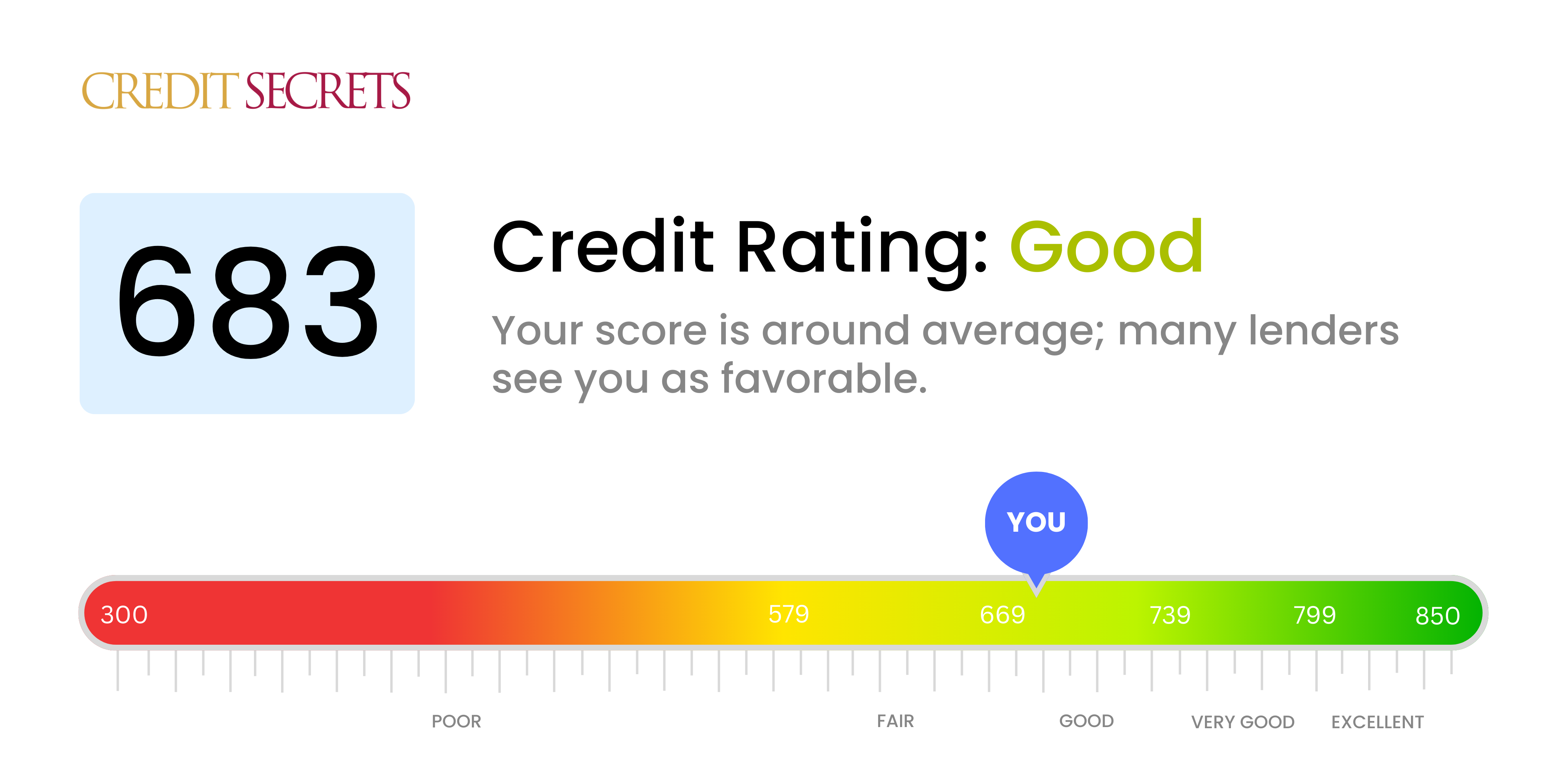

Is 683 a good credit score?

Your credit score of 683 falls into the 'Good' category. With this score, you can expect to generally be approved for new credit and loans, however, interest rates and financial terms won't always be as favorable as with higher scores. Additionally, while applicants with better scores might get approved more easily, do not worry - continuing regular, on-time payments and maintaining low balances can still significantly improve your financial picture. Looking ahead, there are great opportunities to boost that score further and create more financial options for yourself.

Can I Get a Mortgage with a 683 Credit Score?

With a credit score of 683, you may be met with mixed results when applying for a mortgage. This score falls into the 'fair' category, and while higher scores gain more favorable interest rates and terms, approval isn't impossible with your current standing. However, lenders might perceive a degree of risk, which could potentially reflect in the terms or conditions associated with the mortgage.

Knowing where you stand is important. The mortgage approval process can be stringent, with your credit history, current income, and other debts considered alongside your credit score. While you're more likely to qualify for a mortgage than someone with a lower score, you may want to anticipate a higher interest rate on your mortgage. It’s important to compare offerings from different lenders to ensure you get the best deal. In the meantime, continue practicing responsible credit habits to steadily improve your score.

