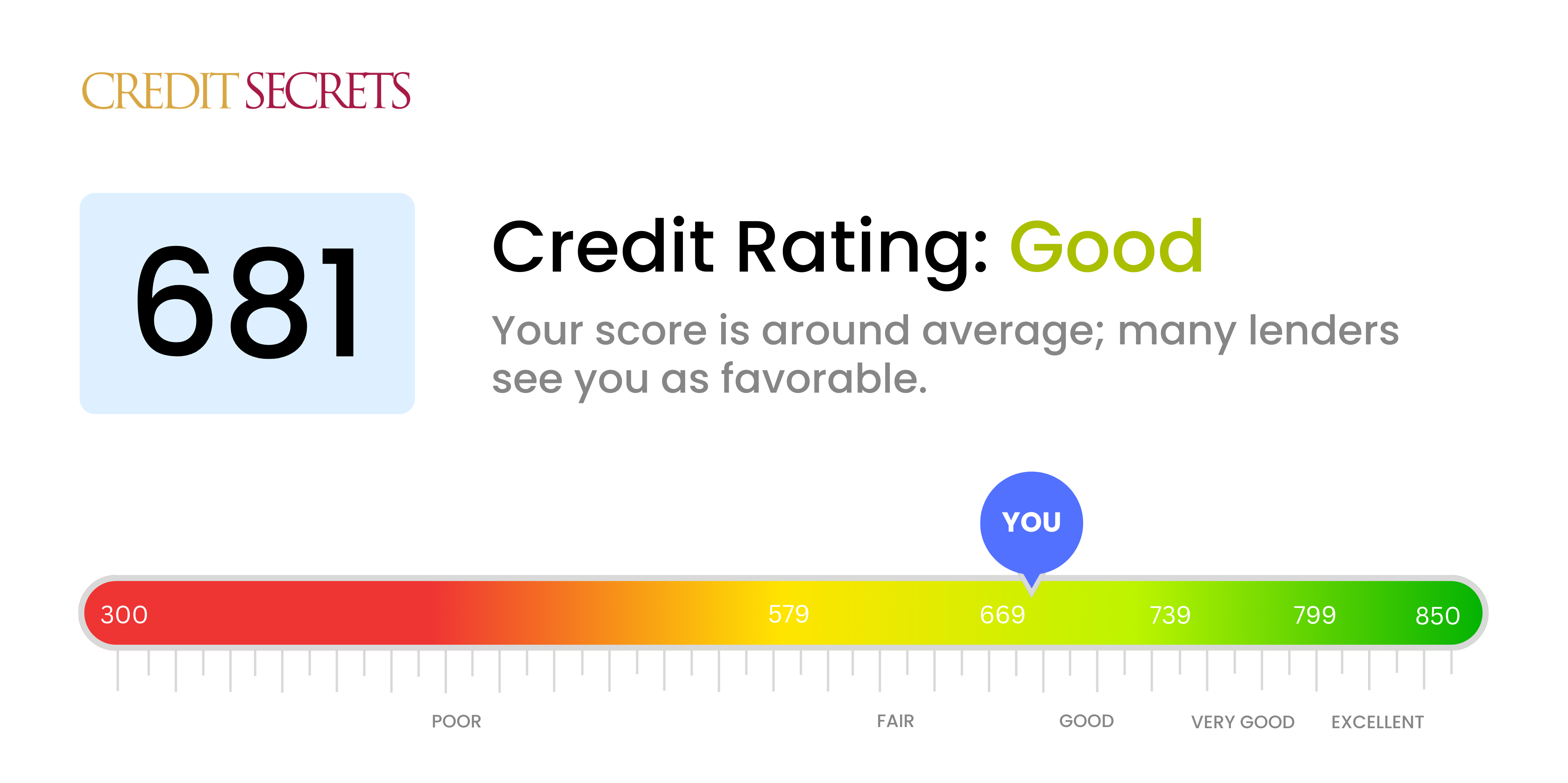

Is 681 a good credit score?

A credit score of 681 falls into the 'Good' category. While it's certainly not the highest score, it does indicate a general sense of responsible credit management, which creditors like to see.

Having a 'Good' credit score means you're likely chosen for higher than average loan amounts and interest rates, but you might not get the most premium offerings. With consistent effort however, it's clear your financial habits can lead you towards a higher credit score. It's advisable to keep up the good work and look for ways to further improve and reach the next level.

Can I Get a Mortgage with a 681 Credit Score?

With a credit score of 681, your chances of mortgage approval are possible but not guaranteed. This score borders on the 'Good' categorization, and some lenders may deem it as acceptable, offering you a mortgage, but with higher interest rates than those extended to borrowers with excellent credit scores. Getting a mortgage with a fair credit score like yours can be more challenging when market conditions are tight, but not impossible.

Though you are on the brink of 'Good' credit, your credit score indicates that you may have had some minor financial missteps in the past. While these discretions are in the past, they can still impact your ability to secure a mortgage. Understanding this, it's essential to manage your financial obligations wisely from now on. Regular, on-time payments can have a positive impact on your credit score over time, making you a more appealing prospect to lenders. Remember, maintaining consistency in your credit habits can signal to lenders that you're a reliable borrower and can improve your odds of mortgage approval in the future.

