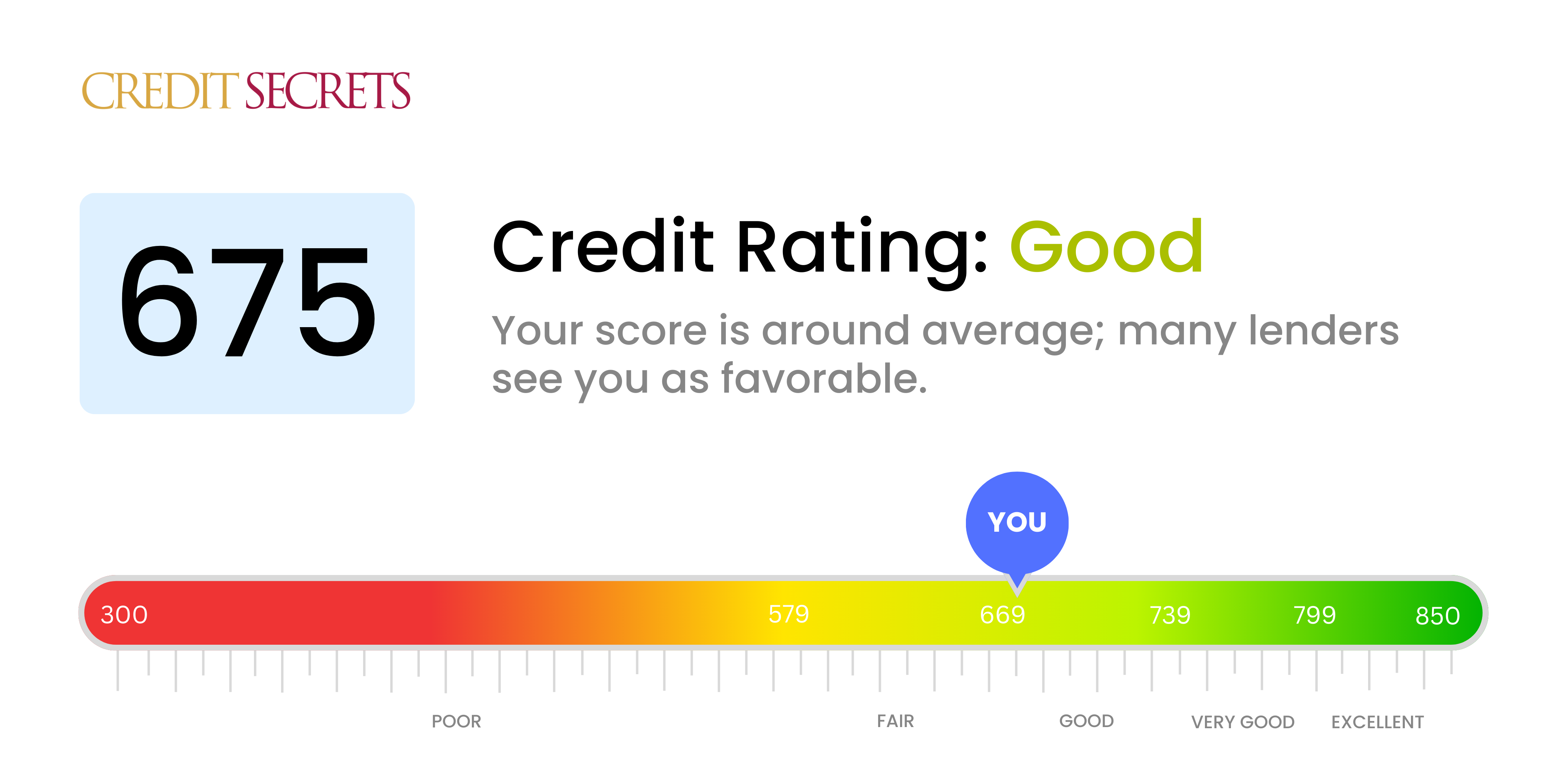

Is 675 a good credit score?

A score of 675 is classified as a good credit score, putting you in a favorable position when it comes to financing options. With this score, you can expect relatively easy approval for many types of credit, including loans and credit cards, and you'll often be able to secure reasonable interest rates.

However, the higher your score, the better the terms you can get, so it's always beneficial to aim for improvement. By consistently making payments on time, keeping credit balances low, and wisely managing your credit accounts, you can steadily increase your score and open up even more financial opportunities.

Can I Get a Mortgage with a 675 Credit Score?

With a credit score of 675, while not perfect, you stand a fairly good chance of getting approved for a mortgage. As this score is around the average credit rating for U.S. consumers, some lenders may find your creditworthiness acceptable; however, you could face slightly higher interest rates.

Remember, even though your credit score is a significant factor, lenders also consider other elements like employment history and debt-to-income ratio. And while receiving approval is likely, the terms of the mortgage will hinge heavily on your credit score. Your interest rate may be higher than someone with an excellent credit score, meaning you could end up paying more over the life of the loan. By keeping up with all your credit responsibilities and continuing to enhance your financial habits, you can improve your credit score and potentially get more favorable mortgage terms in the future.

