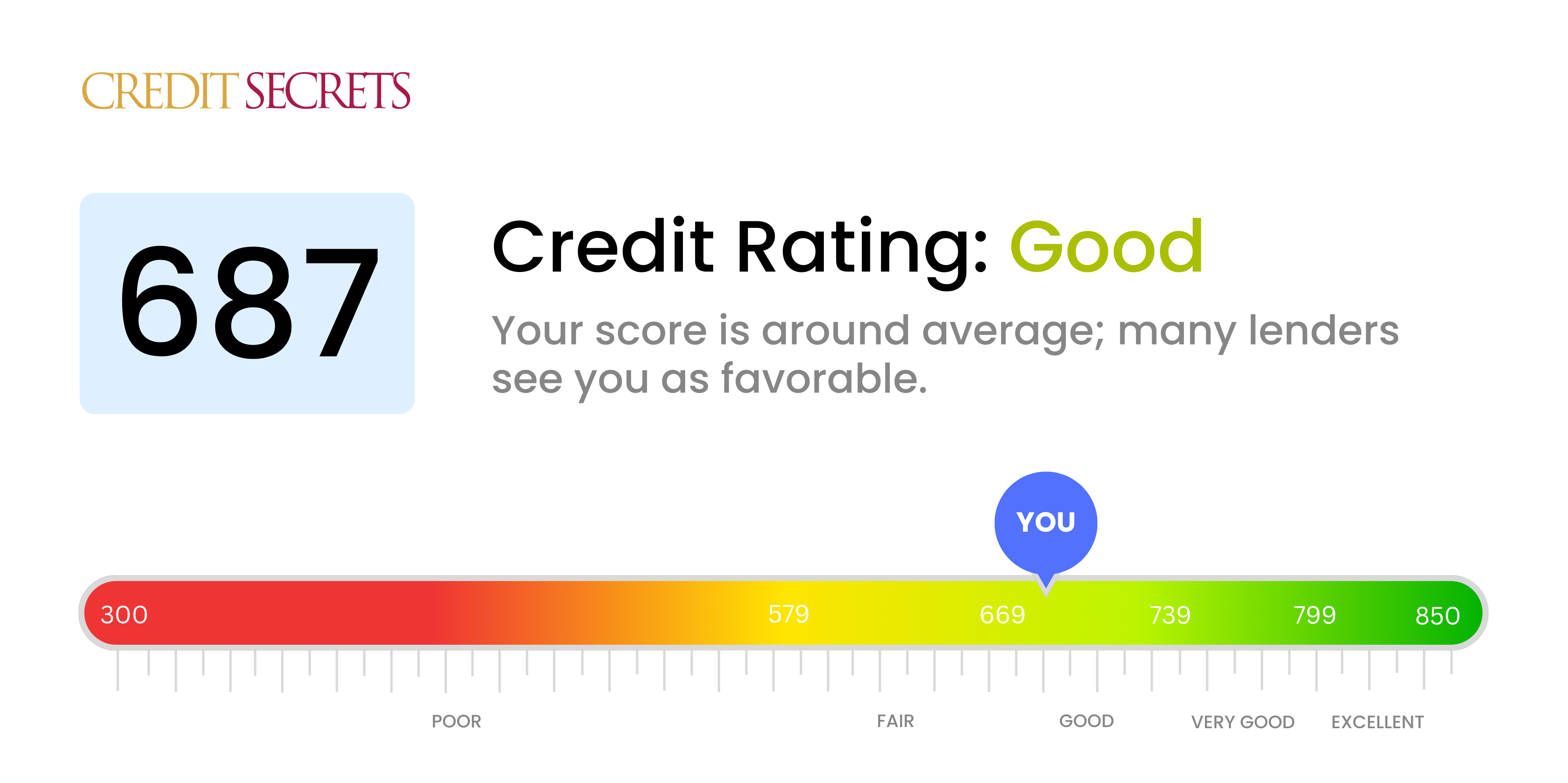

Is 687 a good credit score?

Your credit score of 687 falls into the 'Good' category. With this score, you have a fair shot at being approved for credit cards or loans, and may qualify for decent interest rates, but there is room for improvement to get even better terms.

It's important to remember that while a 'Good' score is a positive step, raising your score could potentially save you hundreds or even thousands on a mortgage or auto loan. Fortunately, you already display signs of responsible credit management. By continuing these practices and addressing any potential issues, you'll be well on your path to improving your credit even further.

Can I Get a Mortgage with a 687 Credit Score?

Having a credit score of 687 places you in the "fair" credit category. This is not an optimal score for mortgage applications, but it does not automatically disqualify you. Every lender has different criteria, and some may be willing to approve a mortgage with this score. However, chances are you may face higher interest rates and stricter lending conditions.