Can I Get a Credit Card with a 681 Credit Score?

If your credit score is 681, you're likely to be approved for a credit card. This score indicates a fair credit history and lenders may see this as an adequate score to take on. Understandably, the idea of applying for a credit card might be intimidating with this score, but rest assured, this score is not a barrier for approval. The situation isn't as bleak as it might seem.

With a credit score of 681, a variety of credit card options could be a good match for you. Secured credit cards, which function based on a refundable deposit, could be a suitable choice. Starter cards are another option - they are designed for those with fair credit and typically offer moderate credit limits and basic rewards. Some premium travel cards may even be within your reach, depending upon the specific lender's criteria. Remember, interest rates on your card will be influenced by your score, with higher scores generally earning more favorable rates. So, keep this in mind while comparing options. Your journey towards a healthier financial future looks promising.

A credit score of 681 falls into the "fair" category. This means you have a moderate likelihood of being approved for a personal loan by most lenders, but it's not necessarily a guarantee. Lenders will factor in additional considerations like your debt-to-income ratio, employment history, and loan amount needed. It's important to note that due to your score not being in the "good" to "excellent" range, the interest rates offered may be higher than for those with better credit scores.

The loan application process will likely involve a hard credit check, which temporarily might lower your score slightly further. Always shop around for the best rates: sometimes, online lenders may offer lower rates or better term conditions than traditional banks. Remember to only borrow what you can afford to repay, as failing to make repayments on time could negatively impact your credit score further.

Can I Get a Car Loan with a 681 Credit Score?

Having a credit score of 681 places you in a favorable position when it comes to applying for a car loan. While it's not in the highest tier, this represents a fair credit score, and there's a strong chance many lenders will consider your application. They see your credit score as a mirror of your financial behavior, and a score of 681 suggests a history of generally responsible credit management.

If approved, however, it's important to bear a few things in mind. With a score of 681, you may not be presented with the most favorable interest rates the lender has to offer. Since there's a higher risk involved for the lender compared to someone with a higher score, they may impose slightly higher interest rates to balance that risk. Still, as long as you make your payments on time and uphold the terms of your loan agreement, there's no reason why your car financing journey can't be a satisfying one.

What Factors Most Impact a 681 Credit Score?

Analyzing a score of 681 is an important step to enhance your financial performance and achieve better credit health. Recognizing factors affecting this score and addressing these will direct you to a sound financial life. Remember, each financial experience is distinct, presenting lessons for improvement.

Debt Management

Debt management can majorly influence your score. Any outstanding debts or high balances could significantly impact your status.

How to Check: Check your credit report for unsettled balances and make plans to reduce or fully pay these debts. High outstanding balances can lower your credit score.

Credit Card Balances

Maxed out credit cards can also lower your score. If your credit card balances are high, it likely impacts your score.

How to Check: Review your credit card balances. Are they high or almost at the limit? Endeavor to keep balances at 30% or less of the available credit to boost your score.

Credit History Duration

A shorter credit history might negatively impact your score. However, with a score of 681, your credit history could be either short to moderate.

How to Check: Analyze your credit report to see your oldest credit account and the average age of all your accounts. Reflect on whether you've opened new accounts recently.

Type of Credit

Though your credit score is fair, diversifying the types of credit you have could improve it. A mix of accounts, including credit cards, retail accounts, and installment loans, could benefit your credit health.

How to Check: Look at your credit report. Consider the types of credit you currently have and think about responsibly adding different types of credit if needed.

Public Records

If there are any public records such as bankruptcy or tax liens, they might have shown a significant effect on your score of 681.

How to Check: Scrutinize your credit report for any public records. Tackle these issues immediately for credit improvement.

How Do I Improve my 681 Credit Score?

With a credit score of 681, you are at the precipice of having a good credit standing. Nevertheless, there’s still room for improvement. Here are some prescriptive steps to enhance your credit score:

1. Consistent Timely Payments

While your primary financial obligations are likely already addressed, ensuring all bills are paid on time, every time, can optimize your credit health. Remember, consistent timely payments, even of smaller bills such as utility or mobile services, can positively affect your credit score.

2. Credit Utilization Strategy

Chances are, you’re doing a pretty good job managing your credit. To boost your score further, aim to use less than 30% of your credit limit, showing lenders you can handle credit responsibly. Also, distribute your expenses across multiple credit cards to avoid heavy utilization on a single card.

3. Maintain Old Credit Accounts

Longer credit history can boost your credit score. Even if you no longer use certain credit cards, consider keeping them open, as long as they don’t carry high annual fees, this can lengthen your average credit history and enhance your score over the long term.

4. Limit Credit Inquiries

Limit the number of hard inquiries on your credit report. Each time you apply for credit, a hard inquiry is recorded on your credit report, which could lower your score. Only apply for new credit as needed and try to space out your applications.

5. Regular Credit Report Checks

Stay updated with your credit health. Regularly check your credit reports for inaccuracies that may impact your score. If errors are identified, dispute them immediately to get them corrected.