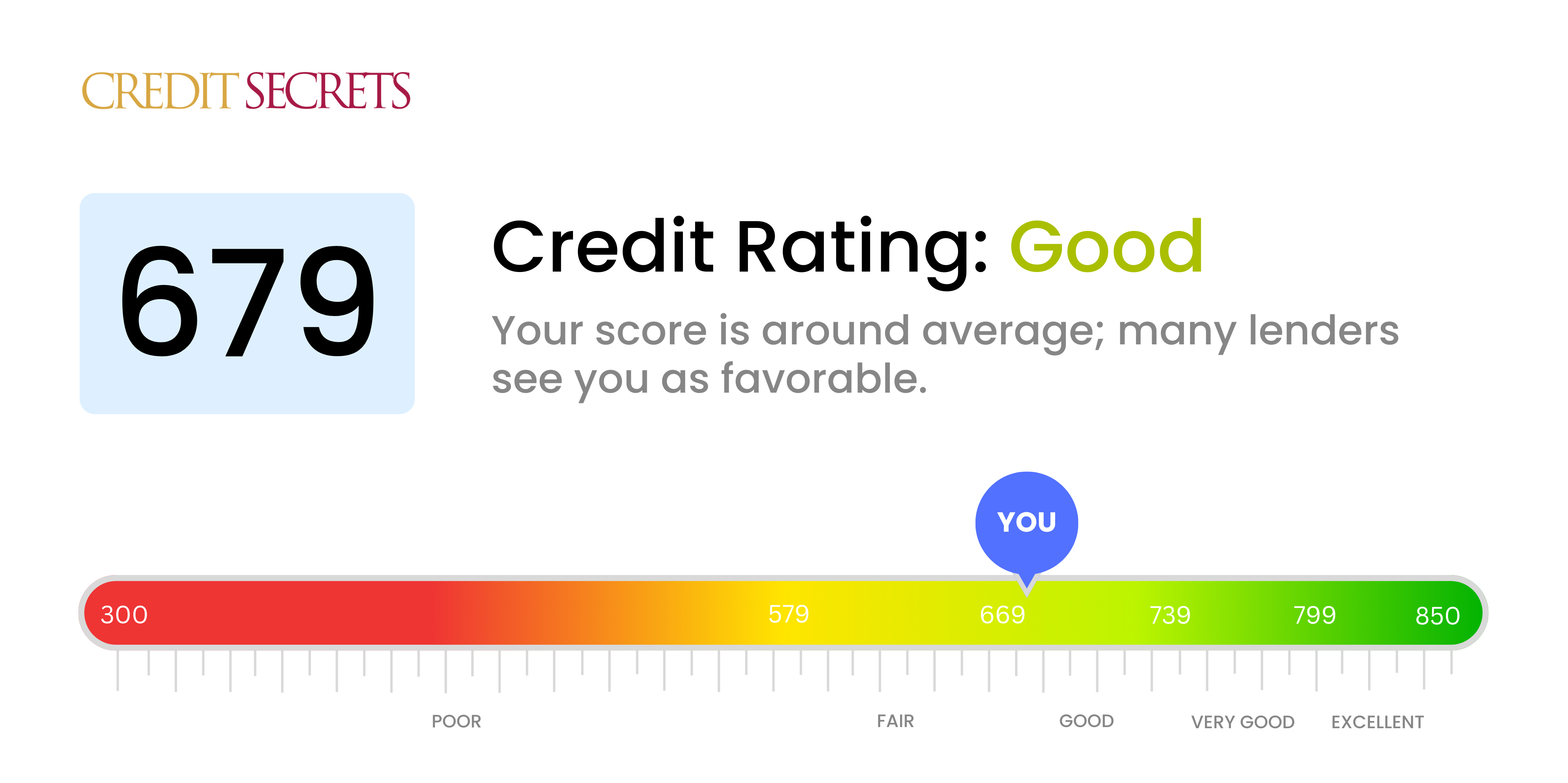

Is 679 a good credit score?

With a credit score of 679, you're hovering within the 'Good' range. This means you've done a commendable job managing your credit so far and are generally seen as a reliable borrower by financial institutions.

The doors to many financial opportunities are already open to you. You can expect to be approved for a variety of loans and credit cards, although the most premium offers with the lowest rates might still be just out of reach. While you're in a secure position, a higher score could help you access even better terms and lower interest rates.

It's important to remember, though, that improving a credit score is a journey, not a race. Slow, steady management of your current credit can gradually lift your score even higher, paving the way for more financial flexibility and freedom in the future.

Can I Get a Mortgage with a 679 Credit Score?

Having a credit score of 679 puts you fairly close to the good range, meaning you have a reasonable chance of getting approved for a mortgage. However, it's important to note that every lender has different thresholds and requirements, and not all of them may deem this score sufficient.

