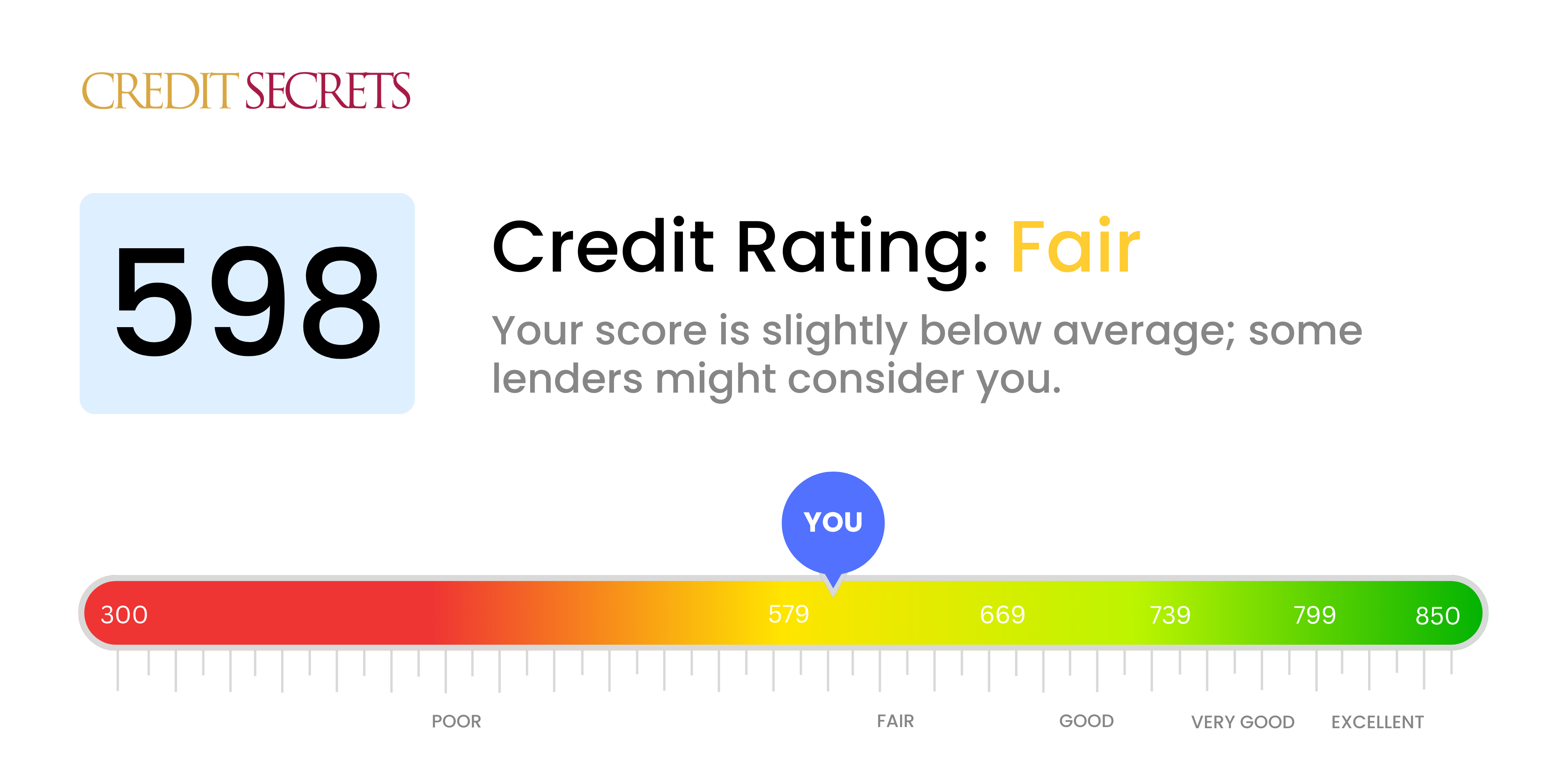

Is 598 a good credit score?

A credit score of 598 falls in the 'Fair' range, meaning it's not classified as a good credit score. However, it is still possible to secure loans and credit cards, although interest rates are potentially higher and lending conditions more restrictive.

The good news is that you're not far from entering the 'Good' credit score zone. With some consistent and disciplined actions such as timely payment of bills, limiting new credit inquiries and maintaining a low balance on credit cards, your credit score can improve gradually. Always remember, every positive step towards your financial health counts.

Can I Get a Mortgage with a 598 Credit Score?

Unfortunately, with a credit score of 598, it's likely you may struggle to get approval for a mortgage. This is because most lenders typically require scores in the mid-600s or higher for conventional mortgages. Your score might be seen as a reflection of risk, indicating you may have faced financial bumps in the past, like late payments or high balances.

Although this is a tough situation, the bright side is that it's not the end of the road. You might still be eligible for certain types of mortgages specifically designed for those with lower credit scores, such as FHA loans. Please remember that even these alternative loans often come with higher interest rates than conventional mortgages. Your best route forward is to continue focusing on improving your credit score. This can be accomplished by making payments on time, reducing overall debt, and maintaining low credit card balances. With patience and dedication, a better financial future is within reach.

