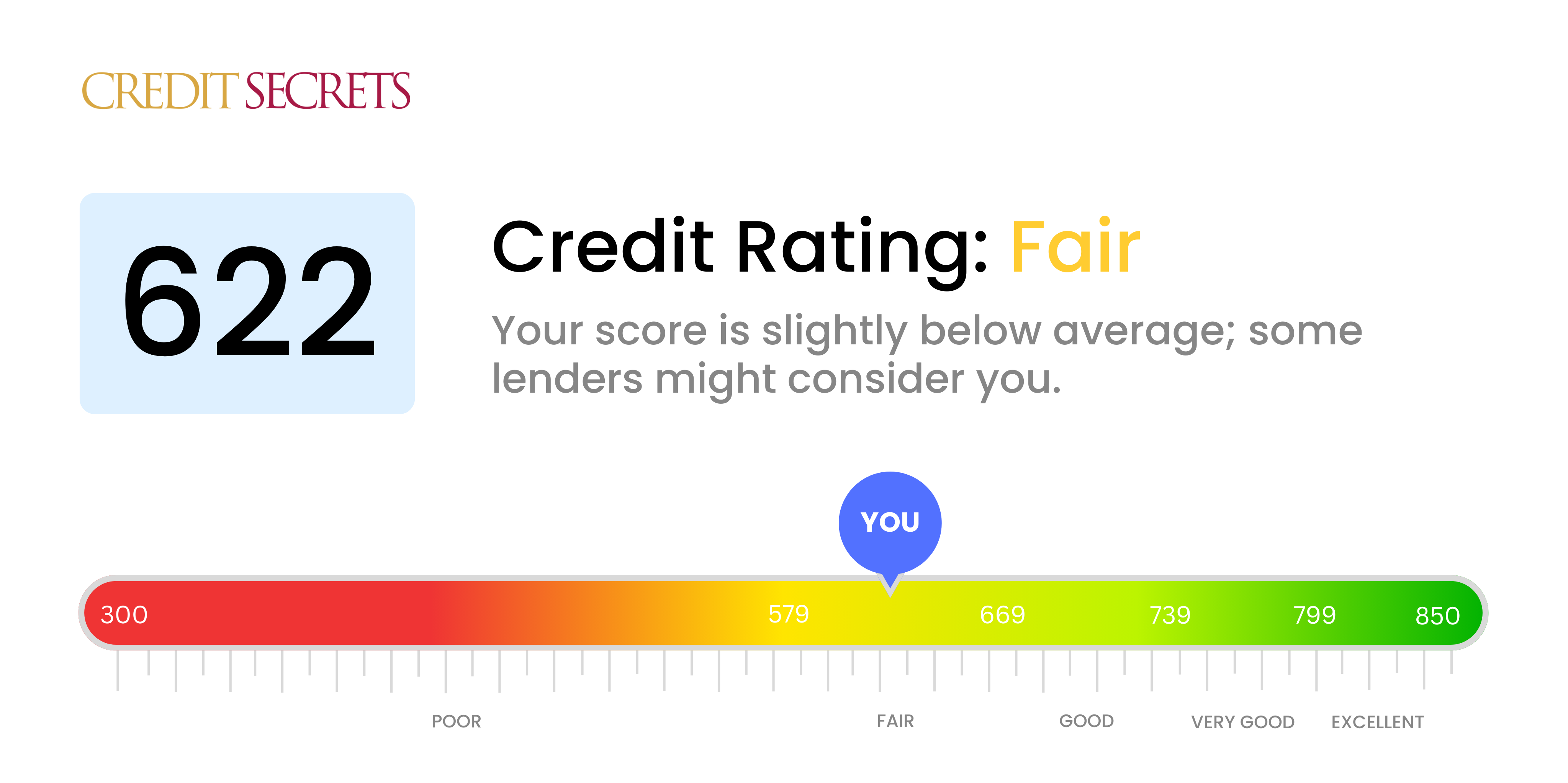

Is 622 a good credit score?

Your credit score of 622 falls into the 'Fair' category. This is not considered a good credit score, but it's not the worst and there is room for improvement. You might face higher interest rates or stricter terms when trying to secure loans or credit cards. Nevertheless, you're on your way to improving your financial situation.

With dedication, you can elevate your score to the 'Good' category or higher. Remember, improving your credit score requires time, discipline, and responsible credit behaviors such as prompt payments, reducing your debts, and maintaining a lower credit utilization ratio. Keep pushing forward towards your financial goals.

Can I Get a Mortgage with a 622 Credit Score?

If your current credit score is 622, you may face some challenges in getting approved for a mortgage. With a score in this range, lenders may consider you a riskier borrower. This could result in less favorable loan terms and potentially higher interest rates and fees. Your score does not reflect as robust a financial reliability as lenders typically seek.

However, it's important not to lose hope as this doesn't permanently close all the doors. There are loan programs – such as FHA loans – that are designed for people with lower credit scores. These loans often have more flexible approval criteria. You are not completely out of options and there are possibilities to improve your situation and boost your score. Remember, steady patience and consistency are just as valuable as any financial strategy when working on your credit health. And always remember, your credit score is not your financial identity. It's just one part of your financial profile.

