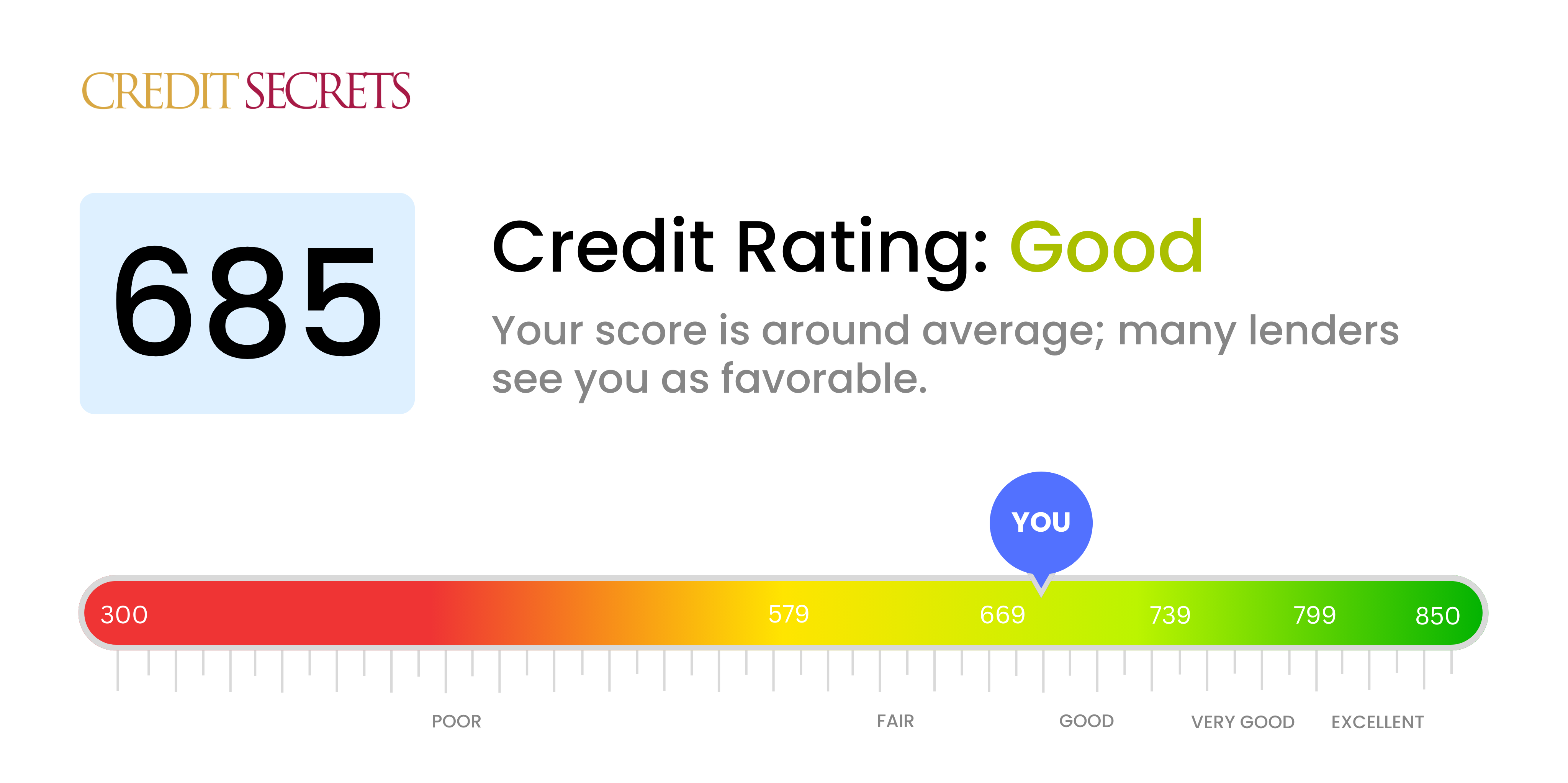

Is 685 a good credit score?

Your credit score of 685 falls into the 'Good' category. A score in this range means you are a relatively reliable borrower and are likely to be approved for many types of credit, though you may not receive the best interest rates or terms reserved for those with higher scores. It's important to keep making timely payments and reduce any outstanding debt as much as possible to further improve your credit score.

Can I Get a Mortgage with a 685 Credit Score?

A credit score of 685 places you on the higher end of a fair credit rating, which means your approval for a mortgage could swing either way. Mortgage lenders often favour those with higher scores, so you may not receive the most competitive interest rates or terms. However, your chances of approval are not completely dashed.

It's crucial to understand that every mortgage lender has different criteria. While some might consider a 685 credit score good enough, others may require a higher score. Although your score is considered fair, improving it can lead to more favourable mortgage options. A higher score can unlock lower interest rates, saving you a significant amount of money over the life of your mortgage. However, if urgency is needed, consider shopping around for lenders that cater to your current credit score to see what options may be available.

