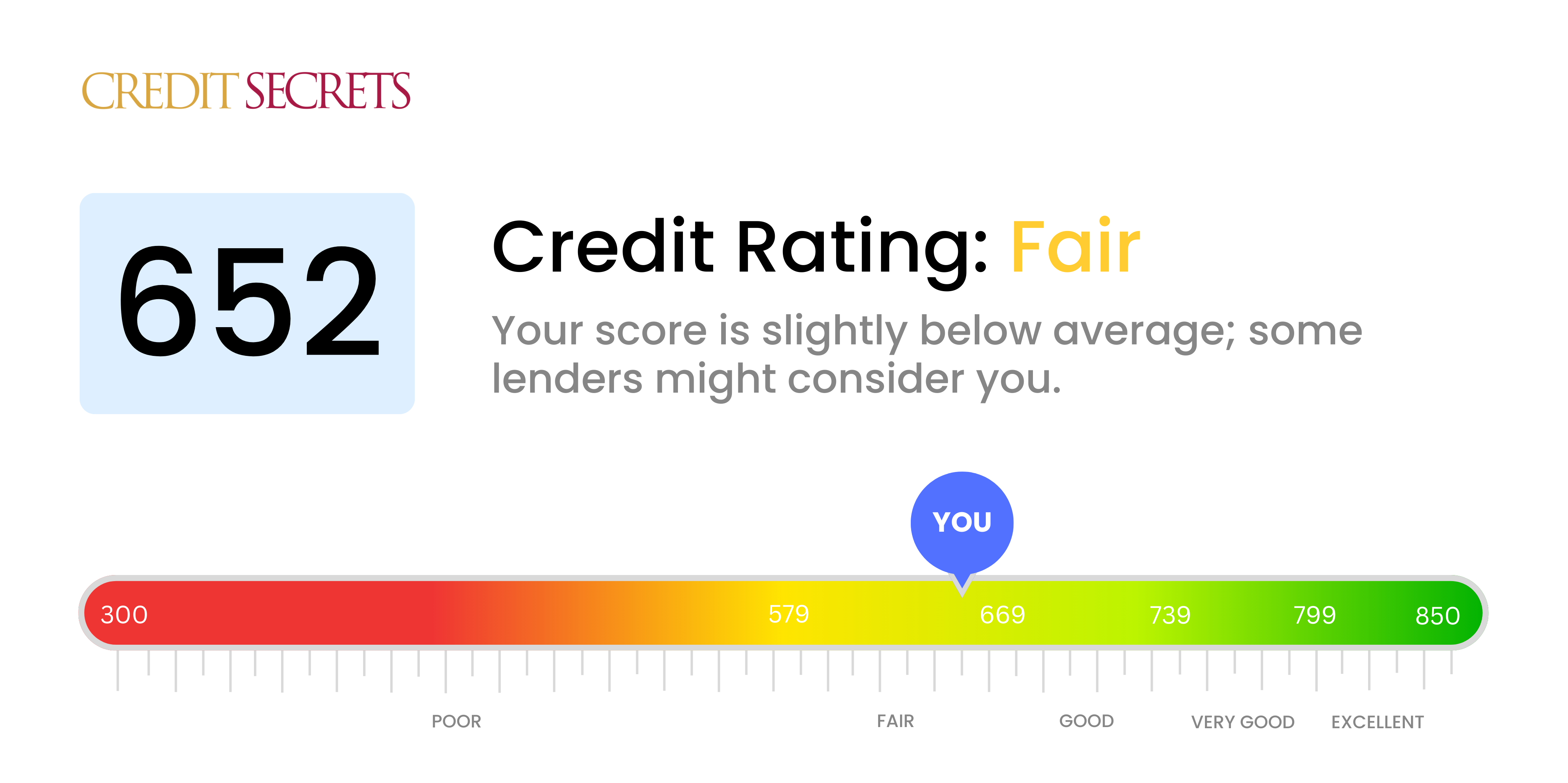

Is 652 a good credit score?

A credit score of 652 falls within the "Fair" range. This means that while your score isn't in the danger zone, it still has room for improvement. With this score, you may face slightly higher interest rates or have a bit more difficulty getting approved for credit.

Keep in mind, each lender has different criteria and this score might be considered good by some lenders. However, improving your score will give you access to better opportunities, from lower interest rates on loans, to more favorable terms on credit cards. Recognize this as your chance to enhance your financial position and plan consciously towards a better credit score.

Can I Get a Mortgage with a 652 Credit Score?

With a credit score of 652, you stand a fair chance of getting a mortgage approval. It's slightly below the average score, but within the range lenders typically consider. This score signifies a reasonably responsible financial past with a few hiccups that might have negatively impacted your score.

Moving through the mortgage approval process, you're likely to notice that your interest rates may be somewhat higher. Lenders often see a credit score like 652 as slightly riskier, thus they offset that risk with higher interest rates. Yet, don't feel discouraged. You can refinance your mortgage as your credit score improves, thereby decreasing your interest rates. Being upfront about your credit score and discussing it with potential lenders can help you understand what to expect, and can open opportunities for negotiations. Remember, finance is a long-term game, and today's score is only a temporary measure of your financial health.