Can I Get a Credit Card with a 598 Credit Score?

Having a credit score of 598 likely makes it difficult to secure approval for a typical credit card. This score often signifies a record of financial challenges, positioning you as a high-risk candidate in the eyes of lenders. It's important to face this reality with a realistic yet positive mindset. Recognizing your credit score situation brings you a step closer to enhancing your financial health.

But don't lose hope. There are still options you can consider. Secured credit cards could be a feasible choice. With these, a deposit equivalent to your credit limit is required, making them more manageable to receive. These cards also provide an opportunity to enhance your credit score over time. Incorporating a co-signer or looking into pre-paid debit cards could also be beneficial. Although these alternatives don't offer an immediate remedy, they're instrumental stepping stones towards achieving financial strength. Bear in mind that the interest rates are typically higher for those with lower credit scores, reflecting the increased risk perceived by lenders.

With a credit score of 598, obtaining a personal loan through conventional means might be quite challenging. Traditional lenders often base their approval on your credit score, and a score of 598 is considered subprime, indicating higher risk from the lender's perspective. Given the circumstances, it's important to understand what this credit score could mean for your loan options.

Despite the hurdles, there are alternatives worth considering. Secured loans, which require collateral, may be an option. Co-signed loans are another path, where a friend or family member with a better credit score vouches for your loan. You may also want to explore peer-to-peer lending networks, as they can sometimes be more accommodating with credit score requirements. However, brace yourself as these alternatives generally come with higher interest rates and less favourable terms due to the heightened lender’s risk. It's essential to carefully weigh these options before making a decision.

Can I Get a Car Loan with a 598 Credit Score?

With a credit score of 598, gaining approval for a car loan could be a bit of a hurdle. Financial institutions usually look for credit scores above 660 to offer favorable loan terms. Scores below 600, like yours, are often seen as subprime. This means your credit score might result in higher interest rates or potentially not being approved for a loan. A score of 598 tells lenders there could be a higher risk of difficulties with repaying a loan.

On the bright side, even with a 598 credit score, a car loan isn't out of reach. Some lenders cater to people with lower credit scores, offering car loans even when others might not. However, be prepared for these loans to come with higher interest rates. They're seen as more risky for lenders, so the higher rates can help them protect their interests. While it's not an easy journey, with a bit of careful planning and understanding of loan terms, a car loan can become a reality.

What Factors Most Impact a 598 Credit Score?

Grasping a 598 credit score is key if you plan to work on your financial health. Recognizing the elements that impact this score may guide you toward better financial choices. Recall, every financial path is individual and provides opportunities for growth and knowledge.

Payment Methods

Your payment habits greatly determine your credit score. Overdue payments or non-payments can play a crucial role in your current score.

How to Check: Analyze your credit report for any unpaid bills or late payments. Consider where you may have missed or delayed payments, as these instances might have brought your score down.

Credit Card Usage

If your credit card balances are close to their limits, this can hurt your score. The proportion between used and available credit is termed as credit utilization.

How to Check: Evaluate your credit card usage by viewing your statements. If you find that the balances are high compared to the limits, this may be a major factor in your score.

Duration of Credit History

Holding a shorter credit history might tarnish your score.

How to Check: Look at your credit report to examine the lifespan of your oldest and youngest accounts and the median lifespan of all your accounts.

Variety and Amount of New Credit

Maintaining a diversified range of credit types such as credit cards, installment loans, retail accounts, and home loans is necessary for a healthy credit score.

How to Check: Review the blend of your credit accounts. Keep note of whether you have applied for new credit recently as too many inquiries may hurt your score.

Official Records

Your credit score can be adversely affected by public records like bankruptcies or unpaid taxes.

How to Check: Inspect your credit report for any listed public records. Prioritize handling any entries that might require resolution.

How Do I Improve my 598 Credit Score?

With a credit score of 598, you’re in the “fair” credit range, but there is no need to panic. It simply means that you need to pursue strategic steps to climb up and reach your financial goals. Specific actions, designed for your present score, will contribute significantly to boosting your credit score.

1. Examine Your Credit Report

Comprehensively review your credit report and check for any errors or fraudulent activities. Dispute any discrepancies with the relevant credit bureau quickly. Removing inaccurate information could give your credit score an immediate lift.

2. Prioritize Bill Payments

Late payments can drop your credit score significantly. Dedicate yourself to consistent, timely payments on all your bills moving forward. Consider setting up automatic payments to ensure you never miss a due date.

3. Limit New Credit Requests

New credit inquiries can dip your score temporarily. If you’re aiming to push your score up from 598, avoiding unnecessary credit checks can help prevent further dips.

4. Manage Credit Card Use

Maintain credit card balances well below your credit limit. Strive to use no more than 30% of your available credit. This shows lenders that you can manage credit responsibly.

5. Slowly Diversify Credit Types

Once your score begins to improve and you have consistent payments with your current credit, consider adding diverse forms of credit – like an installment loan or retail credit – to further boost your score.

Remember, improving your credit score does not happen overnight, but with consistent effort and smart decisions, you will see progress in due time.