Can I Get a Credit Card with a 685 Credit Score?

With a credit score of 685, you're in a position where obtaining a credit card is a real possibility. This score is considered fair in the eyes of most lenders. While it may not guarantee approval, it certainly enhances your chances. Your score shows potential creditors that you have some level of reliability when it comes to managing and repaying debts.

The type of credit card most suitable for you largely depends on your financial goals. If you're interested in rebuilding or further improving your credit, secured cards or starter cards might be good options. These cards can help establish a positive payment history. Conversely, if you're keen on reaping rewards, you might look into certain cashback or rewards cards. Keep in mind, though, that while your score of 685 presents opportunities, it might also come with slightly higher interest rates compared to those with excellent credit scores. This is something to consider carefully when reviewing potential credit card options.

With a credit score of 685, prospects of approval for a personal loan differ based on the lender. It's a fair credit score, which is just below what's considered good. While approval is not impossible, it's likely that you may face slightly higher interest rates than someone with a higher credit score. Keep in mind that the approval for a personal loan doesn't solely depend on your score, lenders might also evaluate your income, employment history, and debt-to-income ratio.

When applying for a personal loan, it's crucial to understand that your credit score can impact the terms of the loan. Having a score of 685 may lead to moderately high-interest rates, which can make your monthly payments higher. Therefore, be prepared to shop around, compare loan offerings, and understand what each term means for you. You may have to invest a little more time in finding the right lender and loan terms, but remember, your willingness to do so can make a significant difference to your financial future.

Can I Get a Car Loan with a 685 Credit Score?

With a credit score of 685, your chances of being approved for a car loan are generally leaning towards the positive side. Most lenders prefer scores of 660 or above, and your own score falls within this range. This puts you in a favorable position as it shows lenders that you are capable of responsibly managing your debt and payments. However, it is essential to understand that a car loan is not guaranteed with this score and the decision remains with the lenders.

If approved, your 685 credit score might affect the interest rates offered to you. While being above the average threshold, it's still not considered to be an 'excellent' score. This means the interest rates you’re offered may be somewhat higher than the lowest rates on the market. It’s recommended that you shop around for the best loan terms and rates, comparing different lenders. Remember, every point matters when it comes to your credit score and the terms of your potential car loan. Make mindful decisions and stay positive on your journey towards purchasing a new vehicle.

What Factors Most Impact a 685 Credit Score?

Examining a score of 685 is the first step towards empowering your control over your credit health. Recognizing and addressing the factors impacting this score, opens a pathway for enhanced financial well-being. Remember, your financial course is individual and filled with progress and learning experiences.

Credit Utilisation

One significant factor impacting your score could be your credit utilisation rate. High utilisation can imply financial overreliance and decrease your score.

How to Check: Scan your credit card statements. Do your balances appear high compared to your credit limits? Keeping your balances under control can improve your score.

Payment History

Having a solid track record of on-time payments is fundamental in boosting your credit score. Missed or late payments may be lowering your score of 685.

How to Check: Review your credit report for any late or missed payments. Remembering instances of any missed or late payments can help you understand the impact on your score.

New Credit Applications

Applying for new credit frequently can be viewed as financial risk, and may negatively affect your score.

How to Check: Your credit report will list all your new credit inquiries. Regularly applying for new credit may have reduced your score.

Credit Length

Longer credit history often means a better score, so a short credit history may be limiting your score of 685.

How to Check: Look into your credit report, noting how old your oldest and newest accounts are, computing the average age of all your accounts. Have you opened more accounts recently?

How Do I Improve my 685 Credit Score?

Having a credit score of 685 means you’re in a fair category, but you’re not far from achieving a good score range. Here are the most viable and relevant strategies you can apply:

1. Check for Errors in Your Credit Report

Errors on your credit report could be holding your score back. Request free copies of your credit reports from each of the three major bureaus and scrutinize them for inaccuracies. If you find any, dispute them promptly to correct your score.

2. Keep the Credit Utilization Low

While you may be making payments on time, having high credit balances might affect your score. Aim to lower your credit utilization to below 30% to show lenders you’re not heavily reliant on credit. In short, spend less and pay more.

3. Regular and Timely Payments

Remain committed to paying your bills on time, every time. Timely payments positively influence your score. Enroll in automatic payments if needed to ensure you never forget a due date.

4. Limit Hard Inquiries

Each time you apply for new credit, a hard inquiry is recorded on your report, slightly lowering your score. Limit applications for new credit and focus on managing your current accounts responsibly.

5. Keep Old Accounts Open

If you have credit cards that are paid off, consider keeping them open. Closing old accounts can lower your total available credit and increase credit utilization rate, which may negatively impact your score.

Remember, repairing credit requires discipline and patience. Keep steadily working on these steps and you’ll see improvements in your score.