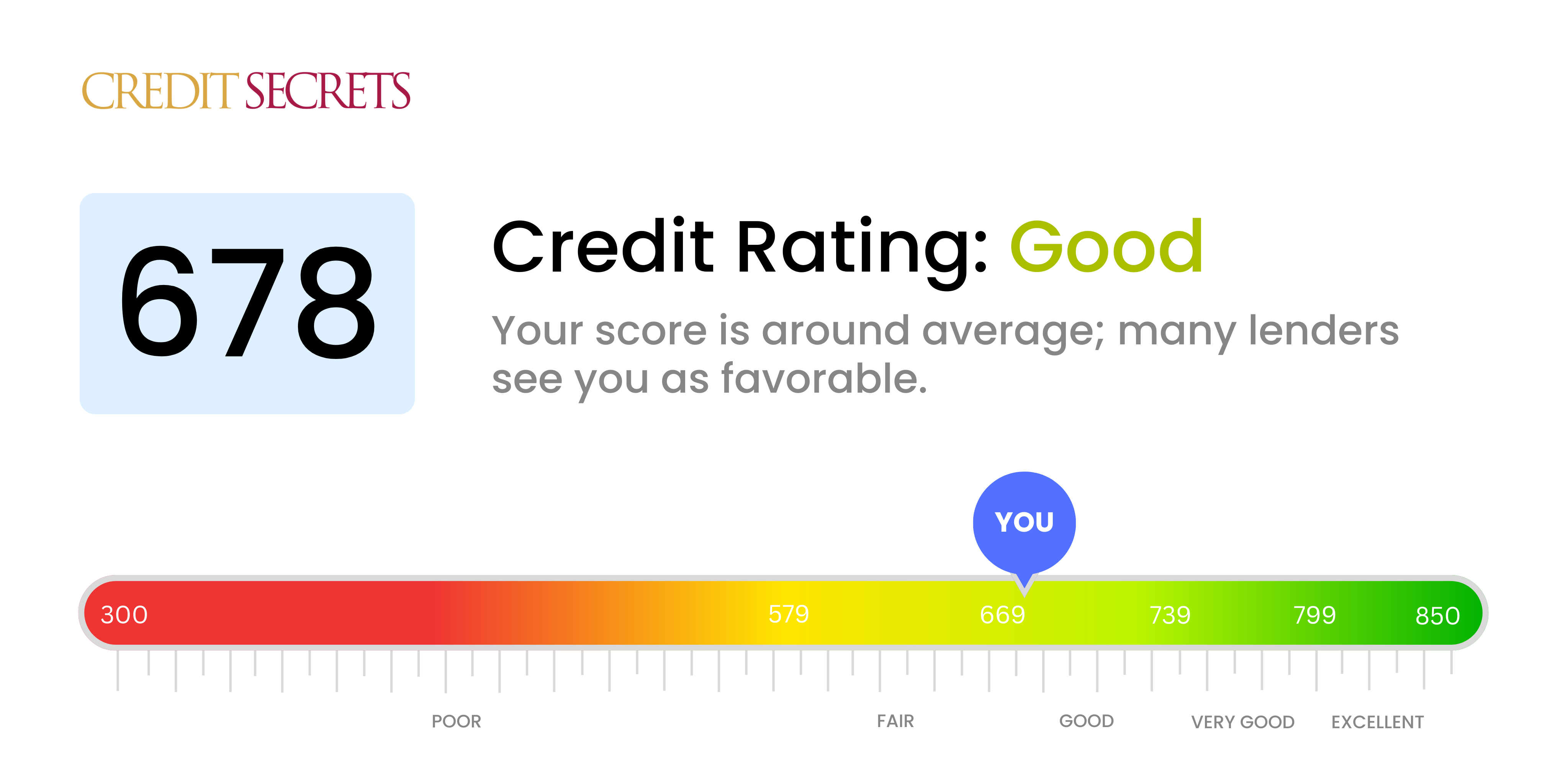

Is 678 a good credit score?

Your credit score of 678 falls into the 'Good' category. With this score, you can generally expect to be approved for credit cards and loans, but potentially at higher interest rates compared to those with very good or excellent scores. It's a solid starting point, but there are ways you can work towards improving your score even further.

Having a good credit score means lenders see you as a relatively lower risk, compared to if you had a fair or poor score. However, bear in mind that other factors like your income and debt-to-income ratio will also be considered by lenders. By making regular, on-time payments and maintaining a low balance on your credit cards, you can inch closer towards a 'Very Good' or 'Excellent' credit score.

Can I Get a Mortgage with a 678 Credit Score?

With a credit score of 678, your chances of being approved for a mortgage are fairly decent. This score typically falls within the 'fair' credit range, which is seen favourably by many lenders. Nonetheless, understand that it does not guarantee acceptance, as lenders also take into account other criteria such as income and debt-to-income ratio.

