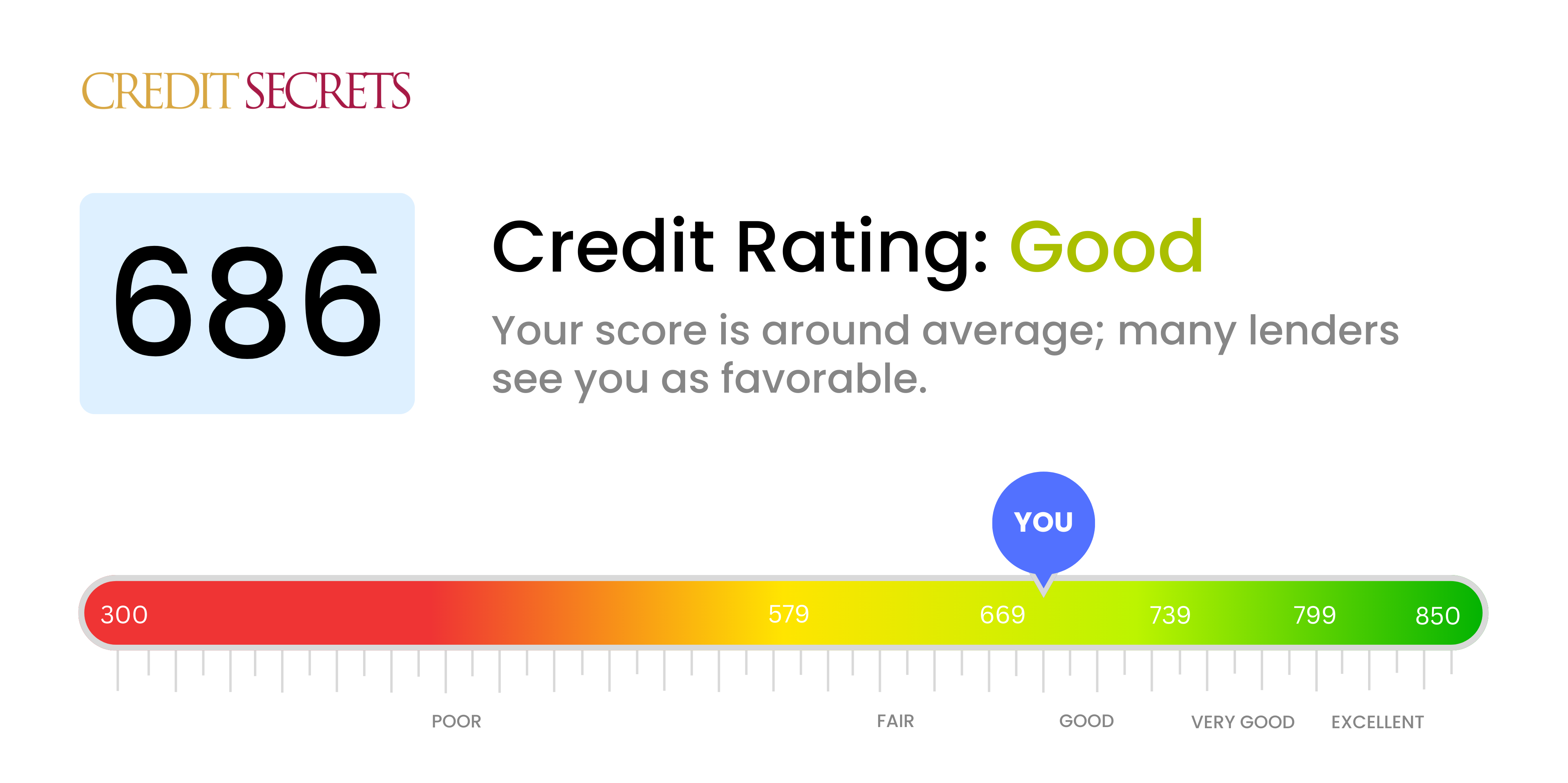

Is 686 a good credit score?

Your score of 686 falls within the 'Good' category of the credit score ranges. This typically means your financial decisions are sound, but there might still be room for improvement.

With a credit score in the 'Good' range, chances are you won't face many substantial obstacles when it comes to financial commitments. You can probably secure lines of credit or loans without much hassle, though the interest rates may not be as favorable as those with 'Very good' to 'Excellent' credit scores can enjoy. Nonetheless, staying responsible with your credit card, paying debts on time, and maintaining a low credit utilization could help boost your score further.

Can I Get a Mortgage with a 686 Credit Score?

With a credit score of 686, you are fairly positioned to get approved for a mortgage. While it might not be termed an 'excellent' score, lenders generally view this as an acceptable score. It shows that you've done a commendable job managing your credit and making payments on time. Keep in mind, this doesn't guarantee approval, as other factors are also considered, but it certainly helps your case.