Remember that while your credit score is a vital factor, it's not the only one lenders look at. They also consider factors such as employment history and income level. Still, a higher score could broaden your mortgage options and potentially secure you lower rates. It's advisable to focus on improving your credit score before applying for a mortgage so you can increase your chances of better terms. Consistent timely payments and maintaining a low credit balance could help gradually boost your credit status.

Can I Get a Credit Card with a 687 Credit Score?

When it comes to a credit score of 687, chances of being approved for a credit card are quite convincing. Lenders typically interpret this score as manageable credit risk, indicating you've fairly managed your finances in the past. Keep in mind that acceptance depends on numerous factors beyond just the score, but a 687 places you in a decent position for consideration.

However, the type of credit card you apply for can heavily impact your chances of acceptance. Given a score of 687, you're more likely to be approved for a starter card or secured credit card to start. Some credit card providers may also offer you lower-tier travel cards or cards with moderate credit limits. Be aware that interest rates may be slightly higher compared to cards offered to individuals with higher credit scores because of the moderate level of credit risk associated with your existing score. Nonetheless, the journey towards improved credit standing is well within reach.

Having a credit score of 687 means you're positioned right around the average range. In general, a score of 687 is viewed as fair, and will usually enable you to secure approval for a personal loan. However, it's important to realize that while you're likely to be approved, it may not be on the most favorable terms.

Expect to face higher interest rates compared to those with superior credit scores. Lenders deem you to be a slightly higher risk due to your credit score, and consequently, they charge higher interest to mitigate this risk. You may also come across stricter loan conditions. Nevertheless, securing a personal loan is a viable reality, giving you the chance to meet your financial goals, move forward and, over time, enhance your credit score.

Can I Get a Car Loan with a 687 Credit Score?

With a credit score of 687, chances are fairly good you will be approved for a car loan. Typically, lenders favor scores that are 660 or higher. Your score is above the border line and suggests to lenders that you're likely to repay borrowed money on time, which could lead to favorable loan terms. Remember, a credit score isn't the only factor taken into consideration during the car loan approval process, but a score of 687 should play in your favor.

However, don't celebrate just yet. With a credit score in this range, be prepared to face some negotiations about the interest rates. Although your credit score might qualify you for a car loan, it might not qualify you for the best interest rates, which could lead to higher monthly payments. Car purchasing isn't only about getting approval, it's also about getting terms that work within your budget. The process can be stressful, but it's also a stepping stone towards reaching your financial goals.

What Factors Most Impact a 687 Credit Score?

Deciphering your credit score of 687 is a step in the right direction towards meeting your financial goals. Let's discuss the factors that are likely affecting your score.

Credit Utilization

Even a healthy score like 687 could still be improved by optimizing your credit utilization. The ratio of your credit card balances compared to the respective credit limits could be influencing your score.

How to Check: Analyze your credit card balances. If they're closer to the limits, work on lowering them to a preferable rate of below 30%.

Payment History

Your 687 score might potentially be affected by payment history infractions. Even few late payments or defaults can impact your score.

How to Check: Browse through your credit report for late payments and defaults. Payment slips may have occurred inadvertently and can be fixed.

Credit Age

The age of your credit impacts your score. Short-lived credit history might be making it difficult for your score to reach higher numbers.

How to Check: Assess the longest and the shortest duration accounts on your credit report, as well as the average duration of all accounts. Opening too many new accounts can harm your score.

Hard Inquiries

Multiple hard inquiries on your credit report can reduce your score.

How to Check: Review your report for hard inquiries. These occur when lenders check your credit during decision making. Limit applying for new credit too frequently.

Your journey to better credit health is underway with understanding these key factors. Remember, improvement is always possible with informed actions.

How Do I Improve my 687 Credit Score?

Your credit score of 687 is close to being good, but there’s room for improvement. Here are some practical steps you can take to boost your credit score at this level:

1. Check Credit Reports for Accuracy

Ensure that your credit reports reveal correct information. Mistakes can occur, and these can negatively impact your score. You’re entitled to a free report from each of the three major credit bureaus every year. Use them wisely.

2. Manage Your Debt

A high debt-to-income ratio can reduce your score. Prioritize reducing your total debt. Aim to keep your total credit usage below 30% of your limit, as higher percentages could harm your score.

3. Optimize Payment History

On-time payments greatly impact your credit score. Prioritize paying bills before their due date. Even one late payment can significantly affect your score.

4. Limit New Credit Applications

Every time a hard inquiry is made on your credit, your score could drop. Minimize applying for new credit to help preserve your score.

5. Consider a Credit-Builder Loan

A credit-builder loan can be a good option. You repay the loan in regular installments, and these are reported to the credit agencies, thereby improving your credit history.

Remember, consistency is key when boosting your credit score. Diligence and patience will lead to improved credit health over time.