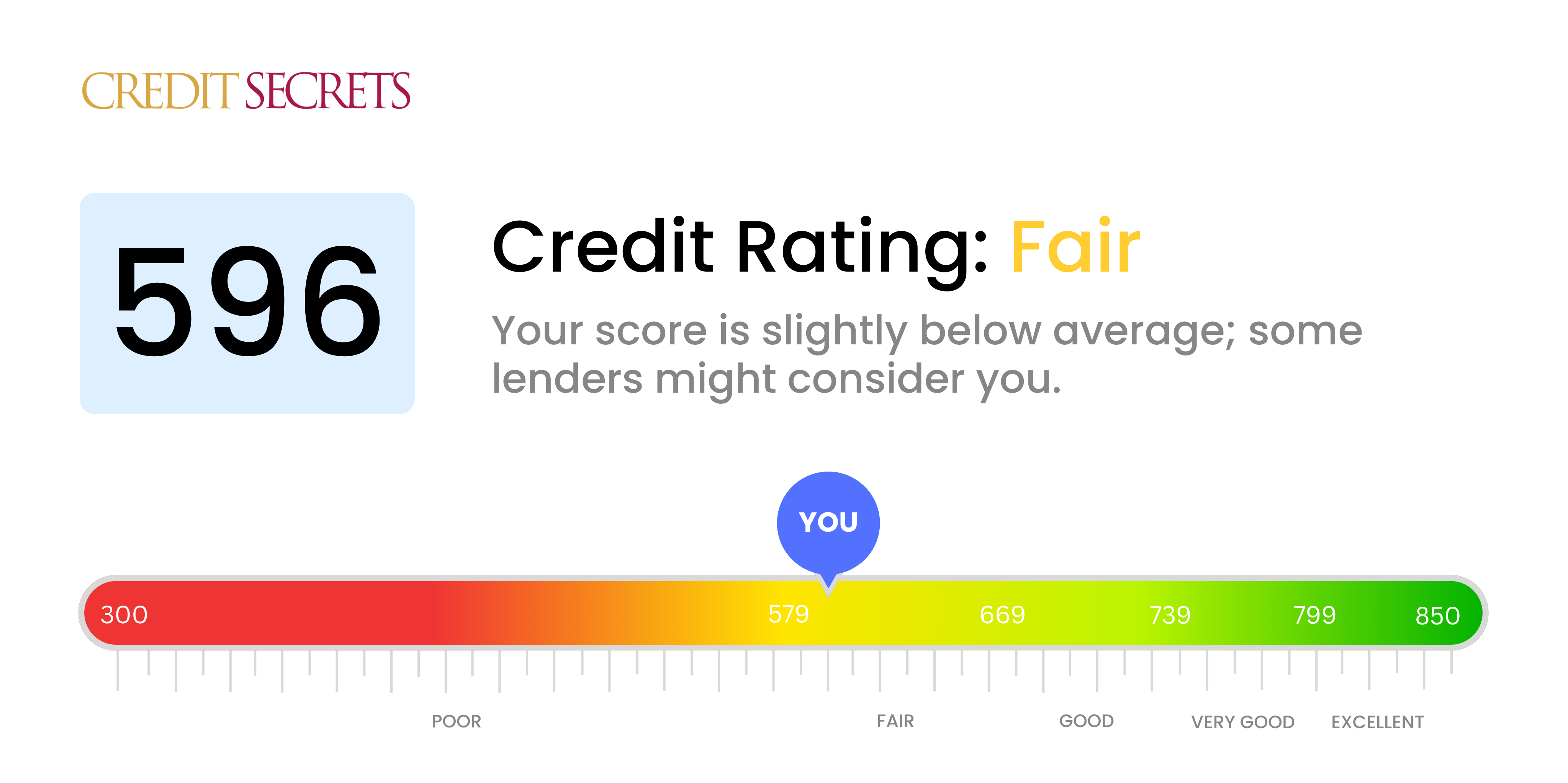

Is 596 a good credit score?

With a credit score of 596, you fall into the 'Fair' category on the credit scale. It's not an ideal score, but don't worry, it's a situation that can be improved. While this score may make borrowing a bit challenging, it doesn't mean you're disqualified from obtaining credit completely. You'd likely face higher interest rates or terms that lean in favor of the lender, but opportunities for improvement are certainly available.

Your financial journey is unique, and there's always room for positive changes. By implementing smart financial habits, such as clearing debts promptly and keeping credit card balances low, you can change the course of your credit score gradually. Remember, it's not about where you start, but where you're willing to progress. Every step you take toward financial responsibility will bring you closer to a better credit standing.

Can I Get a Mortgage with a 596 Credit Score?

With a credit score of 596, getting approved for a mortgage could prove to be a significant challenge. This score is considerably lower than most lenders' minimum requirements, indicative of past financial difficulties such as late payments or other possible credit defaults.

It's important to understand that this isn't an easy situation. It would probably be more beneficial for you to explore alternatives at this point, like seeking a co-signer who has a stronger credit score or saving for a larger down payment. These options might improve your chances of qualifying for a home loan. Don't lose hope, though. Changing your current financial situation for the better can be done over time. By addressing any outstanding debts and demonstrating responsible credit usage moving forward, you can still achieve your goal of homeownership. Just know that improving your credit score is a steady, gradual journey, but certainly a reachable aspiration with persistent effort. The upside is, as your score improves, you'll be eligible for lower interest rates which can make a big difference to your finances in the long run.

