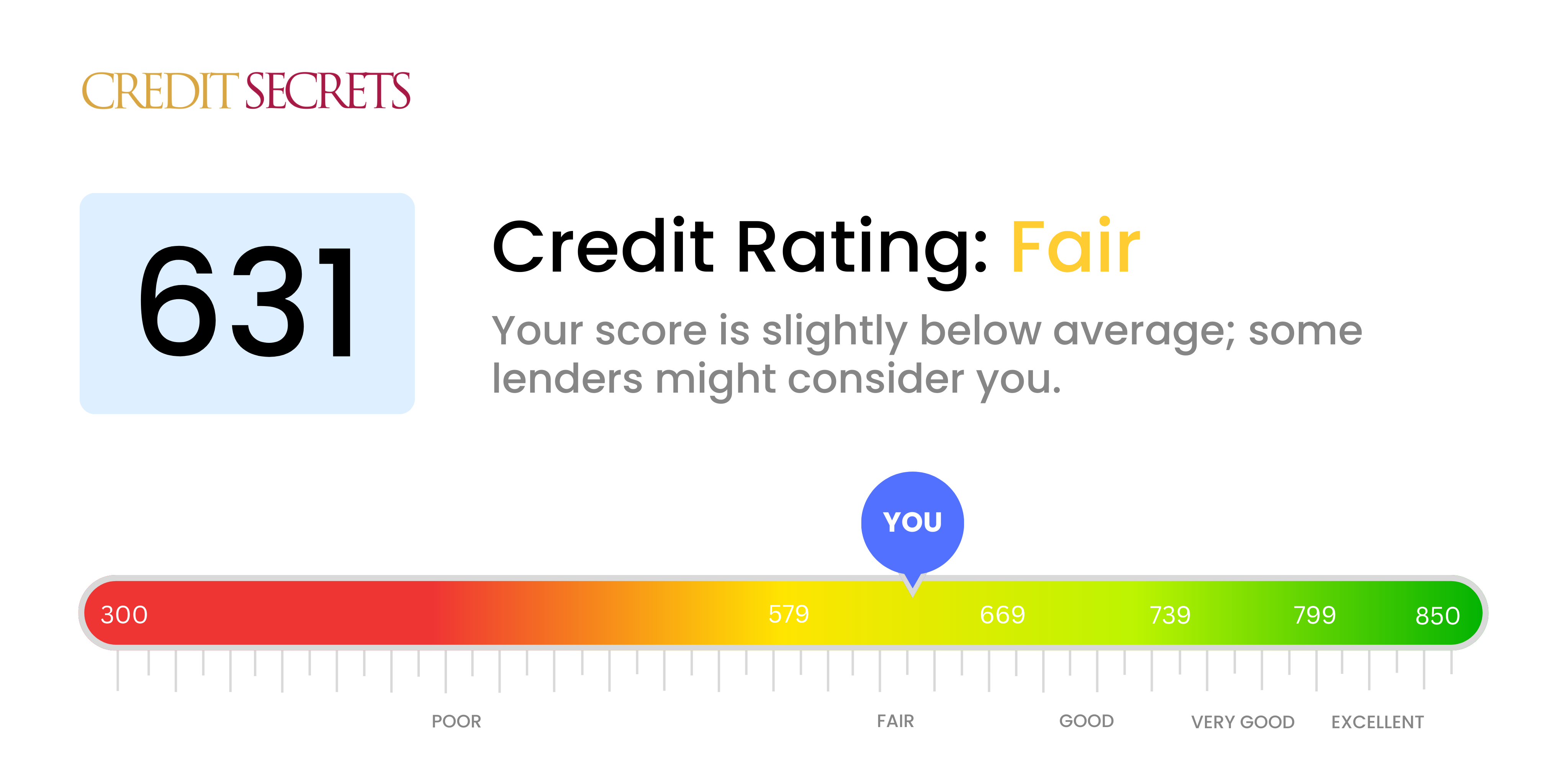

Is 631 a good credit score?

Your credit score of 631 falls into the 'Fair' category. It's not the best score, but it's not the lowest either - there's certainly room for improvement. This means that while you may be able to secure certain forms of credit, such as a loan or a credit card, you might not get the most attractive interest rates or the best terms. Moreover, not all lenders may be willing to extend credit to you.

This score might be a result of past financial missteps, but the good news is that it can be improved. It's important to focus on responsible credit behavior moving forward, like making payments on time, maintaining a low balance on credit cards, and avoiding new debt. With time and disciplined approach, you can improve this score and become more attractive to potential lenders.

Can I Get a Mortgage with a 631 Credit Score?

With a credit score of 631, you might find it challenging to be approved for a mortgage. This score falls below the typical threshold preferred by many lenders, and they may see you as a riskier borrower. Securing a mortgage is not entirely out of reach, but it might come with less advantageous terms, such as a higher interest rate.

The light at the end of the tunnel is that despite the challenges, there are lenders who might consider your application. However, be prepared for the potential higher costs. It's vital to consider these factors carefully to make sure you can handle the financial commitment over the long term. Remember, every lender has different policies, so be sure to do your research. There's always hope, even though you might face some roadblocks along your journey towards homeownership.

