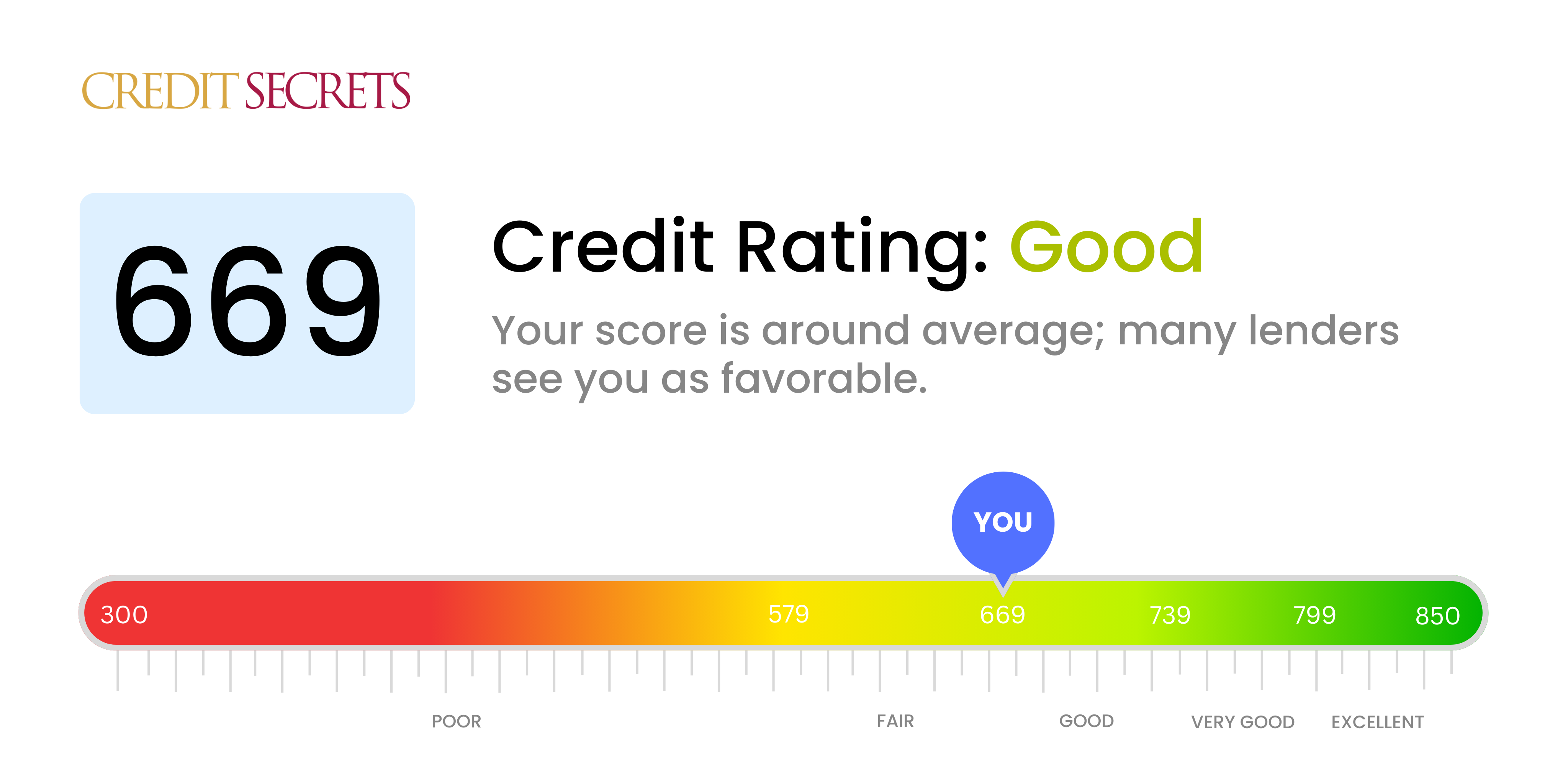

Is 669 a good credit score?

Your credit score of 669 lies in the 'Fair' category, which isn't ideal, but there's room for improvement. With this score, you might face slightly higher interest rates or more stringent terms when approaching lenders for loans or credit, however, a focused plan to improve your credit health could help rise your credit score into the 'Good' or even 'Very Good' range.

Can I Get a Mortgage with a 669 Credit Score?

With a credit score of 669, you stand a decent chance at being approved for a mortgage. This score is only slightly below the fair category under the FICO score rating, hovering at the upper end of the 'fair' category. However, approval may hinge on factors like your income, employment history, and level of debt, so remember that your credit score is just one piece of your financial picture.

