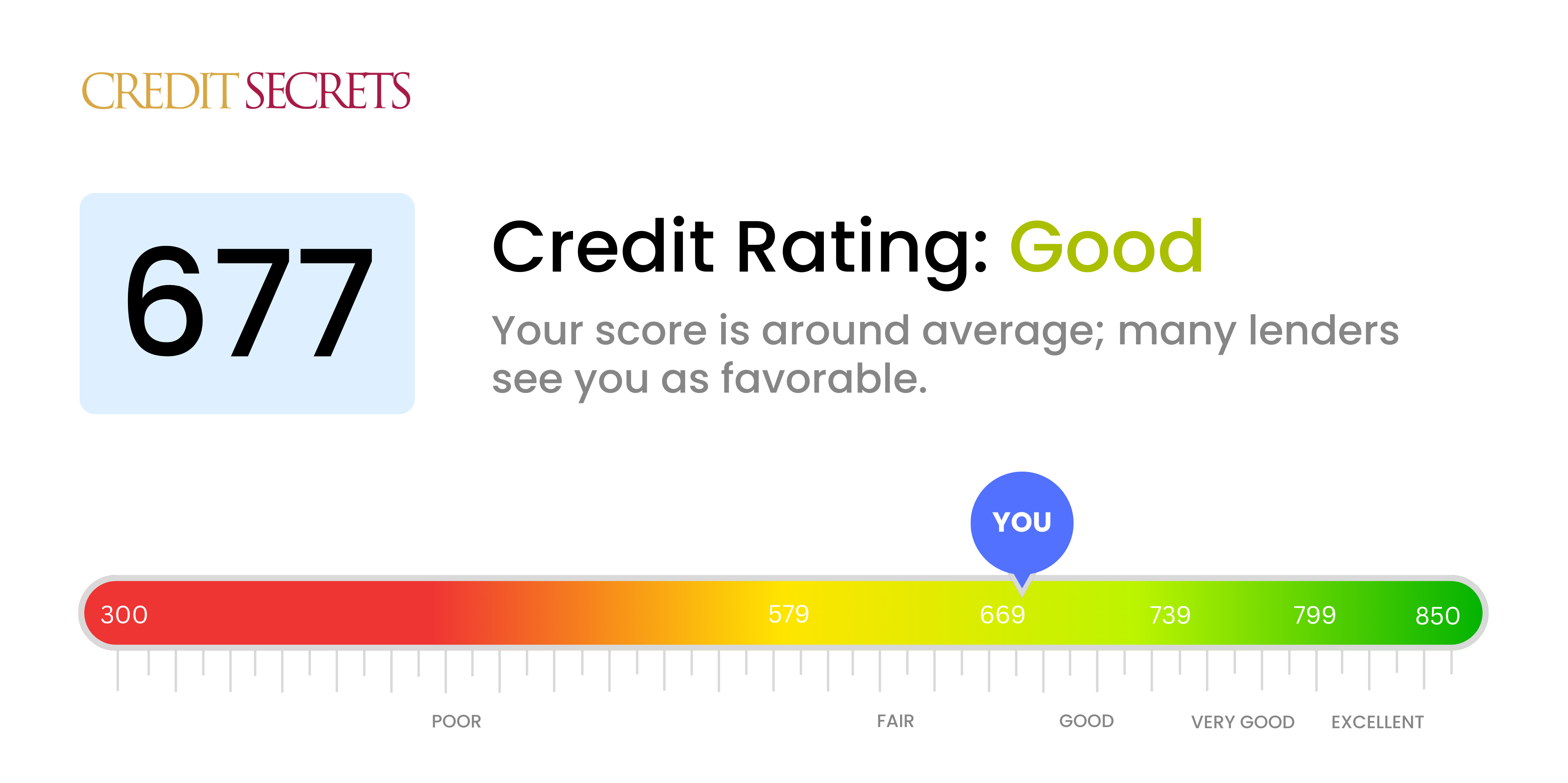

Is 677 a good credit score?

A credit score of 677 falls into the "Good" category. If this is where you stand, it implies that while you have shown a good trend in handling credit, you have also experienced some minor hiccups in the past. You qualify for many conventional loans or credit card applications, but there might be instances where you may not receive the most competitive interest rates. Nonetheless, with patience and responsible credit behavior, it is quite feasible to improve your position.

Whether you are looking to apply for a new credit line or renew an existing one, having a good credit score like 677 can be helpful. However, always remember that lenders consider factors beyond credit scores such as your income, employment stability and existing debts. It's advisable to consistently work at managing your credit well, paying your bills on time and minimizing your debt, which can slowly but surely enhance your credit profile over time. So, keep marching forward and strive for financial betterment.

Can I Get a Mortgage with a 677 Credit Score?

Although a credit score of 677 isn't the best credit score, it doesn't keep you from being eligible for a mortgage. This score falls into the 'Fair' category of credit scores, indicating that while your credit history may have some flaws, there are certainly elements that demonstrate financial responsibility and reliability as well.