You can still expect varying interest rates with your given score. Some lenders may offer you a mortgage with a slightly higher interest rate reflecting the level of risk associated with 'fair' credit. It's worth shopping around to find a lender who is willing to give you the best rate. The mortgage approval process typically involves standard procedures like verifying income and employment, assessing low debts and evaluating your financial capability to repay the loan. Know that a 678 credit score is not a roadblock, but rather a stepping stone towards your dream home.

Can I Get a Credit Card with a 678 Credit Score?

Holding a credit score of 678 usually places you in the "fair" category. While this may not be ideal, don't become disheartened, your path towards a brighter financial future is not completely blocked. It suggests you have been fairly responsible with your credit but there is still room for improvement. Rest assured, being approved for a credit card with a 678 credit score is certainly possible, though it may be tricky.

The type of credit card you could get with this score might be limited. It's likely that you would be more successful in obtaining secured or starter credit cards. These are designed for individuals who are still building or rebuilding their credit. Though you may not qualify for premium travel cards just yet, these types of credit cards can be a stepping stone on your journey to higher scores. Note that cards available might come with higher interest rates due to lenders considering you a higher risk. Nevertheless, this is part of your financial growth process and can lead to better credit opportunities in the future.

Having a credit score of 678 puts you in a position where your chances of approval for a personal loan are reasonable, but not guaranteed. This score lies in the 'fair' category and can indicate to lenders that you pose a moderate risk. Therefore, the decision may vary from one lending institution to another. At the same time, we acknowledge that it can be stressful not knowing where you stand.

If you are approved for a loan, be prepared for the possibility of receiving slightly higher interest rates compared to those with excellent credit scores. Additionally, you might face more stringent loan terms. It's important to remember that each lender's criteria and evaluation process differ, so don't be disheartened if one lender denies your application - other lenders may still approve it. Maintain a positive outlook and continue to work on improving your credit health for a better interest rate in the future.

Can I Get a Car Loan with a 678 Credit Score?

With a credit score of 678, you're in a position that lends itself to potential approval for a car loan. Most lenders look for scores above 660, and with your score being slightly above this threshold, it makes getting favorable terms quite possible. Remember though, every lender has different standards and requirements. Therefore, your 678 credit score does not guarantee you'll secure a loan, but gives you a fighting chance for approval.

As you embark on the car purchasing journey, knowing your credit score is an essential first step. Your score of 678 will play an instrumental role in the process. Depending on the lender, you can anticipate interest rates that are favorable. However, these can vary based on factors such as the length of the loan term, down payment, and your current income levels. Stay patience, perform due diligence, and always shop around for the best terms. After all, a car is a significant investment and getting the right loan is paramount to your financial well-being.

What Factors Most Impact a 678 Credit Score?

Understanding Your Score of 678

Your current credit score of 678 is a stepping-stone towards your path to financial growth. Analyzing the factors influencing this score can help you understand where you stand and ways to improve. Remember, financial journeys are unique with numerous opportunities to learn and grow.

Credit Utilization

A significant influence on your credit score is how much of your available credit you're using. High credit utilization can potentially lower your score.

How to Check: Assess your credit card statements. If your balances are nearing their limits, this might be a substantial factor. Aim to keep balances low in relation to your credit limit.

Payment History

Paying your debts on time makes a huge difference in your credit score. Late payments could be a main reason for your current score.

How to Check: Detailed review of your credit report for late payments or defaults is required. Remember any delayed payments as they impact your score.

Length of Credit History

Having a relatively short credit history might be impacting your credit score.

How to Check: Look at your credit report to determine the age of your oldest and newest account and the average age of all your accounts. If you opened several new accounts recently, it may be bringing down your score.

Credit Mix

Maintaining diverse types of credit accounts responsibly would be crucial for improving your score.

How to Check: Review your credit report and examine the types of credit you have, such as credit cards, student loans, or a mortgage. It's important to handle all kinds of credit responsibly.

How Do I Improve my 678 Credit Score?

With a credit score of 678, you’re on the cusp of fair and good. Here are concrete, particular steps you can take to lift your score further:

1. Maintain Regular Payments

Continued regular payments to your creditors is a surefire way to boost your score. Aim to always pay on time and, if possible, more than the minimum amount. This will illustrate reliable financial behavior which can progressively increase your score.

2. Limit Hard Inquiries

Too many hard inquiries can drop your credit score. Whenever you apply for new credit, a hard inquiry is added to your report. Limit your applications and maintain your existing lines of credit where feasible.

3. Keep Old Credit Accounts Open

Long-standing credit accounts are beneficial for your credit history’s length. Unless they carry high fees, try not to close your old credit accounts, as they help demonstrate your long-term financial responsibility.

4. Lower Credit Utilization Rate

Aim to keep your balance at 30% or below your credit limit on each card. This shows your ability to manage debt effectively and can contribute to increase your score.

5. Review Your Credit Reports

Review your reports for errors or discrepancies that might be weighing your score down. If you spot any, dispute them with the credit bureaus as this can provide a quick boost to your credit score.

Each step may seem small, but together they can have a significant positive impact on your credit score.