While a decision is made on your mortgage application, lenders will look at various elements of your financial history beyond just your credit score, such as your income stability, debt-to-income ratio, and history of repaying loans. Having a score of 679 means you're a moderate risk to lenders, so while there may be some who are willing to extend a mortgage, it might come with slightly higher interest rates because of the inherent risk associated. Through diligent financial habits and consistent on-time payments, you can work towards improving your credit score for better mortgage options in the future.

Can I Get a Credit Card with a 679 Credit Score?

Having a credit score of 679 can sometimes feel like you're in "no man's land". It's not high enough to easily access some of the best credit cards, but it's also not so low that you're automatically rejected. This may initially feel discouraging, but remember, there are still options for you.

With a credit score of 679, you're likely to be approved for a fair-credit credit card. These cards may not offer as many rewards and benefits as cards available to those with excellent scores, but they're designed to help individuals like you build and improve credit. Secured credit cards are also a good option because they require a deposit that becomes your credit limit. This reduces the risk to the lender and can help in bolstering a credit score over time. One word of caution, these cards may come with higher interest rates due to the perceived risk tied to credit scores in this range. However, with responsible use, these types of cards can guide you towards a better financial future.

While a credit score of 679 is not considered excellent, it falls within the fair range. Many traditional lenders may still be open to granting personal loans, as this score does not necessarily represent a high-risk borrower. Therefore, while the road may not be completely smooth, there's a fair chance of you getting a personal loan approved.

When applying for a personal loan with a credit score of 679, you can expect some scrutiny from the lenders. They may conduct a more detailed review of your financial circumstances, such as your income, debt levels, and job stability. The loan application process might require more paperwork and longer processing times. Furthermore, you might face higher interest rates, as lenders tend to charge more to offset the perceived risk of lending to borrowers with less-than-stellar credit. Make sure to thoroughly review the terms before agreeing to a loan. Remember, patience and persistence will see you through this process.

Can I Get a Car Loan with a 679 Credit Score?

With a credit score of 679, you are on the cusp of what lenders generally consider good credit, typically deemed as a score of 680 and above. While this could present some challenges when seeking a car loan, it is not an insurmountable barrier. You do have potential in securing a loan, but the terms are likely to be less favorable than those offered to borrowers with higher scores.

At this credit score, the interest rates offered might be a bit higher, due to lenders associating a slightly elevated risk with your score. This, however, doesn't mean you should be disheartened. There are lenders that have the capacity to work with those hovering around this credit score, but it's wise to thoroughly consider the terms before taking the leap. The takeaway here is, yes; you can get a car loan, but do so with an understanding of the potential for higher costs. Remember, it's possible to negotiate and research to find more suitable loan terms.

What Factors Most Impact a 679 Credit Score?

Having a credit score of 679 puts you in the fair range. There are areas that could potentially benefit from careful attention, helping you improve your score and obtain better borrowing terms.

On-Time Payments

Punctual payments play a principal role in your credit score. If there are any patterns of late payments, it's likely affecting your score.

How to Check: Look through your credit report for late payments. It's a fundamental step to understand how your previous payment habits influence your current credit score.

Credit Usage

Your score may be affected by how much of your available credit you're using. High utilization might be lowering your score.

How to Check: Inspect your statements and note if your balances are close to their limits. Keeping this balance lower can help improve your score.

Length of Credit History

If your credit history is relatively short, it may reflect negatively on your score.

How to Check: Scan your report for the duration of your oldest and newest credit accounts. If you've recently ventured towards new credit, it might have impacted your score.

Variety of Credit and Recent Credit Inquiries

Responsible management of diverse credit types and new credit influences your credit score positively.

How to Check: Evaluate your portfolio of credit accounts. If you've made multiple recent credit inquiries, it might be negatively impacting your score.

Public Records

Records like bankruptcies or liens, even if they are few, can substantially affect your score.

How to Check: Review your credit report for any public records present, and work on resolving any found.

How Do I Improve my 679 Credit Score?

With a credit score of 679, you are presently in the fair category, but there are feasible steps you can follow to boost your score and move into good territory. Let’s delve into actionable strategies suitable for your credit status:

1. Pay Bills on Time

Timely payment of bills can significantly improve your credit score. Put in place measures to ensure you do not miss future payment dates. You may consider automating your bills payment to avoid costly delays.

2. Utilize Credit Sparingly

Maxed out credit can negatively impact your credit score. Aim to use less than 30% of your available credit, maintaining your credit card balances at a minimum.

3. Limit Requests for New Credit

Every time you apply for new credit, it leaves a hard inquiry on your credit report, possibly dropping your score. Plan your credit applications wisely so as not to appear desperate for more credit.

4. Consider a Credit Builder Loan

Given your current score, a credit builder loan can be a viable option. These loans allow you to show a track record of timely payments without needing to qualify for a traditional loan.

5. Review Your Credit Report Regularly

Regularly check your credit report for errors that could lower your score. Report any discrepancies immediately. This is an overlooked but crucial step in credit management.

Improving your credit score can be an attainable goal with calculated steps and disciplined effort.