Mortgage approval with this score is possible, although it's worth mentioning that the interest rates may be slightly higher than they would be for those with 'Good' or 'Excellent' credit scores. Nevertheless, the process requires due diligence. Ensure you have a stable income, a low debt-to-income ratio, and a good saving pattern, as these factors are also crucial for approval. Remember that while your credit score is an important factor, lenders consider all these elements when determining your mortgage eligibility.

Can I Get a Credit Card with a 677 Credit Score?

If you have a credit score of 677, it's understandable to worry about your chances of getting a credit card. However, having this score doesn't mean doors are entirely closed to you. A score of 677 sits near the fair range of credit scores, potentially making approval for credit cards somewhat likely, but not guaranteed.

Should you be approved, the interest rates offered may be higher than those with excellent credit scores receive, reflecting a slightly increased risk for the lender. Focus on credit cards designed for folks with fair or average credit, such as secured credit cards or starter cards. These cards can provide a way to prove creditworthiness over time, potentially leading to better terms and offerings in the future. Do remember that it's vital to manage these cards responsibly to continue improving your credit score and financial health.

A credit score of 677 might feel like you're on uneven ground when applying for a personal loan. While it's not a bad score, it's not the most attractive to lenders either. At this score, you're in a sort of lending middle-ground. Traditional lenders might not outright deny you a personal loan, but they might not approve it without some attached conditions. It's a tricky situation to navigate, and it's important to understand what such a credit score means for your loan prospects.

With a score of 677, if approved, your personal loan terms may not be the most favorable. You might experience higher interest rates than someone with a better score. This is because lenders may see you as a slightly higher risk. When it comes to the application process, be prepared for closer scrutiny of your financial history and potentially providing more documentation. Remember that each lender has their own policies, so shopping around is key to finding the best fit for you.

Can I Get a Car Loan with a 677 Credit Score?

With a credit score of 677, the prospect of securing an approval for a car loan becomes more real. For most lenders, a score above 660 is seen as promising. Your score of 677 comfortably arrives in this range, which may provide more opportunities for financing. This score puts you in a fairly strong position, as many lenders perceive this range to be lower risk. Your credit history has likely shown a consistent habit of money management and repayment ability.

Due to your credit score, the car purchasing process could be more streamlined. If approved, you may be offered average to slightly above average interest rates, compared to those with lower scores. What's important to note is that lenders also consider factors other than your credit score, so ensure all your financial documents are in order. A credit score of 677 brings with it a valuable opportunity to secure desirable loan terms, paving the way for the car purchase you’ve been planning.

What Factors Most Impact a 677 Credit Score?

Comprehending a credit score of 677 is vital for setting a course towards better financial health. By recognizing the contributing factors to this score, you can chart a path toward future financial wellness. Every financial journey differs, accentuating growth, and learning.

Payment Consistency

Keeping a regular payment schedule significantly impacts your credit score. Late or missed payments could weigh heavily on your current score.

How to Verify: Scrutinize your credit report for delayed or missing payments. Look back on past instances of financial stress that might have led to irregular payments.

Credit Use

Overspending on your credit limit can negatively sway your score. If your credit card balances are frequently high, it could be causing adverse effects.

How to Verify: Analyze your credit card statements. Are your debts consistently nearing their limits? Endeavor to maintain lower balances relative to your limit for a positive impact.

Duration of Credit Usage

A limited credit history can pull your score down.

How to Verify: Check your credit report to determine the lifespan of your oldest and most recent accounts and the average age of all your accounts. Mull over any recent accounts you might have opened.

Diversity of Credit and Fresh Credit

Maintaining a range of credit types and handling new credit responsibly is important for a healthy score.

How to Verify: Reflect on your variety of credit accounts, for example credit cards, retail accounts, installment loans, and mortgage loans. Consider if you have applied for new credit judiciously.

Official Documentation

Potent factors are official documentation such as bankruptcies or outstanding tax payments on your record, which can significantly dent your score.

How to Verify: Go through your credit report for any official documents. Act promptly on items that require attention or resolution.

How Do I Improve my 677 Credit Score?

With a credit score of 677, you’re on the cusp of “good” credit, but there are specific measures you can take to push your score higher. Implement these strategies to boost your credit standing:

1. Regularly Review Your Credit Report

At this credit level, it’s crucial to keep an eye out for errors or discrepancies. Obtain free annual credit reports, scrutinize them carefully, and report any mistakes to the credit bureaus.

2. Stay Credit-Active

Ensure a mix of credit types (secured cards, installment loans) and use them consistently. Regular, responsible activity is necessary to boost your credit score. Just remember to pay in full and timely manner.

3. Limit Hard Inquiries

Be cautious about applying for new credit. Each application generates a hard inquiry, which can temporarily ding your score. Make sure you really need that new credit before applying.

4. Maintain Old Credit Accounts

The longer your credit history, the better your score. If an old account is in good standing and has no fees, consider keeping it open to lengthen your credit history.

5. Keep Credit Utilization Low

Aim to maintain a credit utilization ratio – the amount you owe compared to your credit limits – of under 30%. A lower ratio shows you’re managing your credit well, and will give your score a boost.

Now is your time to leverage these strategies to master your credit and reach your financial objectives. Keep going, you’re on the cusp of obtaining good credit!