Can I Get a Credit Card with a 631 Credit Score?

Bearing a credit score of 631, your odds for acquiring a traditional credit card might be moderately challenging. Lenders might perceive this score as a tad risky, indicating a mix of good and unfortunately, some possible adverse credit behaviours in the past. Acknowledging your credit score and its implications is crucial—though not a pleasant task, it's the primary stride towards better financial health.

Despite the obstacles tied to a score of 631, there are credit cards better suited for your situation. Secured credit cards, for instance, demand a deposit that mirrors your credit limit, making them a more feasible option. Aiming for starter credit cards could also work in your favour, as they are created primarily for those looking to build or repair their credit score. But be mindful, with a credit score of 631, interest rates can land on the higher side due to increased perceived risk by lenders. So, it's paramount to stay diligent about payment dates and maintain responsible credit utilization to curb climbing interest rates and pave the path to improved financial wellness.

With a credit score of 631, securing a traditional personal loan may prove to be a challenge. Generally, this credit score is considered below average and indicates a heightened risk to lenders. While it might be disheartening, it's essential to understand the implications of this credit score on your potential borrowing options.

Alternative routes are available if a traditional loan seems out of reach. One option could be a secured loan, where an asset is given as collateral. Additionally, you could consider a co-signed loan, where a person with a higher credit score co-signs the loan to improve your chances of approval. Platforms that provide peer-to-peer lending may also have more flexible credit requirements. Remember, these alternatives usually come packaged with higher interest rates and less desirable terms, reflecting the lender's increased risk.

Can I Get a Car Loan with a 631 Credit Score?

A credit score of 631 is generally considered "fair," meaning you might encounter some challenges when applying for a car loan. Most loan providers prefer applicants with a score above 660, considering them low-risk. Your score of 631 could possibly result in higher interest rates or even a loan rejection due to being perceived as a higher risk to lenders.

However, don't lose hope just yet. There are loan providers that cater to those with lower credit scores. Yet, remember to tread carefully as they often have higher interest rates to compensate for the perceived risk. It's important to understand this isn't aimed at punishing you, rather, it safeguards the lender's investment. Despite a few hurdles along the way, getting a car loan is still achievable. By thoroughly examining the terms and understanding potential implications, you can still make your car purchasing dreams a reality.

What Factors Most Impact a 631 Credit Score?

Interpreting a score of 631 is key to plotting your course towards stronger financial health. Examining the factors impacting this score can lay the groundwork for a better financial tomorrow. Remember, everyone's financial journey is individually tailored, wrought with opportunities for growth and learning.

Credit History Length

The length of your credit history might be impacting your score. A shorter credit history could have a negative effect.

How to Check: Scrutinize your credit report to gauge the age of your oldest and most recent accounts, plus the average age of all your accounts. Contemplate if you have opened new accounts in the recent past.

Credit Card Balances

If your credit card balances are high in comparison to their limits, this could be a key reason your score isn't higher.

How to Check: Inspect your credit card statements. Are you nearing your credit limits? Striving to maintain low balances relative to your limit can help improve your score.

Payment Consistency

Punctual payment greatly impacts your score; late payments or defaults might have lowered your score.

How to Check: Peruse your credit report for records of delayed payments or defaults. Consider times where payments might not have been punctual, as these undoubtedly influence your score.

Variety of Credit

Managing a diverse range of credit types, and carefully dealing with new credit, are important for a healthy score.

How to Check: Reconsider your variety of credit accounts, including credit cards, retail accounts, installment loans, mortgage loans, etc. Think about whether you've been judicious when applying for new credit.

Derogatory Marks

Derogatory marks like bankruptcies, liens, or collections can considerably affect your score.

How to Check: Look through your credit report for any such marks. Attend to any listed items that require resolution.

How Do I Improve my 631 Credit Score?

A credit score of 631 categorizes you in the ‘Fair’ credit range. This means, with planned steps and patient efforts, you can boost your score into the ‘Good’ or even ‘Very Good’ range. Here are some significant next steps:

1. Minimize Outstanding Debt

Reducing the amount of debt currently owed can have a substantial positive impact on your credit score. Concentrate on paying off outstanding balances, prioritizing accounts that have the highest interest rates first.

2. Scrutinize Your Credit Report

Obtain a free copy of your credit report and examine it for any inaccuracies. If there are errors that could depict you as a riskier borrower, start the process to have these mistakes corrected.

3. Choose On-Time Payments

Your payment history impacts your credit score significantly. Make a conscious effort to pay all your bills on time, every time. Setting up automatic payments can be a helpful step to avoid late payments.

4. Make Use of a Credit-Builder Loan

Consider applying for a credit-builder loan. This form of credit designed to help boost your credit. The loan amount is held by the lender until the balance is paid in full. This can help illustrate your ability to make regular and timely payments.

5. Keep Credit Usage Low

Keeping credit card usage below 30% of your total credit limit is advisable. This shows lenders that you are managing your available credit responsibly. Aim for maintaining even lower levels if possible.