You should expect a thorough review of your financial profile during the mortgage approval process. Lenders will evaluate not just your credit score but also your employment history, debt-to-income ratio, and overall financial stability. A score of 686 likely won't secure you the lowest possible interest rates reserved for those with exceptional credit ratings. However, with careful shopping and negotiation of terms, you should be able to find a reasonable and affordable mortgage offer.

Can I Get a Credit Card with a 686 Credit Score?

With a credit score of 686, there's a fair possibility of getting approved for a credit card. This score falls in the 'fair' credit range, meaning while it's not the highest, it's not the lowest either. It shows potential lenders that you've got a decent history of repaying debts, but there could be some areas to improve.

The best choice of cards for a score like yours would likely be unsecured credit cards that cater specifically to those with fair to good credit. Many of these credit cards come with perks like rewards programs, however, they might come with slightly higher interest rates compared to cards designed for excellent credit. Another good option might be a secured credit card, which can help further build your credit score while offering the convenience and benefits of a credit card. It's crucial to read terms and conditions, paying special attention to interest rates and annual fees while making a decision. Remember, responsibly utilizing a credit card can help improve your credit score over time.

A credit score of 686 sits near the upper range of what's considered as a fair rating. This score paints a picture of some financial hurdles in your history, but it is not so poor as to completely close doors regarding loan approval. You may still qualify for a personal loan, though it might not come with the best terms or the lowest interest rates.

You can expect a more scrutinizing review of your personal loan application due to your current score. Lenders might dig deeper into your credit history, income, and current debt to decide your eligibility. They may also charge higher interest rates due to the elevated risk associated with a relatively lower credit score. Remember, this doesn't mean you can't get a personal loan. You just have to understand the implications that your credit score carries in the decision-making process of the lender.

Can I Get a Car Loan with a 686 Credit Score?

Having a credit score of 686 is likely to help in gaining approval for a car loan. This score sits above the 660 mark that lenders typically favor. Still, while it doesn't fall into the subprime category usually associated with higher interest rates or loan denial, it's not classified as excellent either. Therefore, you could face somewhat higher rates than someone with an impeccable credit score. Remember, lenders accord interest rates based on the level of risk associated with the borrower.

As you proceed, prepare to navigate the car purchasing process with careful deliberation. It's probable that you'll be approved for a car loan due to your credit score, but being clear about the terms of your loan beforehand is paramount. As your credit score impacts interest rates, consider if the proposed rates align with your financial capabilities. Even though a score of 686 doesn't guarantee the absolute best rates, it should open the door to options conducive to achieving your aim of a new car.

What Factors Most Impact a 686 Credit Score?

Knowing your 686 credit score's potential influencing factors is essential for creating a strategic plan towards better financial health. Consider the likely reasons behind your score.

On-Time Payment Record

Paying bills on-time has a major influence on your credit score. A history of late or missed payments might have an impact on it.

How to Verify: Check your credit statement for any late or missing payments. Reflect on any circumstances that might have led to delayed payments.

Credit Use Ratio

Excessive credit use can lower your score. If your outstanding credit is near its limit, consider this as a likely factor.

How to Verify: Look over your credit card balances. Are they at their maximum limit? Keeping balances as low as possible is ideal.

Credit History Duration

A short credit history may decrease your credit score.

How to Verify: Check your credit statement for the age of your oldest and newest credit accounts, as well as the average age of all your accounts. Take into consideration if you've opened any new accounts recently.

Credit Variety and New Credit Management

Having a range of credit types and carefully handling new credit are key factors for maintaining a good credit score.

How to Verify: Assess the variety of your credit accounts, which may include credit cards, retail accounts, installment loans, and mortgage loans. Consider if you've been cautious when applying for new credit.

Public Records

Public records such as bankruptcies or tax liens can affect your score dramatically.

How to Verify: Review your credit report for any public records and resolve any issues listed there.

How Do I Improve my 686 Credit Score?

If your credit score is at 686, that’s fair, but you’ve room for improvement to reach a ‘good’ or ‘excellent’ score. Here’s our strategy to enhance your score effectively:

1. Keep Your Credit Utilization Low

Maintain your credit utilization ratio — the percentage of credit you’re using compared to your available credit limit — ideally under 30%. If possible, aim for an even lower ratio. A low ratio indicates that you’re managing your credit well.

2. Payment Reminders and Auto-Pay

Set up a system that guarantees bills are paid on time since your payment history is the largest factor affecting your credit score. Use resources like payment reminders or automatic payments linked to your bank account.

3. Clear Small Balances

If you own several credit cards with small balances, clear them. Handling all these small balances can add up and damage your credit score.

4. Patience and Consistency

Patience is key, as improving your credit score doesn’t happen overnight. Consistently making on-time payments, keeping credit utilization low, and staying committed to good habits can substantially help in achieving your goal.

5. Check for Credit Report Errors

Regularly review your credit reports for inaccuracies or errors. If you spot any, dispute them instantly as they could be dragging your score down unfairly.