Can I Get a Credit Card with a 622 Credit Score?

A credit score of 622 doesn't mean you're unable to obtain a credit card, but it might limit the types of cards available to you. This score is viewed as fair, which means some lenders might be hesitant about your creditworthiness. They might see you as somewhat of a risk, and that can affect your chances of approval. It's tough to face, but being serious about understanding your credit is a powerful step toward achieving your financial goals.

Don't worry, though. There's still hope. You might not be eligible for premium travel cards with lavish rewards just yet, but there are other options suitable for your situation. Secured credit cards, which require a deposit equal to your credit limit, are within reach and can help you improve your credit over time. Starter cards might also be a good fit, as they are designed for individuals working on building or rebuilding their credit. While the interest rates on these cards might be a bit higher due to the perceived risk, they can be valuable tools in your journey toward financial stability.

With a credit score of 622, it may be difficult to receive approval for a personal loan from standard lenders. A score within this range is often viewed as risky by lenders, thus resulting in hesitation to supply such loans. Although this may seem discouraging, it's crucial to bear in mind that this doesn't necessarily mean you won't qualify for any personal loan.

As traditional personal loans may be harder to secure, you could consider other alternatives like secured loans where you back the loan with collateral, or co-signed loans where another individual with a stronger credit history co-signs the loan agreement. You might also explore peer-to-peer online lending platforms - these can be more liberal when it comes to credit score requirements. However, remember that these options might carry higher interest rates or less flexible terms due to the increased perceived risk by lenders.

Can I Get a Car Loan with a 622 Credit Score?

Your credit score of 622 puts you in a challenging position when it comes to securing a car loan. Ideal credit scores for car loans are generally 660 or higher, and anything under 600 is often viewed as subprime. Unfortunately, your score of 622 falls into that difficult middle ground. The reality is, lending institutions tend to view lower scores as a sign of increased risk. Lower scores may indicate that you might have potential difficulties in paying back the loan thoroughly and on time.

But don't be disheartened. It doesn't mean that your dream of owning a car is off the table. There are finance options available and lenders who deal specifically with individuals who have lower credit scores. However, it's important to keep in mind that these lending solutions might come with higher interest rates to counterbalance the risk the lender is taking in. Always scrutinize the terms and conditions of your loan carefully. While the road may seem a little tough right now, don't lose hope. With vigilance and careful planning, getting a car loan is not impossible.

What Factors Most Impact a 622 Credit Score?

Deciphering a score of 622 is the first step on your journey toward elevating your financial health. Gaining clarity on the influences behind your score allows you to focus on the most relevant improvements. Remember, each financial trajectory is personal, full of chances to develop and learn.

Payment Records

Payment history plays a significant role in shaping your credit score. Late or missed payments may be largely responsible for your current score.

How to check: Scrutinize your credit report for any instances of late or missed payments. Reflect on if there have been times when bills were paid after their due dates, which could lower your score.

Credit Utilization

If you're using a high percentage of your available credit, your score may be impacted negatively. This could be a contributing factor if you're consistently reaching or exceeding credit card limits.

How to check: Examine your credit card statements. Are your accounts maxed out, or close to it? Strive to keep card balances significantly lower than their limits.

Credit History Length

A shorter credit history could be pulling down your score.

How to check: Look at your credit report to determine the ages of your oldest and newest credit accounts and the average age of all your accounts. Consider if you have opened new accounts recently.

Type and Amount of New Credit

Maintaining a mix of different types of credit accounts and wisely managing new credit is key to achieving a higher score.

How to check: Assess the variety of credit accounts you have, such as credit cards, retail account, installment loans, and home loans. Also, consider if you've made multiple applications for new credit recently.

Public Records

Public records such as bankruptcies or tax liens could be significantly impacting your score.

How to check: Review your credit report for any public records. Address any items that need resolution.

How Do I Improve my 622 Credit Score?

A credit score of 622 is in the fair range. While not poor, you’ll face some challenges with this score. Regardless, getting it into the good category is absolutely possible and we are here to direct you.

1. Analyze Your Credit Report

Get a grasp on what is dragging your score down by reviewing your credit report. Look for errors, late payments, and defaulted accounts. If there are errors, challenge them with each of the credit bureaus.

2. Pay Down High Interest Debts

Paying off high-interest debts should be a priority. These debts, like credit cards, can accumulate quickly and harm your credit score. Make a plan to chip away at these balances.

3. Create Payment Reminders

Keeping up with payments is crucial as payment history influences 35% of your credit score. Payment reminders on your phone or through your bank can help maintain timely bill paying.

4. Utilize a Secured Loan

If possible, consider a secured loan or a credit-builder loan. By securing a loan with an asset, lenders may be more willing to work with you. Payments for these loans can strengthen your credit history over time.

5. Limit Hard Inquiries

Every hard inquiry on your credit report slightly lowers your credit score. Limit new credit applications and only apply when absolutely necessary. It may seem counter-intuitive but it will help in the long run.

By focusing on these steps, you will soon see improvements in your credit score.