Can I Get a Credit Card with a 596 Credit Score?

Having a credit score of 596 can make obtaining a credit card a bit of a challenge. This score is generally seen as a risk to lenders, as it may convey a past of financial instability or missteps. While this may feel disheartening, remember: understanding the gravity of your credit situation is part and parcel of the journey to better financial health.

Considering the constraints linked to a 596 credit score, one can ponder alternatives such as secured credit cards. These require you to deposit a certain amount which then acts as your credit limit. It's more accessible and can be a ladder to gradually repair your credit. Other possible solutions include finding a co-signer or perhaps inquiring into pre-paid debit cards. Remember, these alternatives aren't quick fixes but are effective resources that may gradually lead you towards financial sturdiness. It's also worth noting, any sort of credit, available to people with a credit score of 596, usually comes with noticeable higher interest rates – resonating with the higher perceived risk from lenders.

With a credit score of 596, securing a traditional personal loan may be challenging. This score falls below what many lenders deem acceptable, thus indicating a higher risk. Please don't feel disheartened, though, as this is only a snapshot of your current financial situation, not a permanent marker.

Given the higher risk associated with a score of 596, traditional lending options might not be readily available. Nonetheless, there are alternatives worth considering. Secured loans, which require collateral, may be a viable option. Co-signed loans, where a trustworthy person with a better credit score vouches for you, could also be beneficial. Another alternative could be peer-to-peer lending platforms that sometimes have less stringent credit requirements. Be advised, however, these alternatives often carry higher interest rates and less favorable terms due to the increased lender risk. In facing your current financial situation, these may be pathways to consider in achieving your goals.

Can I Get a Car Loan with a 596 Credit Score?

With a credit score of 596, getting approved for a car loan might be difficult. This score falls under the subprime category which is generally anything below 600. At this range, lenders might see this as a sign of potential risk in terms of repayment capacities. Consequently, this could result in higher interest rates, tougher loan approval or outright denial.

However, don't lose hope. It is still plausible to secure a car loan despite a lower credit score. Remember that some lenders are willing to work with subprime borrowers, but they might require higher interest rates to offset the perceived risk they're taking. It is important to evaluate the loan's terms thoroughly and understand the implications before proceeding. While the route may not be smooth, owning a car remains a reachable goal.

What Factors Most Impact a 596 Credit Score?

A credit score of 596 highlights certain financial aspects requiring your attention. Determining the contributing elements to this score is the first step towards a better financial future. Each journey to financial wellness is individual and offers many opportunities to learn and grow.

On-Time Payments

Consistent on-time payments have a positive influence on your credit score. Any late payments or nonpayments could be a primary factor influencing your current score.

How to Check: Scrutinize your credit report to spot any late or missed payments. Consider how often you may have postponed payments, as this could have impacted your score negatively.

Credit Usage

Elevated credit usage can have an adverse effect on your credit score. If you're frequently maxing out your credit cards, this could be bringing down your score.

How to Check: Check your credit card balances. If the balances are persistently close to the credit limit, it might be affecting your score.

Duration of Credit History

A brief credit history can negatively influence your credit score.

How to Check: Scan your credit report to evaluate the age of your oldest and latest accounts and the overall average age of all your accounts. Consider if you have opened multiple new accounts recently.

Variety of Credit and Newly Acquired Credit

A diverse mix of credit types and prudent management of new credit plays a critical role in maintaining a good credit score.

How to Check: Review your mix of credit accounts, like credit cards, retail cards, installment loans, and home loans. Do you apply for new credit judiciously?

Public Records

Public records such as bankruptcies or unpaid taxes can drastically affect your score.

How to Check: Search your credit report for any public records. Address any listed entries that need resolving.

How Do I Improve my 596 Credit Score?

Having a credit score of 596 falls under the fair credit score range. But remember, it’s entirely in your hands to turn it around. Let’s look at the most effective, tailor-made steps that you can take to start your credit improvement journey:

1. Prioritize Past-Due Payments

Paying off accounts that have fallen behind needs to be your top priority. Ensure you bring all the due accounts to a current status as fast as possible. Past dues cause a significant dip in your score, so directing your funds there first will make a massive impact.

2. Manage Your Credit Card Balances

High credit card balances can really pull down your credit score. Aim to keep your card balances below 30% of their limits to quickly see an improvement in your score. Start by paying down the cards with the highest balance first.

3. Utilize a Secured Credit Card

Secured credit cards, which require a cash collateral deposit, can be easier to obtain. Make small purchases and promptly clear the balance to cultivate a positive payment track record.

4. Experts in Your Corner

Consider getting added as an authorized user on a credit card of a friend or family member with robust credit. Their good payment habits can help pull your score up but ensure the card issuer reports authorized user activity before going ahead.

5. Diversification is Key

Having multiple types of credit accounts can enhance your credit score. Good practice with a secured card can allow you to explore more credit options like a retail credit card or credit builder loan.