Can I Get a Credit Card with a 683 Credit Score?

Having a credit score of 683 can be seen as fairly average and it's not necessarily a bad thing. This score conveys a sense of financial trustworthiness to lenders, but it's not the best score you could have. Approaching this score with an open mind is crucial even though it's not exactly what you might have hoped for.

While it's likely that you may get approved for credit cards with a score of 683, it's important to be aware that your options may not be as broad as they would be with a higher score. Favorable interest rates and credit card deals may not be within your reach. Secured and starter credit cards could be a wise choice at this point. They can help to bolster your credit score with responsible use. Keep in mind, it's important to use these cards wisely and maintain steady payments to avoid accruing debt and negatively impacting your credit score. Always remember that while this score is not perfect, it leaves room for improvement, and with the right approach, better credit opportunities can be yours in the future.

A credit score of 683 rests comfortably in the fair range according to the standard FICO scoring model. While it may not be in the most desirable bracket, it does carry a fair chance of securing approval for a personal loan. However, it's important to understand that this credit score doesn't guarantee anything. Lenders might scrutinize other aspects of your financial stability, such as your income and existing debt. You must approach the application process diligently.

If your loan application gets approved, you might find that this credit score could affect the terms of the loan. It's possible that you might face higher interest rates or stricter repayment terms compared to applicants with a more robust credit score. Lenders use these tactics to lessen the perceived risk of lending to someone with a fair credit score. It's prudent to shop around for the best offers, ensuring you have a full understanding of the terms before making a commitment.

Can I Get a Car Loan with a 683 Credit Score?

With a credit score of 683, the path towards auto financing is within sight. Most lenders view a score above 660 as more favorable for car loans, and your score falls comfortably within this range. This means you have a reasonable chance of approval for a car loan because your credit history suggests that you are likely to repay your debt in a consistent manner.

As you step into the car buying process, remember that your credit score doesn't just influence loan approval, but it also impacts your loan terms. Although a 683 credit score is generally seen positively, you may face slightly higher interest rates compared to those with higher credit scores. Knowing this in advance empowers you to shop around for the best loan terms. Always remember, understanding your credit score and how it affects your borrowing can keep you in the driver's seat during your car purchasing journey.

What Factors Most Impact a 683 Credit Score?

Grasping a score of 683 is integral to your path to financial progress. Analyzing and resolving the factors behind this score, paves the road to healthier credit standing. Every financial path is distinctive and filled with learning and growth opportunities.

Debt-to-Income Ratio

The debt-to-income ratio can influence your credit score. If your income doesn't match your expenses and debts, it may reflect in your score.

How to Check: Analyze your income and compare it to your debt. Are your expenses continually exceeding your income? Modeled budgeting can help minimize this negative effect.

Credit Inquiries

An excessive number of credit inquiries can negatively impact your credit score. Regularly applying for, or taking on, new credit could be a characteristic that affects your score.

How to Check: Check your credit report for any recent inquiries. Thoughtful and well-planned applications for credit can help maintain your current score.

Account Diversity

Holding a variety of credit types can also count toward your score. Lack of varied credit could be a factor pulling down your score.

How to Check: Review your credit report. Do you have a mix of credit accounts such as cards, retail accounts, loans, etc.? A good balance of diverse credit can help boost your credit score.

Credit Limit Usage

Maintaining a low balance compared to your credit limit is vital. Your credit utilization might be negatively affecting your score if it's higher than around 30%.

How to Check: Look at your credit card balances. If balances are near or over the limit, it may be beneficial to aim for lower utilization.

Late Payments

Late or missed payments, particularly on installment loans or credit cards, can significantly affect your score.

How to Check: Check your credit report for any late payments or missed payments. Regular, on-time payments help maintain and boost your credit score.

How Do I Improve my 683 Credit Score?

With a credit score of 683, you’re in the fair range. While this is not a bad score, there is room for improvement. Here’s what you can do, based on your current situation:

1. Monitor Your Credit Regularly

Keep track of your credit reports, ensure they are free of errors, and take immediate action if you find inaccuracies. Incorrect information can disrupt your credit score inadvertently, so it’s vital to deal with them promptly. This process can be as simple as disputing the error with the credit bureau.

2. Limit New Credit Inquiries

Each hard inquiry can knock a few points off your credit score; therefore, apply for new credit only when you need it. Multiple hard inquiries performed in a short period could signal to lenders that you are a potential risk, which can depress your score.

3. Keep Old Accounts Open

Long-standing accounts showcase your credit management over a considerable period. If possible, avoid closing old credit card accounts, as they add to the length of your credit history, which typically forms part of your credit score.

4. Maintain A Mix Of Credit

Spread your credit use across different types of loans – like car loans, mortgages or credit cards. This shows you can handle different types of credit.

5. Stay Under Your Credit Limit

Aim to use less than 30% of your available credit limit. Lower credit use signals to lenders that you manage your credit effectively, boosting your credit score.