If you're approved, the process may be slightly more challenging due to your credit score. You might face higher interest rates and might need to provide more documentation than someone with a higher score. Approval process will potentially involve a thorough review of your financial history, including an examination of your income, your job stability, and your debt-to-income ratio. It's important to come prepared and to be realistic about what you can afford. Always remember: it’s possible to secure a property loan even with a lower credit score - making a large down payment or opting for a government-backed mortgage can increase your chances of securing a mortgage.

Can I Get a Credit Card with a 669 Credit Score?

Navigating the world of credit can be complicated, but let's be straightforward. A credit score of 669 is teetering on the edge of fair and good credit. It's a score that opens up some doors to credit opportunities but might keep others closed. This score could lead to approval for certain credit cards, but not all.

For a credit score like 669, entry-level credit cards or those specifically designed for fair credit can be a good fit. These cards typically cater towards individuals with this credit range. A secured credit card, which requires a deposit, could be a desirable option. This card will help in establishing a stronger credit history over time, if managed responsibly. It's important to remember that while there are options, interest rates might still be on the higher side due to the perception of risk associated with a fair credit score. But this is a starting point, and progressing past this score is doable with discipline and consistency.

With a credit score of 669, getting approved for a personal loan is plausible, but it could come with some challenges. This score might be perceived as fair or "average" by many mainstream lenders, which means you could face higher interest rates compared to someone with a higher credit score. While it's not an outright rejection, lenders may require additional assurances or proof of your ability to repay the loan.

The loan application process will likely involve detailed scrutiny of your financial records. You may be asked to provide employment history, income tax returns, and other personal financial documents. As a borrower with a 669 credit score, it's critical to ensure that every detail in your application enhances your financial reliability. Even if your credit score is not perfect, showing responsible financial behavior with your present income and expenses can positively impact loan approval decisions. Communicate openly and honestly with potential lenders to potentially increase your chances of approval.

Can I Get a Car Loan with a 669 Credit Score?

If you have a credit score of 669, you're likely to be within the qualifying range for a car loan. Lenders view scores above 660 as fair and usually consider them sufficient for approval. However, bear in mind that while the likelihood of getting approved for a car loan with this score is fairly high, the terms of your loan may not be as desirable as those offered to individuals with higher credit scores.

With a score of 669, you might face higher interest rates compared to individuals with excellent credit scores. This is mainly because lenders perceive you as carrying a somewhat higher risk. But don't let this hinder your car purchasing process. Be sure to research and explore all loan options thoroughly, and always understand the terms before agreeing to the loan. The car ownership dream is certainly attainable with your credit score, even if the road there has a few bumps along the way.

What Factors Most Impact a 669 Credit Score?

Knowing what a 669 credit score represents is the first step towards improving it. By pinpointing and addressing the factors that have affected your score, you can pave the path towards better financial health. Let's take a look at the factors that might be most relevant to your situation.

Payment History

One of the most significant factors in your credit score is payment history. Frequent late payments or defaults can negatively impact your score.

How to Check: Look at your credit report for any late payments or unpaid debts. Reflect on if you have missed or delayed any payments recently.

Credit Utilization

Overusing your available credit can for sure bring down your score. If your credit card balances are high in comparison to your limits, this could be influencing your score negatively.

How to Check: Go through your credit card statements. Are your balances nearing your limits? Try to keep your balances considerably lower than your credit limits.

Length of Credit History

A shorter credit history can sometimes result in a lower score. If you've recently opened new accounts, this may be negatively affecting your score.

How to Check: Look at your credit report to see the age of your credit accounts. Have you established new accounts frequently?

Credit Mix

Having a varied mix of credit, like loans, retail accounts, and credit cards, is beneficial for your score.

How to Check: Review your credit accounts. Do you have diverse types of credit?

Public Records

Public records like defaults or bankruptcies can bring down your score significantly.

How to Check: Review your credit report for any public records, and focus on addressing any listed issues.

How Do I Improve my 669 Credit Score?

With a credit score of 669, you’re on the edge of a fair and good credit rating. Here are clear, specific steps to enhance your credit.

1. Stay Current with Bills

Make paying your bills on time a high priority. Late payments are a top factor that dents credit scores. Setting up automatic payments or reminders could be beneficial.

2. Manage Credit Utilization

Your credit utilization, the ratio of your credit card balances to their limits, should ideally be below 30%. Should yours be higher, lowering it could significantly improve your score.

3. Review your Credit Reports

Access your free annual credit reports and review them for inaccuracies. Any errors, especially related to payment history and amount owed, could be hurting your score and should be disputed.

4. Limit Hard Inquiries

Try to refrain from unnecessary credit applications. Each application results in a hard inquiry, which may lower your score and stay on your credit report for two years.

5. Opt for Installment Loans

A good mix of credit types can enhance your score. If your current credit primarily consists of credit card debt, consider an installment loan like an auto loan or a mortgage, if you can afford it.

While raising a credit score takes time and discipline, start with these steps and you’ll soon see improvement.