Can I Get a Credit Card with a 652 Credit Score?

Having a credit score of 652 is moderately healthy and there is a reasonable chance of being approved for a credit card. However, it's important to remain both aware and understanding of your situation. Progress and improvement remain possible, and secure credit management can certainly boost your score higher. It's not a bad score, but there's always room for progress.

A score of 652 puts you on the fair side of credit scores, so many credit and loan opportunities are potentially open to you. Starter or secured credit cards could be a fantastic starting point. These cards often offer lower credit limits, helping you get grounded in responsible use and payment habits. On the subject of interest rates, they can be a bit elevated with this score, mirroring your slightly elevated risk to credit companies. Keep in mind that timely bill payments and responsible credit utilization are crucial to keep growing your score and accessing better credit options in the future.

Unfortunately, a credit score of 652 is not typically considered strong enough for approval of a personal loan from most traditional lenders. This score may denote a high level of risk to the lender, which can present certain challenges when trying to secure a loan. Facing the facts about your credit score and what it means for your loan eligibility can be tough, but it's crucial to gaining full understanding of your situation.

While mainstream personal loans might be currently inaccessible, you still have lending alternatives to explore. Secured loans or co-signed loans are viable options; the former requires providing collateral, while the latter involves having a person with a better credit score backing your commitment. You could also consider peer-to-peer lending channels, which may sometimes be more lenient with their credit standards. However, be aware that these alternatives often come with increased interest rates and less ideal terms to compensate for the lender's risk.

Can I Get a Car Loan with a 652 Credit Score?

With a score of 652, getting approval for a car loan might prove to be a little challenging. Most car lenders prefer to lend to those with scores of 660 or above. Your score of 652, while closer to this range, still falls a little short. A score in this range may suggest a higher risk to lenders based on your previous credit history.

While this implies a somewhat uphill battle, it doesn't spell the end of your car purchase journey. There are lenders available who are willing to consider borrowers with scores similar to yours, but be aware that these loans may have higher interest rates. This is due to the added risk lenders feel they are taking. As long as you give due consideration to the terms of the loan and are aware of the potential for higher interest charges, finding a car loan with your present score isn't out of the question.

What Factors Most Impact a 652 Credit Score?

Getting to grips with a credit score of 652 can guide you toward meaningful financial progress. Consideration and management of the factors influencing this score can lay the foundation for a more secure financial future. Every financial journey is unique and a great chance for personal growth and development.

Payment History

The impact of payment history on your credit score is considerable. If your payment history is peppered with late payments or defaults, this could be a fundamental driver of your current score.

How to Check: Look through your credit report specifically for any late payments or defaults. Try to recall if you've missed any recent payments, as these could have negatively affected your score.

Credit Utilization

Credit utilization plays a pivotal role in your score. If your credit cards are nearing their limits, this may be having a detrimental impact.

How to Check: Scour your credit card statements. Are your balances nearly maxed out? It's beneficial to keep balances as low as possible compared to the limit.

Length of Credit History

If you don't have a long-standing credit history, this could be negatively affecting your score.

How to Check: Analyze your credit report to determine the age of your oldest and most recent accounts, as well as the average age of all your accounts. Reflect on whether you've newly opened accounts, which would shorten the average age of credit.

Credit Mix and New Credit

Managing a diverse array of credit types efficiently and responsibly taking on new credit are crucial for a good score.

How to Check: Review your various credit accounts, including credit cards, retail accounts, installment loans, and mortgage loans. Be mindful about applying sparingly for new credit.

Public Records

Public records like bankruptcies or tax liens can substantially lower your score.

How to Check: Check your credit report for any public records and look to resolve any issues that you may find there.

How Do I Improve my 652 Credit Score?

Having a credit score of 652 sets you in the fair category. While this isn’t poor by any means, there are certainly ways you can aim for a better score. Here are the most actionable steps you can take with your current score:

1. Keep a Check on Your Credit Utilization Pattern

Your current score might be impacted by your credit utilization rate, which should ideally stay below 30%. Try to speed up payments to lower utilization and always avoid using your full credit limit.

2. Steer Clear of Late Payments

Payment history is a key component of your credit score, so managing your bills and payments is crucial. Make sure to pay on time, every time, to prevent damage to your score.

3. Don’t Close Old Credit Accounts

A longer credit history can be beneficial for your credit score. Even if an account is inactive or has a low limit, it’s best not to close it. This may negatively impact your credit history length and utilization rate.

4. Fully Repay Outstanding Debts

Demonstrating the ability to pay off larger amounts of debt, like personal loans or car finance, can have a positive effect on your credit score. Try to clear these debts as soon as possible for a possible credit boost.

5. Apply For New Credit Sparingly

Each new credit application entails a hard pull on your credit report, which can lower your score. Hence, it’s advisable to only apply for credit as needed to avoid unnecessary credit inquiries.