a moderately favorable position when it comes to applying for a mortgage. This score is within the "fair" range in the credit world, showing potential lenders that you've had some bumps along the way, but overall have had a decent track record with credit. While it might not guarantee immediate approval, many borrowers in this range often gain approval for a mortgage, albeit potentially at a higher interest rate than those with higher scores.

The mortgage approval process can be somewhat stringent, requiring careful review of your credit history, income, and financial background. Expect the lender to thoroughly analyze your financial profile, taking into account not only your credit score but your income, job stability, and other debts. While 673 isn't a "top-tier" score, don't become discouraged. Each lender has their own approval thresholds, and many lenders are willing to work with borrowers to help them secure a mortgage. As you embark on this journey, know that maintaining timely payments and responsible credit use can open the door to better loan terms in the future.

Can I Get a Credit Card with a 673 Credit Score?

With a credit score of 673, you are in a reasonably good position to get approved for a credit card. This score is generally thought of as fair by many lenders– this isn't the most favorable place to be, but it is far from the worst. It's serious business, yet there's a silver lining. Lenders will see you as less risky compared to someone with a lower score.

Bearing this in mind, your focus should be on credit cards that are designed for fair-to-good credit scores. Starter cards – credit cards meant for those looking to build or repair their credit – could be a good starting point for you. They often have lower credit limits but are easier to get approved for. Alternatively, you might consider secured cards. These require an upfront deposit but they report to the credit bureaus just like regular credit cards, helping you continue to improve your score. Do remember that interest rates may be higher in comparison to cards offered to those with higher scores, given the moderate level of perceived risk. Stay positive, you are on the right path towards good credit health.

With a credit score of 673, you are in what most lending institutions view as the "fair" credit range. Despite not being in the optimal credit score bracket, it's not all bad news. Many lenders are willing to consider applications for personal loans from individuals with a credit score in this range. The important thing to keep in mind is that every lender's requirements differ, and a score of 673 does not guarantee loan approval.

When navigating the personal loan application process with a credit score of 673, expect a detailed review of your financial history. Lenders may look at factors such as your income, employment history, and debt-to-income ratio in addition to credit score. However, you should be prepared for potentially higher interest rates or less favorable terms due to the perceived risk. You see, from a lender's perspective, your score of 673 indicates a "fair" creditworthiness, meaning there's a bit more risk associated with lending money to you. So, stay positive but also remain realistic about the possible outcomes.

Can I Get a Car Loan with a 673 Credit Score?

Having a credit score of 673 means you sit in a bracket that lenders consider as 'fair' credit. It's not particularly poor, but it also isn't quite in the 'good' range either, which typically begins around 670. In the world of auto loans, your score should be sufficient to obtain approval, although it's not guaranteed.

When pursuing a car loan with a score of 673, be prepared for the possibility of slightly higher interest rates. It's common for lenders to charge more to borrowers with lower scores to offset perceived risk. Keep in mind, this score is on the edge of entering the 'good' credit category. As such, the terms you're offered may be still be reasonable, just not the absolute best available on the market. Shop around and negotiate to ensure you secure the best deal for your financial situation. As you tread the path of car ownership, maintain optimism and diligence in your journey.

What Factors Most Impact a 673 Credit Score?

Deciphering a credit score of 673 is your first step towards building a solid financial future. By pinpointing the key contributory factors, you can implement strategies to enhance your score. Each person's financial experience is distinctive, offering numerous prospects for growth and learning.

Punctuality of Payments

Your payment timeline majorly influences your credit score. Missed or late payments maybe the prime contributors to your score.

How to Check: Scrutinize your credit report for late or defaulted payments. Contemplate on any occurred instances of delayed payments that could have possibly affected your score.

Credit Usage

Excessive credit usage can negatively impact your score. If your credit cards are nearing their limits, this could potentially be a factor.

How to Check: Inspect your credit card balances. Are they flirting with the limits? Keeping your balances low relative to your limit is favorable.

Duration of Credit History

A shorter credit history can dent your score.

How to Check: Review your credit report to gauge the age of your oldest and newest accounts along with an average age of all your accounts. Reflect on whether you’ve recently opened new credit lines.

Diversity and Age of Credit

Maintaining a varied mix of credit and responsibly handling new credit are crucial in achieving a sound credit score.

How to Check: Assess your variety of credit accounts such as credit cards, retail and installment loans, and mortgages. Contemplate on whether you’ve been judicious in applying for new credit.

Public Records

Public records like bankruptcy or tax liens can dramatically lower your score.

How to Check: Scan your credit report for any public records. Resolve any items listed promptly.

How Do I Improve my 673 Credit Score?

With a credit score of 673, you’re on the edge of the ‘fair’ and ‘good’ credit categories. The right actions can certainly boost you into the ‘good’ tier. Here are the most effective steps specific to your situation:

1. Monitor Your Credit Report

Regularly monitoring your credit report will keep you informed about your credit status. Be diligent about identifying and correcting any inaccuracies, as these errors could be pulling your score down.

2. Keep Credit Utilization Low

Attempt to maintain your credit card balances well below your credit limits. Lower utilization rates positively influence your credit score. Strive for a credit utilization rate of 20-30% or even less.

3. Be Consistent with (Your Payments

Your payment history is one of the most influential factors in your credit score. Ensure you make all your payments on time, every time. Automation can aid you in consistency.

4. Refrain from Applying for Unnecessary Credit

Avoid opening unnecessary credit accounts, particularly retail cards with high interest rates. These can harm your score due to credit inquiries and potentially increase your credit utilization rate.

5. Plan for Long-term Credit Goals

Focus on long-term solutions like maintaining a diverse mix of credit accounts — credit cards, retail accounts, installment loans, mortgage, etc. A diversified credit profile contributes to a healthier score over time.