Can I Get a Credit Card with a 675 Credit Score?

With a credit score of 675, it's more likely that you’ll be approved for a credit card. This score falls within the 'fair' credit range and while it's not perfect, many lenders view it as acceptable. Keep in mind, the better your score, the better the terms and conditions on any credit you're approved for. So even though your score isn't disappointing, there's still room for improvement.

Bearing in mind your current credit score, you might not be eligible for cards with the most lavish rewards or lowest interest rates. Nevertheless, there are credit cards designed specifically for people within this credit range. Starter cards are a viable choice and could offer moderate rewards. There’s also a chance for approval with some secured cards, which require a deposit as collateral. It's vital to remember, the goal here is not merely to get a credit card, but to use it wisely as a tool for building up your credit score for a more secure financial future.

With a credit score of 675, you are positioned in the fair range of creditworthiness. Although not considered excellent, this score may allow you to qualify for a personal loan. However, be prepared to possibly face higher interest rates or more stringent terms, as lenders may perceive a slight risk in lending to individuals with this score. Lenders are in the game to make money, so the higher the risk, the higher the interest, to compensate for any potential losses.

In your loan application process, do anticipate thorough reviews of your credit history and personal financial situation. Despite your credit score, some lenders may appreciate the favourable aspects of your financial behaviour, such as regular income or minimal debt. Such factors could strengthen your loan approval chances. It might also be advantageous to consider multiple lenders to increase your chances of securing a personal loan with more favourable terms.

Can I Get a Car Loan with a 675 Credit Score?

With a credit score of 675, you stand a fair chance of getting approved for a car loan. Most lenders typically seek credit scores of 660 and above to offer favorable terms. Your score is slightly above this threshold which could lead to a more positive lending experience. However, keep in mind that every lender is different and what may be acceptable to one may not be to another.

Bearing this in mind, when you go through the car purchasing process, it's important to carefully review interest rates and terms. Because your credit score is at the lower end of a "good" score, you may be offered slightly higher interest rates. Try to negotiate the best rate and terms you can. Remember, obtaining a car loan is not just possible, it's likely with a credit score of 675. Just make sure you're doing so under terms that make sense for your financial position and long-term goals.

What Factors Most Impact a 675 Credit Score?

Delving into a credit score of 675 is the first step on your path to a solid financial future. Identifying factors impacting this score is important for understanding what has led to your present situation. Remember, your financial journey is unique and filled with potential for growth and change.

Payment History

One factor that greatly influences your credit score is your payment history. Missed or late payments can contribute negatively to your score.

How to Check: Analyze your credit report to look for any missed or late payments. Think about any payments that you might have missed, as these could be affecting your score.

Credit Card Balances

High credit card balances may change your score negatively. If your balances are near the credit limit, this may be a reason for your current score.

How to Check: Look at your credit card statements. Are your balances near or at their limits? Keeping your balances low as compared to your credit limits can help your score.

Total Amount of Debt

High total debt could also affect your score. It isn't just about credit cards; installment loans and mortgages count, too.

How to Check: Assess your total debt. The less debt you have, the better it is for your credit score.

Credit History Age

A shorter credit history may not bode well for your score.

How to Check: Refer to your credit report to evaluate the age of your accounts. If you have recently opened new accounts, it might be impacting your score.

Credit Inquiries

Many recent inquiries for new credit can also bring down your score.

How to Check: Review your credit report to check if you have applied for multiple new lines of credit in a short period of time. Remember, it's better to apply for new credit sparingly.

How Do I Improve my 675 Credit Score?

A credit score of 675 is considered fair. You’re not too far from having a good score, and with focused actions, you can definitely improve. Here are the most strategic and achievable steps suitable for your score range:

1. Regularly Monitor Your Credit Report

The first step to improving your credit score is to be aware of your credit history. Make sure to regularly check your credit report for any errors or fraudulent activities. Disputing and correcting errors can significantly boost your score.

2. Pay More than the Minimum Balance

Paying just the minimum on your credit cards may not be enough to improve your credit score. Neighborhood of fifteen to twenty percent of your credit score is based on your credit card balance-to-limit ratio. A higher payment reduces your balance, bringing your ratio down and improving credit utilization, which can lift your score.

3. Limit Your Credit Applications

Applying for new credit can lead to a hard inquiry on your credit report, which might lower your score. Limit applications to what’s necessary, considering how you can improve your credit just based on your current accounts.

4. Set Up Automatic Payments

A single late payment can damage your credit score. Prevent this by setting up automatic payments for all your credit accounts. This ensures consistent payments on time, a key factor in determining your credit score.

5. Negotiate Outstanding Balances

If feasible, negotiate with your lenders to pay less than what you owe. While it’s not a guaranteed strategy, lenders might agree to report accounts as ‘paid in full’ instead of ‘settled for less than the full amount’ if they get most of their money back. Be sure to get such an agreement in writing.